Submissions open for 2024 Top Firms by AUM

Accounting Today

APRIL 23, 2024

Accounting Today is in the midst of surveying CPA firms with wealth management practices for this year's 'Wealth Magnets' ranking.

Accounting Today

APRIL 23, 2024

Accounting Today is in the midst of surveying CPA firms with wealth management practices for this year's 'Wealth Magnets' ranking.

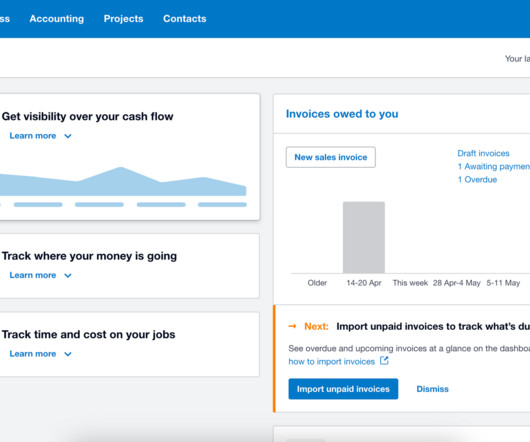

Xero

APRIL 23, 2024

The latest Xero Small Business Insights (XSBI) data is a good reminder about the important contribution your small business makes to your local community, particularly around job opportunities. There are more people working in small businesses than a year ago in the three countries where we track jobs (Australia, New Zealand and the UK). In fact, jobs growth is either already well above average, as seen in New Zealand, or accelerating.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

APRIL 22, 2024

Experts say that busy entrepreneurs often miss incentives and advantages available to them. Financial advisors and tax professionals can give them a nudge.

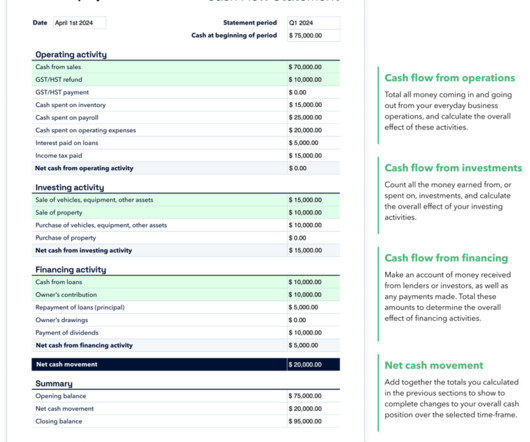

Accounting Department

APRIL 22, 2024

In a dynamic industry where change is the only constant, good cash flow management stands as one of the most critical factors for the success of e-commerce businesses. Navigating the online retail waters is often turbulent, with fast-paced transactions and a myriad of financial nuances that demand efficiency and foresight. Poor cash flow management could capsize even the most promising ventures, while a firm grasp on financial inflows and outflows can propel your e-commerce business forward, ens

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

Compleatable

APRIL 24, 2024

Join Compleat Education as we run through our purchasing and accounts payable automation software especially for schools and multi-academy trusts. We’ll go over ways to save your school/s time, money, and increase visibility on every purchase. The post Purchasing & AP Automation for Schools and MATs Like Yours first appeared on Compleat Software.

FinOps Foundation

APRIL 23, 2024

Key Insight: The FinOps Maturity Model – often referred to by its stages “Crawl, Walk, and Run” – is a key component of the FinOps Framework. The goal for organizations is not to get to the “Run” stage across all Capabilities of the FinOps Maturity Model, but to perform each Capability at the appropriate level of maturity for your environment.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Accounting Department

APRIL 19, 2024

We are thrilled to announce that Episode 17 of our podcast, Beyond the Books , is now live and ready for your listening pleasure.

Fidesic blog

APRIL 23, 2024

What is RoueWise? RouteWise by Fidesic is a visual workflow editor that makes it easy to setup and maintain invoice approval processes within your accounts payable department.

Xero

APRIL 25, 2024

Nothing beats an in-person event. Especially one like Accountex, where the curated speakers, exhibits, and masterclasses mean you can build both your knowledge and industry friendships – all in one place. This year, we’re bringing our popular masterclasses back, along with a whole team of Xero experts to help you cultivate an efficient and rewarding practice.

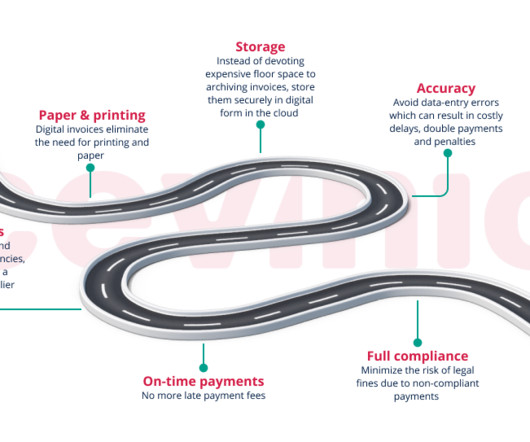

Cevinio

APRIL 18, 2024

How AI and RPA Are Transforming Accounts Payable Processes in the Year Ahead Introducing Our Whitepaper: “8 Accounts Payable Trends to Watch” In the dynamic landscape of financial operations, staying ahead means understanding the evolving trends shaping the future of Accounts Payable (AP). Our latest whitepaper delves into “8 Accounts Payable Trends to Watch: How AI and Robotics Are Transforming Accounts Payable Processes in the Year Ahead.” As businesses navigate through

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

Accounting Department

APRIL 18, 2024

Last week, the AccountingDepartment.com team attended the 2024 Entrepreneurial Operating System (EOS) Conference in San Diego, CA.

Blake Oliver

APRIL 22, 2024

I'm honored to be quoted by Gene Marks, CPA , in his latest piece on The Hill, in which he brilliantly unpacks why investors should approach audit reports with a healthy dose of skepticism. Read it here.

Insightful Accountant

APRIL 23, 2024

Insightful Accountant proudly announces this year's Top 25 Up-n-Coming ProAdvisors. Congratulations to all being recognized as this year's award recipients.

Cevinio

APRIL 23, 2024

Automated accounts payable software transforms your business by cutting costs and boosting efficiency.

Advertisement

The status quo for AP in small and mid-market companies is broken. It consists of messy tech stacks of siloed solutions that give rise to manual work, a lack of control, wasted spend, and unnecessary risks. The benefits of shifting to spend management are tangible, measurable, and are felt across the whole organization. Spend management is a different way of thinking and an innovation whose time has come.

Accounting Today

APRIL 18, 2024

PricewaterhouseCoopers US is realigning its organizational structure across three lines of service — Assurance, Tax and Advisory — starting in July.

Ace Cloud Hosting

APRIL 19, 2024

Tax season 2024 is ongoing, and the tax firms are busy handling their clients’ taxes. However, cybersecurity is one aspect most tax firms ignore during the tax season. Like tax.

Plooto

APRIL 18, 2024

Managing cash flow effectively is an essential aspect of running a business smoothly. However, many small businesses struggle with cash flow management, especially if they don’t have a lot of experience in bookkeeping and accounting.

Insightful Accountant

APRIL 18, 2024

Murph takes a first look at 'Figured', a cloud-based agribusiness software app that works with either QuickBooks Online or Xero and that he thinks is '"perfect for farming and ranching.

Speaker: Carolina Aponte - Owner and CEO, Caja Holdings LLC

In today's rapidly changing business environment, building a resilient balance sheet is crucial to the survival of any business. A resilient balance sheet allows a company to withstand financial shocks and adapt to changing market conditions. To achieve this, companies need to focus on key strategies such as maintaining adequate liquidity, managing debt levels, diversifying revenue streams, and prioritizing profitability over growth.

Accounting Tools

APRIL 24, 2024

What is Liquidity Ratio Analysis? Liquidity ratio analysis is the use of several ratios to determine the ability of an organization to pay its bills in a timely manner. This analysis is important for lenders and creditors , who want to gain some idea of the financial situation of a borrower or customer before granting them credit. There are several ratios available for this analysis, all of which use the same concept of comparing liquid assets to short-term liabilities.

Accounting Today

APRIL 18, 2024

Accounting and finance professionals are expressing greater confidence about the world economy this year, according to a new survey.

Economize

APRIL 22, 2024

What is Gemini for Google Cloud? Gemini for Google Cloud brings in a new era in cloud computing, introducing a suite of generative AI tools that redefine the capabilities available to developers, cloud service providers, and enterprise applications.

Nanonets

APRIL 24, 2024

Business leaders have moved on from discussing whether or not software solutions and business applications can change how business is done; now, they’re focused on what SaaS platforms can fulfill their organization’s needs. For accounting and finance professionals, accounting software is paramount, but when it comes to accounting software, there are right and wrong choices.

Speaker: Wayne Spivak, President and CFO of SBA * Consulting Ltd., Industry Writer, Public Speaker

If you’re lost in the world of spend management needs and your GAP analysis is lacking perspective on the future state of your business performance, listen up! With the advancement of technology, the implementation of spend management best practices and concrete GAP analyses is more streamlined and accessible than ever before. And while this may sound like great news for you and your clients, it won’t be worthwhile unless you have the latest techniques to back up your ambitions!

Insightful Accountant

APRIL 21, 2024

If you haven’t learned to harness the power of the pivot, you’re missing out! Follow this detailed, step-by-step guide to create your own pivot tables in QBO and harness the full power of your financial data.

Accounting Tools

APRIL 24, 2024

What is a Semi-Fixed Cost? A semi-fixed cost is a cost that contains both fixed and variable elements. As a result, the minimum cost level that will be experienced is greater than zero; once a certain activity level is surpassed, the cost will begin to increase beyond the base level, since the variable component of the cost has been triggered. A cost that is classified as semi-fixed does not have to contain a certain proportion of fixed costs or variable costs to be classified as such.

Accounting Today

APRIL 19, 2024

Seventeen percent of comment forms in 2021 and 2022 contained auditor evaluation deficiencies, according to the PCAOB.

Counto

APRIL 23, 2024

Quick Ratio: A Liquidity Metric for Small Businesses For small business owners, mastering financial metrics is crucial, and the Quick Ratio is an essential tool. This straightforward indicator helps assess your company’s ability to cover short-term obligations using its most liquid assets, ensuring you’re prepared to handle financial commitments efficiently What is the Quick Ratio?

Advertisement

Developing a consistent month-end close doesn’t need to be a mystery. We’re sharing our top 10 secrets (plus one bonus!) for streamlining your close.

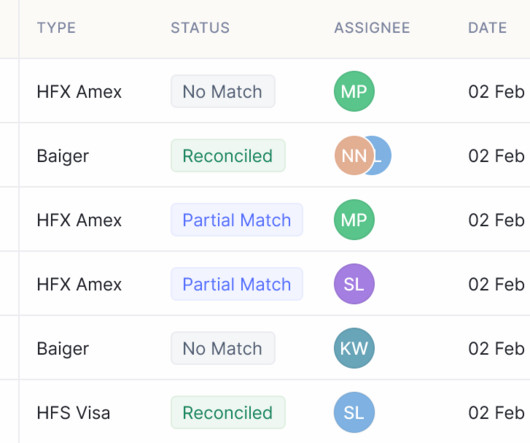

Nanonets

APRIL 24, 2024

Audit Bank Reconciliation Guide Both internal and external accounting audits are essential parts of financial management as well as organizational risk management. A bank reconciliation audit is one such process that helps in identifying financial gaps or discrepancies. In addition to companies performing bank reconciliations internally at least once a month, it is recommended that external auditors conduct a thorough bank reconciliation process biannually or annually to verify the interna

Insightful Accountant

APRIL 22, 2024

Intuit will unpack the latest updates to its QuickBooks Live strategy to prioritize its assisted, do-it-with-me service, taking place on Wednesday, April 24th.

Accounting Tools

APRIL 24, 2024

Fraud Schemes Related to Cash There are a number of ways in which an individual can commit fraud by stealing cash from a business. Since cash is essentially untraceable once stolen, someone intent on stealing assets will be particularly focused on this type of asset. Several ways in which cash fraud can be committed are noted below. Note that all of the following types of cash fraud are perpetrated by corporate insiders.

Accounting Today

APRIL 18, 2024

Speedy decision; trouble in paradise; diplomatic imbecility; and other highlights of recent tax cases.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Whether you’re on a 1-day close or a 10-day close, there are some fundamental commonalities that all strong accounting departments share when it comes to the month-end close. Please join us for an informative webinar where we share best practices that your team can implement today to ace your close! 1 CPE credit will be provided for qualifying participants.

Let's personalize your content