4 Signs That Your Business Needs to Reassess Its Bookkeeping

4 Signs That Your Business Needs to Reassess Its Bookkeeping

Bookkeeping is a vital part of running a successful business. It helps track income and expenses and can provide insights into a company’s financial health. However, knowing when your business needs to step up its bookkeeping practices is not always easy. In fact, most start-ups may choose to engage accounting services for SMEs in Singapore to help streamline their processes.

If you are finding it difficult to keep track of financial data, here are five signs you need to reassess your bookkeeping processes. These signs can provide valuable insight into the state of your business’s finances and help you make informed decisions to improve your bookkeeping and, ultimately, your business’s bottom line.

1. You’re not maintaining accurate financial records

It’s imperative to maintain organised financial records, not just to remain in compliance with the IRAS and financial auditors, but also to present a comprehensive view of your company’s financial position to potential investors.

Good bookkeeping practices should include the maintenance of records for all financial transactions covering at least three years or more, depending on the applicable legal requirements. The evidence gathered through bookkeeping will enable you to claim any tax deductions and provide financial statements to potential investors.

Having a complete and accurate financial record is also essential for any business seeking outside funding. A bare-bones cash-basis bookkeeping system, such as an Excel spreadsheet, will not provide the level of detail needed for potential investors to evaluate the company’s financial health. Therefore, keeping accurate and detailed financial records is vital for any business looking to secure investments from outside sources.

2. You don’t conduct a bank reconciliation following the end of the month

Every business needs to ensure that its bank statements and accounting records match at the end of each month. This is because the bank statement is one of the most important sources of validation for banking activities.

We strongly suggest doing a reconciliation once the bank statement is accessible online to ensure accuracy. Doing so ensures that businesses can trust their financial records and keep track of their finances with peace of mind. It also reduces the risk of errors and helps businesses make accurate financial decisions.

It is critical to compare the cash account transactions in the accounting records to the bank statement when completing a bank reconciliation. If the transactions do not match, it is crucial to investigate why this is the case. A cheque that has not yet been posted to the bank account at the end of the month is a common cause of discrepancies.

Resolving any differences between the statement and the books will help ensure the accuracy and completeness of financial records. It is also essential to ensure any checks have cleared, as this can significantly affect your financial position and cash flow if not included in the statement. By conducting regular reconciliations, you can ensure your financial records are up-to-date and accurate.

3. You have problems with cash flow

There is undoubtedly a cash flow problem when your financial statements indicate that you are making money, yet your bank account is short of funds. Poorly managed cash flow may have major ramifications for any entrepreneur, including miscomputations related to burn rate and runway, failure to pay salaries or meet financial obligations, and missing out on investment prospects if the liquidity ratio is not achieved.

Managing cash flow is a critical component of running a successful business. The first step in addressing any cash flow issues is to confirm that accounts payable and accounts receivable have been accurately calculated. To reduce accounts payable each time a payment is issued, it is beneficial to establish a system to ensure the accounts payable detail aligns with the payments made. Additionally, it may be beneficial to consult with a financial expert or an accountant to understand how to optimise your cash flow.

Automating your invoicing process can benefit your company once all financial records are in good standing. This can help reduce any errors or delays in issuing invoices while also providing insight into customer delinquencies. Additionally, it makes it easier to recoup overdue payments.

Nevertheless, it’s crucial to keep in mind that cash flow problems aren’t usually the result of poor bookkeeping. Cash flow issues occasionally may have their origins in the business model itself. Therefore, a detailed assessment of the business model is required when attempting to resolve cash flow concerns.

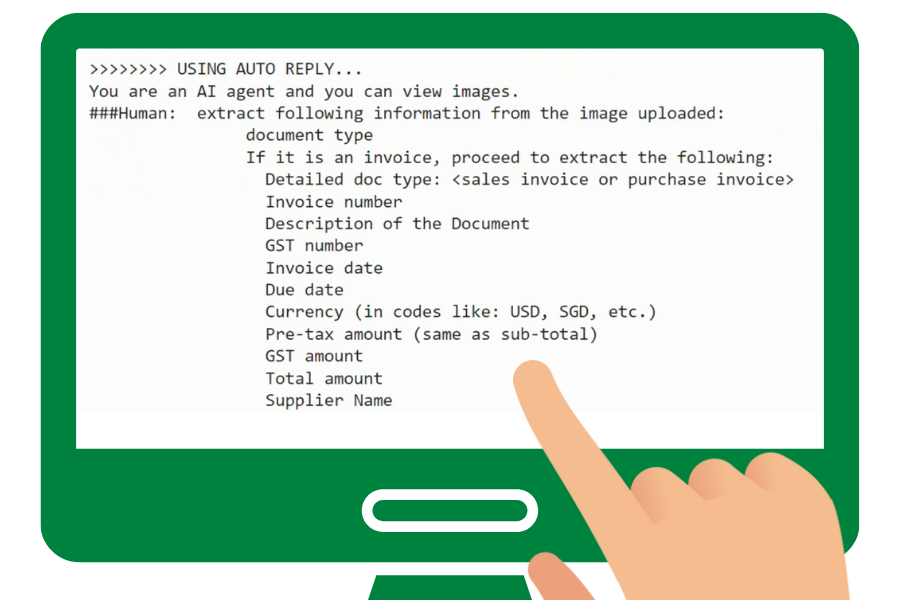

4. You’re not taking advantage of software solutions

Many businesses prefer to outsource their bookkeeping to keep up with the ever-changing business landscape. These software solutions are a great way to outsource bookkeeping tasks and free up more time for your business. With these automated solutions, you can easily manage financial data, optimise billing processes, and track and analyse your financial performance in real time.

By outsourcing menial tasks and taking advantage of software solutions, you can ensure the accuracy and timely completion of financial transactions. Additionally, you can reduce the need for manual data entry, which is both time-consuming and prone to errors. Outsourcing bookkeeping tasks to an automated software solution gives you the power to access precise, up-to-date financial information quickly and efficiently.

Conclusion

If you own a business, bookkeeping is a fundamental part of its success. It allows you to track and monitor income and expenses and get an insight into your company’s financial health. Knowing when to step up your bookkeeping practices can be tricky, especially for start-ups. Thus, outsourcing your bookkeeping can help streamline processes and ensure accurate records.

Counto is the ideal solution for businesses looking to save time and money on their accounting processes. Our AI technology enables you to process invoices, track spending, and record assets with just a few clicks. We take away the menial accounting tasks, so you can focus on your business’s core competencies and make informed decisions.

In addition to bookkeeping, Counto is also a tax filing company in Singapore. We have professionals that are well versed in the latest tax regulations and provide guidance on how to navigate the system. Their expertise, combined with our filing software, makes it a great choice for anyone looking for tax filing services. Get in touch with us today to discover how you can benefit from our services and grow your business.