Accounts payable (AP) e-document compliance is a topic that has been gaining traction in recent years. As businesses continue to move towards digitalization and automation, ensuring compliance with e-document regulations is becoming increasingly important. In this article, we will explore the latest news and developments in AP e-document compliance with focus on France and Spain.

What is AP e-document compliance?

AP e-document compliance refers to the process of ensuring that electronic documents used in AP processes, such as invoices and purchase orders, meet regulatory requirements. This includes complying with legal requirements for the storage, processing, and transfer of electronic documents.

One recent development in AP e-document compliance is the increasing adoption of e-invoicing by governments around the world. In 2020, the European Union (EU) mandated that all public sector entities in the EU must be able to receive and process e-invoices by April 2021. This is part of the EU’s wider efforts to promote the digitalization of business processes and reduce administrative burdens.

Source

Source

Similarly, in the United States, the Internal Revenue Service (IRS) has been encouraging businesses to adopt e-invoicing as part of its efforts to modernize tax administration. In 2020, the IRS launched a pilot program for e-invoicing, which allows businesses to submit invoices electronically directly to the agency.

Another development in AP e-document compliance is the increasing use of blockchain technology. Blockchain is a distributed ledger technology that enables secure and transparent transactions between parties without the need for intermediaries. In the context of AP e-document compliance, blockchain can be used to create a secure and tamper-proof record of transactions.

For example, in 2020, the Mexican government announced that it would be implementing a blockchain-based platform for the management of government contracts. The platform, called “Contratobook”, will use blockchain technology to create a secure and transparent record of all government contracts, including invoices and purchase orders.

Finally, it is worth noting that the COVID-19 pandemic has accelerated the shift towards digitalization and automation in AP processes. With remote work becoming the norm for many businesses, the need for digital processes that can be accessed from anywhere has become more important than ever.

France

In France, the use of electronic documents for accounts payable (AP) compliance has been gaining momentum in recent years. The French government has been encouraging companies to switch from paper-based processes to digital ones, as part of its broader efforts to modernize the country's economy and improve its competitiveness in the global marketplace.

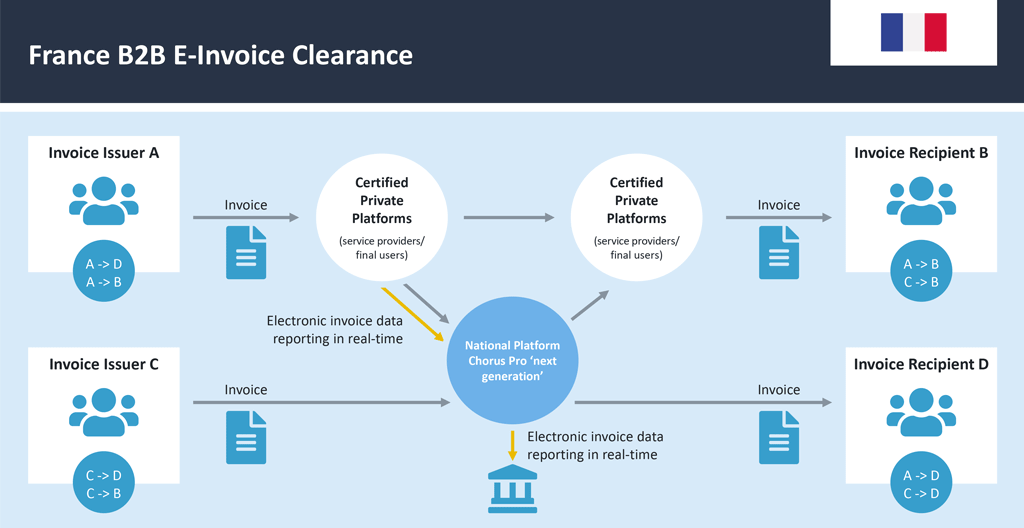

One of the main drivers of this trend is the increasing regulatory pressure on companies to comply with stricter standards for financial reporting and documentation. In 2019, the French tax authority, Direction Générale des Finances Publiques (DGFiP), introduced new rules requiring all companies to provide electronic invoices (e-invoices) to their customers and suppliers.

Under the new regulations, companies must use electronic invoices that meet certain technical specifications and are compliant with the European Union's e-invoicing standard, known as the European Norm (EN) 16931. This standard aims to standardize e-invoicing across the EU and ensure interoperability between different systems.

Source

In addition to e-invoicing, companies are also required to use electronic signatures and time-stamping for certain types of financial documents, such as contracts and purchase orders. These measures are intended to enhance the security and reliability of digital transactions, and to prevent fraud and errors.

To comply with these regulations, companies must use certified service providers that offer secure and compliant e-document solutions. These providers must be approved by the French government and comply with strict data protection and security standards.

Spain

In Spain, there is new development of regulations and compliance requirements for e-documents in accounts payable.

One of the key regulatory frameworks for e-documents in Spain is the Spanish Tax Agency's (AEAT) electronic invoice system, known as Facturae. Facturae is a standardized format for electronic invoices that ensures compliance with Spanish tax regulations. All invoices sent to public administrations in Spain must be in Facturae format, and it is also recommended for invoices sent between private companies.

Another important development in accounts payable e-document compliance in Spain is the European Union's e-invoicing Directive, which sets out standards and requirements for electronic invoicing across the EU. The Directive requires that all EU member states implement e-invoicing by April 2020 for public sector contracts, and by April 2023 for all other contracts.

In Spain, the implementation of the Directive has led to the development of new regulations and technical specifications for e-invoicing, including the use of the Universal Business Language (UBL) and the PEPPOL network for cross-border invoicing. The UBL is an open, royalty-free XML-based format for business documents, while PEPPOL is a network for the exchange of e-documents between businesses and public authorities.

In addition to these regulatory developments, there are also new technologies and solutions emerging to support e-document compliance in accounts payable. For example, some companies are using blockchain technology to create tamper-proof and secure records of their transactions. Others are using artificial intelligence (AI) and machine learning (ML) to automate the processing and analysis of e-documents, reducing errors and improving efficiency.

However, despite these developments, there are still some challenges and obstacles to overcome in the adoption of e-documents for accounts payable in Spain. One of the main issues is the lack of standardization and interoperability between different systems and formats, which can make it difficult for businesses to exchange e-documents with their partners and suppliers.

Another challenge is the need for effective data protection and cybersecurity measures to ensure the confidentiality and integrity of e-documents. This is particularly important in light of the increasing frequency and severity of cyber attacks and data breaches.

Conclusion

In conclusion, AP e-document compliance is a rapidly evolving area that is becoming increasingly important as businesses continue to digitize and automate their processes. With governments around the world mandating the use of e-invoicing and the increasing use of blockchain technology, it is clear that the future of AP e-document compliance will be driven by innovation and technology. Businesses that are able to stay up-to-date with the latest developments in this area will be well-placed to reap the benefits of a more efficient and compliant AP process.