Introduction

We hope that you know the importance of finance in business!

“A study by the U.S. Small Business Administration says 82% of businesses fail due to poor cash flow management or a lack of financial understanding.”

This startling statistic underscores just how critical financial management is to a business’s growth and survival.

Finance is a key to a business’s growth. Call it the lifeline instead, as it is required for the well-being of a business, irrespective of its size. Apart from all the reasons a business needs finances, one of the major reasons is the fight for survival and growth.

Since finance is a business’s most important aspect, business owners or freelancers must create a financial plan or strategy to stay in control of their finances.

Thus, this blog post will discuss every aspect of financial management, including its importance and a few tips to better manage your finances.

Let’s dive in.

What is Financial Management?

Financial management encompasses the proper planning and organizing of the company’s finances, as well as controlling and monitoring their use to achieve the company’s business goals.

The process includes different financial tools for a company to sustain it, pay its liabilities, and make it steadier for future growth.

Importance Of Financial Management

Good financial management helps your business in many ways:

- Budgeting: It lets you plan how much money you’ll need for different tasks, like buying materials or paying employees. This way, you won’t run out of cash when you need it most.

- Cash Flow: Keeping track of money coming in and going out helps ensure you always have enough to cover bills and other expenses.

- Profitability: Financial management shows you which parts of your business are making money and which ones are not. This helps you focus on what’s working and fix what’s not.

- Decision Making: With solid financial information, you can make better decisions about where to invest or cut costs.

Key Elements Of Financial Management

Here are some key elements of financial management:

- Record Keeping: Accurate records help you know where your money is going and make it easier to file taxes.

- Cost Control: This involves looking for ways to reduce costs without hurting the quality of your products or services.

- Financial Planning: Planning for the future ensures you have the resources to grow and expand your business.

5 Tips for Financial Management in a Business

1. Establish a Solid Financial Plan

Financial planning should be there at each and every step of running a business. Start planning as soon as you get the business idea. Do not look back. Planning now would give you freedom to flex your hands a bit, giving you some time to act, if something urgent had to come up. Keep reserves for the rainy day.

2. Forecast Finances Easily

While it’s not literally possible to peep into the future, you could just picture what your goal is and then take some efforts to manage your finances efficiently. Study and analyze how likely you are to spend and invest your money. Depending upon the same, create a blueprint of the plan on which you would take things forward. Invoicera is a finance management software available online that has revolutionized the entire experience of finance management. The trusted partner for more than 3 million users has created a platform for businesses to make the complex task of finance management easier.

Read : 3 Easy Finance Management tips for Small business

3. Keep Your Lenders Aware

Quite often, it is seen that small business owners borrow money from outside. Lenders, in turn, expect a quick return. Hence, they should be well informed of a business’s financial condition and the rate at which it’s progressing.

4. Make Changes, if Needed

Forecasting your finances is not an easy task to do. It could be difficult but with changing scenarios, the budget you created in the beginning might look foggy few months down the line. Make sure you stay updated with your financial plans as per the market.

5. Use An Online Finance Management Software

An online financial management software like Invoicera allows you save all your cash flow data on the cloud. Unlike, paper invoicing, Online invoicing lets you access your data at the ease of your convenience. The online available financial management solution has given a new area for businesses to work on. With financial management software, you can easily keep track of all your cash flow. The added spreadsheets create an effortless segregation of entire records giving you accurate information in no time.

Quick Tip

Experience does count when it comes to financial planning. Try consulting a financial expert who could help you out in drafting budgets and long-term plans. Usually, small businesses prefer consulting these advisers, owing to their expertise and understanding in such situations.

So, in case you were planning to start-up a business, make use of these tips to put your finances in good use.

5 Mistakes to Avoid in Financial Management

1. Ignoring Cash Flow

Cash flow is the fuel that powers your business. When you neglect it, sooner or later you will face problems with paying bills or salaries to your workers. It is important for you to track the cash flow frequently.

2. Not Budgeting

If you don’t have a budget in place, it’s easy to overspend or allocate funds misplaced. Design a budget and stick to it. Modify if necessary.

3. Overlooking Record Keeping

It is essential that accounting is precise. When you don’t have a track record of your spending, income, and other financial details, you’ll have problems with taxes, audits, or even business decisions.

4. Ignoring the Preparation for the Future

The absence of financial planning is nothing less than flying without a safety net. This may cause you to fail to benefit from other opportunities or under prepare yourself and your companies for downturns. Create a financial plan that includes your target and will explain how you will achieve it.

5. Neglecting Professional Advice

Though managing everything by yourself brings expensive errors. Seek a financial advisor or accountant for support particularly on such complex issues as tax planning or business expansion.

Manage Your Finances With Invoicera

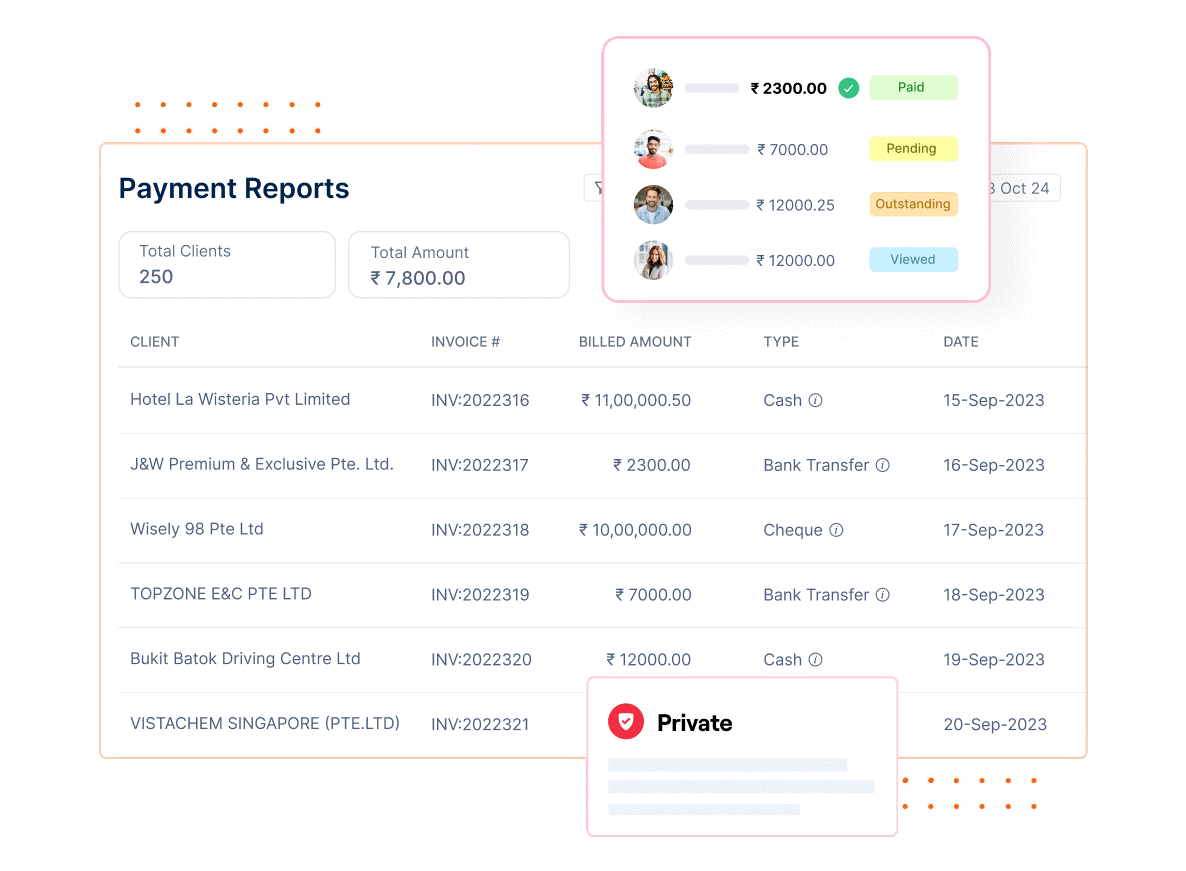

Invoicera is a versatile expense management tool offering comprehensive features to simplify financial processes.

From expense tracking and reporting to invoice generation, this tool provides businesses with a one-stop solution for managing expenses efficiently.

Features

1. Expense Tracking

Invoicera streamlines expense tracking by allowing users to record, categorize, and monitor expenses effortlessly in real time.

Its user-friendly interface simplifies the process of:

- Logging expenses

- Attaching receipts

- Allocating costs to specific projects or clients

2. Customizable Expense Reports

This tool enables the creation of detailed expense reports tailored to your business needs. Users can generate comprehensive reports showcasing expenditure patterns, categories, and trends.

These reports provide invaluable insights for informed decision-making and budget planning.

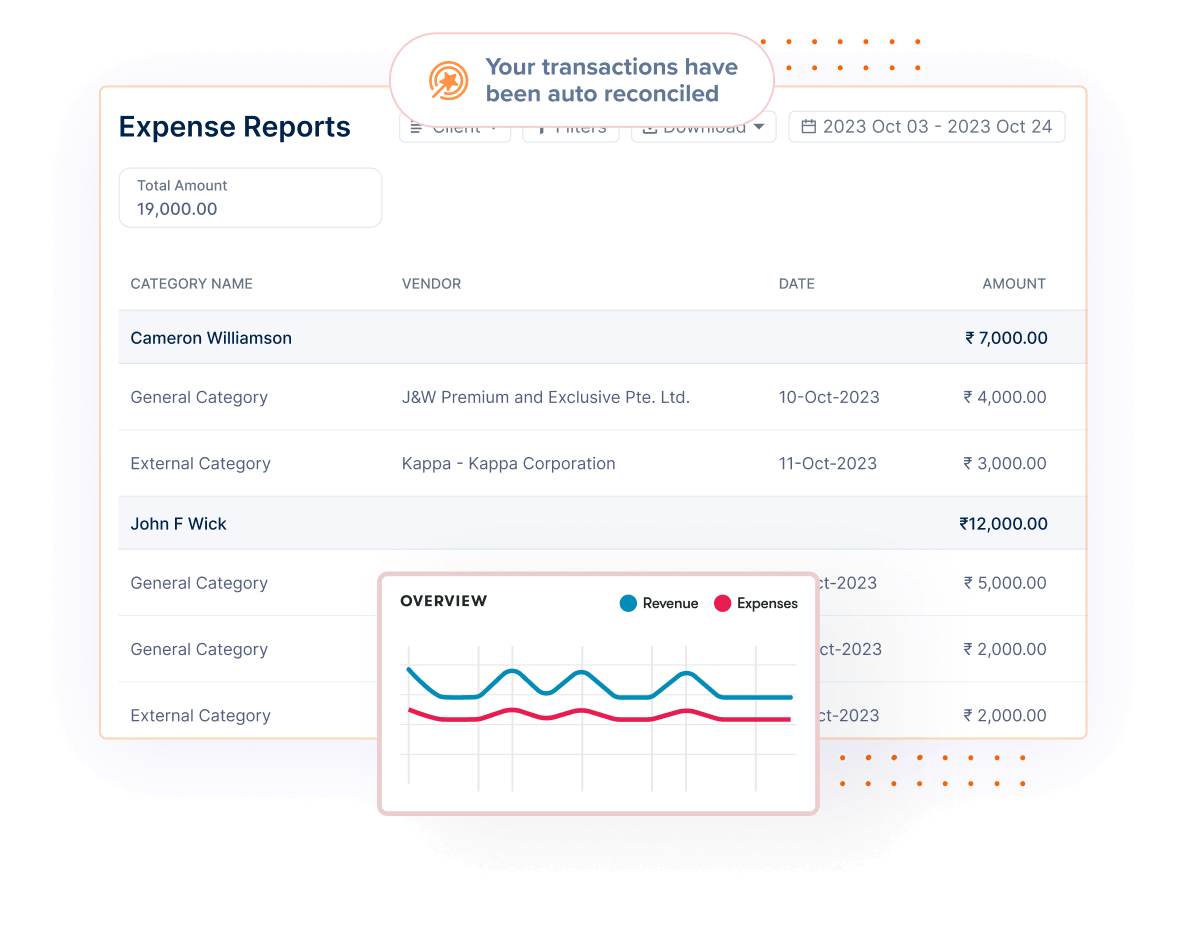

3. Automated Expense Management

Invoicera automates repetitive expense-related tasks, such as recurring expenses or approvals, reducing manual effort and ensuring accuracy.

Automation optimizes workflows, minimizing errors in expense reporting and reimbursement processes.

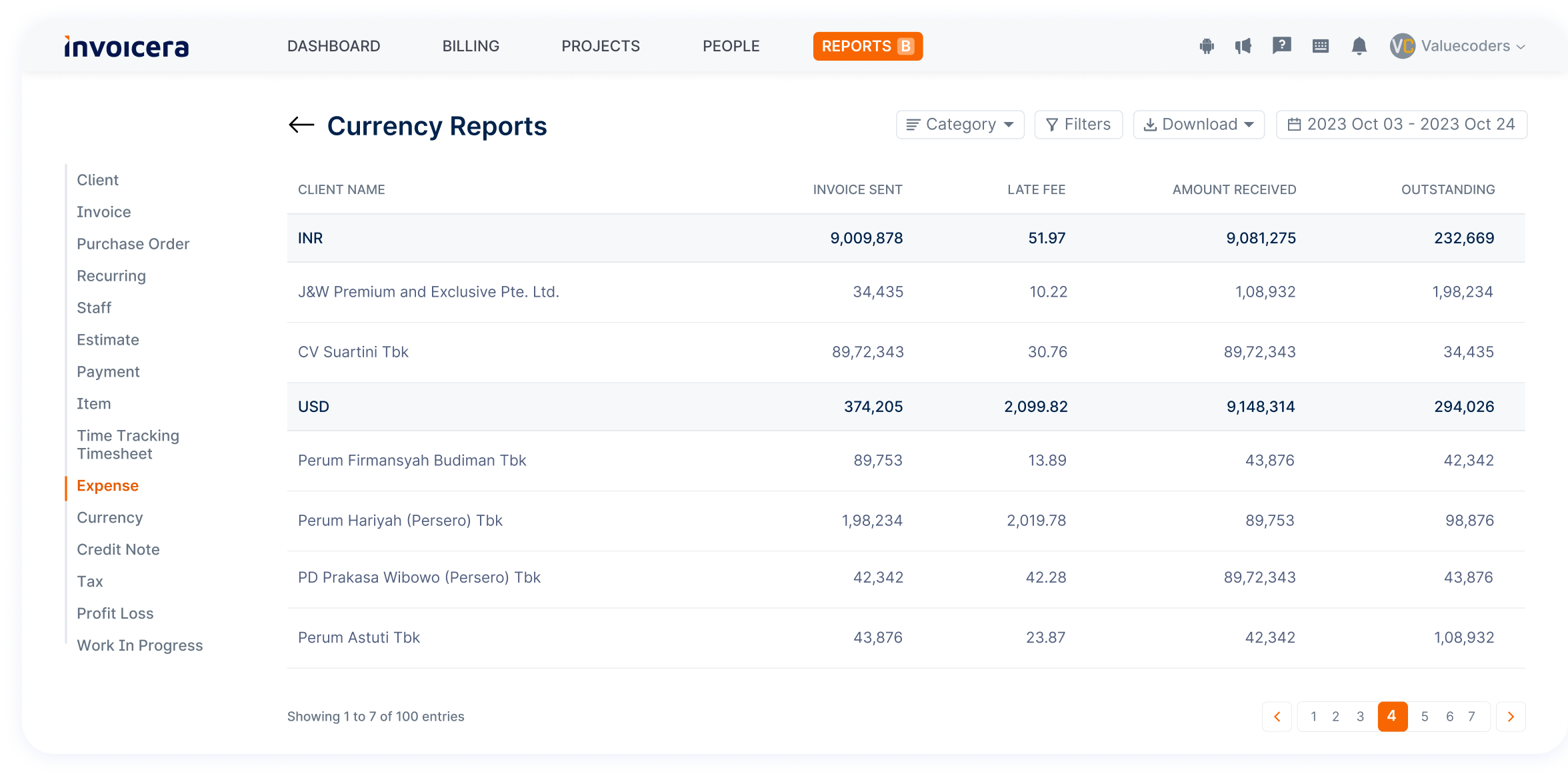

4. Multi-Currency Support For Expenses

With its multi-currency functionality, Invoicera simplifies international expense management.

Users can effortlessly handle expenses in different currencies and accurately convert and record expenditures, making it an ideal choice for businesses operating globally.

5. Expense Collaboration And Workflow Management

Invoicera supports collaboration among team members, allowing seamless communication and coordination in expense-related tasks.

It facilitates workflow management by assigning roles, responsibilities, and approvals within the expense management process.

Conclusion

Financial management is the key factor of business success. It will help you prepare a budget, control cost, and ensure a cash flow, leading to growth and stability.

To steer successfully under financial management, start by creating a good plan to fathom your specific spending pattern and adjust accordingly. Tools such as Invoicera can speed up invoicing and tracking processes and enhance the effectiveness of your business.

Flexibility in payment terms and keeping lenders up to date as well are very important. Think about getting the services of financial consultants for guidance and planning. This way, you can establish a secure financial base and begin your entrepreneurial journey on the right foot.

Is chasing payments a constant headache?

Get Paid On Time With Automated Reminders

FAQs

What is the difference between budgeting and forecasting?

Planning involves outlining what you have to spend it on and foreseeing the income and expenses for some time. Forecasting is a process of predicting future financial outcomes using past data, trends, and assumptions.

How does financial management software improve cash flow?

Software for financial management can automate invoices, track expenses, and monitor payments. This enables businesses to get paid faster, cut down errors, and keep a continuous view of cash flow.

How can I ensure my business’s financial plan is flexible?

Flexibility should be ensured by frequent reviews and plan adjustments influenced by market movements, business performance, and unexpected situations. This adaptation can help you remain active and react appropriately when new changes occur.

When should I consider hiring a financial advisor?

You can opt to hire a financial advisor if your business is experiencing rapid growth, is encountering complex financial issues, or when you require expert advice on budgeting, tax planning or investment strategies.