Introduction

Expense management is undisputedly one of the primary issues faced by organizations in today’s ever-changing business times. Manual tracking consumes time and leaves room for errors, possibly disrupting financial prosperity.

Nevertheless, technology upgrades have led to the development of numerous expense management systems that aim to provide better accuracy and efficiency.

We’ll delve into the top 10 expense management software for 2024 and beyond. We’ll look into their advantages, learn what they are capable of, and see how they help companies plan and manage their spending, resulting in better financial management and fewer bottlenecks.

Let us discover the path of simple expense management together.

What Is Expense Management?

Expense management is a pillar of business activities— tracking, analyzing, and utilizing expenses effectively.

It can be used for a range of activities from office supplies to equipment. Well-spent money is both the means to achieve goals and prevent money loss. Don’t look for only cost reduction. Focus on spending wisely to build and remain strong.

Used technologies and software to simplify and improve the figures of expense recording. These software, therefore, are crucial in managing your business expenditure, as we shall elaborate further later.

Getting the expense management software has now become a must for businesses, big or small. They bring a bunch of perks: making the process easier to go through, saving time and money, and adding a level of financial control.

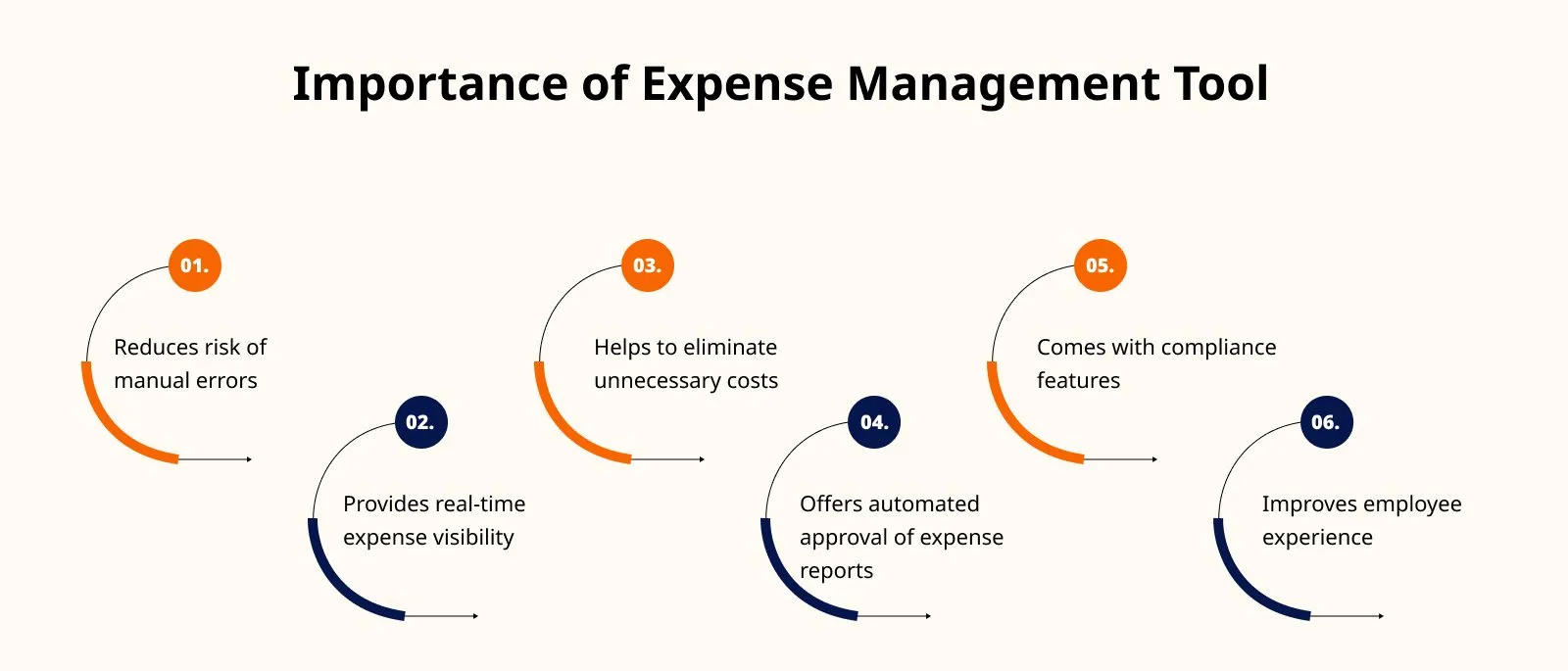

Here’s why they’re essential:

Expense management software is now a must-have for businesses, big and small. They bring a bunch of perks: making the process smoother, saving time and cash, and boosting financial oversight. Here’s why they’re essential:

Efficiency and Accuracy: Expense management software systematizes much of the procedure, reducing extensive labor efforts like manual data input and the risk of mixing up the outcome. This saves time and makes it certain that reports on expenses are more accurate.

Real-time Visibility: These tools make it possible to assess the real-time state of spending in the company as it occurs. You can record expenses as they take place, which will make spotting any overspending before taking prompt measures simple.

Policy Enforcement: A remarkable feature of expense management systems is that these systems allow you to set and enforce spending policies. This facilitates employees’ compliance with company spending limits, a factor that reduces spending that is highly likely extravagant or off-the-grid.

Cost Savings Tracking Tool: Such tools could significantly reduce expenses by locating where you can save expenditures. They provide a way of cutting costs and eradicating redundancies and unnecessary expenses.

Streamlined Approval Process: The built-in automated approval workflow will help you accelerate the approval process of expense reports. This allows for faster staff reimbursement while concurrently eliminating administrative gridlock.

Compliance and Reporting: Expense management tools include tax compliance that enables the operations to conform to the tax regulations and the financial reporting rules.

Improved Employee Satisfaction: Both employees and employers benefit from such tools, which are designed to make the submission and monitoring of expenses easy. They can provide job enjoyment and increased levels of motivation.

Top 10 Expense Management Tools

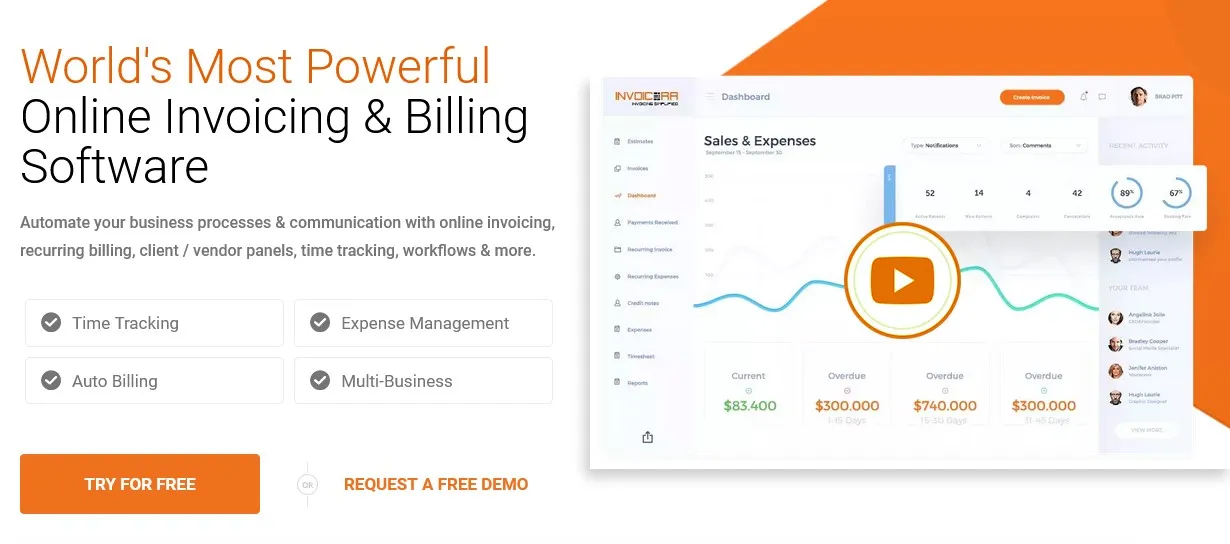

1. Invoicera

Invoicera is a versatile expense management tool offering comprehensive features to simplify financial processes.

From expense tracking and reporting to invoice generation, this tool provides businesses with a one-stop solution for managing expenses efficiently.

Features

- Expense Tracking

Invoicera streamlines expense tracking by allowing users to record, categorize, and monitor expenses in real time effortlessly.

Its user-friendly interface simplifies the process of

– Logging expenses

– Attaching receipts

– Allocating costs to specific projects or clients

- Customizable Expense Reports

This tool enables the creation of detailed expense reports tailored to your business needs. Users can generate comprehensive reports showcasing expenditure patterns, categories, and trends.

These reports provide invaluable insights for informed decision-making and budget planning.

- Automated Expense Management

Invoicera automates repetitive expense-related tasks, such as recurring expenses or approvals, reducing manual effort and ensuring accuracy.

Through automation, it optimizes workflows, minimizing errors in expense reporting and reimbursement processes.

- Multi-Currency Support For Expenses

With its multi-currency functionality, Invoicera simplifies international expense management.

Users can effortlessly handle expenses in different currencies and accurately convert and record expenditures, making it an ideal choice for businesses operating globally.

- Expense Collaboration And Workflow Management

Invoicera supports collaboration among team members, allowing seamless communication and coordination in expense-related tasks.

It facilitates workflow management by assigning roles, responsibilities, and approvals within the expense management platform.

Pros

- User-Friendly Interface: Its intuitive design makes it easy for beginners and seasoned users alike.

- Comprehensive Reporting: Gain deep insights into your finances through detailed reports.

- Automation Capabilities: Automate recurring invoices and payments, saving time and reducing errors.

Cons

- Customization Limitations: It might have restrictions in certain areas while offering customization.

Pricing

Invoicera offers a tiered pricing model starting at $30/month for basic features and scaling up based on the needs of growing businesses.

The higher tiers provide access to advanced functionalities such as unlimited clients, custom workflows, and additional team members.

2. Happay

Happay brings together travel, expenses, and payments all in one place. It’s a complete system that helps businesses by bringing everything together smoothly.

Features

Manage All Business Expenses Easily: Happay handles business expenses easily. It works great on your phone or computer, so you can access it wherever you are.

Smooth Expense Management: This software specifically handles all the expenses for your company. It even helps with GST by capturing and organizing that info for you.

Expert Help and Setup: Happay’s support team helps set it up and supports you whenever you need it.

Stay Compliant and Get Insights: Its built-in features help you follow all the rules and regulations. Plus, you’ll get helpful analytics to understand your spending better.

Smart Reports and Filing: It uses smart technology to help create reports and handle filing for expenses automatically.

Top-Level Security: They use super-strong security measures. All your data is encrypted to keep it safe.

Pros

- Records expenses from credit card bills, emails, SMS, WhatsApp, Uber, etc

- Real-time views of expenses, policy violations, and budget utilisations

- Captures state-wise GST, saving time for finance teams

Cons

- It does not support Chinese and Japanese languages.

Pricing

Happay provides pricing options that match users’ individual needs and specifications. For further information, reach out to Happay’s team.

3. Zoho

Zoho Expense is part of the broader Zoho suite of business software, and it’s designed to streamline expense management for organizations.

With its user-friendly interface and integration capabilities, Zoho Expense simplifies expense reporting and approval processes.

Features

- Simplifies business travel and automates expense reports

- AI-powered fraud detection for added security

- Automates employee expenses effortlessly

- Syncs credit cards seamlessly with the expense software

- Smooth integration with Zoho’s CRM

- Speedy approval processes

Pros

- Enforces policies, customizes reimbursements, and automates workflows

- Automatically scans receipts and organizes expenses

- Competitive pricing and AI-driven fraud detection for audits

- 24/5 support, free onboarding, and an intuitive interactive dashboard

Cons

- Compact Expense Reporting

- Lengthy Onboarding

- Slow Customer Support

- Steep Learning Curve

- Disconnected Features & Unfriendly UI

Pricing

Get a monthly subscription with a free trial. The monthly plans are below:

- Standard– INR 1300 per month

- Professional– INR 2100 per month

- Enterprise– INR 3000 per month

- Ultimate– INR 3200 per month

4. Expensify

Expensify stands out as a handy tool for automating expense and travel management. Its user-friendly app, available on Android and Mac, lets you snap pictures of receipts and handwritten bills from your phone.

With just a click, you can compile and submit expense reports, making things super easy for both employees and the environment.

It offers different plans suitable for businesses of all sizes, though it shines brightest for larger companies needing tailored solutions.

Features

- SmartScan simplifies receipt tracking and expense management within a single app.

- It integrates seamlessly with ERPs for easy use.

- Provides precise foreign exchange rates for accurate expense tracking.

- Detects and prevents duplicate expenses, ensuring accuracy and compliance.

Pros

- Easy-to-navigate interface

- Automatic expense categorization

- Reimbursements are sent in direct deposits to the bank account

- Mobile app for on-the-go expense management

Cons

- Pricing can be expensive for larger organizations

- Some users find it challenging to use

- Customer service is not satisfactory

Pricing

- Free trial plan– Under the free trial, users can use the Expensify Card, Reimburse travel expenses, Pay bills, and send invoices.

- Collect plan– Starts at $5 per month

- Control plan– Starts at $9 a month

5. ITLITE

ITLITE is a cloud-based expense management tool that offers various features, including expense tracking, policy enforcement, and analytics.

It caters to businesses looking for a comprehensive solution to control their expenses efficiently.

Features

- Integration with credit cards for seamless transactions

- Automated reminders for timely expense management

- Capability to handle multiple currencies effortlessly

- Mobile app accessibility for on-the-go management

- Intuitive dashboard for easy navigation and overview

- Streamlined approval process workflow for efficient management

Pros

- Reduces complexity in travel operations

- Convenient for travel business to manage expenses

Cons

- Unable to book expenses in an Excel format

Pricing

ITILITE offers plans at:

- $4.99/month (Billed annually)

- $ 7.99/month (Billed monthly)

6. Fyle

Fyle is an innovative expense management tool focusing on automation and seamless integration with various accounting systems. It offers automated expense tracking, intelligent policy checks, and real-time reporting.

Features

- Real-time credit card feeds and prompt ACH reimbursements

- Live report updates and approval/rejection options

- Automated policy checks and robust compliance

- Advanced analytics benefit finance teams

- Secure login and mobile app for on-the-go access

Pros

- Integrates smoothly with Slack, Gmail, Outlook, and more apps

- Matches receipt images with respective credit card transactions

- Fyle seamlessly integrates with all credit cards

- 24/7 customer support is available via chat and email

Cons

- Users cannot edit a report before approval has been given

- It is found that there are incorrect transactions with receipts forwarded by email

Pricing

- Standard:$6.99 per user per month

- Business:$11.99 for one active user per month

- Enterprise: This is a customizable plan according to business requirements. You can contact their sales team to get this plan.

7. SAP Concur

SAP Concur is a globally recognized expense management solution that caters to organizations of all sizes.

With its powerful expense tracking, policy enforcement, and analytics, it simplifies expense management while ensuring compliance with corporate policies and tax regulations.

Features

- Financial data integration for spending control

- Automated business, travel, and AP processes

- Leading in travel, expense, and invoice management

Pros

- Integration with travel and invoice management

- Robust reporting capabilities

- Policy enforcement and approval workflows

- Raise tickets and get an immediate resolution

Cons

- The interface is overwhelming for some users

- File attachment difficulties

- Higher pricing than alternatives

- Complex setup and configuration

Pricing

- Free Trials: Experience SAP Concur for a limited time

- Automate:$9/report for the dashboard, card integration, and faster reimbursement

- Insights & Optimization: Price varies based on features and customization

8. Spendesk

Spendesk is a spend management platform that combines company cards, expense reimbursements, and invoice processing in one comprehensive tool.

It’s designed to give businesses complete control over their spending and expenses.

Features

- Unlimited virtual cards, users, and subscriptions

- Free setup with no hidden fees

- 7-in-1 platform: cards, invoices, expenses, budgets, approvals, automation, reporting

- Scalable tools for spend management

Pros

- Streamlined finance workflow

- Accurate revenue reports

- Secure virtual cards

- Customizable approval flows

- Integration with popular accounting systems

- Automated receipt collection and reconciliation

- Four times faster monthly book processing

Cons

- Inconsistent policy workflows

- Limited acceptance of card

- Errors in auto-scan filling

Pricing

Spendesk offers four plans: Free, Essentials, Scale, and Premium. You can get a quotation by contacting their sales team.

9. Ramp

Ramp is an expense management tool that offers corporate cards with real-time spending tracking and control.

With its smart features, Ramp helps businesses optimize their expenses while gaining insights into spending patterns.

Features

- Cashback rewards and incentives are offered

- User-friendly cards with spending limits and approval flow

- Average savings of 3.5% available

- AI-powered Finance feature for savings and insights

Pros

- User-friendly interface for easy navigation

- Global corporate card and expense management

- Real-time spending insights and receipt matching

- Expense optimization and vendor negotiation

- Ramp users close books 8x faster

Cons

- Integration challenges reported by some users

- Lack of customer support, only email ticket resolution

- Inability to halt multiple notifications for recurring payments

Pricing

Ramp Free: Basic features

Ramp Plus: Advanced features

Ramp Enterprise: Highly advanced features

10. Webexpenses

Webexpenses is a cloud-based expense management tool that makes expense reporting and approval workflows simple and efficient.

It allows businesses to capture, submit, and approve expenses on the go, improving overall productivity.

Features

- On-the-go expense recording, tracking, and management

- Built-in travel expense policies for compliance

- Intelligent tech matches receipts to credit cards

- User-friendly petty cash management system

- Carbon tracking monitors travel carbon footprint

Pros

- Simple workflow and compliance management platform

- Diverse receipt capture for organized reports

- Quick employee reimbursements to banks or payroll

- Seamless compatibility with finance, HRMS, and CRM systems

Cons

- Repetitive input for key details needs default options

- Difficulty in saving frequently visited addresses in the app

Pricing

- Starts at $7 per active user per month, with varying costs based on solution complexity

Security Considerations While Making The Choice

Here are some crucial security aspects to consider:

- Data Encryption: Ensure the tool offers end-to-end encryption for all sensitive financial information, including bank account details and invoices. This prevents unauthorized access to data during transmission and storage.

- Compliance Standards: Verify if the tool complies with industry-specific regulations such as GDPR, HIPAA, or SOC 2. Compliance ensures that the tool follows established security protocols and safeguards user data.

- Access Controls: Look for tools that provide robust access controls, allowing administrators to manage user permissions and restrict access based on roles. This prevents unauthorized individuals from accessing sensitive financial data.

- Regular Audits and Updates: A reputable expense management tool conducts regular security audits and updates to identify vulnerabilities and patch them promptly. This ensures the system is fortified against emerging threats.

- Secure Authentication: Two-factor authentication (2FA) or biometric authentication adds an extra layer of security, reducing the risk of unauthorized access even if login credentials are compromised.

- Data Backup and Recovery: A reliable tool should offer frequent data backups and a robust recovery system. This ensures that in the event of data loss or system failure, your information remains intact and accessible.

Why Is Invoicera The Best Expense Management Tool?

Invoicera stands out as the premier expense management tool for several compelling reasons:

- Comprehensive Features: Invoicera offers an extensive array of features, combining expense management, time tracking, invoicing, and billing in one platform. This comprehensive approach streamlines financial processes, making it a versatile solution for businesses of all sizes.

- Intuitive User Interface: Its user-friendly interface simplifies navigation and usage, ensuring that both novices and seasoned professionals find it easy to manage their expenses effortlessly.

- Customization Options: Invoicera allows for extensive customization, letting users tailor invoices, reports, and expense categories according to their specific needs. This flexibility ensures that the tool adapts seamlessly to diverse business requirements.

- Robust Security Measures: Invoicera prioritizes security, employing state-of-the-art encryption, stringent access controls, and regular security audits to safeguard user data from potential threats.

- Integration Capabilities: Seamless integration with various accounting software, CRM systems, and payment gateways enhances its functionality and compatibility with existing business tools.

- Exceptional Support: Invoicera offers excellent customer support, providing timely assistance and resources to resolve queries or technical issues promptly.

Invoicera’s got it all: strong features, safety measures, ways to customize, and top-notch support. That’s why it’s the go-to for businesses wanting a solid expense tool in 2023-2024.

Additional Tips for Effective Expense Management

Efficient expense tracking and cost control are pivotal for financial stability. Here are some best practices:

- Establish Clear Policies: Define expense policies to guide employees, ensuring clarity on what expenses are reimbursable.

- Regular Monitoring: Track expenses consistently to identify trends, anomalies, and areas for cost-saving.

- Leverage Technology: Utilize expense management tools to automate processes, reducing errors and saving time.

- Employee Training: Educate staff on expense policies and proper procedures to encourage compliance and accountability.

- Encourage Smart Spending: Encourage employees to make cost-effective choices without compromising productivity.

The Importance of Regular Financial Audits

Regular financial audits offer:

- Accuracy Check: Audits verify the accuracy and reliability of financial records, ensuring transparency.

- Identifying Risks: Audits help in identifying potential risks, fraud, or errors, mitigating future financial issues.

- Compliance Assurance: Ensuring adherence to legal and regulatory standards safeguards the business’s reputation.

Future Trends in Expense Management

The future of expense management holds exciting advancements:

- AI and Machine Learning Integration: Predictive analytics and AI-driven insights will enhance expense forecasting and decision-making.

- Mobile-Centric Solutions: More tools will prioritize mobile accessibility for on-the-go expense tracking and approvals.

- Blockchain for Transparency: Blockchain technology may revolutionize expense tracking, ensuring immutable and transparent records.

- Integrated Ecosystems: Tools integrating expense management with broader financial systems will streamline operations.

- Sustainability Tracking: Emerging trends might focus on tracking eco-friendly expenses, aligning with corporate sustainability goals.

Keep an eye on these trends to stay ahead in expense management in the coming years!

Conclusion

The SaaS-based Expense Management Market is thriving, set to hit $6.6 billion by 2028, growing at 11.2% CAGR. Managing expenses is vital for financial control, and automation is key to staying competitive.

Selecting the right expense software matters for business efficiency. We’ve explored 10 top choices, each with unique features and pricing. When deciding, consider your needs, budget, and what suits you best.

Invoicera stands out here, offering AI-powered expense tracking, customizable options, seamless integrations, a user-friendly interface, strong security, and scalability. With Invoicera, businesses streamline expenses, boost accuracy, save time, and gain more precise financial insights.

FAQs

How do I choose the right expense management tool for my business?

Consider factors like company size, budget, required features (such as receipt scanning and integrations), and ease of use. Take advantage of free trials to test usability.

How often should financial audits be conducted?

Financial audits should be performed annually as a standard practice. However, specific industries or regulatory requirements might demand more frequent audits.

Are expense management tools secure for storing sensitive financial data?

Reputable expense management tools employ robust security measures like encryption, secure servers, and compliance with data protection laws to safeguard sensitive information.

How can businesses encourage employees to adhere to expense policies?

Clear communication and regular training on expense policies are crucial. Incentivize compliance through rewards or recognition for employees who consistently follow guidelines

Feel free to reach out if you have more questions or need further assistance!