Mastering Payroll Compliance: A Guide for Singapore SMEs

In this guide, we’ll provide essential tips and best practices tailored to companies in Singapore, empowering business owners to streamline their payroll processes and avoid potential pitfalls.

Understanding Payroll Compliance

Payroll compliance encompasses a range of legal obligations that businesses must fulfil concerning employee compensation and tax-related matters. Key aspects include adhering to laws governing minimum wage, working hours, overtime pay, and leave entitlements outlined in the Employment Act.

Additionally, compliance involves accurately calculating and remitting CPF contributions to employees’ accounts, as mandated by the CPF Act.

Key Requirements and Responsibilities

To maintain payroll compliance, SMEs must diligently adhere to several requirements and responsibilities:

- Calculating Payroll: Ensure accurate calculation of employee salaries, allowances, and deductions in accordance with contractual agreements and statutory requirements.

- Filing Government Forms: Submit payroll-related forms and reports, such as the IR8A, IR21, and CPF contribution statements, to regulatory authorities within stipulated deadlines.

- Withholding Taxes: Deduct and withhold income taxes, CPF contributions, and other statutory deductions from employees’ wages as per prevailing tax rates and regulations.

- Remitting Payroll Taxes: Timely remit withheld taxes and CPF contributions to relevant government agencies to avoid penalties and legal repercussions.

- Year-End Reporting: Prepare and file end-of-year payroll tax returns, including the IR8A and Appendix 8A (if applicable), to reconcile annual income and tax liabilities for each employee.

Best Practices for Payroll Compliance

To ensure accurate and compliant payroll processing, SMEs can adopt the following best practices:

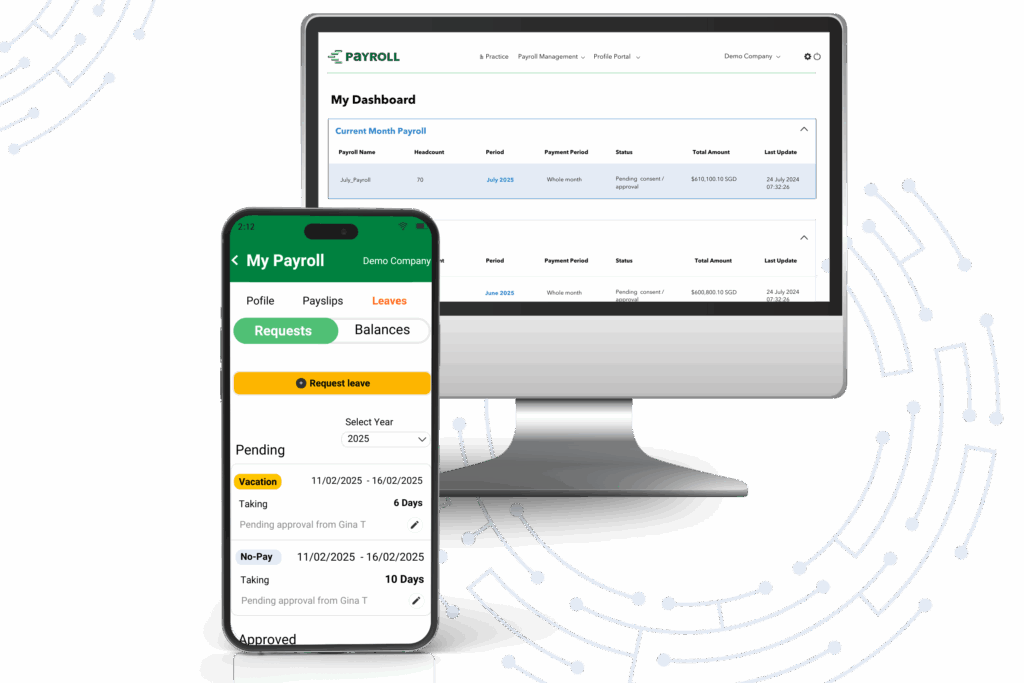

- Implement Payroll Software: Leverage automated payroll software to streamline calculations, deductions, and tax filings, reducing manual errors and enhancing efficiency.

- Maintain Compliance Audits: Conduct regular audits of payroll processes and records to identify discrepancies, errors, and potential compliance issues proactively.

- Foster Cross-Functional Collaboration: Foster collaboration between HR, finance, and relevant departments to ensure alignment and compliance with payroll regulations and reporting requirements.

- Facilitate Employee Self-Service: Offer self-service portals that empower employees to access their payroll information, tax documents, and leave balances, promoting transparency and reducing administrative burdens.

- Seek Professional Expertise: Consider engaging professional payroll consultants or outsourcing payroll functions to reputable providers with expertise in Singaporean payroll regulations and compliance requirements.

Summary

Navigating payroll compliance can be daunting for SMEs, but it’s essential for legal adherence and business success. By implementing robust processes, leveraging technology, and seeking expert guidance, businesses can streamline their payroll operations, mitigate risks, and foster a culture of compliance. Stay informed, stay compliant, and propel your business forward with confidence.

Try Counto’s payroll service

If you’re looking for a modern payroll provider, Counto is an excellent option. Our payroll service comes with an advance bill payment and spend management software, offering AI-backed smart tools other providers can’t provide. To learn more, speak to us directly on our chatbot, email us at hello@counto.sg, or contact us using this form.

Here are some articles you might find helpful:

Filing requirements for Pte Ltd companies

United States

United States Singapore

Singapore United Kingdom

United Kingdom