Introduction

You probably come across it as an everyday challenge or have at one time experienced the experience of dreading due payments on your invoices!

Managing these partial payments is not always easy and may seem like assembling a puzzle with missing pieces.

Research conducted by the National Federation of Independent Business (NFIB) found that about 64% of small businesses receive payments after the agreed due date from their customers, many of which are partial payments.

Consider working on a huge project and sending out a large invoice in anticipation of getting enough money to fund your operations, only to get a small percentage of the total bill.

This disrupts cash flow and adds complications to financial strategy and business relationships with clients.

However, the good news is that some measures can be employed to manage this problem without much inconvenience.

It has been said that one can achieve anything if they have the right equipment – and when we talk about invoicing, the right tool is Invoicera.

- So, how exactly do partial payments impact businesses?

- To what extent do they represent challenges in financial management?

- And importantly, how can proper management of partial payments become a solution to handle financial operations efficiently?

Let us take a closer look at partial payments on invoices, their challenges, solutions, and how Invoicera fits the puzzle.

What Are Partial Payments?

Partial payments refer to a client or customer paying a fraction of the total amount of money on an invoice rather than making a full payment.

These payments can be made for various reasons, and understanding them is crucial for better financial management.

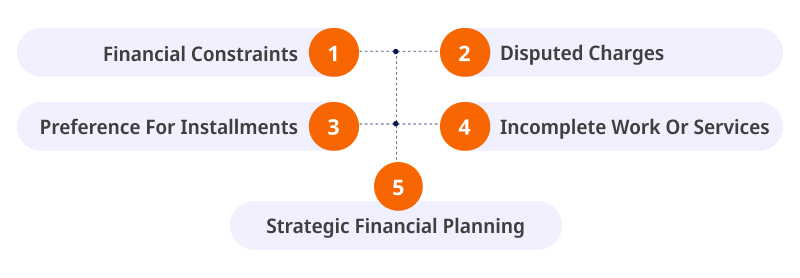

Why Do Clients Make Partial Payments?

Clients opt for partial payments due to a range of reasons:

- Financial Constraints: Sometimes, clients might face temporary financial limitations, making paying the full amount upfront challenging. They choose partial payments to manage their cash flow more effectively.

- Disputed Charges: In the case of a problem or a dispute concerning the supplied goods or services, the clients can pay in parts with the intention not to pay in full amount until the problem is resolved.

- Preference For Installments: There are clients who would prefer to pay in tiny portions based on their capability, timing, or convenience.

- Incomplete Work Or Services: In cases where the work or services are ongoing or incomplete, clients may opt for partial payments until the project reaches specific milestones or completion stages.

- Strategic Financial Planning: Occasionally, clients allocate funds across various expenses, resulting in partial payments to multiple vendors or service providers.

Understanding these reasons helps businesses better navigate client relationships and adapt their invoicing and payment strategies.

Impact Of Partial Payments On Cash Flow

Below are some impacts of partial payments on a company:

- Delayed Revenue: When clients make partial payments, it delays expected revenue, thus making it difficult for the company to cope with expenses and investments.

- Cash Flow Uncertainty:

Reports from the Federal Reserve Bank of New York reveal that about 19% of invoices are paid past their due date, affecting cash flow and forecasts in micro, small, and large businesses.

This leads to cash flow unpredictability, where the firm may not be able to predict how much money will be generated from sales to pay for future obligations or invest in projects.

- Increased Administrative Burden: Processing partial payments necessitates additional administrative efforts in tracking, reconciling, and following up on outstanding balances, potentially growing overhead costs.

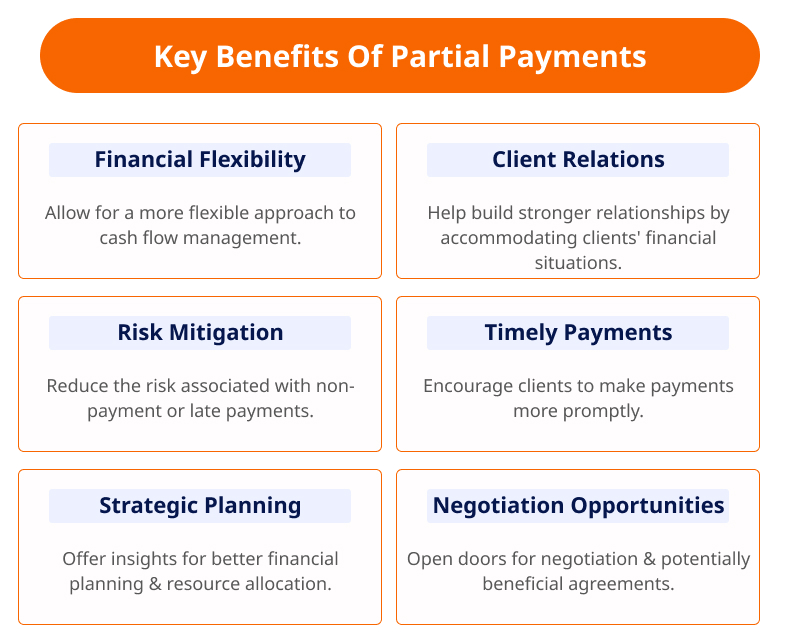

How Partial Payments Benefit Your Business?

Working with invoices means dealing with partial payments where clients pay a specific sum of money towards the total account balance. This kind of practice has become quite popular in business productions, and has its benefits as well as its drawbacks.

Partial payments, while seeming complex, offer unique advantages for businesses:

It is always helpful to know how to handle partial payment issues as a way of ensuring that business people do not face so many problems when dealing with their clients.

Now, let us expand a bit about partial payment challenges and the ways how to manage them.

Challenges In Managing Partial Payments

Incomplete Payments Affecting Revenue

Partial payments might seem like progress, but when they fall short of the total invoice amount, they pose a significant challenge.

They can create gaps in your expected revenue stream, impacting your ability to meet financial obligations, invest in growth, or even pay your bills.

Accounting Complexities And Reconciliation Issues

Think about what happens when you are working on a number of different accounts with partially paid invoices. Every partial payment contributes to confusion in your accounting systems and complicates efforts to determine what has been paid and what is outstanding.

This is time-consuming and requires a lot of energy to ensure the records are well ordered, and all the financial information is correct. This complexity can also lead to errors, affecting financial stability and decision-making.

Maintaining Client Relationships While Handling Partial Payments

Managing partial payments flexibly is somewhat of a challenge as they can affect your relationship with your clients. While clients making partial payments might have valid reasons, it can still cause friction.

Bridging the gap between timely collections and good image is always hard. Several problems may occur due to misunderstandings concerning partial payments: the relations may deteriorate, which will affect future cooperation or recommendations.

Allowing partial payment is not all about money; it concerns relationships and maintaining accounting records.

These challenges showcase the need for effective strategies and tools to navigate this terrain smoothly.

Manage Partial Payments With Invoicera

Managing partial payments can be easy if certain tools and mechanisms have been employed.

Partially paid invoices present a unique set of challenges that are well addressed through the features provided by Invoicera, an invoicing software solution.

Features

Invoicera stands out as a solution due to its tailored features that streamline the handling of partial payments:

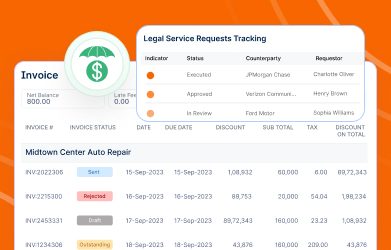

- Customizable Invoice Templates: Invoicera lets you create professional and detailed invoices. With personalized templates, you can include specific terms and conditions for partial payments.

- Partial Payment Tracking: With Invoicera, you can record all partial payments. This helps you keep track of your business’s outstanding revenue.

- Automated Payment Reminders: You can automate sending follow-up reminders to clients with partial unpaid balances.

- 14+ Payment Options: Businesses can set up flexible payment plans for clients, to easepayments.

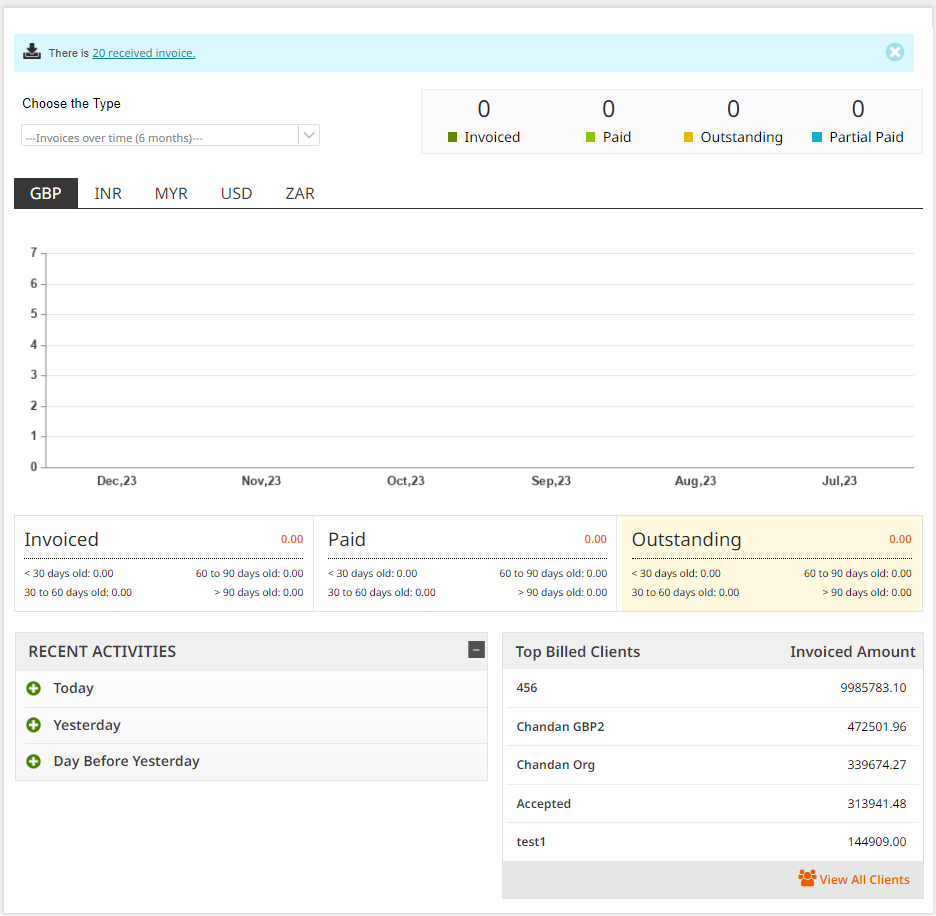

- Real-Time Payment Status Updates: With Invoicera, you can retrieve payment details in real time and mange your finances in a better way.

- Integrated Reporting And Analytics: You can access detailed reports and analytics on partial payments, helping businesses analyze trends and make informed financial decisions.

Benefits

The benefits of using Invoicera for managing partial payments are multifold:

- Efficiency: Simplify the partial payment process so as to minimize the time and effort expended on such processes.

- Improved Cash Flow: Handle partial payments more effectively while tracking and reconciling them with improved cash flow management.

- Enhanced Client Relationships: In a situation where a client is unable to offer the set amount of payment, flexibility and transparency in payment options should be encouraged to maintain a positive client relationship.

- Financial Insights: This helps you make more strategic decisions about payments and payment patterns.

Through these benefits, Invoicera makes it easier for businesses to accept partial payments, leading to more efficiency and improved relations with clients.

How To Enable Partial Payments With Invoicera?

Step-By-StepGuide

Let’s delve into a step-by-step guide on enabling partial payments using Invoicera:

Step 1: Access Your Invoicera Account

- Log in to your Invoicera account using your credentials.

- Once logged in, you will be directed to the dashboard to access various functionalities.

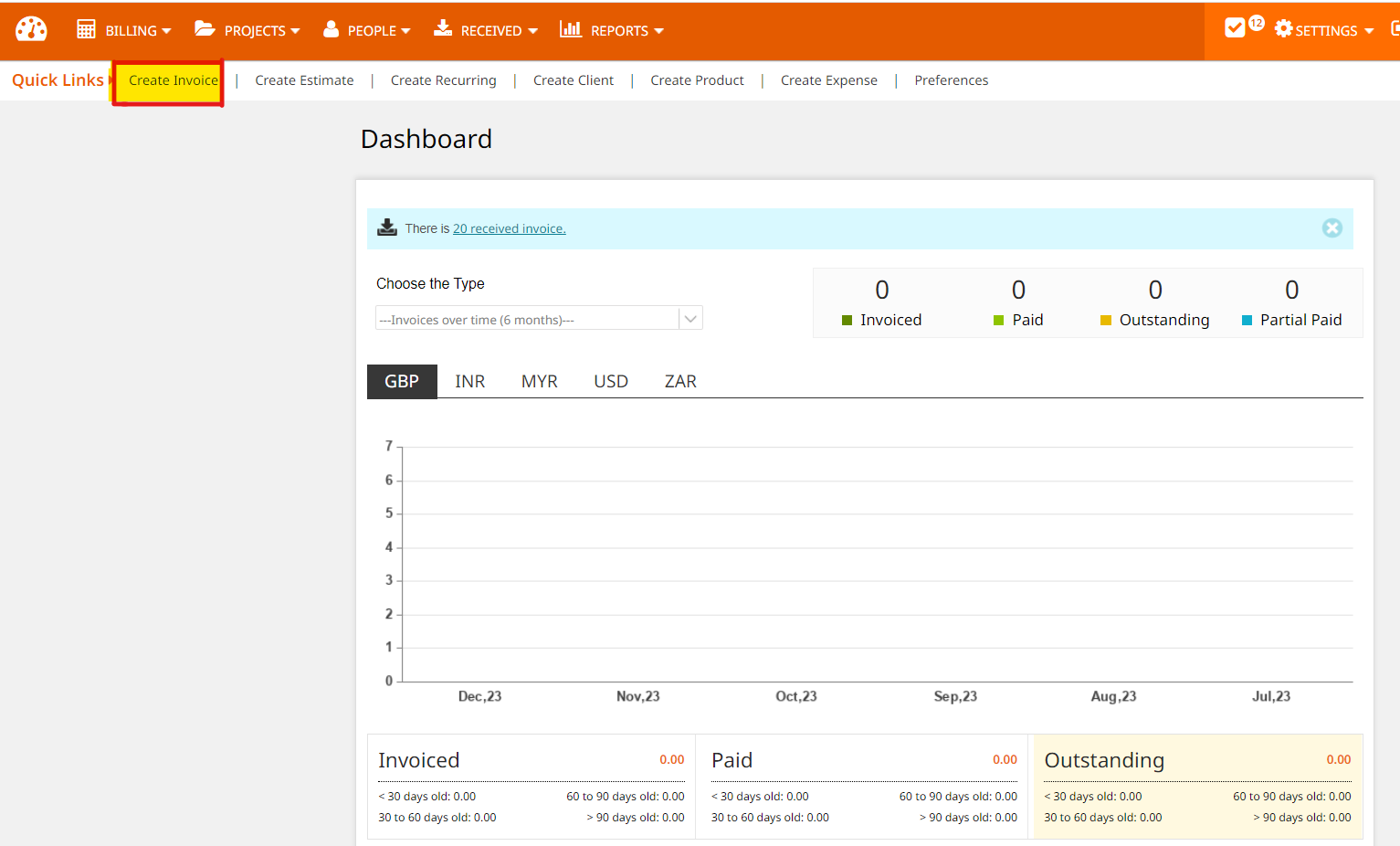

Step 2: Create An Invoice

- Click on the “Create Invoice” or similar option on your dashboard.

- Fill in the necessary details – client information, invoice items, costs, due dates, etc.

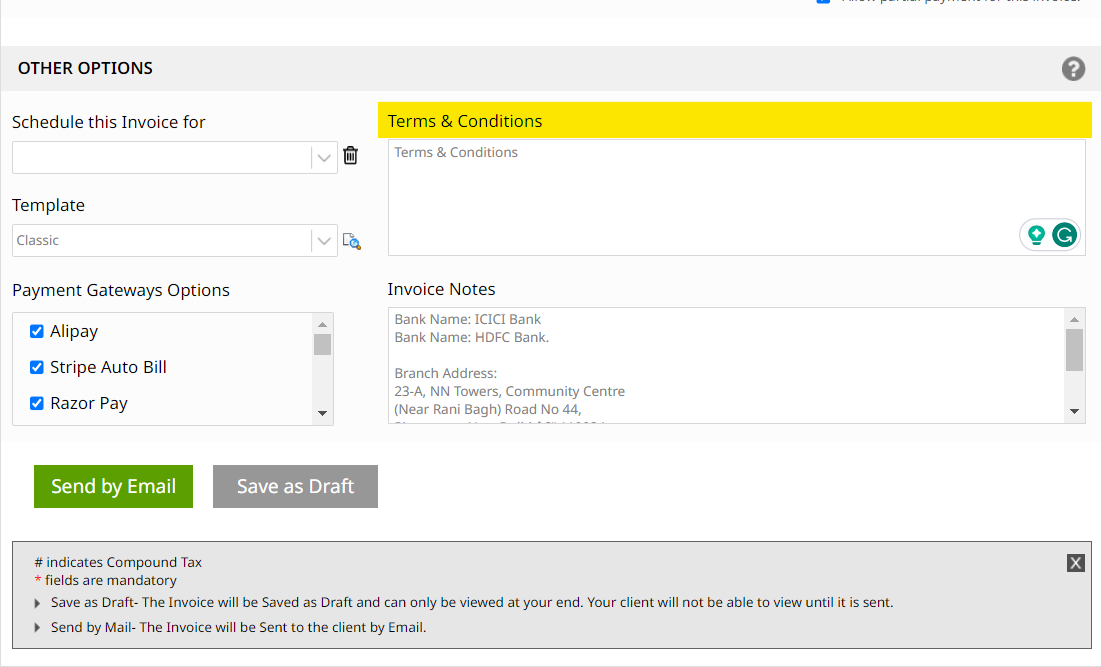

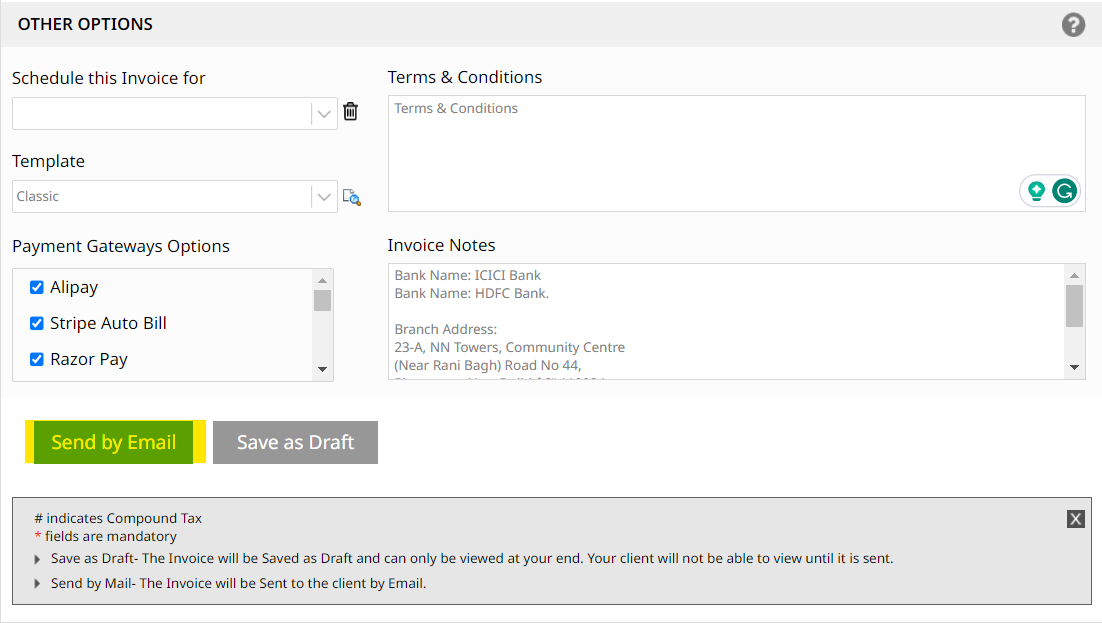

Step 3: Specify Partial Payment Terms

- Locate the section for payment terms or options at the bottom.

- Choose the option that allows partial payments. This might be labeled as “Enable Partial Payments” or something similar.

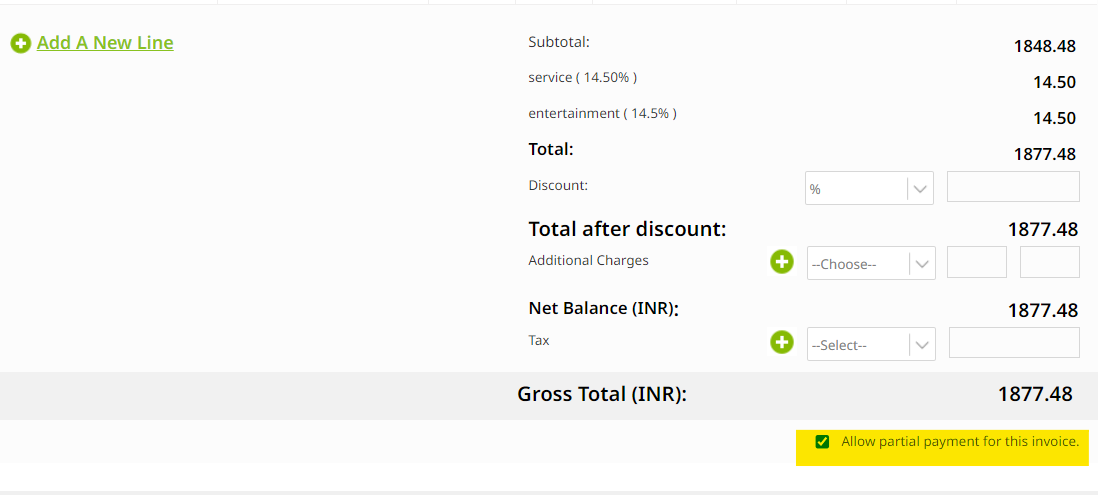

Step 4: Set Partial Payment Parameters

- Define the terms for partial payments. Specify the percentage or amount that can be paid initially and the remaining balance.

- Invoicera usually offers flexibility in defining the number of installments or partial payments allowed.

Step 5: Notify Your Client

- Once the invoice with partial payment terms is created, send it to your client.

- Communicate clearly about the partial payment option, outlining the payment schedule, amounts, and due dates for each installment.

Step 6: Monitor And Track Payments

- Keep a close eye on the payment status within your Invoicera dashboard.

- Track partial payments made by the client against the invoice and monitor the remaining balance.

Step 7: Automate Reminders And Notifications

- Use Invoicera’s automated reminder system to nudge clients about upcoming or overdue partial payments gently.

- Set up notifications to alert you when you receive partial payments, ensuring efficient tracking.

Step 8: Record Completed Payments

- As clients make partial payments, record each transaction accurately within Invoicera.

- Update the invoice status to reflect the remaining balance or mark it as fully paid once all installments are completed.

Step 9: Review And Adjust

- Regularly review your partial payment settings and strategies based on the invoicing and payment patterns.

- Adjust terms if needed to enhance efficiency and better suit your business needs.

Risks Associated With Partial Payments

Partial payments on invoices might seem like a relief at first, but they bring challenges that can impact your business in various ways.

1. Cash Flow Challenges

Since partial payments are made, this disrupts the constant inflow of money into the business. Incomplete payments can hinder your financial stability and growth. It may lead to inconveniences in terms of meeting expenses or funding expansion.

2. Impact On Financial Reporting And Forecasting

Lack of complete payment also distorts the balance sheet, income statement, and other statements in the event that they do not provide an accurate picture of the financial state of your business. This distortion could potentially skew the decisions made for future growth, investments, or even operations on a daily basis.

3. Increased Administrative Burden

Handling partial payments means additional administrative work. It involves tracking multiple payment amounts, reconciling them, and maintaining updated records. This administrative burden can be time-consuming and prone to errors.

4. Strained Client Relationships

Constant reminders for outstanding payments may strain your relationships with clients. It can create tension or discomfort, potentially harming the reputation you’ve built with them over time.

5. Legal Implications And Dispute Resolution

Partial payments might lead to disputes regarding the agreed-upon payment terms. Settling these disputes often requires a court process, which can take time and resources and may ultimately harm your business.

6. Difficulties In Budgeting And Planning

Irregular or unscheduled payments affect your forecasting. Budgeting for future expenditures, investments, or strategic development becomes difficult where payments are unpredictable or partial.

Handling these risks requires a proactive approach, clear client communication, and practical tools to streamline the partial payment process.

Solutions like Invoicera can mitigate these challenges, providing a structured system to manage and track partial payments, ultimately helping maintain a healthier financial ecosystem for your business.

How To Handle Partial Payments?

Managing partial payments on invoices can be a delicate balance for businesses. Here are some practical strategies to effectively handle these payments:

Clear Invoice Terms And Conditions

Setting clear and detailed terms on your invoice is one of the most basic procedures that one has to follow while dealing with partial payment. Be very specific when it comes to outlines of payment policies, areas of coverage, and consequences of delayed payment. It makes communication clear, and it establishes realistic expectations right on the bat.

Discounts/Perks For Prompt Partial Payments

Offering incentives like discounts for clients who make partial payments early or in more significant amounts can encourage timely payments. It’s a win-win situation: clients save money, and you receive more substantial payments sooner.

Communication And Negotiation For Payment Plans

Encourage open communication with clients regarding their financial situations. If they’re unable to make full payments, discuss feasible payment plans. Flexibility and understanding can go a long way in securing consistent partial payments.

Regular Payment Status Updates To Clients

The notification to the clients in regard to outstanding dues and updates on the payment status make the process more transparent. Such messages should be regular in form, either through emails or statements, so that they can act as reminders and minimize instances of misunderstandings.

Late Payment Penalties Or Interest

Including penalties or charging interest for late payments can motivate clients to adhere to the agreed-upon payment terms. However, it’s essential to apply these penalties consistently and fairly.

Using Automated Reminder Systems

Automated reminder systems can significantly ease the burden of manually tracking and following up on payments. Set up reminders through accounting software or specialized tools to send gentle nudges to clients for pending payments.

By incorporating these strategies into your invoicing practices, you can navigate the complexities of partial payments more effectively, fostering better relationships with clients while ensuring a healthier cash flow for your business.

Conclusion

Effectively managing partial payments on invoices is essential for sustaining a healthy business.

It involves more than just receiving money:

- It’s about ensuring consistent cash flow

- And nurturing strong client relationships

You can tackle partial payment challenges through clear communication, structured approaches, and the right tools.

Invoicera serves as a powerful solution for handling partial payments. Its user-friendly features streamline invoicing processes, making tracking payments, sending reminders, and maintaining accurate records easier.

By implementing best practices and leveraging tools like Invoicera, businesses can navigate the complexities of partial payments more efficiently, leading to improved financial stability and client satisfaction.

Handling partial payments may present hurdles, but with proactive strategies and tools like Invoicera, businesses can turn this aspect of financial management into a well-managed, seamless process that benefits both parties involved.

FAQs

Are there tax implications associated with managing partial payments?

Partial payments can affect tax filings and reporting, mainly if discrepancies exist between invoiced amounts and received payments. Consulting a tax professional is advisable.

How secure is the payment handling within Invoicera?

Invoicera prioritizes security and employs encryption and secure payment options to make sure the safety of financial transactions and sensitive client data.

Can I generate reports specifically for tracking partial payments and outstanding balances?

Yes, Invoicera offers detailed reporting functionalities, including specific reports for tracking partial payments and monitoring outstanding balances.