6 Reasons Why You Should Outsource Your Bookkeeping

6 Reasons Why You Should Outsource Your Bookkeeping

Are you a small business owner who is looking for bookkeeping tips, cost-cutting strategies, or ways to streamline your business operations? Engaging outsourced bookkeeping services in Singapore could be an excellent solution for you.

Outsourcing your bookkeeping can help ensure that your business operates in the most efficient and cost-effective way possible. Here are six reasons why outsourcing your bookkeeping services can benefit your business.

What is bookkeeping outsourcing?

Bookkeeping outsourcing is the practice of hiring an outsourced bookkeeper or third-party company to manage your company’s bookkeeping and financial reporting needs. With bookkeeping outsourcing, you will have more time to focus on growing your business and less time worrying about your company’s financial data.

Outsourcing bookkeeping services is the most cost-effective way for small businesses to get professional-grade financial reporting and bookkeeping without having to hire a dedicated in-house bookkeeper.

Benefits of bookkeeping outsourcing

Outsourced bookkeepers can handle all the details related to processing payments, reconciling accounts, recording financial transactions, preparing financial statements, and tax-related tasks. Here are some additional benefits of outsourcing your bookkeeping:

1. Time and money savings

Logging, recording, and organising financial data takes time and effort, especially if you do it manually. With an outsourced bookkeeping service, you can receive professional-grade financial data without spending time and effort doing so manually — all while you focus on growing your business.

2. Accurate records

Accurate financial records are necessary for managing cash flow, calculating profit and loss, and tax purposes. If you are manually recording financial data, there is a risk of making errors. With an outsourced bookkeeping service, you can be sure that your financial records are accurate. Outsourced bookkeepers can review your financial data and ensure everything is written correctly.

3. Reduced risk of errors

Bookkeeping services can reduce the risk of errors by auditing financial records and identifying any potential issues. When manually logging financial data, you may miss errors and make completely inaccurate financial records. With an outsourced bookkeeping service, your financial records are carefully reviewed and audited by professionals, significantly reducing the risk of errors.

4. Access to specialised skills

Many small business owners are generalists who are skilled at multiple aspects of business operations. Bookkeeping, however, isn’t always one of them. With bookkeeping outsourcing, you can access professionals who have specialised skills and training in accounting and financial reporting. This can help you make more accurate financial decisions and access valuable information that can help you make critical business decisions.

5. Increased security

Manual record-keeping has its own set of risks and security issues — there’s a risk of identity theft, fraud, and other security issues. Financial data is extremely sensitive and is often targeted by malicious actors. Outsourced bookkeeping services use sophisticated security measures and encryption to protect your sensitive financial data. Additionally, many bookkeeping services offer a host of security features, including password protection, two-factor authentication, and more.

6. Scalability

As your business grows and evolves, your bookkeeping needs will change, and you may need to hire additional employees. With an outsourced bookkeeping service, you can scale up or down as needed. If you need additional financial data or hire more employees, you can simply add one or more bookkeeping services to your account. If your business has a seasonal or cyclical pattern, you can simply scale back your bookkeeping services during slow periods.

Conclusion

Bookkeeping outsourcing can be a great solution for businesses of all sizes. You also get to enjoy more benefits — such as saving time and money and reducing the risk of errors — without hiring a dedicated in-house bookkeeper. With the help of outsourced bookkeeping services, your business can focus on what it does best while an accountant takes care of the bookkeeping.

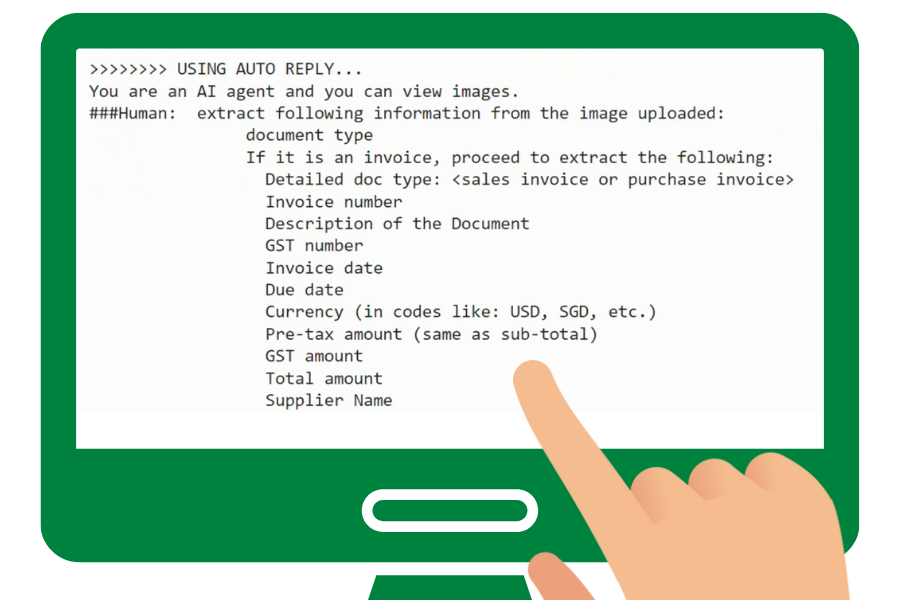

With Counto, you can focus on your business’s core competencies while we handle all the accounting. With a few clicks, you can process invoices, track spending, and record assets with our AI technology. You can also access reports and analyse your data to make informed business decisions. We are here to assist you in expanding your business by offering accounting services that allow you to focus on what matters most.

In addition to outsourced bookkeeping, Counto is also a tax filing company in Singapore. With our platform, you can manage all your financial data in one place while having your taxes filed efficiently and accurately. Stay connected with us and start growing your business today by dropping us a message.