Guide to Vendor Account Reconciliation Process

Introduction

Running a business involves collaboration with various vendors who provide different kinds of products and services. Vendor reconciliation, a crucial part of this process, involves scrutinizing purchase-related documents to ensure accuracy in all vendor transactions. In this article, we will discuss the importance of the vendor reconciliation process and the benefits of employing AI-enhanced tools such as Nanonets.

What is Vendor Reconciliation

In accounts payable (AP) activities, a vendor is an individual or entity that provides goods or services to the company. An alternative term for vendor is "supplier."

Reconciliation in accounting refers to the comparing of details of transactions and financial activities between various documents.

The vendor reconciliation process is the systematic procedure of verifying and aligning the financial records of a company with those of its vendors. This process involves comparing the company's accounts payable data, which includes invoices, purchase orders, receipts, and statements, with the corresponding records maintained by the vendors.

Why is Vendor Reconciliation Important?

Vendor reconciliation offers numerous benefits that contribute to the financial health and stability of an organization.

Accuracy and Transparency: Vendor reconciliation ensures that financial records accurately represent the company's transactions. This accuracy promotes transparency, allowing stakeholders such as investors, customers, other vendors, shareholders, and regulatory bodies to have confidence in the integrity of the financial information.

Fraud Detection and Prevention: Through vendor reconciliation, businesses can detect discrepancies that may indicate fraudulent activities such as overbilling, duplicate invoices, or fictitious vendors. For instance, if a vendor's invoice appears multiple times in the reconciliation process without corresponding goods or services received, it could raise a red flag for further investigation.

Cash Flow Management: Effective vendor reconciliation aids in optimizing cash flow management by ensuring that payments to vendors align with the goods or services received. By reconciling invoices and payments promptly, businesses can avoid overpaying or missing payments, thereby maintaining healthy cash flow levels.

Vendor Relationship Management: Regular reconciliation fosters stronger vendor relationships by promoting trust. By promptly addressing discrepancies and resolving payment issues, businesses demonstrate reliability and professionalism. Vendors are also more likely to view the company as a reliable partner, potentially offering preferential pricing or prioritized services.

Compliance and Audit Readiness: Vendor reconciliation plays a crucial role in ensuring compliance with regulatory requirements and audit standards. By maintaining accurate records and reconciling vendor transactions, businesses can readily provide evidence of financial integrity and adherence to applicable regulations during audits or regulatory inspections.

Vendor Reconciliation Workflow

Typically conducted monthly, the vendor reconciliation process begins upon receipt of an invoice from a vendor. Efficient vendor reconciliation typically involves the following steps:

Collection and Standardization of Records: All records must be collected and consolidated into a unified format, such as a PDF or a spreadsheet. This ensures consistency and facilitates data organization and management.

Inspection of Vendor Invoices: Vendor invoices should be thoroughly inspected to ensure accuracy and completeness. All line items must be reviewed for errors in vendor names, invoice numbers, payment amounts, and terms. It is essential to ensure that all invoices are accurately recorded in the accounts payable system.

Verification of Payment Records: Payment records, such as checks or electronic confirmations, need to be compared with corresponding vendor invoices and entries in the accounts payable system. Any discrepancies, such as duplicate payments or missing entries, must be identified.

Comparisons and Matching: Vendor statements must be matched with accounts payable records to confirm that outstanding balances align correctly. Any discrepancies found, such as missing payments or invoices, should be investigated and resolved.

Double-Checking with Bank Statements: A thorough comparison between payment records in the accounts payable system and bank statements is necessary.

Dealing with Discrepancies: Immediate action must be taken to resolve any inconsistencies identified during reconciliation. This may involve contacting vendors, reviewing payment documentation, or reconciling records with bank statements. Detailed records of all discrepancies and their resolutions should be maintained.

Making Adjustments and Corrections: All adjustments required to rectify errors or discrepancies in the accounts payable system must be recorded. This could include entering missing invoices, correcting payment amounts, or updating payment terms as necessary.

Review: Once all discrepancies are resolved, the reconciled accounts payable records should be carefully reviewed to ensure accuracy and completeness. A summary report detailing any adjustments and findings should be prepared, and necessary approvals obtained.

Staying Vigilant: Continuous monitoring and review of accounts payable records are necessary. Internal controls, such as using automation tools and segregating responsibilities, should be implemented to prevent errors and fraud in the accounts payable process.

A standardized vendor reconciliation process facilitates consistency and clarity in AP. Key fields such as reconciliation account, vendor's account, statement date, opening and closing balances, due date, references, and notes provide comprehensive documentation for each transaction. Establishing a schedule is essential to prevent last-minute rushes and interruptions to ongoing tasks. It is also important to determine the duration, whether in days or hours, dedicated to this process to be better prepared.

Vendor Reconciliation Examples

Consider, for example, a company, Hypothetics, Inc. specializing in software development. Here are how and why vendor reconciliation plays a crucial role in ensuring the financial integrity of the organization.

Scenario 1: Invoice Discrepancy

Hypothetics, Inc. (HI) engages with a third-party IT service provider, VendorVision (VV), to upgrade its network infrastructure. After the completion of the project, HI. receives an invoice from VV for the agreed-upon amount. However, upon closer inspection, the finance team notices discrepancies between the services outlined in the invoice and those specified in the original contract.

The accounts payable manager at HI immediately flags the issue and initiates the vendor reconciliation process. She reaches out to the project manager of VV to clarify the discrepancies and ensure that the invoice accurately reflects the services rendered. Through open communication and collaboration, HI and VV teams can reconcile the invoice, aligning it with the terms of the contract and avoiding any potential overpayment.

Scenario 2: Duplicate Payments

While processing a flurry of payments, HI’s accounts payable system encounters a hiccup—an unexpected duplicate payment to its cloud hosting provider, CloudWorks (CW). Panic ensues as the finance team scrambles to identify the cause of the error and mitigate any potential financial losses. The accounts payable supervisor springs into action and combs through payment records, comparing them with the invoices and bank statements. Sure enough, the duplicate payment transaction is identified. Without delay, he contacts CW and initiates the necessary steps to rectify the error and recover the excess payment. Thanks to prompt vendor reconciliation, HI is able to recover the duplicate payment and safeguard its financial resources.

Scenario 3: Unrecorded Credits

HI frequently collaborates with software vendors to procure licenses and subscriptions for its development tools. However, amidst the hustle and bustle of day-to-day operations, the finance team inadvertently overlooks a credit memo issued by one of its vendors, CodeMastes (CM).

Realizing the oversight, the finance analyst of HI, takes immediate action to rectify the situation. He reviews the vendor statements and identifies the unrecorded credit memo from CM. The financial analyst then applies the credit to the corresponding invoice, ensuring that CM receives the full benefit of the credit and maintains accurate financial records.

In each of these scenarios, vendor reconciliation is seen to be a critical component of HI’s financial management process. Through careful review, effective communication, and attention to detail, various teams at HI successfully navigate various challenges, ensuring the accuracy and integrity of the company's financial records.

Common Mistakes to Avoid During Vendor Reconciliation

There are a few common mistakes that can be made during vendor reconciliation, which can lead to discrepancies and inefficiencies. Here are some key mistakes to avoid:

- Incomplete Records: One of the most common mistakes in vendor reconciliation is the presence of incomplete or inaccurate records. Failure to maintain comprehensive records of vendor transactions can make it challenging to reconcile accounts accurately. It's essential to ensure that all invoices, payments, and credits are properly documented and accounted for to avoid discrepancies.

- Failure to Communicate: Effective communication is vital during the vendor reconciliation process, particularly between departments responsible for purchasing, receiving goods, and accounting. Miscommunications or lack of communication can lead to discrepancies in invoices, payments, and credits. It's crucial to establish clear communication channels and processes to facilitate the exchange of information and resolve any discrepancies promptly.

- Lack of Regular Reviews: Another common mistake is the failure to conduct regular reviews of vendor accounts and transactions. Without periodic reviews and audits, errors and discrepancies may go unnoticed, leading to inaccuracies in financial records. Implementing a schedule for regular reviews and audits can help identify and address issues promptly, minimizing the risk of financial discrepancies.

- Overreliance on Manual Processes: Relying solely on manual processes for vendor reconciliation can increase the likelihood of errors and inefficiencies. Manual data entry and reconciliation are prone to human error. The Institute of Finance and Management reports that 39% of invoices have errors that could affect the financial integrity of the company. According to another survey by Amalto Technologies, incorrect invoices cause 61% of late invoice payments. Furthermore, as transaction volumes increase, manual processes become increasingly time-consuming and error-prone. Implementing automated reconciliation tools and software can streamline the process, reduce errors, and improve efficiency.

- Ignoring Vendor Relationships: Vendor relationships play a crucial role in the vendor reconciliation process. According to Forbes, 47% o supplier collaborations fail because of a lack of commitment or trust between the companies. Failing to nurture positive relationships with vendors can lead to delays in resolving discrepancies and disputes. It's essential to maintain open lines of communication with vendors, address issues promptly and professionally, and strive to build mutually beneficial partnerships.

Vendor Reconciliation Best Practices

To optimize vendor reconciliation and streamline operations, organizations can implement the following best practices:

- Maintain Accurate Records: Consistently update and maintain detailed records of all vendor transactions, including invoices, payments, credits, and adjustments. This ensures that financial data is readily available for reconciliation and reduces the risk of discrepancies.

- Implement Automation: Leverage technology and automation tools like Nanonets to streamline the reconciliation process. Automated reconciliation software can match invoices with purchase orders and receipts, identify discrepancies, and flag exceptions for review, reducing manual effort and errors.

- Establish Clear Procedures: Develop standardized procedures and workflows for vendor reconciliation to ensure consistency and efficiency. Clearly outline roles and responsibilities, approval processes, and escalation procedures for resolving discrepancies.

- Regular Reviews and Audits: Conduct regular reviews and audits of vendor accounts to identify discrepancies, errors, and anomalies promptly. Establish a schedule for periodic reconciliations, such as monthly or quarterly, to ensure that accounts are up-to-date and accurate.

- Segregation of Duties: Implement segregation of duties to prevent fraud and errors in the reconciliation process. Separate responsibilities for initiating payments, approving invoices, and reconciling accounts to create checks and balances and minimize the risk of manipulation.

- Monitor Key Performance Indicators (KPIs): Track key performance indicators related to vendor reconciliation, such as reconciliation accuracy, cycle time, and outstanding discrepancies. Monitor KPIs regularly to identify areas for improvement and measure the effectiveness of reconciliation processes.

- Proactive Communication: Foster open communication channels with vendors to address issues and resolve discrepancies promptly. Establish clear channels for communication, such as dedicated email addresses or online portals, and respond to vendor inquiries and concerns in a timely and professional manner.

- Training and Education: Provide training and ongoing education for employees involved in the vendor reconciliation process. Ensure that staff members understand the importance of reconciliation, know how to use reconciliation tools effectively, and are aware of relevant policies and procedures.

- Vendor Relationship Management: Cultivate positive relationships with vendors to facilitate collaboration and cooperation in the reconciliation process. Communicate openly, negotiate favorable terms, and address any issues or concerns proactively to maintain strong vendor partnerships.

- Continuous Improvement: Continuously evaluate and improve vendor reconciliation processes based on feedback, lessons learned, and industry best practices. Regularly solicit input from stakeholders, monitor performance metrics, and implement enhancements to optimize efficiency and effectiveness.

Why Automate Vendor Reconciliation?

Automation is an indispensable asset for any financial operation dealing with substantial financial and transactional data volumes, particularly as a business expands. Automating vendor reconciliation alleviates the burdens associated with manual processes and enhances overall efficiency in the following ways.

The use of automation tools conserves employee time and effort. By automating repetitive tasks, employees can focus on more strategic activities, boosting productivity and reducing the risk of errors.

Automation helps to mitigate payment errors inherent in manual reconciliation processes. Human errors such as overpaying suppliers, missing late payments, or making duplicate entries can be costly to rectify. Automating the reconciliation process minimizes such risks.

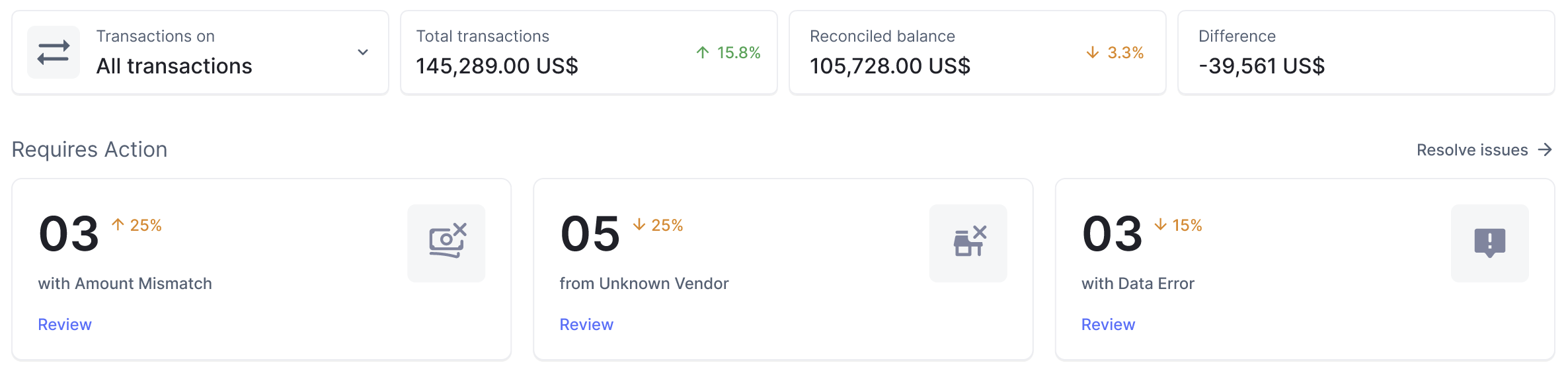

Automation improves invoice tracking, eliminating the hassle of sifting through piles of documents to identify missing invoices. Expense management software facilitates quick identification of discrepancies, enabling smoother accounting processes and better financial management.

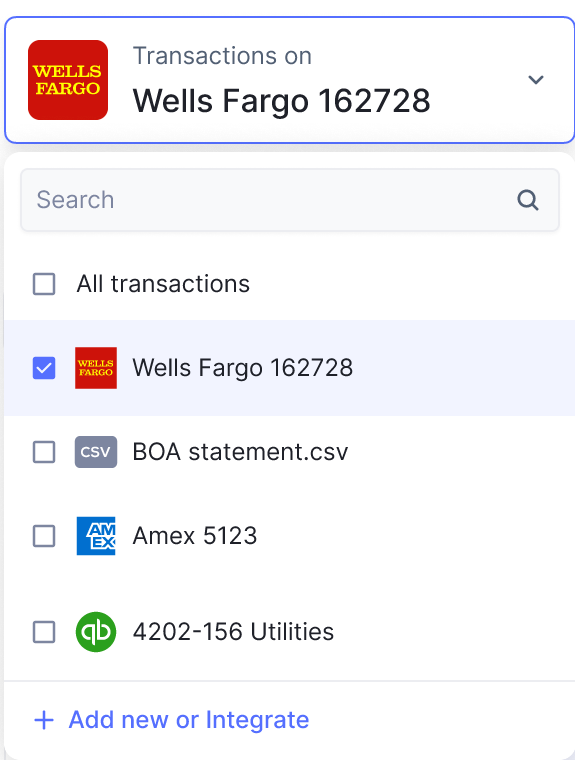

Most automation tools connect to other accounting software used by businesses and thereby provide a centralized dashboard for tracking automated bill payments, custom approval workflows, and reconciliation procedures.

Automation eases the reporting and auditing processes, enabling businesses to generate financial and audit reports instantly. By streamlining the reconciliation procedures, automation software enhances compliance and transparency while saving time and resources.

How can your business benefit from automated vendor reconciliation?

By streamlining the reconciliation process, automation reduces the time and effort needed to match invoices with payment records, resulting in more efficient workflows. Automation minimizes the risk of human error, ensuring greater accuracy in your financial records and reducing the likelihood of discrepancies. This increased accuracy translates into cost savings by decreasing the need for manual labor and preventing unnecessary expenses such as duplicate payments. Automated systems often come with built-in compliance features, helping your business stay compliant with regulatory requirements and industry standards. Faster payment cycles and improved communication facilitated by automation can strengthen relationships with vendors, fostering trust and reliability. With access to real-time reconciliation data, your business can make more informed decisions, driving strategic initiatives with confidence. Furthermore, automated reconciliation solutions offer flexibility and scalability, enabling your business to adapt to changes in transaction volume and accommodate growth more easily.

Nanonets as your vendor reconciliation partner

Leveraging advanced AI and ML technologies, Nanonets expedites supplier communication and invoice processing, facilitating prompt approvals and accurate record-keeping. Here's how Nanonets can assist with vendor reconciliation activities:

Looking out for a Reconciliation Software?

Check out Nanonets Reconciliation where you can easily integrate Nanonets with your existing tools to instantly match your books and identify discrepancies.

Efficient Data Extraction: Nanonets automates data extraction from various documents. This feature reduces the time and errors associated with manual data entry.

Touchless Processing: Through touchless invoice processing driven by AI and machine learning, Nanonets minimizes manual intervention, thereby reducing the risk of errors. This feature enhances accuracy and ensures financial integrity.

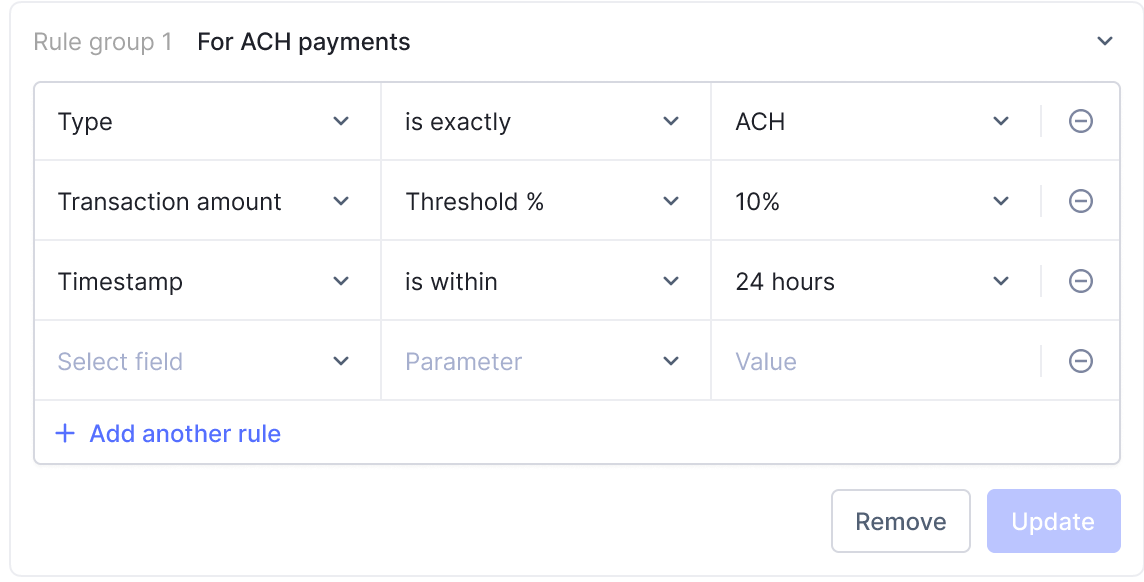

Advanced Matching Rules: Nanonets employs advanced matching rules to detect discrepancies and prevent fraudulent activities. This capability further enhances accuracy and strengthens financial security.

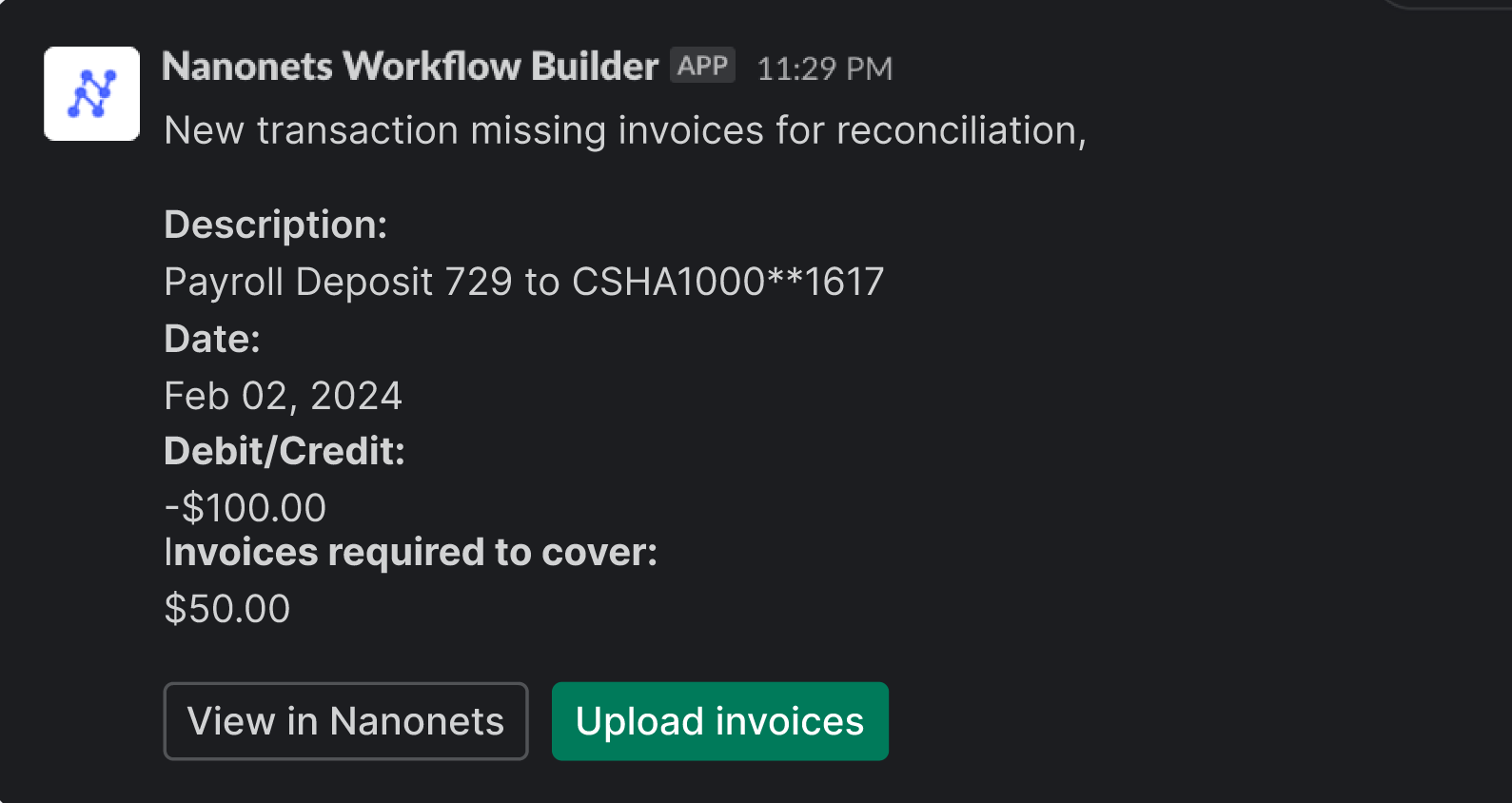

Real-Time Notifications: The platform provides real-time notifications for invoices requiring attention, allowing users to promptly address any discrepancies or outstanding issues.

Transparent Reconciliation: Nanonets simplifies reconciliation by extracting data from various sources and identifying errors precisely. This fosters transparent and error-free accounting practices, providing businesses with reliable financial insights.

Scalability and Integration: Tailored for large enterprises, Nanonets offers robust scalability and seamless integration with existing systems. This ensures that the platform can accommodate growing business needs without disruptions.

Stringent Security Measures: Adhering to stringent security standards, Nanonets ensures data confidentiality and encryption of the highest standards. This provides businesses with peace of mind regarding the security of their financial data.

Comprehensive Reporting: Through automated reporting, Nanonets delivers comprehensive insights into reconciliations, facilitating transparent audit trails and informed decision-making processes.

Take Away

Vendor account reconciliation is important for businesses to ensure accurate payments, avoid errors, and save valuable time. By adopting effective automation solutions, such as Nanonets, organizations can streamline their reconciliation processes, expedite supplier communication, and enhance financial integrity. Through advanced technologies like AI and machine learning, manual intervention is minimized, errors are mitigated, and efficiency is maximized. By harnessing the power of automation, businesses can optimize their vendor reconciliation efforts leading to better bottom lines.