Four ways small businesses can work smarter in Xero this EOFY

Xero

MAY 24, 2023

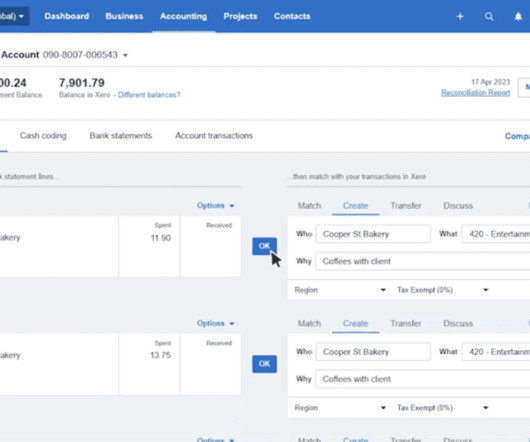

It’s often said that (almost) no one goes into business to do their own accounting. So it’s no surprise that many entrepreneurs lean heavily on a trusted advisor for support, particularly around busy times like EOFY when tax, compliance, payroll and other business obligations come into play. For those on the Xero platform, collaborating with your accountant or bookkeeper is simple via the cloud.

Let's personalize your content