Accurate accounting or professional bookkeeping services practiced by an expert accountant ensure that financial data is correctly recorded. Moreover, it helps in making sure that tax obligations are met, and strategic decisions are made based on solid financial insights. In short, it is necessary to have an experienced accountant taking care of your financial books. However, businesses face an important choice when it comes to managing their bookkeeping needs. They need to think about whether they should look for reliable bookkeeper services near me or consider outsourced bookkeeping solutions for a business.

Breaking it down further, choosing between two stated models depends on the business size, complexity, and available resources. In this article, we will explore the benefits and drawbacks of each option. Moreover, we will discuss further details. Undoubtedly, this information will help you make an informed decision that aligns with your goals and financial strategy. Moreover, it will make sure you make a decision that is profitable for your business in the short and long term.

What Are Professional Bookkeeping Services?

Simply put, it is outsourced financial solutions provided by third-party firms like CapActix Business Solutions to its customers. Typically, these services are ideal for small to medium-sized businesses that do not need full-time bookkeepers. Outsourced bookkeeping solutions allow businesses to focus on their core operations. As a result, they are not bogged down by financial record-keeping tasks. However, it is not limited to small and medium scale businesses. In fact, more and more enterprises and CPA firms have started replacing their in-house bookkeeping team with professional bookkeeping services.

In the case of enterprise and CPA firms, the offshore team works similarly to an in-house team and delivers the expected professional services. However, it often provides much better value over resources as they are more committed and come with less fuss.

The professional bookkeeping services cover everything from record keeping, bank reconciliations, and payroll management to tax preparation, financial reporting, and audit support. Interestingly, it is not what several businesses think, just managing books. In fact, it goes beyond that scope. Certainly, you can keep extending the scope of work and get a full-fledged accounting solution along with reliable outsourced bookkeeping services.

As a major benefit, businesses can scale the services thy require. As a result, they only pay for what they use and maximize their returns on investment.

Industries That Commonly Use Professional Bookkeeping Services

- Startup

Startups are entrepreneurial, high-paced companies that usually have tight budgets. Engaging a full-time in-house bookkeeping department might not be an affordable investment in the early stages of a business. Indeed, professional bookkeeping services offer the skills these companies require to handle their finances. Notably, without the overhead of having an in-house department. Outsourced bookkeeping enables startups to concentrate on growing their business and innovating while making sure that their finances are taken care of by professionals

For instance, a technology startup would have to keep tabs on venture capital investment, stock options for employees, and R&D tax credits. Contracting out the bookkeeping helps them address all the complicated money matters without needing to employ permanent accountants. Indeed, this might be quite a financial burden in the early years.

- Retail and E-commerce

Certainly, retail and online businesses have high volumes of transactions, inventory control, and regular sales fluctuations. Thus, such businesses require precise, current financial information to make effective decisions regarding inventory, pricing, and cash flow. Professional Bookkeeping Services are particularly useful in this regard. The reason is that they can manage day-to-day transactions, sales tax reporting, and online payment reconciliation, which are usually complicated and require expert knowledge.

For example, an e-commerce retailer selling through marketplaces such as Shopify or Amazon can have inconsistent volumes of sales. Outsourcing bookkeeping over in-house accounting enables such firms to monitor revenues precisely, process returns and generate financial reports without skipping a beat. Outsource bookkeeping providers also typically provide access to sophisticated tools, including inventory tracking and sales tax handling. This may be costly to implement and maintain in-house, however.

Also Read: Why Bookkeeping for E-commerce is Essential for Business Growth

- CPA Firms

CPA firms, quite often, deliver a wide range of services to their clients, such as tax preparation, auditing, and financial consultation. For CPA firms, having to handle clients’ internal finances can be a monumental task as client bases increase and become larger in size and complexity. Bookkeeping outsourced assists these CPA firms in carrying out their strengths while making their clients’ everyday financial records cost-effective.

For example, a CPA firm with multiple small and mid-size businesses as clients might require helping clients with record keeping, payroll, and monthly financial reports. Thus, employing professional bookkeeping services can benefit the clients by offering more holistic solutions without incurring extra in-house bookkeeping personnel. Also, outsourcing provides scalability as the client list expands, enabling the firm to service more clients without compromising service quality.

These services tend to be flexible, scalable, and economical, particularly for companies that don’t have huge financial management departments. For example, outsourced bookkeeping service providers tend to use advanced software that might not be within the budget of a company to buy or maintain internally.

Also Read: Why CPA Firm Should Outsource Bookkeeping Services

What Is In-House Bookkeeping?

Unlike professional bookkeeping services, an in-house alternative involves hiring a dedicated team or individual who works directly within the company. Similar toan outsourced bookkeeping solution, in-house professionals will handle all day-to-day financial operations.

Typically, this is a standard in larger corporations or enterprises with intricate financial requirements. For this kind of company, having full-time bookkeeper services near me provides a constant stream of information from department to department.

An in-house bookkeeping solution normally deals with tasks such as dealing with accounts payable and receivable, preparing financial statements and reports, making invoices and ensuring timely payments, budgeting and managing cash flow, and similar accounting services.

For instance, a midsize manufacturing company with several suppliers and complex tax returns might need an in-house bookkeeper to have day-to-day control over financial activity. The in-house system also suits companies requiring specialized industry knowledge, e.g., real estate companies or multi-store retailers.

Key Differences Between Professional Bookkeeping Services and In-House Bookkeeping

When deciding between the two, there are several critical differences to consider and make the most profitable choice.:

- Cost: Internal bookkeeping typically comes with increased expenses because of salaries, benefits, training, and software. On the other hand, outsourced bookkeeping services can be less expensive, particularly for small enterprises.

- Control: In-house bookkeeping provides higher control over process, as funds information is addressed directly by the company. Outsourcing involves becoming dependent on someone else, as it may leave one with an impression of ceding some form of control. However, a majority of professional bookkeeping services provide complete control over processes and operations.

- Scalability: Professional outsourced bookkeeping services allow businesses to scale bookkeeping efforts as needed. Conversely, in-house bookkeeping may not be able to adapt to changes in business size or complexity without the addition of extra staff or resources.

- Specialization: In-house bookkeeping enables more customized services, particularly in niche industries. Nevertheless, professional bookkeeping services tend to include a wide range of experience and expertise across many sectors, making your business profit from their varied knowledge base.

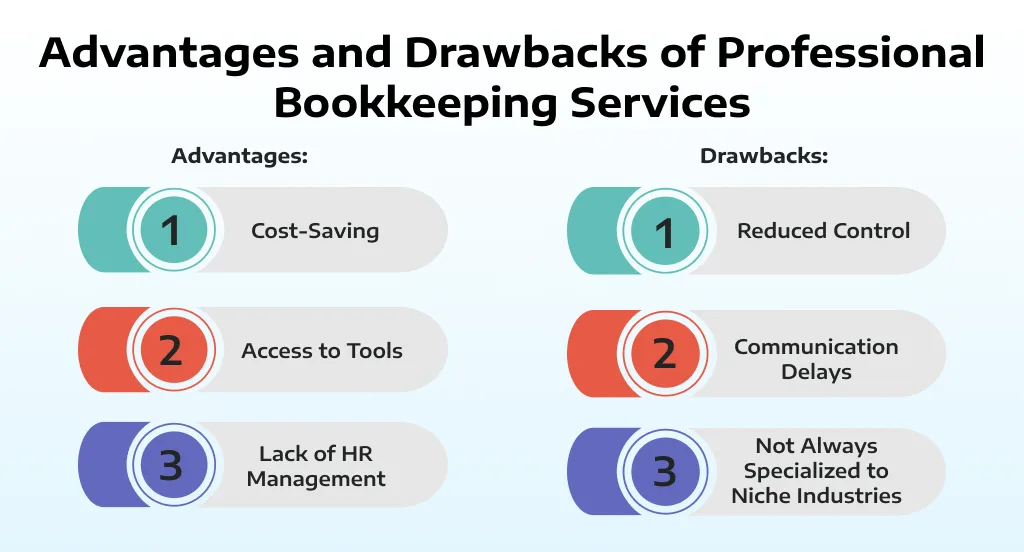

Advantages and Drawbacks of Professional Bookkeeping Services

Advantages:

- Cost-Saving: Outsourcing is normally less expensive for small businesses. It can cost more to hire a full-time worker, pay them benefits, and buy accounting software.

- Access to Tools: Professional bookkeeping services usually grant access to innovative accounting management tools and technologies that could be out of the price range for in-house staff.

- Lack of HR Management: Outsourcing saves time and effort in bringing on, training, and caring for an internal team, reducing valuable management hours.

Drawbacks:

- Reduced Control: By having a third party handle certain functions, a portion of the control over these financial functions gets lost, perhaps creating a possibility for goals or priority mismatch.

- Communication Delays: Delays in communication may result depending on the responsiveness of the provider, particularly if the provider is in a different time zone or if priorities are not set.

- Not Always Specialized to Niche Industries: Certain professional bookkeeping services are not necessarily industry-specific, and therefore, cannot serve complex, industry-specific requirements.

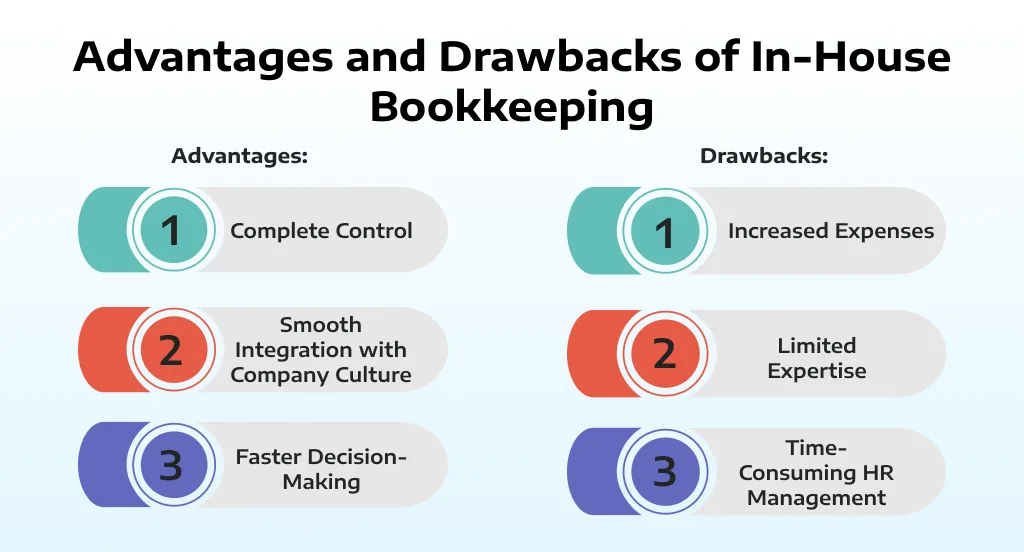

Advantages and Drawbacks of In-House Bookkeeping

Advantages:

- Complete Control: Bookkeeping done in-house enables entrepreneurs to exercise greater control and direct oversight over financial affairs. Real-time access to information means faster decision-making.

- Smooth Integration with Company Culture: An in-house team over professional bookkeeping services is likely to be well integrated into the company’s culture, enabling them to better comprehend the business’s nuances and offer more customized insights.

- Faster Decision-Making: Because your bookkeeper is always present, there is no waiting for replies. Real-time financial decisions can be made.

Drawbacks:

- Increased Expenses: Having and keeping an in-house staff is more expensive due to salaries, benefits, and the necessity of continuous training.

- Limited Expertise: A single or two in-house bookkeeper services near me may not possess the depth of knowledge that a larger professional outsourced bookkeeping service can offer. This is especially true if you require specialized knowledge in areas such as tax preparation or financial forecasting.

- Time-Consuming HR Management: Recruiting, training, and managing an in-house bookkeeper may be a drain on a company’s resources. Companies will also have to factor in turnover and recruitment expenses.

How to Decide Which Option Is Best for Your Business

There’s no one-size-fits-all solution, and choosing between professional bookkeeping services and in-house bookkeeping professionals depends on several factors:

- Budget: Small businesses will tend to see outsourcing as the cost-saving alternative, whereas big businesses with a higher level of complexity will seek to employ an in-house staff.

- Business Size: The size and complexity of the business are directly correlated with the necessity of employing an in-house bookkeeping team for managing finances.

- Expertise Requirements: If your company needs advanced financial handling, you may choose professional bookkeeping services with sector-based experience.

- Growth and Scalability: As your business expands, you might find it more useful to scale outsourced bookkeeping, while an in-house team can easily get overwhelmed.

FAQs

Outsourcing saves on overhead, as no full-time employees are required. It also makes sophisticated financial tools available, allowing you to make better financial choices and increase profitability without additional in-house costs.

Yes, CPA firms can concentrate on high-level services such as tax planning and auditing, while outsourced bookkeeping takes care of day-to-day financial work. This enables scalable, affordable service delivery without having to add staff.

Outsourcing releases time for core business activities such as marketing and sales, enabling faster growth. Professional bookkeeping services also yield sound financial insights, which empower you to enhance cash flow and find cost-saving opportunities.

Conclusion

Interestingly, there is no ideal option that fits all types of businesses when you are making this choice. Certainly, a business needs to consider different factors while making a decision between outsourced and in-house bookkeeping options.

In conclusion, it is up to you whether you opt for professional bookkeeping services or in-house bookkeeping. Certainly, it is based on your business needs, budget, and growth plan. While outsourcing provides flexibility, cost-effectiveness, and expertise, an in-house team offers direct control and greater integration in your company. Weigh your options carefully, evaluate your needs, and make a decision that will enable you to stay financially healthy while you concentrate on expanding your business.