9 Common Mistakes to Avoid During Company Incorporation in Singapore

In the bustling business landscape of Singapore, company incorporation is a strategic move for entrepreneurs seeking to establish a foothold in the region’s vibrant economy. However, navigating the incorporation process requires careful planning and attention to detail to avoid potential pitfalls that could hinder business success. Here are nine common mistakes to steer clear of when incorporating your company in Singapore:

1. Choosing the Wrong Business Structure

Selecting the appropriate company structure is paramount during the incorporation process. Whether opting for a Private Limited Company (PLC), Limited Liability Partnership (LLP), or Sole Proprietorship, each structure has its unique advantages and disadvantages. Understand the legal implications of different business structures and choose the one that aligns with your long-term goals.

2. Choosing the Wrong Company Name

Selecting a suitable company name is more than just a branding exercise—it carries legal implications and affects customer perception. Entrepreneurs must ensure their chosen name is original, does not infringe on existing trademarks, and aligns with their brand identity. Ensure your chosen business name is unique and complies with legal requirements to avoid costly rebranding efforts.

3. Neglecting Founders/Shareholder Agreement

Drafting a comprehensive agreement protects shareholders’ rights and prevents disputes over ownership and decision-making. When crafting your Founder’s and shareholder’s agreement, it’s essential to address three key areas:

- Roles and Responsibilities: Clearly defining the roles and responsibilities within the co-founding team fosters effective collaboration. Designating specific duties ensures accountability and streamlines decision-making processes.

- Time Commitment: Establishing the expected time commitment from each founder is crucial for project management and resource allocation. Agreeing on minimum weekly hours ensures alignment and dedication to the business’s success.

- Equity Distribution and Vesting: Equity allocation can be sensitive but must be addressed transparently. Determining the distribution of equity ensures fairness and incentivizes commitment. Consider factors such as the value contributed by each founder and potential financial investments to arrive at equitable terms.

4. Insufficient Market Research

Conducting thorough market research is essential before embarking on the incorporation journey. Understanding the competitive landscape, customer trends, and market demands can provide invaluable insights that shape business strategies and offerings. Neglecting market research may lead to entering saturated markets or offering products/services that fail to resonate with consumers.

5. Neglecting Proper Financial Planning

A robust financial plan is the bedrock of any successful business venture. Entrepreneurs must develop a comprehensive budget that includes cash flow projections, expense analysis, and economic forecasts. Seeking guidance from financial experts ensures a solid financial foundation and guards against cash flow challenges or debt accumulation.

6. Inadequate Understanding of Compliance and Regulatory Requirements

Singapore’s business environment is governed by strict compliance standards across various areas such as taxation, employment laws, and intellectual property rights. Ignorance or negligence of these regulations can result in fines, legal repercussions, or business closure. Seeking professional advice ensures adherence to all regulatory requirements and fosters long-term business sustainability.

7. Lack of a Comprehensive Business Plan

A well-defined business plan is essential for charting the course of a new company. It should encompass business objectives, target markets, marketing strategies, financial forecasts, and growth plans. A robust business plan serves as a roadmap for decision-making and guides the company’s expansion and development initiatives.

8. Providing Incorrect Information

Accuracy is crucial when filling out incorporation forms to prevent rejection and legal issues. Documents necessary for business registration in Singapore include:

- Company name

- Concise activity description & SSIC Code

- Shareholder particulars and KYC details

- Director information and KYC particulars

- Registered business address in Singapore

- Share capital details

- Company constitution

9. Overlooking Intellectual Property Protection

Protecting intellectual property assets is critical for safeguarding the company’s innovations and branding efforts. Registering trademarks, patents, and copyrights provides legal recourse against unauthorized use or infringement. Prioritizing intellectual property protection preserves the company’s competitive advantage and ensures its long-term success.

Summary

Incorporating a company in Singapore offers abundant opportunities for entrepreneurs, but it requires careful planning and execution to avoid common pitfalls. By steering clear of these mistakes and seeking expert guidance, aspiring business owners can lay a solid foundation for growth and profitability in Singapore.

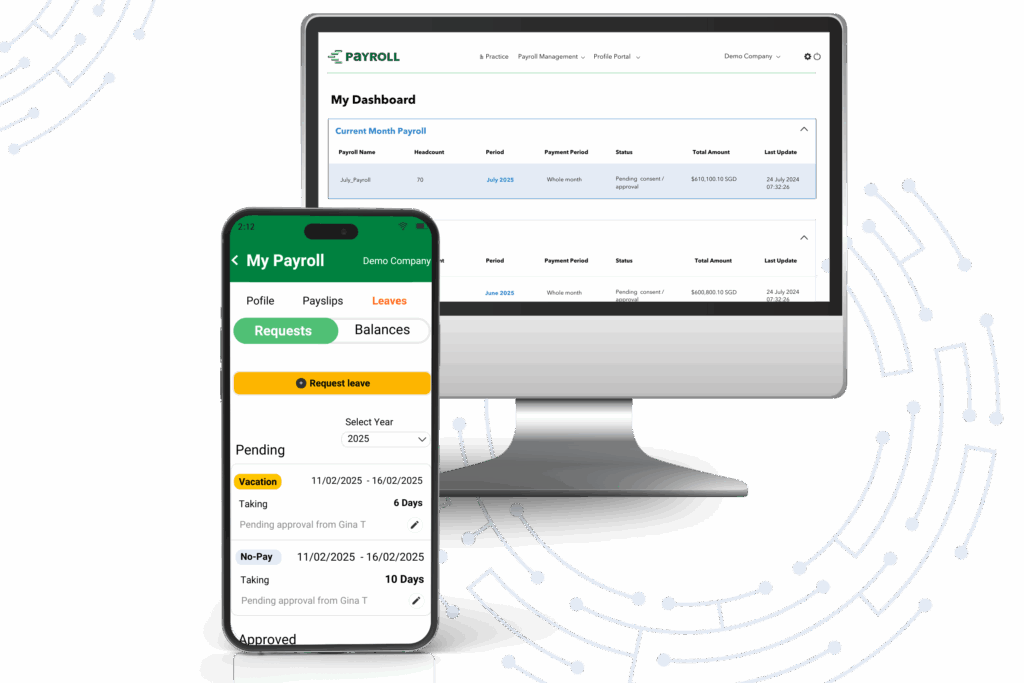

Using an incorporation service as an extension of your team

Setting up a company in Singapore can be challenging, but with professional support, it can be simple, Counto’s mission is to support your new business, take away the complexities of compliance, and save you time and money throughout the year. Speak to us directly on our chatbot, email us at hello@counto.sg, or contact us using this form.

Here are some articles you might find helpful:

United States

United States Singapore

Singapore United Kingdom

United Kingdom