The Public Company Accounting Oversight Board imposed a $30,000 civil penalty against K.R. Margetson, a firm in North Vancouver, British Columbia, and its sole partner, Keith R. Margetson, for quality control violations and revoked his firm's registration for a year.

The PCAOB said in its

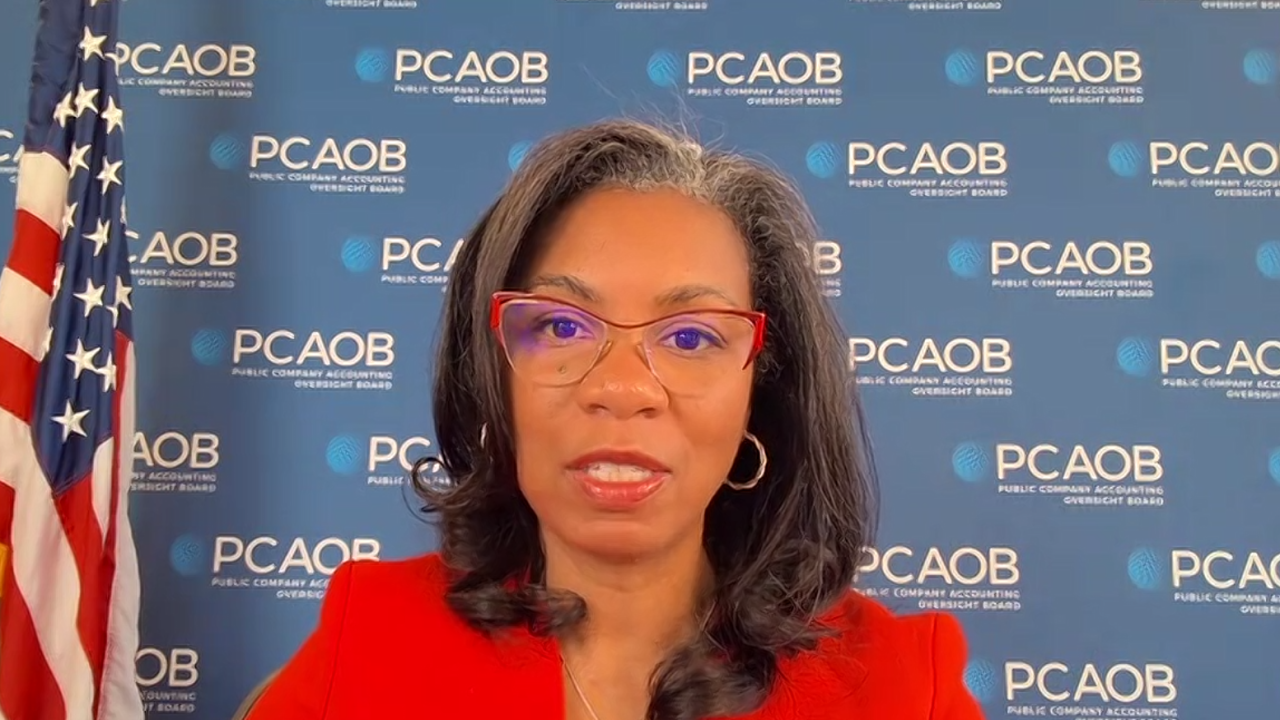

"Firms put investors at risk when they take on audits that they aren't equipped to complete to the highest standards," said PCAOB chair Erica Williams in a statement Tuesday. "The PCAOB will aggressively enforce its quality control and audit standards to ensure that investors are protected."

Without admitting or denying the findings, Margetson and his firm settled with the PCAOB and agreed to the order, which censures him and his firm, imposes a $30,000 civil money penalty, revokes his firm's registration, with the option to reapply after one year from the date of the order, and requires the firm to improve its quality control system before applying for re-registration. The order also bars him from associating with a registered public accounting firm, though he can file for consent to associate after one year.

Margetson plans to retire. "My only response is that the valuation method used in this file, which is the reason for the sanction, was basically the same method used in an earlier file that received no adverse comment," Margetson said in an email to Accounting Today. "When I pointed this out to the PCAOB (and it was noted in the file and was relied upon as a valid approach) their explanation was that every situation is different. This, of course, is a ridiculous comment. The file was completed in April 2021, it was reviewed by the PCAOB in June 2021, and it took two years to issue the sanction. Not real efficient, I would say. None of this makes sense to me, but I am of retirement age and I chose to settle and move on. Also, I have seen others get sanctioned for really petty violations, so I am calling this a win."