Getting the right information at the right time can dramatically change the direction of your business. Yet, you may not have enough time to keep up with everything.

We get it. So, our team pulled a few all-nighters (so you don’t have to) and brings you the key SaaS statistics every SaaS leader, team, and engineer should see right now.

You can dig even deeper by checking out the sources we included.

What Is Software-as-a-Service (SaaS)?

SaaS is a cloud computing model for accessing a complete, cloud-hosted application via a web browser, a mobile app, or an API over the internet. You then pay for using the service on a monthly or annual subscription basis

Another company, known as the SaaS provider, manages all the hardware, software, storage, and other infrastructure components for that application, including security patches and upgrades.

This approach limits your control over the underlying infrastructure. Yet this also sets your team free to focus on maximizing the benefits of the application — rather than building and managing its infrastructure.

The most common companies that use this approach are those that build and sell consumer-facing software, such as office productivity tools, customer relationship management (CRM) systems, project management tools, and financial management tools.

Want to implement a SaaS platform yourself vs the on-premises approach? Learn more about how SaaS architecture works here.

That said, here are essential SaaS statistics you should know now to keep up with the industry.

Top Picks: 10 Must-Know SaaS Stats For SaaS Executives And Teams

- The cloud bill of 60% of organizations is slightly over or way above their expectations (Source: CloudZero)

- 91% believe SaaS will help them adopt new technologies and boost their revenues (Finances Online)

- SaaS (cloud application services) contributes nearly 30% of worldwide public cloud end-user spending (Gartner)

- Slack, DocuSign, Zoom, ZenDesk, LucidChart, Salesforce, and Culture Amp are among the most renewed SaaS products today (Vainu)

- 119 SaaS companies were funded between January and May 2023 (Software Suggest)

- 53% of SaaS licenses go unused while companies use over 300 SaaS apps on average (Poductiv)

- SaaS vendors can save $349 million from negotiating contracts (Vendr)

- 50% of organizations that use multiple SaaS applications intend to centralize them for management in the next five years (Gartner)

- 48% were unaware that a former employee could still access their corporate network (OneLog)

- 72% of IT specialists believe zero-touch SaaS automation is the future (BetterCloud)

Dive right in for the full story.

SaaS Market Size: What Does The SaaS Industry Look Like Today?

SaaS is by far the most popular type of cloud computing today — and will be for the foreseeable future. Here’s what that means.

1. SaaS spending will grow to $232 billion in 2024 (source: Gartner)

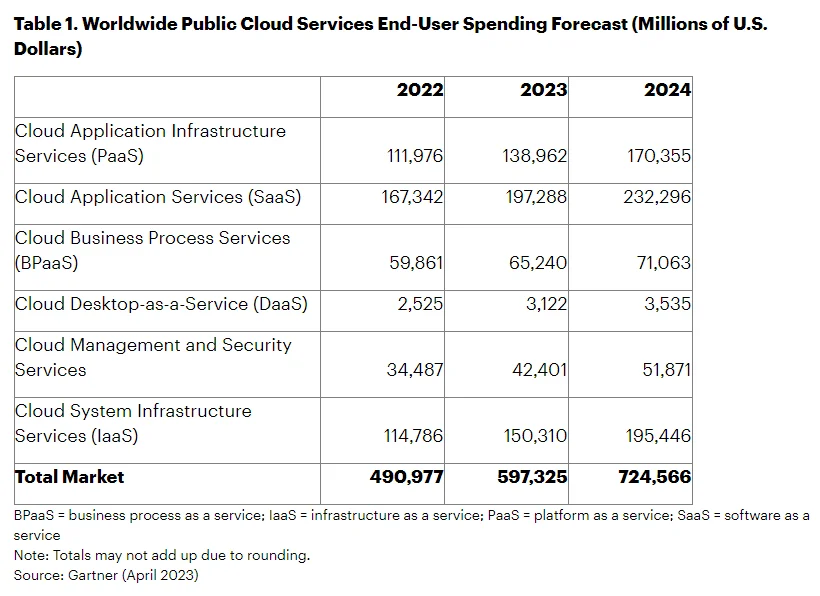

According to Gartner’s forecast, worldwide end-user spending on cloud application services (SaaS) will exceed $232 billion in 2024 — up from $197 billion in 2023.

For context, Gartner forecasts the entire public cloud end-user spend to be $725 billion in 2024, across IaaS, PaaS, DaaS, BPaaS, and Cloud management and security services. So, SaaS alone will contribute about 30% of that.

Credit: Gartner

2. SaaS solutions will make up 85% of all business software in 2025 (source: BetterCloud)

Companies said they use an average of 80 external SaaS apps compared to 21 custom SaaS applications. The majority of their business apps will be cloud-based by 2025, according to BetterClouds’ State of SaaSOps survey.

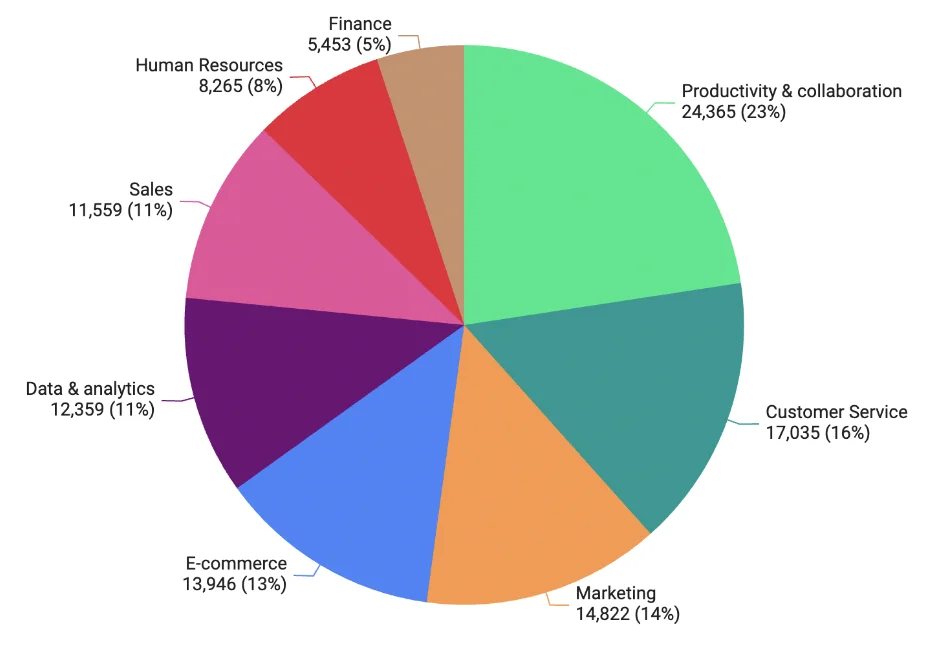

3. Productivity and collaboration solutions dominate the SaaS market (source: Vainu)

Vainu estimates there are over 24,365 SaaS solutions in 2023. Customer service (17,000+), marketing (14,800+), and e-commerce SaaS tools lock in the top four slots.

Credit: Vainu

4. What are the top SaaS markets today?

- China, India, and Brazil will grow their SaaS industries twofold between 2020 and 2025. (Reply)

- Among major markets, Germany’s SaaS market will grow the most, from €6.85 billion to €16.3 billion. (Statista)

- SaaS startups made up 41.12% of Brazil’s startups in 2020. (Associação Brasileira de Startups)

- China’s SaaS sector had an output value of $7 billion in 2020 and is expected to grow at a CAGR of 34% by 2024. (China Briefing)

Oh, one more thing.

5. Today, public SaaS companies’ median valuation is 15X forward revenue (source: Battery Software)

The median valuation of a SaaS company has grown 5X since 2010. And, according to Battery Software’s 2021 survey, many SaaS companies are trading above 30 times their next-12-months revenue.

So, why is the SaaS computing model so popular? Well, this has to do with the benefits of SaaS solutions and their potential for profit.

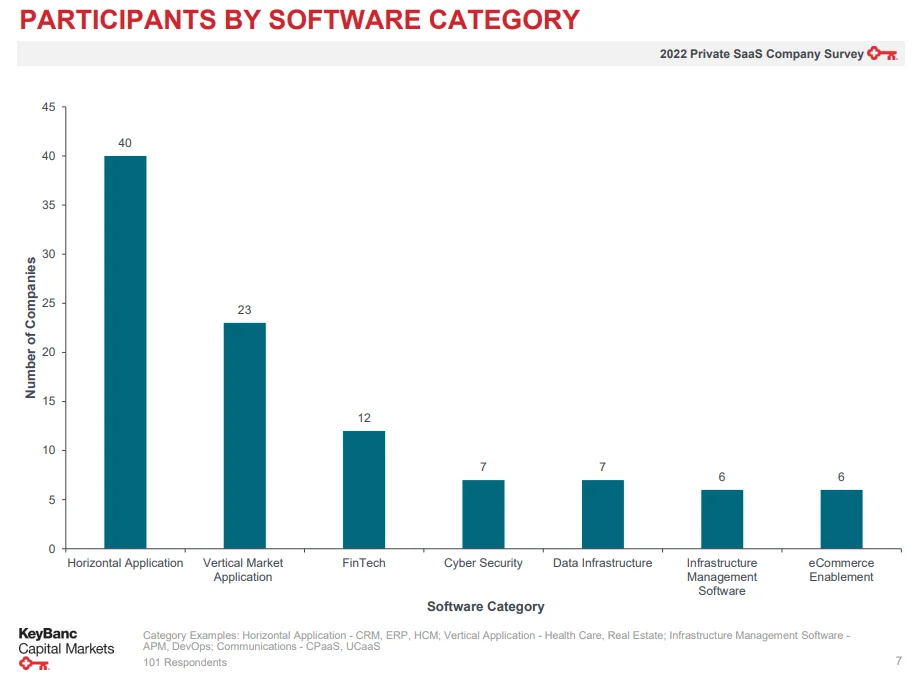

6. Many SaaS companies are in the horizontal category (source: KeyBanc Capital Markets)

The 2023 Private SaaS Company Survey shows 40 out of 100 medium-sized SaaS providers serve in the Horizontal category compared to just 6 in the infrastructure management service or e-commerce enablement categories.

Credit: KeyBanc

Statistics On The Benefits Of SaaS Platforms

Here are some statistics that demonstrate the potential and proven benefits of SaaS solutions.

7. With SaaS, companies can introduce new capabilities to the market faster (source: McKinsey)

Companies said in a McKinsey study that adopting cloud platforms helps them get to market 20% to 40% faster. They said leveraging a SaaS model on platforms like AWS, they can build, test, and release new products faster to respond to market demands.

8. 91% of organizations expect SaaS to help them adopt new technologies and boost revenue (source: Finances Online)

Respondents said they expected SaaS to become the key enabler of emerging technologies, including Augmented Reality (AR), Machine Learning (ML), and Artificial Intelligence (AI). More benefits of SaaS include:

- 71% of businesses use cloud-based SaaS to speed up IT service delivery

- 71% want to speed up IT service delivery

- 63% want more flexibility

- 58% want to promote business continuity

Ultimately, businesses choose SaaS solutions because they are complete, cloud-native solutions that require little maintenance.

Statistics On SaaS Providers

Salesforce led the enterprise SaaS market for years until Microsoft surpassed it not too long ago. Here’s more.

9. Microsoft is the leading SaaS vendor globally (source: Synergy Research)

Microsoft leads with a 17% market share, followed by Salesforce with 12% and Adobe with Adobe. Oracle, SAP, and Alphabet are some of the other top SaaS vendors today.

10. Google is the fastest-growing SaaS vendor (source: CloudZero)

Alphabet has been coming up fast since 2019. The company is the parent company to Google’s collection of companies, including Google Workspace (Gmail, Docs, Drive, Meet, etc) and Google Cloud Platform (GCP).

Want to migrate to one or more of the top cloud service providers today? Check our guide to the biggest cloud providers right now.

Top SaaS Companies Today

Want to see the largest, most influential, and most profitable SaaS providers today? Check out this list of the best of the best 99 SaaS companies here. In this section, we share some mind-blowing stats on the most influential SaaS companies today.

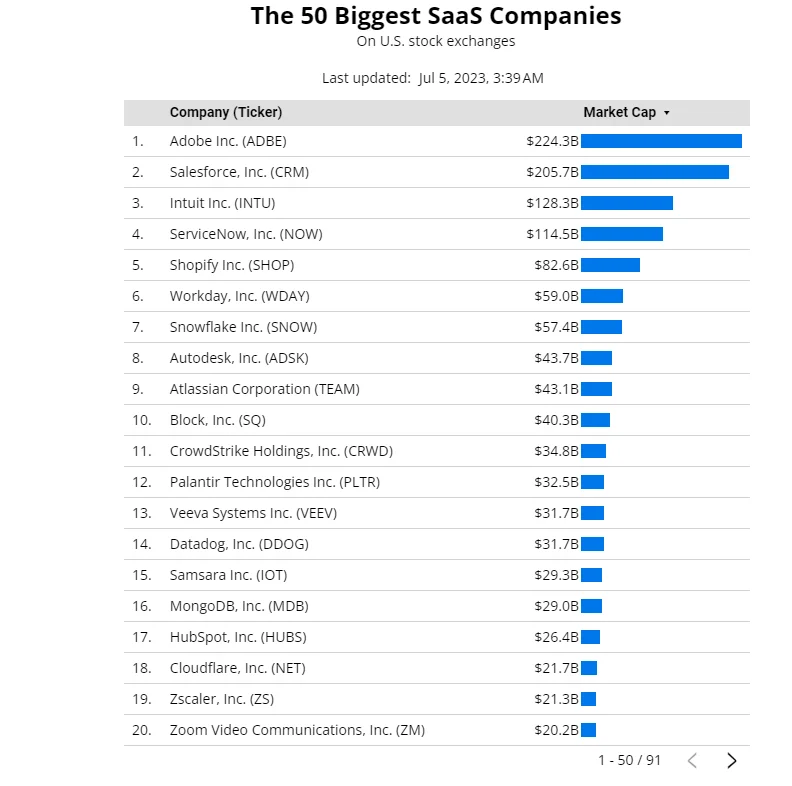

11. 81 SaaS Companies have crossed the $1 billion market cap threshold (source: Mike Sonders)

The latest update of Mike Sonder’s 50 Biggest SaaS Companies on the US Stock Exchange shows Adobe is the most valuable SaaS company today at over $224 billion while Olo Inc closes the top 81 with a market cap of $1 billion.

Credit: Mike Sonders

12. There may be over 72,000 SaaS companies worldwide (source: Vainu)

Well, that depends on who you ask. Vainu reports over 72,000, Statista concludes the number is more than 31,000, Capterra features over 50,000 solutions, and SaaSHub lists more than 168,000 products.

According to Statista, over 17,000 SaaS Companies are in the US alone.

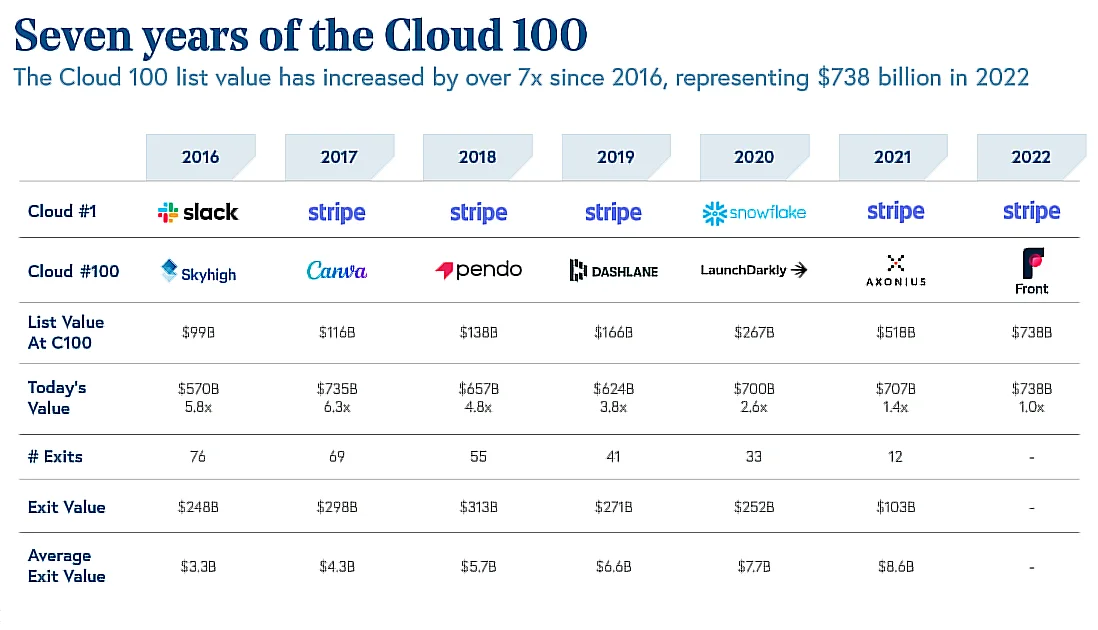

13. The largest privately-held cloud company is valued at $95 billion (source: Bessemer Venture Partners)

In 2008, LinkedIn became the first privately-held cloud company to achieve a $1 billion valuation.

Stripe leads the Cloud 100 as the largest private-equity-backed company, followed by Databricks, Canva, and Miro (Bessemer Venture Partners and Salesforce Ventures).

Credit: Bessemer Venture Partners

Today, there are more than 15 decacorns (Over $10 billion valuation) and 337 SaaS unicorns (over $1 billion valuation) in the US. (SaaStr)

14. What are the most purchased SaaS apps today (source: Vainu)

Vainu processed over $2.5 billion in software spend in 2022. It reported that the most purchased apps were CaptivateIQ (for commissions tracking), TripActions, Gong, Lattice, 6sense, Docker Desktop, and Kandji.

Security software led the park with Snyk, FloQast, Greenhouse, Okta, Highspot, Crowdstrike, Auth0, and SentinelOne. Data solutions also contributed significantly with Fivetran, Snowflake, and Datadog. Other top performers on Vainu included Drift (for conversational marketing and sales) and Jamf PRO (for Apple device management and security).

15. What are the most renewed SaaS applications? (source: Vainu)

Vainu shared 20 of the most renewed SaaS solutions based on payments it processed for them. Slack, DocuSign, Zoom, ZenDesk, LucidChart, Salesforce, and Culture Amp were among the top renewed solutions.

SaaS Funding And IPO Statistics

Despite the effects of the pandemic on fundraising and exits, SaaS companies continue to attract record-breaking funding.

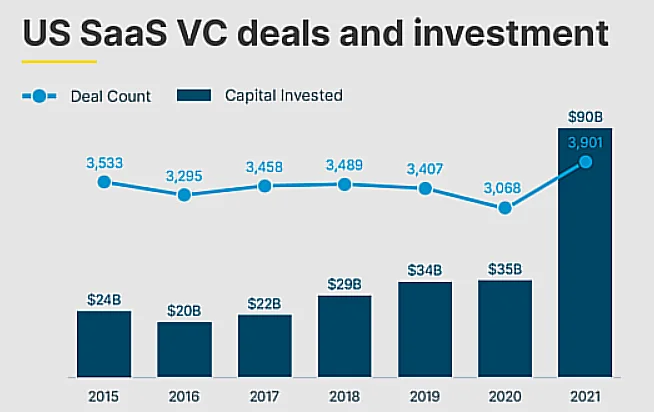

16. SaaS companies got over $90 billion in funding (source: SVB)

Before the Silicon Valley Bank collapse, it reported in H1 2022 that SaaS companies raised over $90 billion. It was more capital raised in a single year than in 2018, 2019, and 2020 combined – a new record.

Credit: Silicon Valley Bank

17. SaaS funding is alive and well in 2023 (source: Software Suggest)

SaaS companies continue to raise good amounts of capital through multiple fundraising rounds each month. Some 119 SaaS providers got funded between January and May 2023, according to new data.

SaaS Statics By Industry

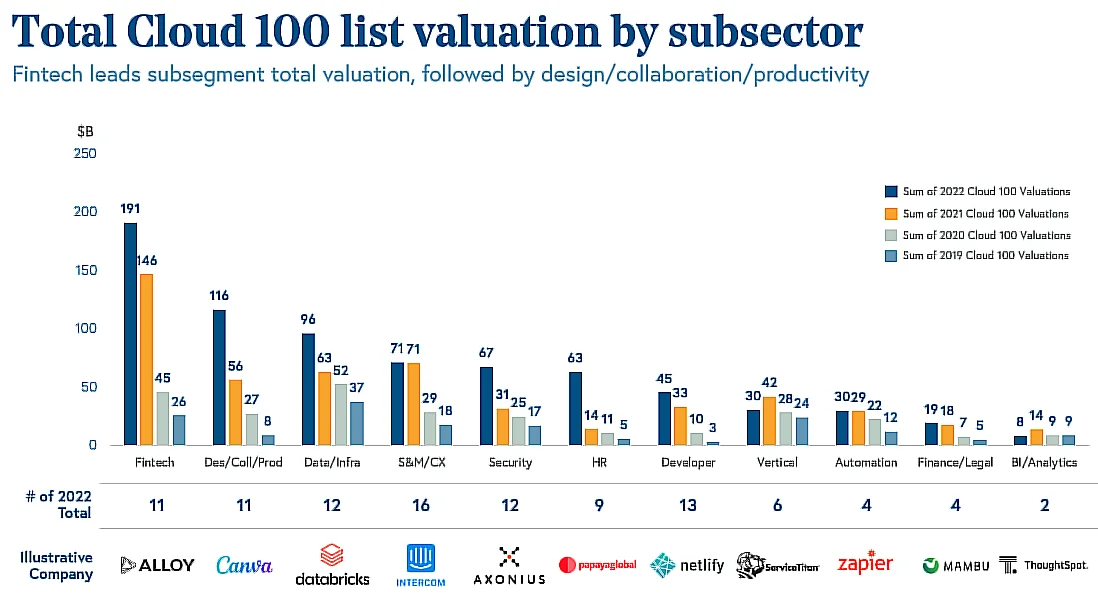

18. FinTech comprises the most valuable SaaS subsector today (source: Bessemer Venture Partners)

FinTech is followed by the design, collaboration, and productivity subsector. The data and infrastructure segment also jumped to replace sales and marketing as the third most valuable SaaS segment today.

Credit: 2022 Cloud 100 data by BVP

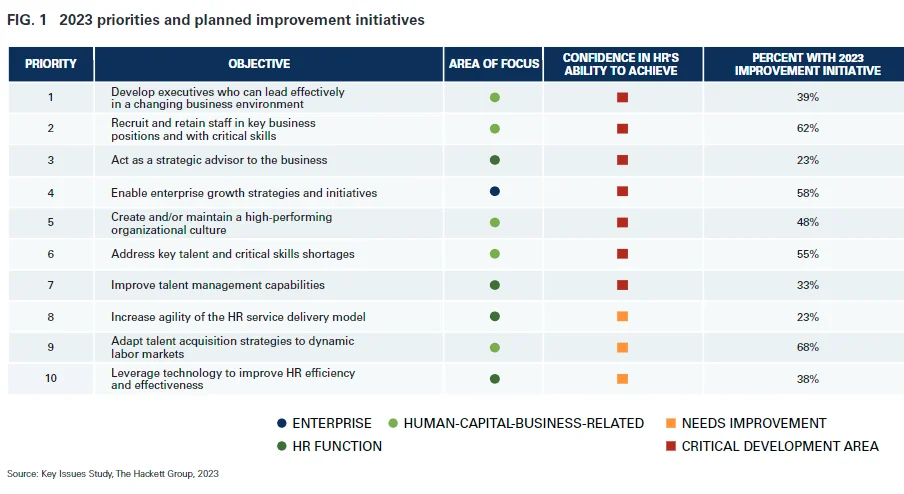

19. HR software spending has increased year-over-year but will drop in 2023 (source: Hacket Group)

HR leaders said they would be reducing spending on HR SaaS solutions from 8.7% to 1.85 in 2023 as they focus on improving other priorities.

Credit: HR priorities in 2023 – Hacket Group

20. More on the Global SaaS market (Source: BCC Research)

The global BFSI sector (banking, financial services, and insurance) is projected to reach $130.7 billion by 2027 from $54.4 billion in 2022, a CAGR of 19.2%.

Retail and e-commerce should grow with a CAGR of 23.6% to $138.9 in 2027 versus $48.1 billion in 2022.

P&S Research forecasts that the 2023 cloud-based Supply Chain Management solutions market will exceed $11 billion in value.

SaaS Adoption And Usage Stats: How Many Companies Use SaaS Solutions?

In this section, we highlight how organizations use SaaS solutions and other related concerns, such as shadow IT and subscription waste.

21. 94% use a cloud SaaS app (source: Insivia)

Insivia reported that 73% of organizations said they would adopt SaaS applications for all their workloads by 2021. In 2023 and beyond, most organizations, teams, and individuals use a SaaS application to get the job done.

BetterCloud has a more modest outlook, forecasting 85% of all business apps will be SaaS-based by 2025, based on its 2023 State of SaaSOps survey.

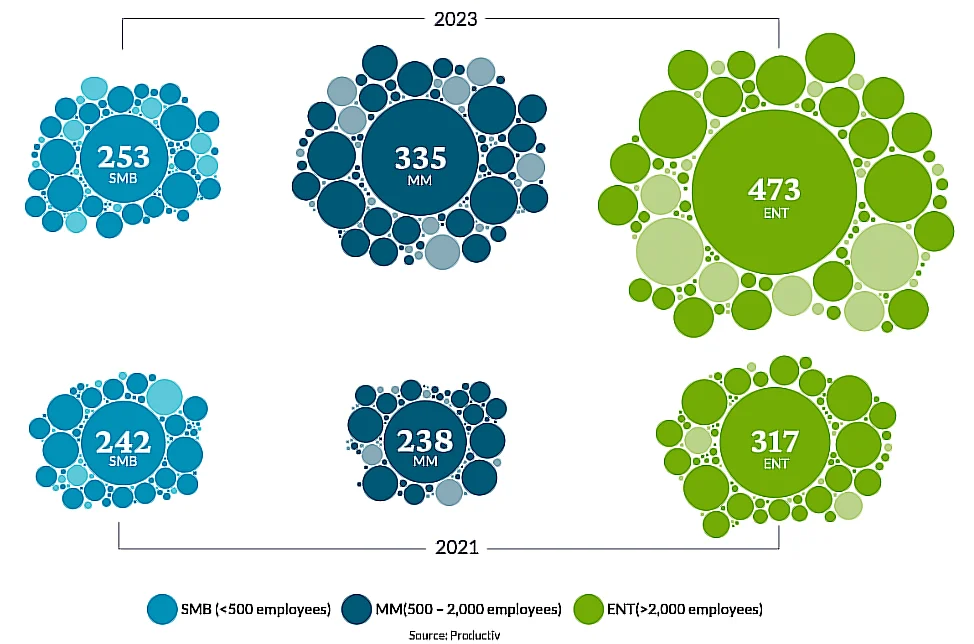

22. Organizations use 371 apps on average (source: Productiv)

The State of SaaS Series for 2023 survey analyzed how different organizations used around 100 million SaaS licenses between 2021 and 2023. The study covered more than 100 billion app usage indicators.

Findings also showed:

- The average SaaS spend per employee will be nearly $9,600 by the end of 2023. In 2021, Insivia predicted a more modest amount, quoting $2,623 per employee.

- More than half (53%) of the SaaS licenses go unused.

- Companies with fewer than 500 employees use around 253 apps, those with up to 1,000 employees use about 335 apps, and enterprises (over 10,000 employees) use a staggering 473 apps.

Credit: Productiv

23. Shadow IT is a growing concern (source: Productiv)

Productiv’s findings also suggested that businesses were adopting more efficient procurement and governance strategies around SaaS. To that end, shadow IT decreased by 8% from the 2022 figures.

Yet, staff and lines of business opt to get software outside IT control. So, as high as 51% of SaaS apps in an organization today are shadow IT.

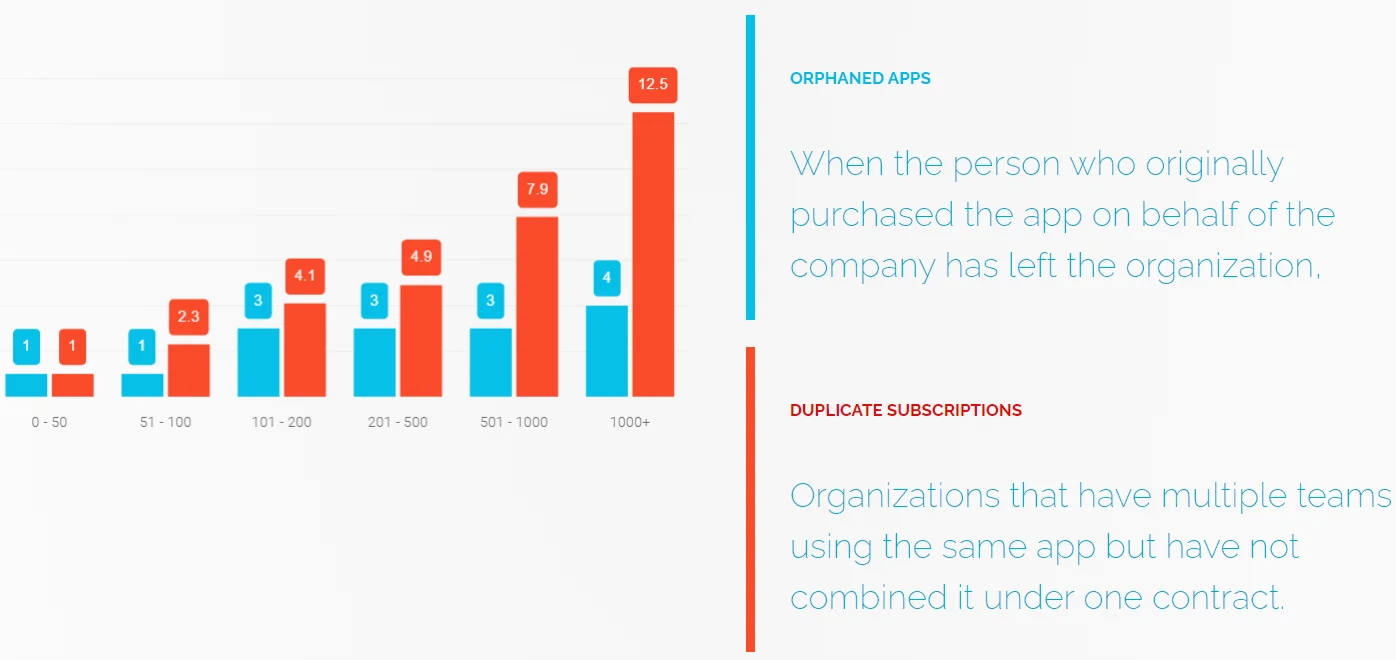

24. Duplicate subscriptions and orphaned apps are a wasteful concern, too (source: Insivia)

A bit earlier in 2021, Insivia found that:

- IT and security were responsible for 93% of SaaS app usage. Customer support (60%), HR (40%), and Product (25%) follow.

- There’s a problem with orphaned apps and duplicate subscriptions, as you can see below:

Credit: SaaS Purchase and Usage Statistics – Insavia

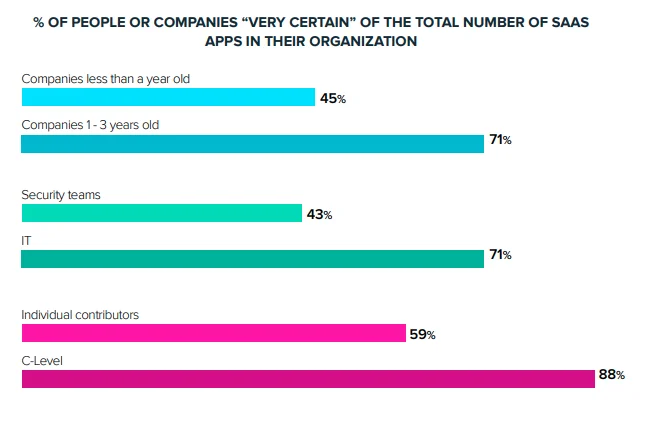

25. Organizations are looking into consolidating SaaS app usage to reduce waste (source: Insivia)

According to Insivia, the average midsized organization had 32 different billing owners for its SaaS apps in 2020/2021.

Other organizations aren’t sure about the exact number of apps they use:

Credit: BetterCloud

In the 2023 edition, BetterCloud reported that 297 out of 743 IT professionals consolidate their app usage, reducing the number of apps used on average to 130 per organization. Still, 65% of all SaaS apps remain unsanctioned by IT.

In 2023, Productiv showed that ChatGPT usage has jumped to the 11th most frequently used app yet it is a shadow IT app (used outside of IT control).

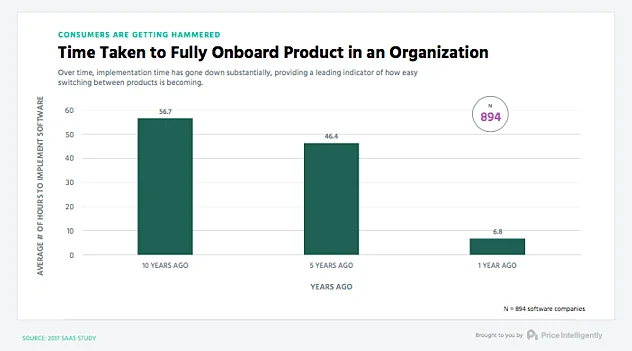

26. Implementing new software now takes about 7 hours (source: Price Intelligently)

It’s easier than ever to deploy SaaS solutions. A decade ago, implementing a new software product took 57 hours, but now it takes just 7 hours. This supports faster time to market and value.

Credit: Price Intelligently

Views On SaaS: What Do People Think Of SaaS Solutions?

Here are some quotes from different stakeholders in the SaaS industry that are worth considering.

27. The fastest growth came from companies with ARRs of $5 million to $10 million and over $100 million

“Responses from larger companies are more indicative of the overall trends in the sector,” explained Peterson, “The median ARR this year is 40% higher than it was last year, this data is more indicative of mature SaaS companies.”

- Scott Peterson, Managing Director, KeyBanc Capital Markets Technology Group in October 2022

28. Forward multiples retreated to 6x levels, on par with the 10-year average prior to the pandemic

“Investors have been stress-testing their forward models for recession scenarios,” said Celino. “Companies with a combined growth rate and profit exceeding 40% and those that can at least maintain margin leverage in a downturn have relatively outperformed. High growth companies with worsening margin profiles have obviously underperformed.”

- Jason Celino, Director, Equity Research Analyst at KBCM

29. Indispensable Saas solutions aren’t going anywhere

“Companies don’t cut mission-critical SaaS. Yes, it’s a harder sales environment. Yes, prospects expect a deal. Yes, budget compression is real. But, companies still need world-class SaaS to operate their businesses.”

-Ryan Neu, Vendr CEO

30. SaaS buyers can save $349 million by negotiating contracts

“We found these insights by analyzing our customers’ SaaS spending. With over 20,000 deals, 2,500 suppliers, and over $2.3 billion in processed spend, we’ve seen the following trends:

- Total savings achieved by customers through negotiations was $349 million

- The average savings percentage for completed deals was 16.49 percent

- The average ROI for complete retainers was 7.6x, with a total ROI of 8.4x”

-Ariel Diaz, Co-founder and Chief Strategy Officer, Vendr

31. Cloud providers’ revenue will be flat or down overall and that’s a cause for celebration

“The reduction in cloud spend we’ve seen in the last six months is one of its greatest success stories: That’s money that would have otherwise fed the always-on data center, which, despite all the grumbling about “cloud waste” every year, has never approached the efficiency of the cloud.”

-Erik Petersen, CEO, CloudZero

32. SaaS Suites are the way of the future

“It isn’t good enough to have a best-of-breed application. You have to have a suite. The front office, the eCommerce system, has to talk to the supply chain system.”

-Mark Hurd, Oracle CEO

He also noted that the largest SaaS companies may consolidate the market, presenting a serious entrance barrier.

33. SaaS quotes on priorities and CAC Payback time

- Nearly half of 1,920 business professionals said customer experience (CX) will be their highest priority for the next five years, surpassing SaaS pricing and product (SuperOffice).

- 13% of customers leave brands they love after just one bad experience. Several more negative interactions and that figure jumps to 92% (PwC).

- 89% of SaaS businesses say new customer acquisition is their top growth activity (Totango).

- In the first year, 92% of startup revenue is spent on acquiring customers. And it takes 11 months to recoup the Customer Acquisition Cost but can be up to 18 months or as low as 5 months (David Skok, General Partner, Matrix Partners).

- SaaS businesses with annual revenues of less than $10 million experience a 20% churn rate (SaaS Capital).

- 85% of customers are willing to spend more on a SaaS product if the user experience is good.

SaaS pricing is also a big deal as you’ll see in the next section.

SaaS Pricing Methodologies

So, how do SaaS companies purchase SaaS applications and services? And how do they set prices for their own SaaS products? You can check out our guide to SaaS pricing plans here if you are exploring how to set pricing options.

34. Annual subscriptions are the most popular (solutions: Insivia)

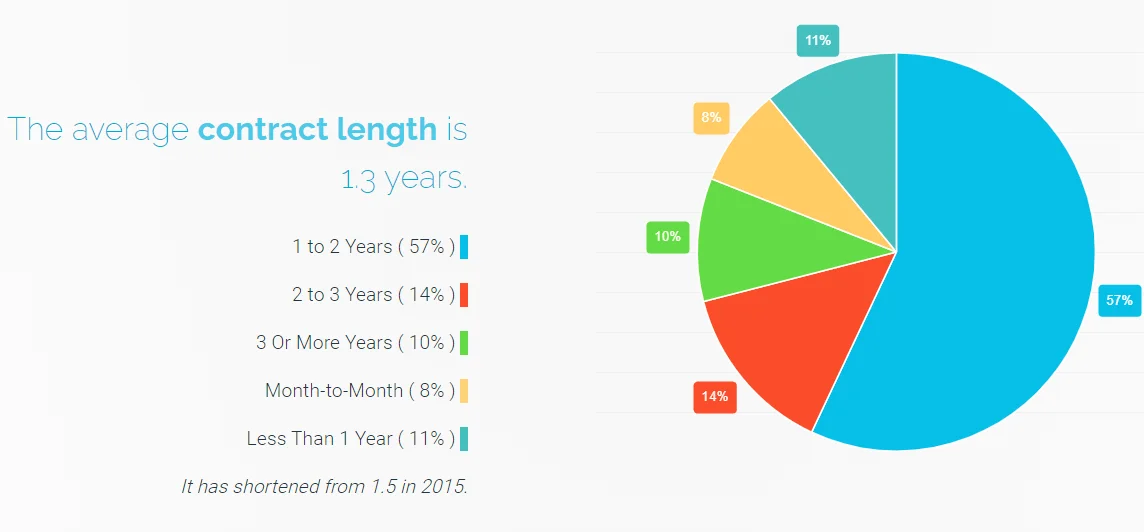

The most popular SaaS billing periods are annual plans (42%), monthly (36%), quarterly (11%), under one year (9%), and 1-2 years (3%). However, the average contract length is 1.3 years as shown here:

Credit: Insivia

35. Month-to-month contracts have a 14% churn rate (source: Reply)

In 2019, Reply reported several interesting findings on churn (which 69% of respondents measured by the number of customers and 62% by revenue):

- The churn rate for SaaS companies on month-to-month contracts is 14 percent, compared to 15 percent for those with one to 1.5-year contracts

- 89% said their executive’s highest priority was new customer acquisitions, 59% prioritized existing customer renewals, and 46% said upsells and add-on sales

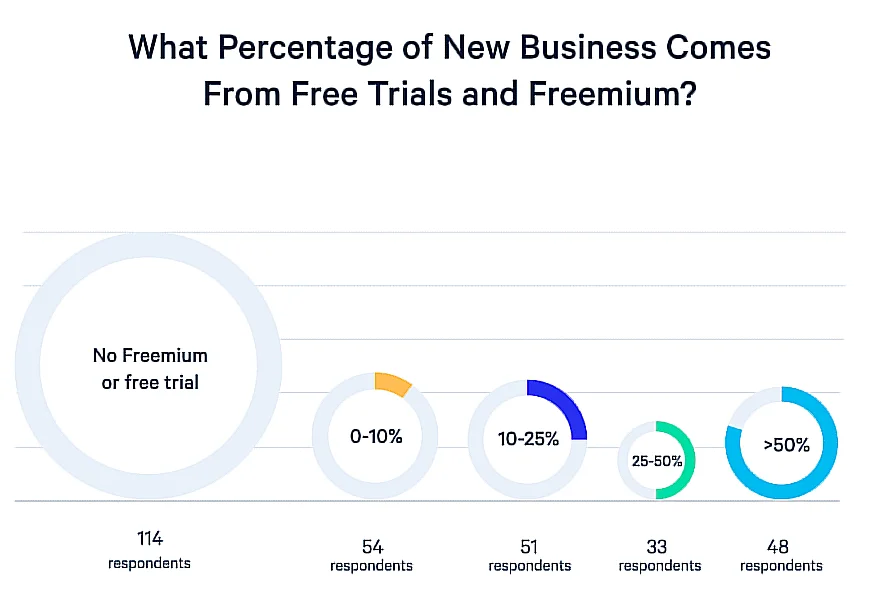

- Offering freemium plans or free trials to attract customers can be hit or miss

- 192 out of 300 respondents said their annualized revenue churn was 0-10%, 51 said 10-15%, and 57 reported higher than 15%

Credit: Do freemium plans and free trials increase conversions for SaaS companies – Reply survey

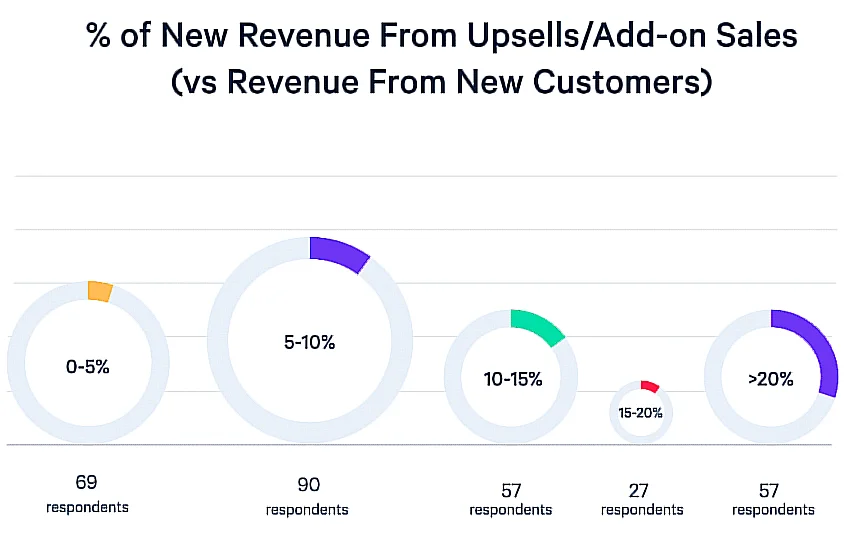

In comparison, revenue from upsells and cross-selling can also be hit and miss, depending on who you ask:

Credit: Does upselling and cross-selling increase revenue?

36. The profit boost from a 1% price increase could be as high as 12.7% (source: Price Intelligently)

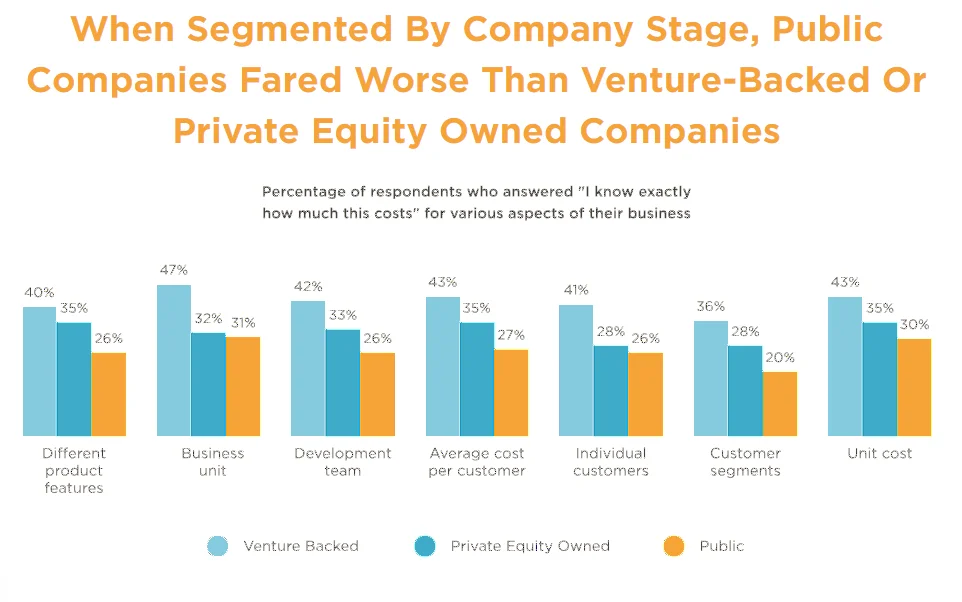

You don’t want to ignore pricing – or use guesswork when setting it up. You can instead use real-world data to figure out how to set profitable pricing for your SaaS product using your own cost of goods sold, cost per customer, and other unit cost insights.

With CloudZero, you can collect, understand, and act on granular, immediately actionable cost data. That includes such as cost per individual customer, per project, per service, per environment, per product, per software feature, and more — down to the hour. No cost allocation tags are required.

This empowers you to tell exactly how much you can price your service to protect your margins and grow your income to fund growth.

to see how it works for yourself.

to see how it works for yourself.

SaaS Cloud Cost Statistics

It’s no secret that sales and marketing eat up over 50% of SaaS company revenues (McKinsey). Yet, Cloud costs are a growing concern as some SaaS companies report weaker margins.

37. 60% say their cloud bill is a little higher than it should be or way too high (source: CloudZero)

CloudZero’s State of Cloud Cost Intelligence report is a must-read for any SaaS team that should treat cost as a first-class metric.

- A whopping 73% of respondents said that cloud cost is either a C-suite or board-level issue.

- It can take a week or more to discover a cost variance (cost anomaly such as a spike) leading to surprise costs

- Only 13% said they have 75% of their cloud costs allocated. So, 87% are not sure what to do about chargebacks and showbacks, making it tough to tell who, what, or why their cloud costs are changing.

Another thing. Only 3 out of 10 can tell where their cloud spend goes, such as to a specific product, business unit, or customer. It’s worse for larger SaaS companies:

38. Nearly half of SaaS companies want to optimize costs (source: Flexera)

Over the next year, 48% of businesses plan to improve how they manage their SaaS products. The majority of 54% are looking to maximize savings and optimize software spend.

How Many Companies Achieve the SaaS Magic Number?

The SaaS Magic Number indicates the sales efficiency of a SaaS business. It does that by evaluating the return on investment on sales and marketing spend compared to annualized revenue growth. Here are insights on it:

39. Typically, the SaaS Magic Number at $15 million Annual Recurring Revenue is 1.2 (source: SaaStr)

A good 25% of SaaS companies reach 2.1 or reach profitability on a customer within 6 months while 10% achieve “profitable” on a customer within just 3 months or less.

Also noteworthy is that sales efficiency is fairly constant across the entire SaaS industry (Mendoza Line for SaaS Growth).

40. Grow fast or die slow (source: McKinsey)

Other companies can afford to grow at 20% annually. But a software company growing at this rate has a 92% chance of going out of business in a few years. Software companies only stand a chance of becoming billion-dollar giants if their growth rate exceeds 60 percent.

How Many SaaS Companies Meet The Rule Of 40?

According to The Rule of 40 SaaS principle a software company’s combined revenue growth rate and profit margin should equal or exceed 40%. At above 40%, the SaaS company is often generating sustainable profit, but companies below 40% may have cash flow or liquidity problems.

41. 50 out of 175 companies met the rule of 40 (source: KeyBanc Capital Markets)

In 2021, data from the KeyBanc Capital Markets (KBCM) 2021 SaaS Survey indicated that 50 out of 175 SaaS companies with more than $5 million Annual Recurring Revenue met the Rule of 40, which translates to 29% of the companies.

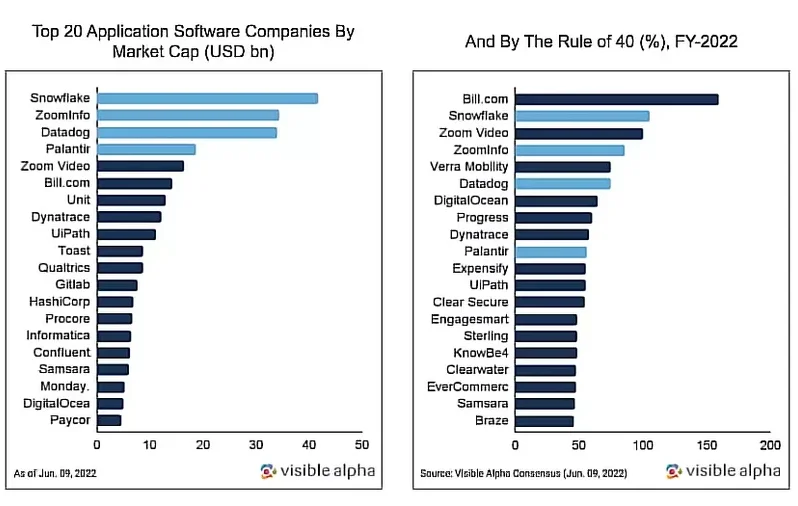

42. The largest SaaS companies don’t always meet the Rule of 40 (source: Visible Alpha)

Visible Alpha reported that the share of SaaS companies that meet the Rule of 40 may reduce to just 26% in 2024 from a high of 47% in 2021. Also, the most well-known or largest firms in SaaS don’t always have the best outlook based on the Rule of 40.

Credit: Visible Alpha Rule of 40 research

Statistics on SaaS Challenges

The following stats show the challenges other SaaS companies are struggling with right about now.

43. SaaS sprawl is a persistent problem year after year (source: BetterCloud)

Here is the thing:

- Multiple app configurations presents the greatest challenge for 42% of IT professionals

- 40% say they consolidated redundant SaaS apps in 2022/2023

- By 2027, 40% of the companies with multiple SaaS apps will use SMPs to centralize app management

Gartner’s findings complement BetterCloud’s.

44. 50% of companies that use multiple SaaS applications plan to centralize them in the next five years (source: Gartner)

In fact, the Gartner Market Guide for SaaS Management Platforms has a warning. It asserts that organizations without centrally managed SaaS lifecycles will be 5X more vulnerable to data loss or a cyber incident related to misconfiguration.

45. 30% of employees use SaaS apps not approved by IT (source: IBM)

A recent study by IBM found that 1 out of every 3 employees at Fortune 1000 companies use cloud-based SaaS apps without their IT department’s approval. And that increases data security risk.

46. 94% of IT executives think managing SaaS manually leads to poor decision-making about SaaS spending (source: Productiv)

In addition, 25% of IT teams said they spent most of their time managing external vendors and solutions — and 31% of the time involved overseeing security and compliance.

Statistics On SaaS Employees And Team Management

Now, picture this:

47. Proper onboarding can reduce employee turnover by 82% and boost their commitment to your company 18X over (source: Brandon Hall Group and BambooHR)

There’s more. 89% who had an all-around onboarding felt fully integrated into the company culture versus the 59% who got an effective onboarding.

48. Offboarding is more tedious than it should be (source: BetterCloud)

Offboarding can take up to 7 hours per user, which is tedious. Engineers are the hardest to offboard, followed by operations, sales, and finance professionals. Something else:

Speaking of data loss and risks, the following SaaS security stats will concern you.

SaaS Security Statistics

Take a look at these findings.

49. SaaS security is a major issue across the board (source: Logic Monitor)

The greatest challenges businesses face when using public clouds are:

- Security (66%)

- Compliance (60%)

- Lacking training or experience (58%)

- Privacy (57%)

- Vendor lock-in (47%), and

- Cost (40%)

That’s not all.

Misconfigurations in SaaS are difficult to detect and remediate manually, leaving organizations at risk. Almost half (46%) only check monthly or less frequently, while 5 percent never do.

The lack of visibility into the security settings of SaaS applications is the top concern for 56% of respondents. Concerns over a lack of visibility into the entire SaaS security settings follows.

50. 56% of enterprise apps aren’t managed (source: Productiv)

Unfortunately, that also means there isn’t much attention paid to security, and compliance alongside renewal dates, licenses, and app usage.

Also, 56% of respondents to a G2 study admitted to using software that their respective IT or InfoSec teams hadn’t vetted or approved.

51. Former employees cause up to 22% of incidents (source: Security Boulevard and OneLog)

Insider threats, counting ex-employees with access to a company’s SaaS apps, account for 22% of security breaches.

According to OneLog, 48% of organizations were unaware that a former employee could still access their corporate network.

- More than half of IT leaders admit that ex-employee accounts aren’t deactivated within a day after the employee departs.

- An alarming 32% reported it took a week while 20% reported a month or more. A further 25% are unsure how long accounts remain active after employees leave.

SaaS Industry Trends, Growth, And Predictions: What Are The Top SaaS Initiatives For 2023?

Here are some trends set to transform SaaS into the future that you’ll want to pay attention to.

- 72% of IT specialists believe zero-touch SaaS automation is the future (BetterCloud)

- AI-driven automation will be applied to all business processes (Tidio)

- Low-Code/ No-Code platform usage will be 3X by 2025 (Gartner)

- For SaaS vendors and users alike, security will remain a top priority including zero-trust and secure coding (O’Reilly)

- White-Label SaaS will become popular (Chargebee)

- The evolution of API services into full-blown Software-as-a-Service products

How To Understand, Control, And Optimize Your SaaS Costs With Confidence

These SaaS statistics can help you develop new strategies to lead your company in the right direction. If you are one of the SaaS leaders keen to understand, control, and optimize your cloud costs this year, CloudZero can help you.

With CloudZero, you can:

- Identify, analyze, and share cloud cost metrics automatically in the context of engineering, finance, or FinOps.

- View costs of tagged, untagged, and untaggable resources. No endless, manual tagging is required here.

- Engineers receive insights related to their technical role, including cost per feature, per environment, per development team, per project, per deployment, and more. This enables them to determine how their architectural choices impact the bottom line so they can design cost-effective solutions.

- Finance and FinOps get immediate insights into cost per customer, project, team, and more. In turn, you can set profitable pricing for your services, know how much discount to give a specific client based on their usage, etc.

- Visualize, understand, and share your COGS, gross margin, and other investor-oriented insights with the board at any time.

- Take advantage of real-time cost anomaly detection. Get timely alerts straight to your Slack to prevent overspending.

Yet, reading about CloudZero is nothing like experiencing it for yourself. Drift tried CloudZero and saved over $2.4 million in annual AWS spend.  and see what you can achieve.

and see what you can achieve.