Accounts Payable Process: Overcoming Common Challenges with Automation

Managing your accounts payable (AP) process effectively is crucial for maintaining smooth financial operations and vendor relationships. Any mishaps in this process can have far-reaching consequences for your business.

In this article, we’ll delve into common challenges faced by businesses in their accounts payable process and explore practical solutions, focusing on the benefits of automation in streamlining this critical function.

1. Slow Processing: Manual paper-based processes slow down your accounts payable workflow considerably. Every time an invoice passes through multiple hands, it increases the risk of errors and delays. Slow processing can lead to late payments and disgruntled vendors.

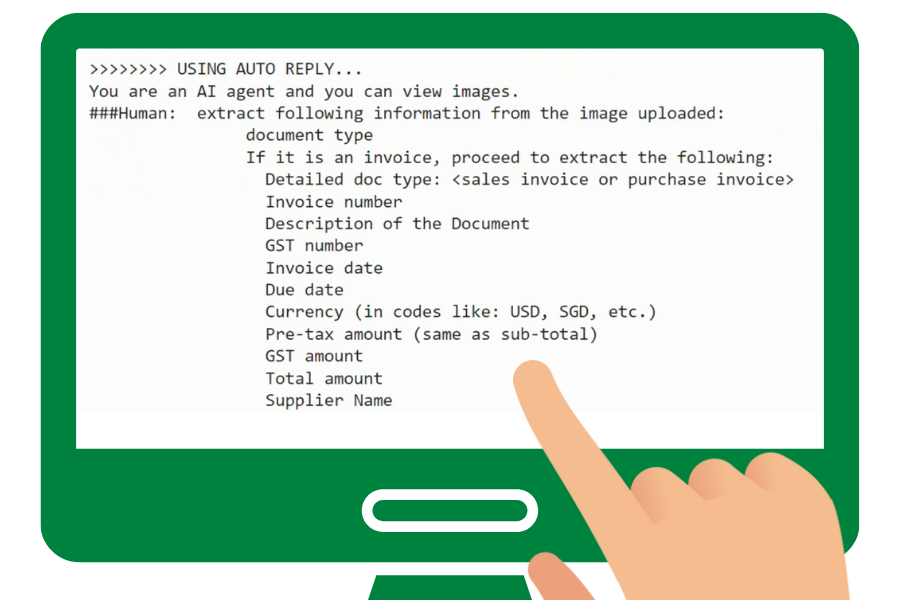

Solution: Going Paperless Transitioning to digital processes is key to improving accounts payable efficiency. Embracing advanced invoice processing, electronic payment systems, and comprehensive AP automation software can significantly reduce processing times and boost accuracy.

2. Unauthorised Purchases: Unauthorised purchases can occur when employees bypass established procurement procedures, leading to unaccounted invoices and additional workload for the accounts payable team.

Solution: Streamline Workflows Standardising and automating workflows can minimise unauthorised purchases. By establishing clear procedures and using automation software, you can enforce purchasing policies and reduce the chances of off-contract spending.

3. Sending Payment Before Delivery: Paying suppliers before receiving goods or services can lead to complications in case of damaged or incomplete deliveries. Isolated AP processes can contribute to this issue.

Solution: Improve System Integration Integrating your accounts payable process with broader business systems and procurement departments ensures that payment authorisation aligns with order fulfillment. This integration enhances communication and transparency, reducing payment discrepancies.

4. Disappearing Invoices: Lost or misplaced invoices within paper-based systems can result in late payments, penalties, and difficulties in maintaining accurate financial records.

Solution: Switching to digital workflows and adopting AP automation software eliminates the risk of losing invoices. Digital records are easily accessible, searchable, and securely stored, simplifying record management and compliance.

5. Double Payment: Typos or human errors in purchase orders or invoice tracking can lead to duplicate payments, impacting your bottom line and supplier relationships.

Solution: Advanced AP automation software can prevent double payments. Machine learning algorithms can identify and flag potential duplicate invoices, allowing your team to rectify the issue before processing payments.

6. Potential Fraud and Theft: Lack of visibility into financial data can expose your business to fraud and theft risks, including unauthorised vendor invoices and duplicate payments.

Solution: Constant Monitoring and Strict Regulations Implement AP automation software to monitor transactions, detect irregularities, and enforce strict regulations. Automation provides real-time visibility into your financial data, reducing the risk of fraud and theft.

Summary

Effective accounts payable management is essential for a well-functioning business. By embracing automation and modern software solutions, you can eliminate common AP challenges, improve accuracy, enhance vendor relationships, and streamline your accounts payable process. Don’t let outdated manual processes hinder your financial operations; take proactive steps to optimize your accounts payable workflow with automation.

Try Counto BillPay

An all-in-one bill payment, spend management, and accounts payable solution. Automate financial processes and set custom smart rules, thanks to intelligent AI. Want to schedule a demo? Speak to us directly on our chatbot, email us at [email protected], or contact us using this form.

Here are some articles you might find helpful: