Introduction

Retained earnings are an important part of a company’s financial statements and indicate business health.

They are profits a company holds onto for future use instead of paying out as dividends. They show a company’s ability to grow and reinvest in itself.

Statistics have revealed that companies with high retained earnings tend to have higher growth rates and can better handle economic downturns.

A McKinsey study found businesses with higher retained earnings ratios saw a 15% increase in market value over 5 years compared to those with lower ratios.

This post will discuss the critical role of retained earnings in financial reporting, a company’s profitability, and growth opportunities. We will also provide a detailed tutorial on how to calculate retained earnings.

Whether you’re an entrepreneur, finance manager, or investor, grasping retained earnings is crucial to business success.

What Are Retained Earnings?

Retained earnings are the profits a business keeps back instead of dividing them among the shareholders by paying dividends. In simple words, it is the net profits a company keeps for reinvestment purposes or to maintain a financial cushion when required later.

The equity portion of the balance sheet contains retained earnings (total cumulative earnings minus any dividend payments).

Role Of Retained Earnings Business Growth

The contribution of retained earnings is paramount for a company’s development. Let’s find out why.

Reinvestment: Companies utilize retained earnings to start new undertakings, conduct research and development, buy equipment, and undertake other assignments that anticipate growth. This, in turn, helps firms remain competitive and innovative in their sector.Financial Stability: Retained earnings function as a financial buffer, allowing firms to weather economic downturns or any unexpected disbursement of expenses without another debt. This stability is one of the key factors for long-term success.

Debt Reduction: Businesses can utilize their retained earnings in various ways. One of these methods is repaying debts that they owe, which will result in them lowering interest costs and stabilizing cash flow. This sort of debt reduction provides financial leverage to the firm. On the other hand, improving the creditworthiness as well.

Shareholder Value: While dividends are not payable as retained earnings, they create value for shareholders. Established companies with high retained earnings have very bright future growth prospects, which may end up in the rise of the prices of stocks and, consequently, to shareholder’s value.

Where Retained Earnings Fit in Balance Sheet

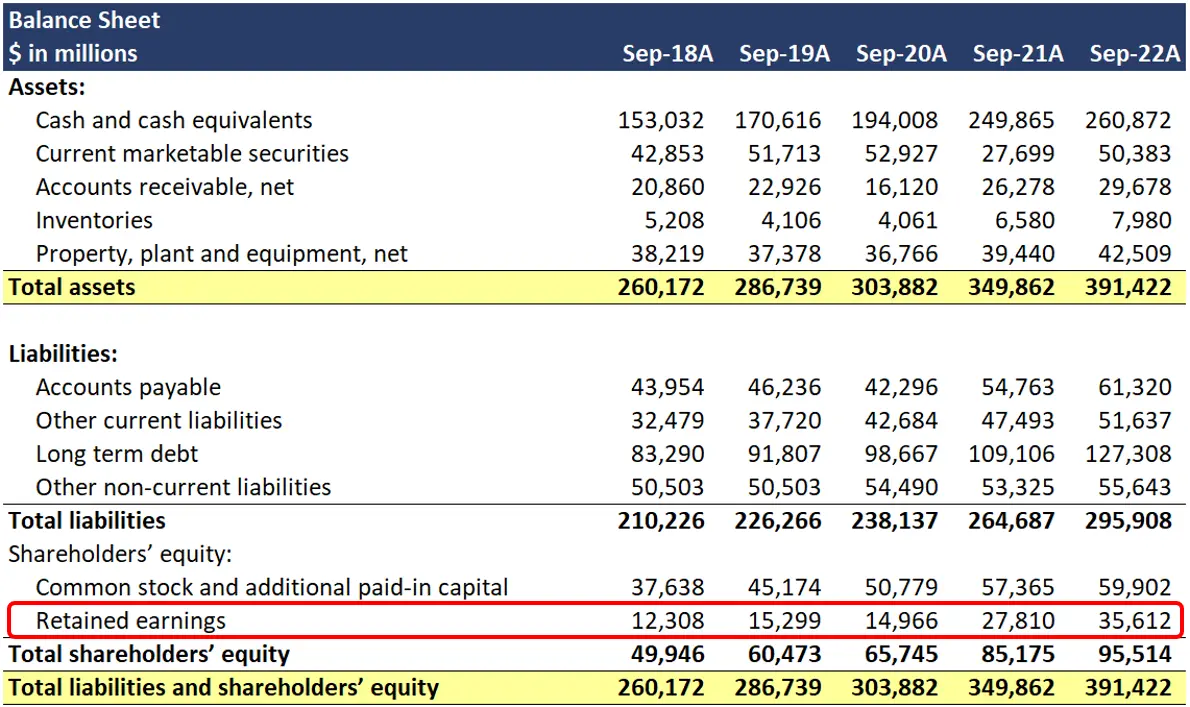

Source: https://www.careerprinciples.com/resources/retained-earnings

Retained earnings are an important component of a company’s financial statements. These liabilities usually appear in the equity section of the balance sheet: they are the profits that have not been paid out to the shareholders as dividends.

Retained earnings, appearing as the last line of the equity section of the balance sheet, are listed next to other equity components, including common stock and additional paid-in capital. This shows that retained earnings help build a company’s ownership value.

This amount is a combination of profits reinvested in the business, showing further growth potential and financial health.

How To Calculate Retained Earnings?

Retained earnings represent the sum of profits after paying shareholders dividends. It is a crucial aspect of the company’s balance sheet and illustrates how much free cash an organization has to reinvest, pay its debts, or be prepared for the future. To calculate retained earnings, you need to understand a simple formula:

Basic Formula

Using this formula, you can evaluate new retained income for the current period, which will serve as a basis for the next period.

Components Explained

Let’s break down each part of the formula to understand its significance:

Beginning Retained Earnings

Beginning Retained Earnings is the retained balance of the previous financial year. It is the beginning of the operation wherein the current period’s retained earnings are determined. Take this as an account balance that reflects how much profit the company kept in the past.

Net Income

Net income is total revenue minus total expenses for the said period. It is the representative of earnings and/or losses within that period. If the company had earned profit, it will then be added to the retained earnings. While the gain is added, the loss is subtracted.

Dividends

A dividend is a monetary payout to shareholders. When a firm declares a dividend, the retained earnings are decreased by the total payout amount of that particular dividend. This is due to the fact that the funds are now no longer available to finance reinvestment and other business requirements.

Example Calculation

To illustrate the formula in action, let’s consider a fictional company, ABC Corp., and calculate its retained earnings for a specific period.

- Beginning Retained Earnings: At the start of the period, ABC Corp. had $100,000 in retained earnings.

- Net Income: During this period, the company generated a total revenue of $300,000 and incurred $200,000 in expenses. The net income is calculated as follows:

- Dividends: ABC Corp. decided to pay dividends totaling $20,000 to its shareholders during the period.

- Ending Retained Earnings: Applying the basic formula, the ending retained earnings are calculated as:

Thus, the retained earnings at the end of the period are $180,000. This value becomes the beginning retained earnings for the next period, continuing the financial management and reporting cycle.

Importance Of Retained Earnings In Financial Reporting

Retained earnings are a big deal when looking at a company’s financial reports. They tell us if a business is making good profits and has a healthy financial situation. By checking the retained earnings, people involved with the company can see how well it’s doing and whether it might grow bigger in the future.

Assessing Financial Health

Retained earnings are the profits a company holds onto instead of paying them out. Monitoring retained earnings lets money experts and business owners see if the company is making profits over time. If retained earnings keep going up, that’s a really good sign. It means more cash is coming in than going out, which shows the business can keep running long-term without needing outside money helpers.

Influence on Investor Decisions

Investors look at retained earnings to judge if they are stable and can grow. When retained earnings are high, the company uses that money to build the business. This could mean making more products, growing, or finding new ways to grow. Long-term investors are happy to see high retained earnings numbers. How much is retained also affects how much profit-share the company gives to investors.

Impact on Creditworthiness

Money lenders think retained earnings are very important when deciding whether a company can repay loans. If retained earnings keep climbing, the business makes steady profits and can pay what it owes. The higher those earnings, the more stable the company looks to lenders. This leads to better loan deals and cheaper interest rates because lenders see less money risk. Companies with solid retained earnings have a better chance of getting good borrowing terms.

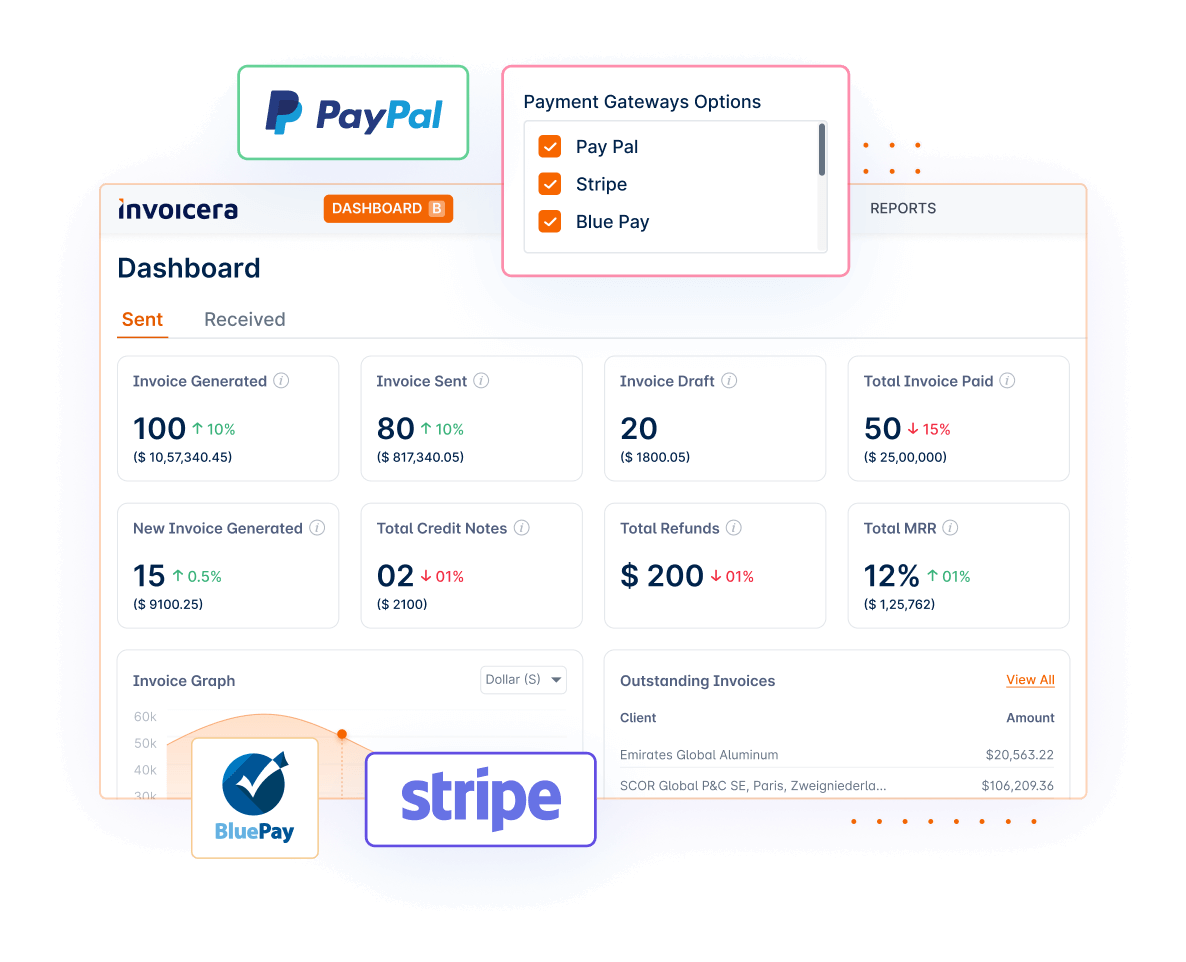

Manage Financial Reporting With Invoicera

Financial reporting is tough, but the right tools can make it much easier. Invoicera is a super helpful tool for businesses. It lets you handle all sorts of financial tasks and keep an eye on income, costs, and other money info. The software is easy to use, and its smart features make money reporting way less of a headache and much more on point.

Key Features for Financial Reporting

Invoicera has several cool features that make it a real champ for financial reporting:

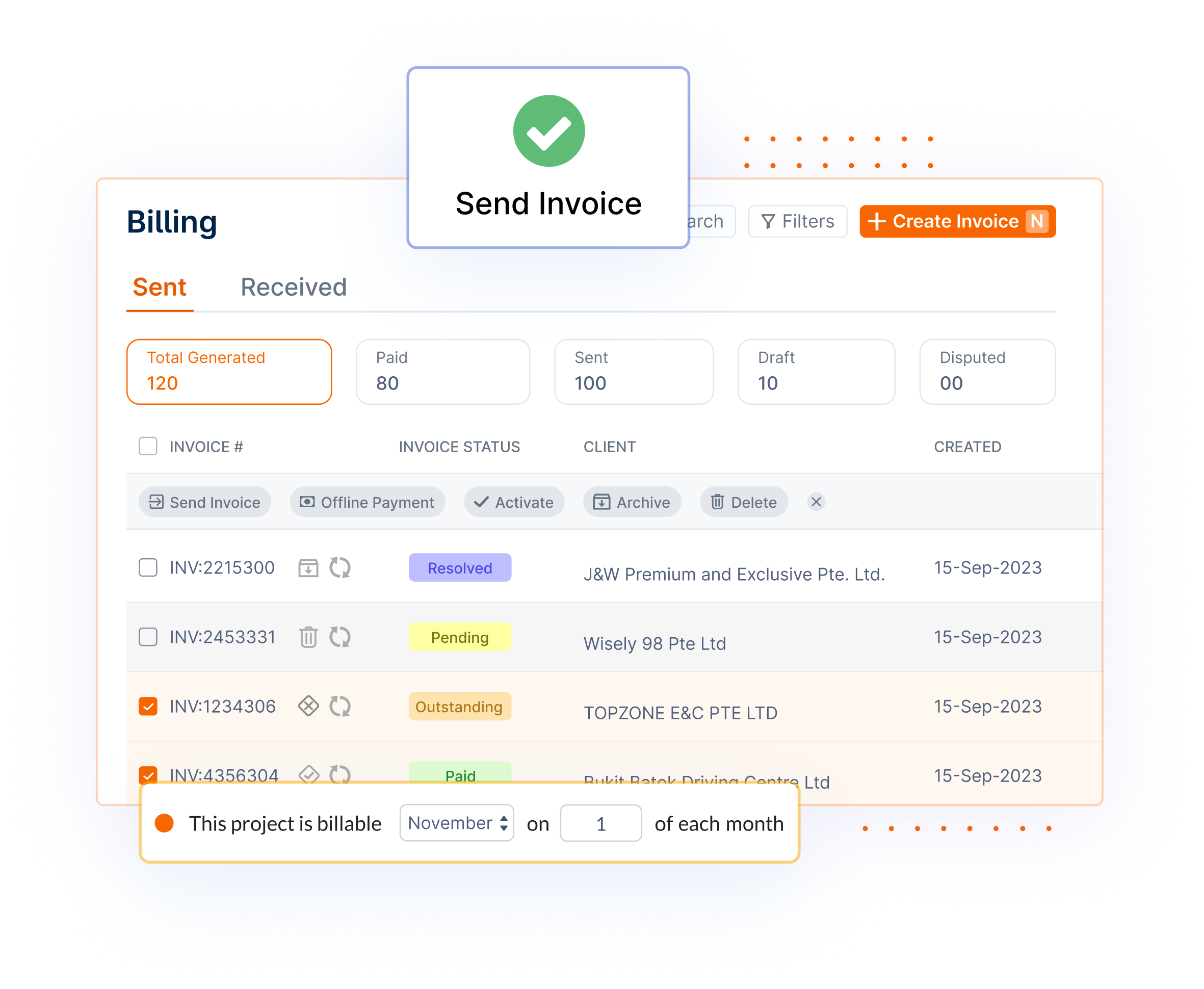

- Automated Invoicing: With Invoicera, you can send out invoices quickly and properly. You can customize the invoice designs, set repeat billings, and send payment reminders to customers automatically, ensuring you get paid on time.

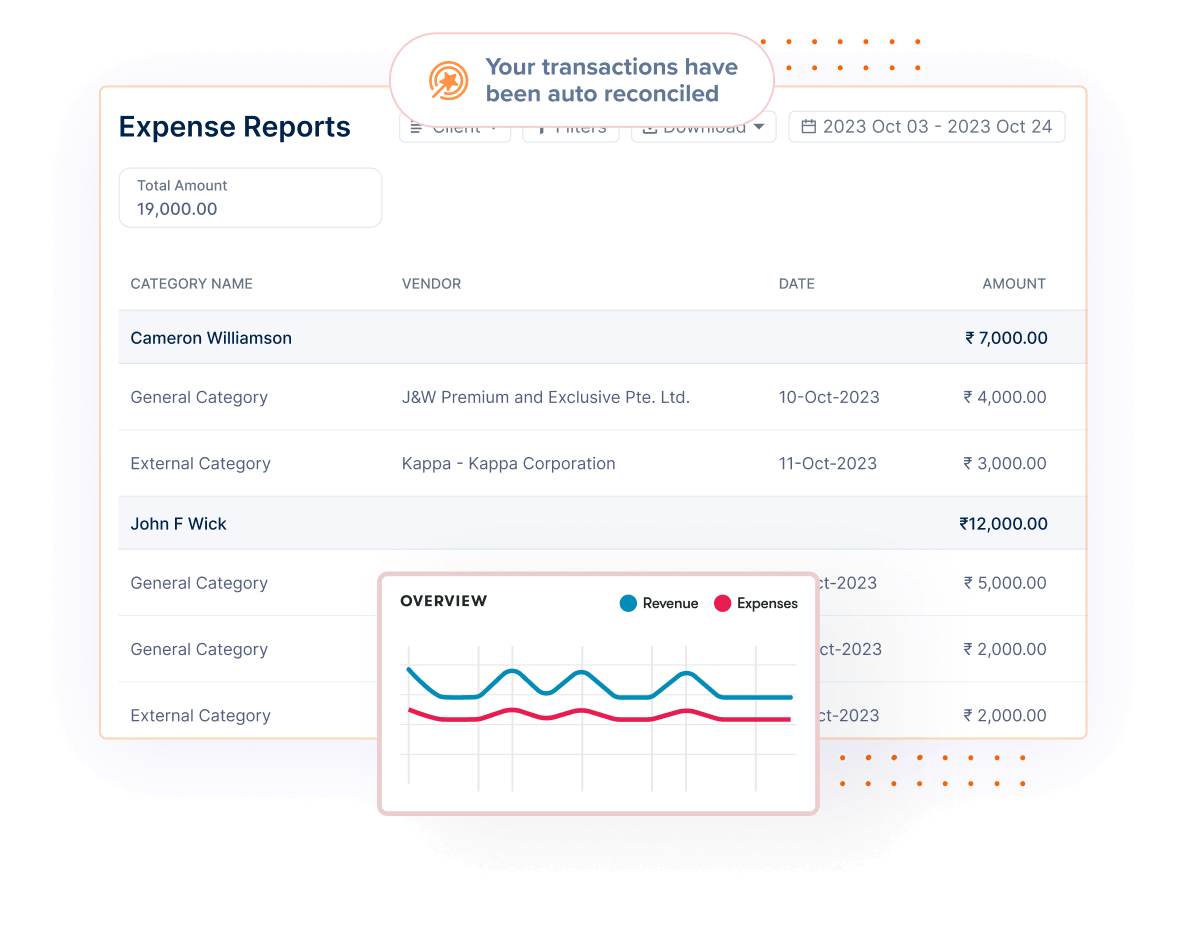

- Expense Tracking: The program helps you keep tabs on your costs by sorting them into easy-to-see groups. This lets you have the right financial records which are a must for reporting and tax times.

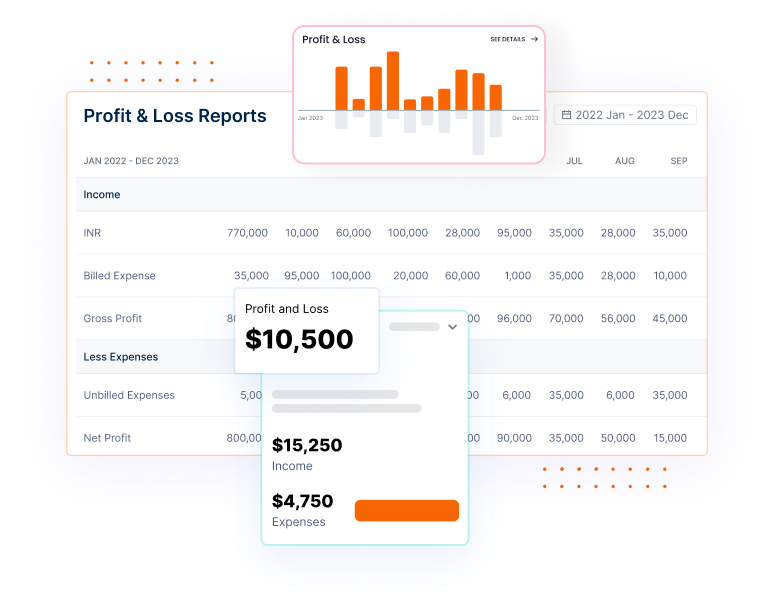

- Financial Statements: Invoicera can make important statements like income report, cash flow details, and the overall money situation paper. These reports are key to knowing if your business is doing well money-wise and following all the rules.

- Integration with Accounting Software: Invoicera connects to most of the accounting software that are used by businesses. This makes the money data flow smoothly without manual data errors.

Additional Advantages

Beyond its core features, Invoicera offers additional benefits that further enhance its value for financial reporting:

- Improved Accuracy: By automating invoicing tasks, Invoicera cuts down human mistakes so your money reports are more on-point.

- Time Savings: Automation and smooth processes can save you time and allow you to focus on other important business tasks.

- Compliance: Invoicera helps ensure compliance with financial regulations by keeping accurate records and generating essential financial reports. This can be especially helpful during audits or tax season.

- Scalability: Whether small or large, Invoicera can grow with your business and give you flexibility as your needs change.

Overall, Invoicera is a powerful tool for managing financial reporting. It simplifies complex jobs, makes things more accurate, saves time, and keeps your business funds straight and narrow.

Best Practices for Managing Retained Earnings

Appropriate handling of retained earnings might result in better management, a strong financial outlook, and growth in the value of the stock. The following are recommendations on how to maximize your retained earnings.

- Conducting Frequent Financial Reviews

Periodically review your financial statements to gauge your retained earnings ratio. This allows you to identify patterns, track exceptions, and ensure error-free reporting. Conducting quarterly or annual reviews can also keep you abreast of your business’s financial health.

- Define a Specific Dividend Policy

A steady and uniform policy on dividends guarantees your approach to paying out profits and retaining earnings is well-balanced. A structured policy can help you to avoid too much dividend distribution. This can stimulate more investment and thus increase the profitability of the business.

- Reinvest in Business Developments

Retained earnings serve as capital for reinvesting in your company to enhance its value. Consider allocating these proceeds to R&D, new product launching, marketing campaigns, or upgrading your infrastructure. This approach can create business growth and improve profitability over the long run.

- Establish the Contingency Fund

Dedicate part of your saved money as a contingency fund. This deposit can build up as a shield against unforeseen impediments such as recession or emergency spending. A balanced contingency fund is one of the factors which may probably increase your company’s creditworthiness.

- Use Technology to Streamline Financial Management

Leverage technology tools like Invoicera to simplify financial management and improve accuracy. These tools can automate invoicing, track expenses, and generate financial reports, making it easier to calculate retained earnings and manage your business’s finances.

- Consult Financial Experts

Seek advice from financial advisors or accountants to ensure you’re managing retained earnings effectively. These professionals can offer insights into tax implications, compliance requirements, and investment strategies that align with your business goals.

- Maintain Transparency with Stakeholders

Transparency with stakeholders—such as investors, shareholders, and employees—is crucial. Communicate your company’s financial strategy and explain how retained earnings drive growth and stability. This builds trust and confidence in your business.

Final Thoughts

Retained earnings are crucial to any business’s financial health. They represent a company’s profits that can be reinvested or saved for future use, indicating potential for growth and sustainability. In this blog, we’ve explained how to calculate retained earnings, why they’re important for financial reporting, and best practices for managing them effectively.

By following the advice in this guide, you can better use your retained earnings to grow your business, improve financial stability, and keep stakeholders informed. Tools like Invoicera can help streamline this process by automating invoicing, tracking expenses, and generating financial reports.

Thank you for reading! We hope you found this information helpful. If you have any questions or tips about managing retained earnings, please comment below.

FAQs

Can retained earnings be negative?

Yes, retained earnings can be negative. This is often referred to as an “accumulated deficit.” It occurs when a company has more net losses than profits over time or pays out more in dividends than retained earnings.

How are retained earnings different from equity?

Retained earnings are a part of a company’s total equity, representing the cumulative retained profits instead of paid out as dividends. Equity, however, encompasses a broader range of items, including common stock, additional paid-in capital, and other forms of shareholder investment.

How do retained earnings impact a company’s credit rating?

Retained earnings are seen as an indicator of a company’s financial stability and ability to generate consistent profits. A high level of retained earnings generally signals to creditors and lenders that the business is financially healthy, which can improve its credit rating and make it easier to secure loans or credit.