The Biggest Mistakes Accountants Make Starting Their Firm (Or New Service)

If you are reading this, then you might be an accountant (or maybe a bookkeeper) looking to start your own firm or practice. It can be a game changer for your career and finances.

But it also can be an overwhelming process.

We’ve now worked with thousands of firms who utilize our workflow software to streamline their projects, workflows, and automate repetitive tasks. And we have learned a lot about what works and what doesn’t when it comes to starting and growing a viable practice.

But we also wanted to ask our network what they thought the biggest mistakes accountants make when starting their firm. Or even a new service department, like client advisory services.

And boy, did firm owners and leaders in the space deliver. Below is what they shared with us.

1. Focusing too much on the wrong things.

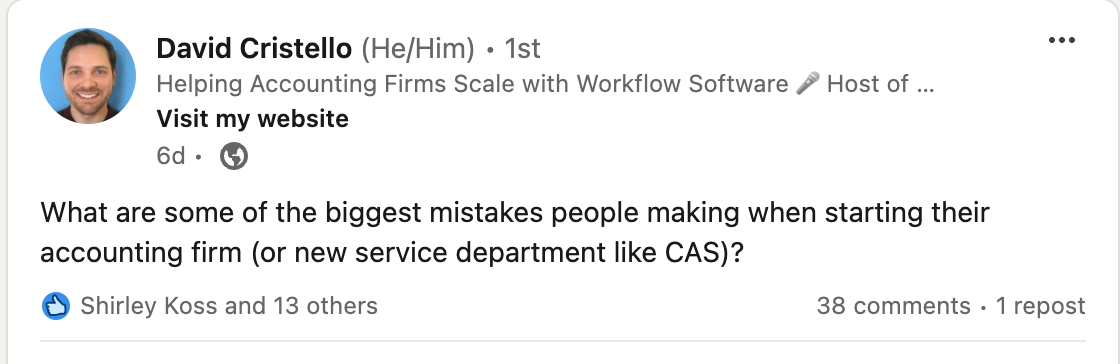

Corey Lord, CPA chimed in and shared these few nuggets related to our question.

“Focusing too much on the service or even names of services instead of what the client is asking for or needs. Also focusing too much on the current value of a service instead of the lifetime value of the client.

“I know from experience. I used to spend time coming up with fancy names that fit the client. Like one time I had a psychologist as a client and I came up with package names called Id, Ego, and Superego. The client thought the names were cute but ultimately the names made no difference in the outcome of our work.”

2. Not narrowing the scope of services.

Mike Payne, JD – CPA wrote:

“We all try to do everything that a client needs instead of just focusing on what we do best.”

And then Corey Lord, CPA dropped some additional thoughts on this one:

“I am just going to challenge you on semantics here. I think scope of work is the wrong phrase and instead we should focus on scope of expertise. Meaning that we set the scope based on what we are experts at. And even that doesn’t sit right with me. Really it’s about what we are experts at and what we want to attend to. Who is our target market? Who are we trying to appeal to? That’s the scope.”

3. Taking on anyone and everyone as clients.

More clients is good right!? Well not exactly…Tailor Hartman, wrote:

“Definitely taking on anyone and everyone as clients. You’ll regret it later on… trust me.”

David asked: “Is it always the ‘low cost’ clients or are there other warning signs?”

Tailor’s response: “It’s not just the money. Jerks, anyone that’s not excited about what you can do for them, or maybe someone that doesn’t seem like they’d communicate well could all be disqualifiers.”

4. Not having structured services.

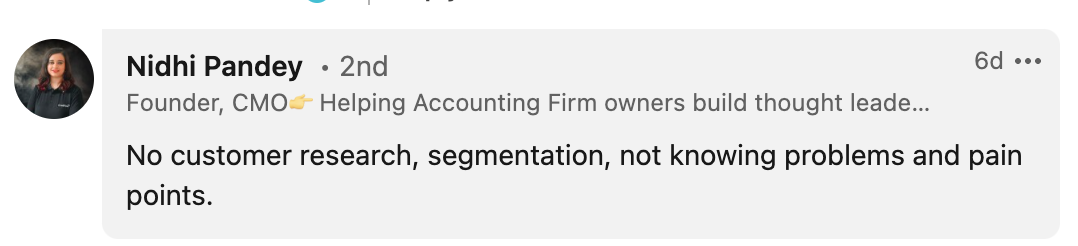

Samantha Musser, CPA wrote:

“Not having structured services. For example, for clients we touch on a weekly basis, they have a set day that we know (and they know) when we work on their account. It reduces SO MUCH chaos.”

She continued:

“Prior places when we didn’t have set days, clients would be emailing all the time expecting immediate answers, our inboxes would be totally clogged and it would be so distracting and challenging trying to decide on priorities. Now everyone is on the same page with schedules and it makes it a lot easier to schedule work. Of course clients are going to have things that need to be addressed outside of their regular day once in a while but it happens much less than you would think.

The other thing we do is have an email accounting @ “client”.com for the higher volume clients so it reduces the clutter in our Chime email and they know that we handle all of those emails on their set day so if an emergency pops up, they email our Chime email.”

5. Not being clear about your customer research.

When launching a firm, you probably will be niching down to some extent. Maybe it’s only certainly industries, specific services, etc.

But we often found new firms just launching or trying to grow are approaching broadly and aren’t segmenting properly. That can impact your ability to attract the right clients and scale your firm into a healthy business.

Nidhi Pandey wrote:

6. Continuing with an employee mindset instead of an owner mentality.

If you worked for a firm or were an accountant for a specific employer, sometimes it can be hard to break out of the employee mindset. But it’s critical as you become an owner of a firm.

Loren Fogelman shared:

“Continuing with an employee mindset instead of an owner mentality. As a result, they sell time rather than outcomes because they don’t realize their value.

Essentially it’s what you value – your time or your expertise.”

7. Trying to build a “generalist” practice.

Edward D. Warren wrote:

“Trying to build a practice as a generalist is a mistake many practitioners make. It can be tempting to take on any client if you don’t have a steady book of business.

The downside is If you don’t specialize in a niche or vertical then you can’t develop specialized skills or intellectual property (IP) those clients need. If you don’t have IP, you can only compete on price. Do you really want to compete on price?”

That’s such a strong point and we agree.

8. Not charging enough for your expertise.

Over the years, we’ve had many discussions about pricing your services at your firm. And it popped up in a few comments on the LinkedIn post.

Although price increases sometimes can be an uncomfortable feeling, it’s necessary for the health of your business and how clients access your valuable expertise.

As David mentioned in a reply to someone who mentioned this: “Feels like every firm owner should set a reminder to raise prices significantly after year 1.”

YES.

9. Not getting your workflows set up early.

This one is from our team here at Jetpack Workflow and what we’ve seen across thousands of accounting firms.

Although we are in the workflow software space, we do often find small firms or newly launched firms delaying looking at their workflows and how they plan to manage projects.

Hint: it’s usually just using spreadsheets, sticky notes, and relying on their own memory. YIKES.

While you may only have a handful of clients to start as you grow it becomes more challenging to manage. And soon you are missing deadlines, losing sleep at night, and working 60+ hours a week scrambling to get work done.

We are fans of using spreadsheets and sticky notes, but not for workflows and client project management.

Instead, get ahead of those future headaches with the right tech to handle your workflows, projects, and tasks. It will help your sanity. And will be valuable in keeping work in order if you have partners in the firm or if you start hiring additional accountants.

Workflows are the foundation of your firm’s success. If you are curious to learn more about Jetpack Workflow and how firms are utilizing our platform, schedule your demo here.