Introduction

Are you having a hard time creating professional invoices?

You’re not alone.

According to the survey, more than 60% of small business owners consider it a time-consuming and irritating task to issue invoices.

Worry no more! Online invoice generators have made it possible for businesses to manage billing in different ways. With just a few clicks, you can now make professional-looking and clean invoices with no need for design skills.

However, the next question is how do you choose the right online invoice generator from the broad array of offers? That’s where our elaborate guide is perfectly placed. We’ve put in the hard work for you, testing and comparing the best invoice generators available.

Here is your chance to get your invoicing streamlined, save time, and get paid faster. Our user-friendly guide will help you to make a thoughtful choice and to find the right online invoice generator for your business.

What Is An Invoice Generator?

An invoice generator is a tool that helps you create professional invoices quickly and easily. It’s like having a personal assistant who takes care of the formatting, calculations, and design for you.

With just a few clicks, you can input your business details, services rendered, and payment terms. The generator then converts this information into a polished invoice, ready to be sent to your clients. It’s a hassle-free way to save time and ensure your invoices look consistent and professional.

How It Simplifies The Invoicing Process?

An invoicing generator takes care of the whole invoicing process for you through its efficiency. Here’s how it helps:

- Effortless Creation: The invoicing generator will enable you to generate professional invoices in a matter of minutes. No more problems of format or calculations. It covers it all by itself.

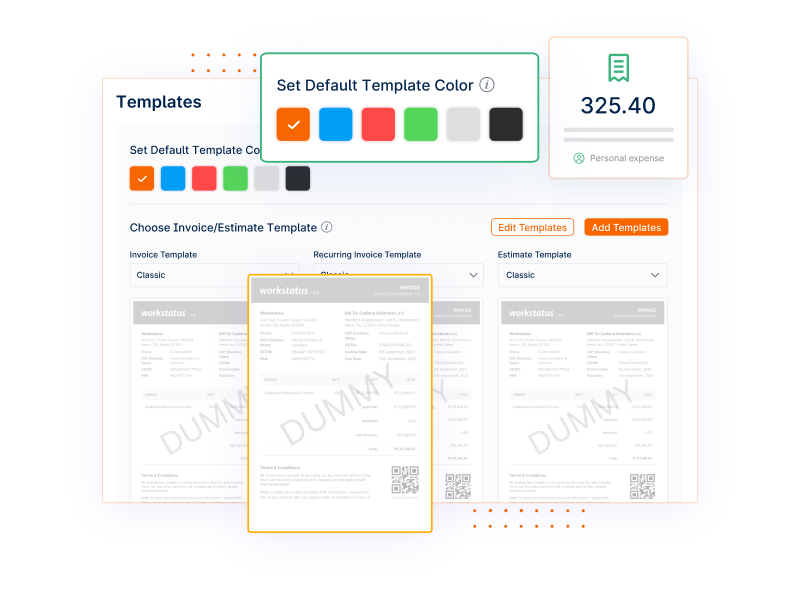

- Templates for Efficiency: You will be able to use professional templates that can easily be adapted to suit your brand. It enables to save your time and also gives uniformity to the invoices.

- Accuracy in Numbers: Farewell to math by hand. The generator automatically adds totals, taxes and discounts automatically invalidating errors on your invoices, thus ensuring accuracy.

- Organized Records: Monitor all your invoices in one central location. The generator facilitates you to have well kept records making tracking the payments and following up on unpaid invoices much easier.

- Faster Payments: Properly designed, timely invoices would contribute to prompt payments from your customers. The generator simplifies the procedure as you can get money sooner.

Key Features To Look For In An Invoice Generator

You must choose an invoice generator with features that make the invoice process fast. Below are some of them to consider:

- User-Friendly Interface: Make sure the invoice generator is so easy to generate invoices without wasting time and energy.

- Customization Options: Choose software that provides you an option to incorporate your brand logo, colors, and other elements to give them a professional look.

- Automatic Calculation: A good invoice generator will autonomously calculate totals, taxes, and discounts for you, which will bar time consumption and eliminate errors.

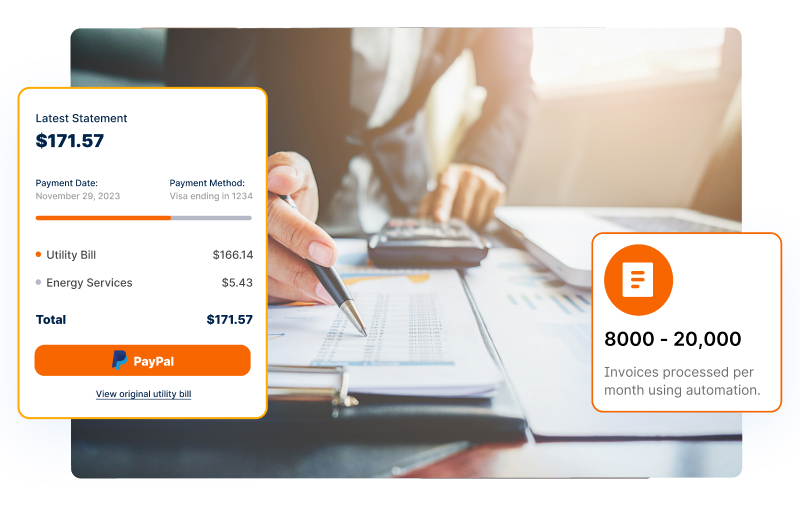

- Multiple Payment Options: Choose a tool that supports a wide range of payment means, including credit card payments, PayPal, and bank transfers, in order to make it a plain process for your clients to pay you.

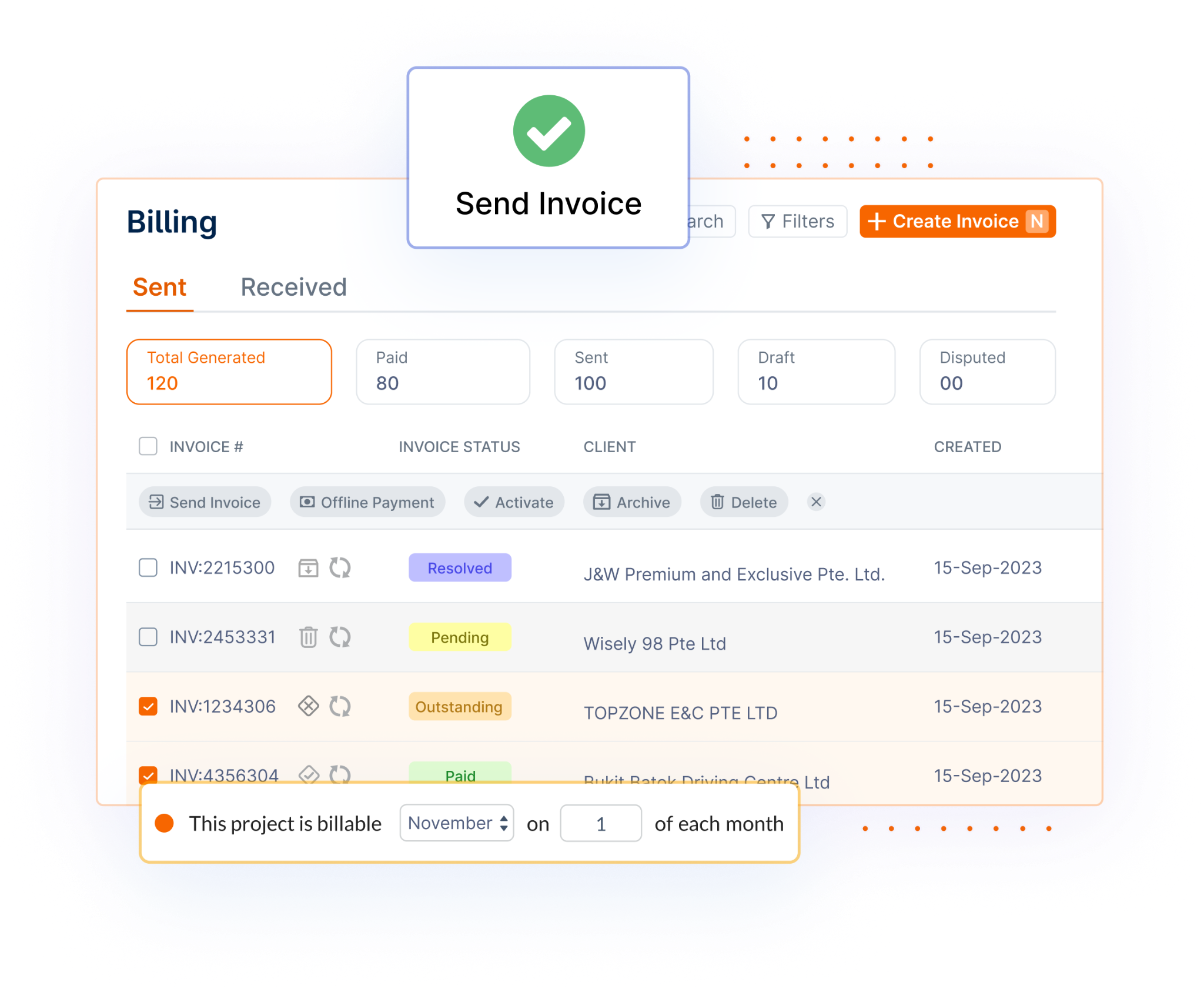

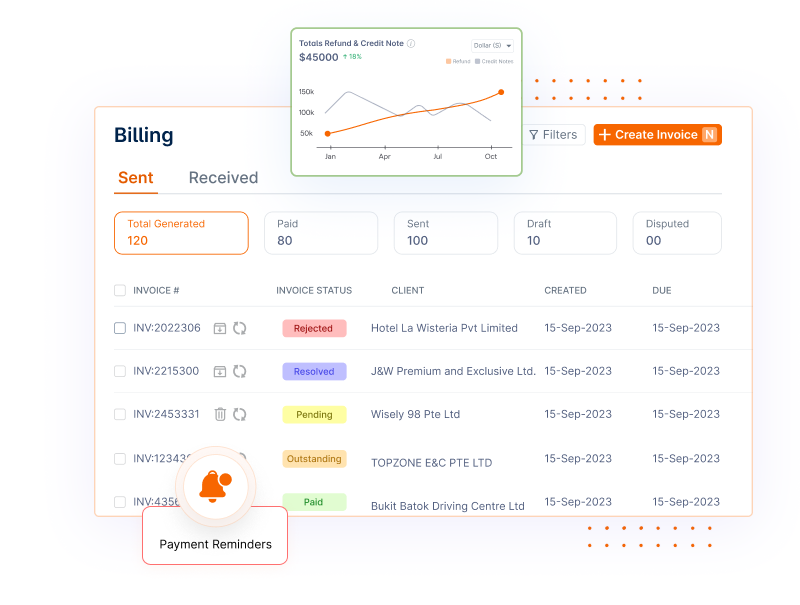

- Invoice Tracking: Make sure the software has the tools to monitor the status of your invoices, tracking when they are sent out, viewed, and also when paid.

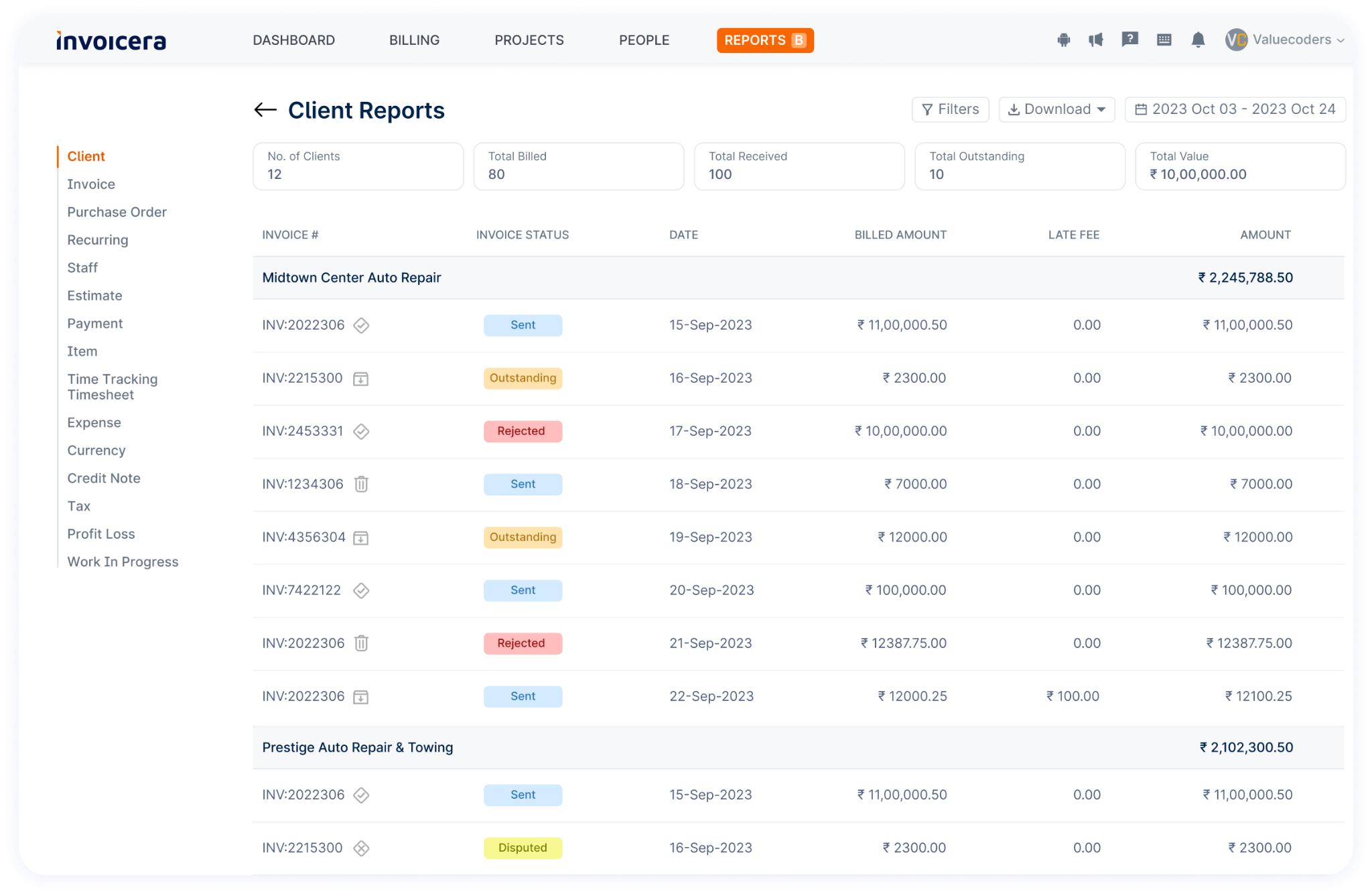

- Reporting and Analytics: Take note of in-built reporting and analytics tools, which support you with overseeing your incoming and going funds, tracking the debts as well as analyzing the business performance.

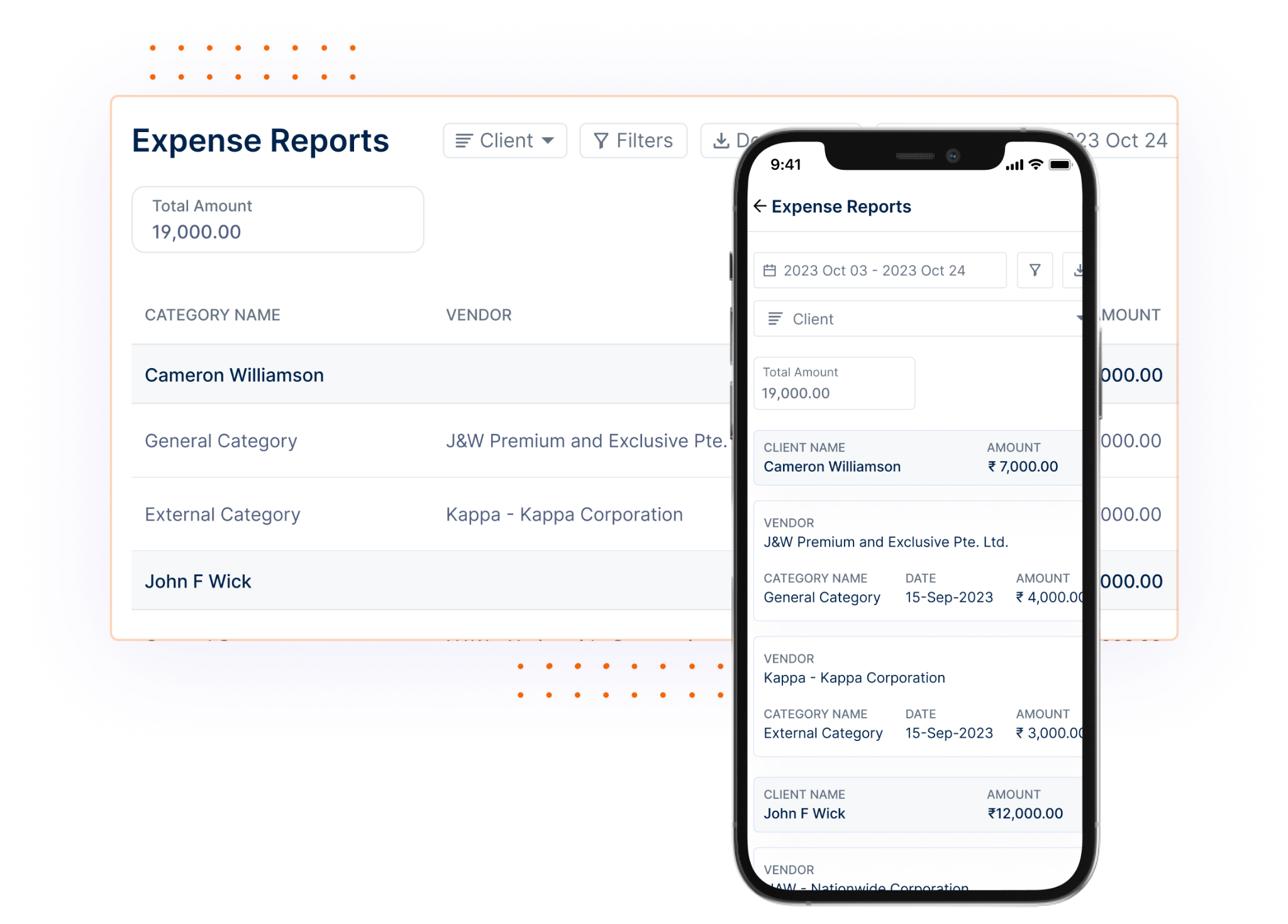

- Mobile Compatibility: Go for the invoice generator that would work both on the desktop and mobile platforms. It is very convenient to manage the invoices on the go.

10 Best Online Invoice Generators

1. Invoicera

Overview

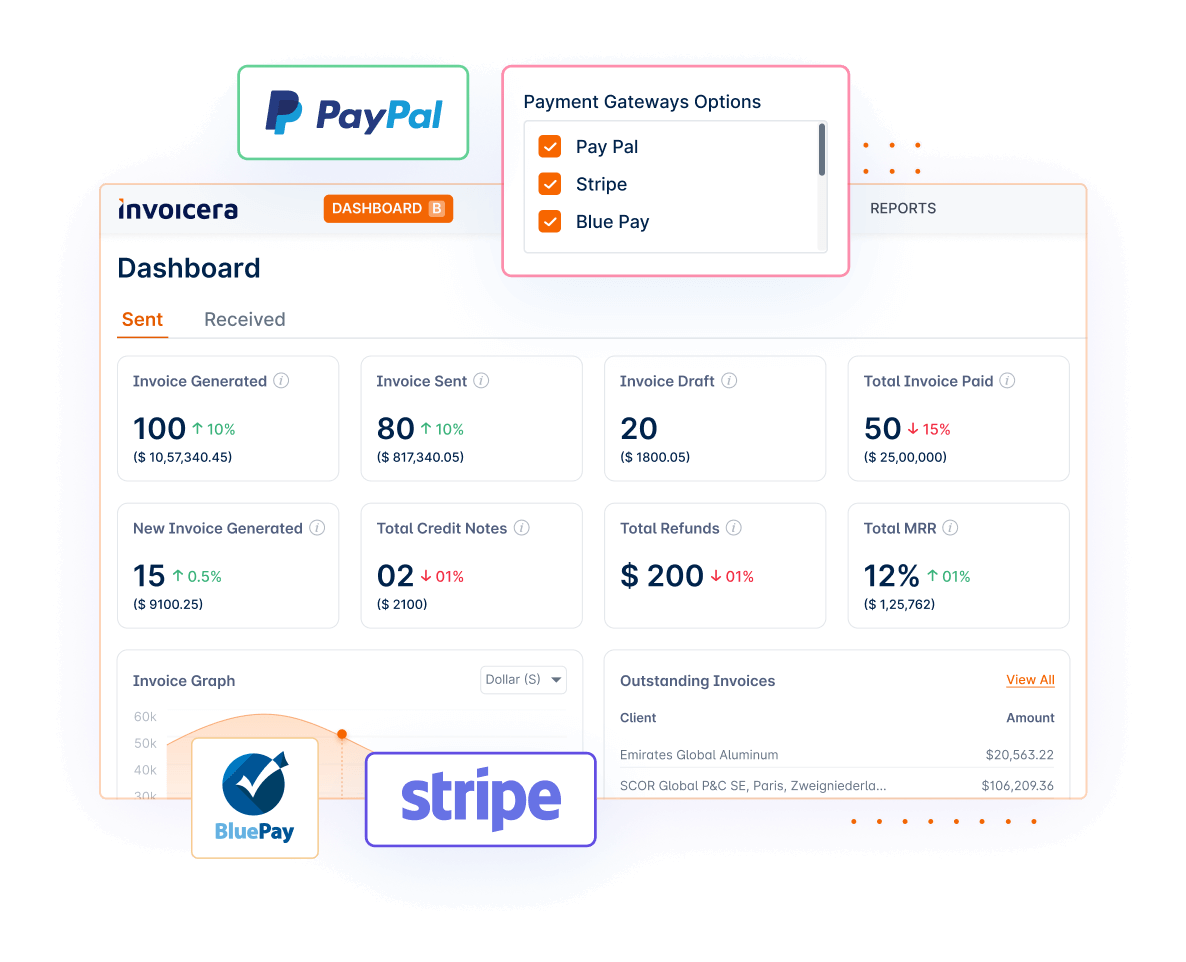

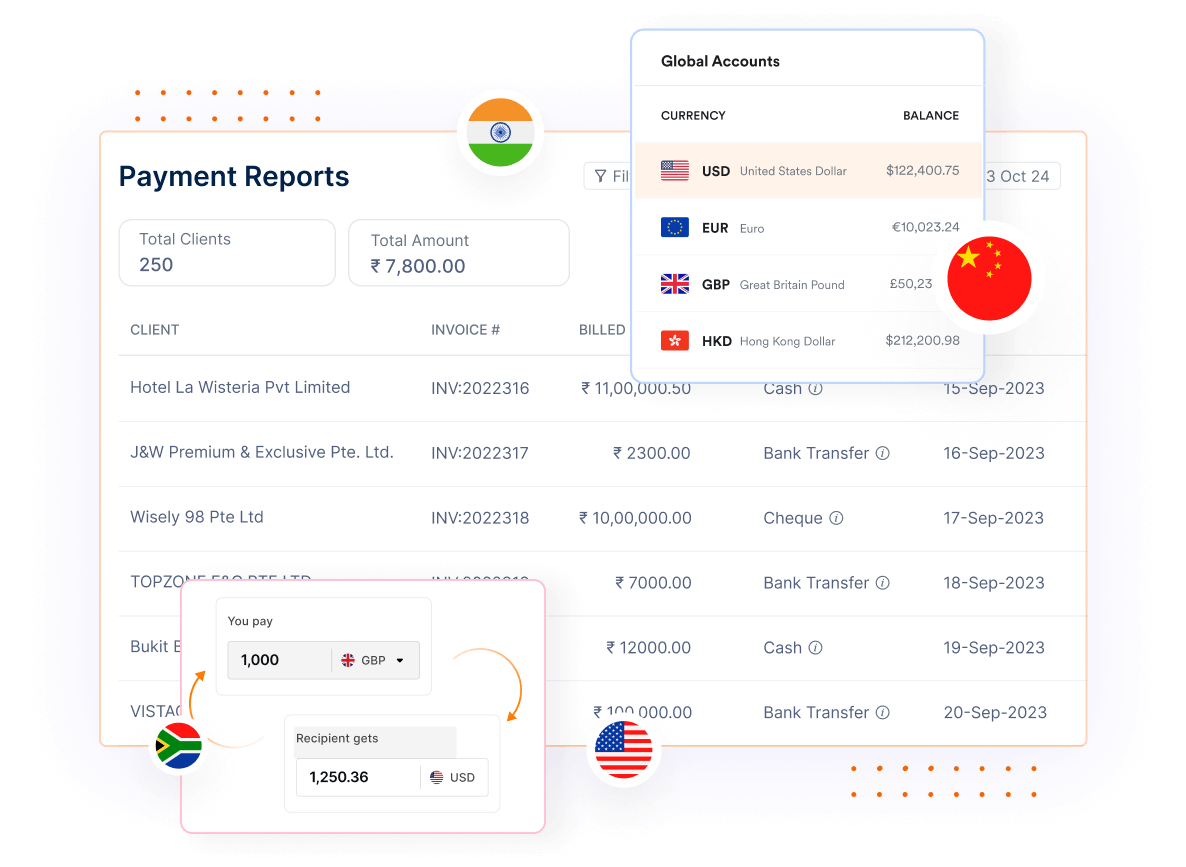

Invoicera is a popular online invoicing and billing software solution used by freelancers, small businesses, and even large enterprises. It is a user-friendly platform to create professional invoices, manage finances, and get paid faster. While it goes beyond invoice generation, its core features make it a strong contender for Best Online Invoice Generator.

Key Features

- Automated Invoicing: You can generate and send your invoices quickly, within less than one or two minutes. Furthermore Invoicera has special features of recurring invoices to be sent to the retainer clients.

- Custom Templates: Using Invoicera, you create your own personal branded templates that are retrievable for later invoices, and you can also add your brand elements. This includes your logo, colors, and more.

- Automated Payment Reminders: Send customers automated email reminders when invoices are due to gain prompt payments.

- 14+ Payment Gateways: Provide your clients with a pool of payment solutions, i.e. through collaborations with well-respected payment gateways.

- Global Invoicing: Generate invoices in more than a hundred and twenty currencies and fourteen languages that will be able to cater to an international clientele.

- Integration with Accounting Software: Link Invoicera with your accounting software so that data flow will be in continuous flow.

- Real-time Invoice Tracking: Always track your invoice status in real time, see when the invoices are viewed, and get alerted when payments are received.

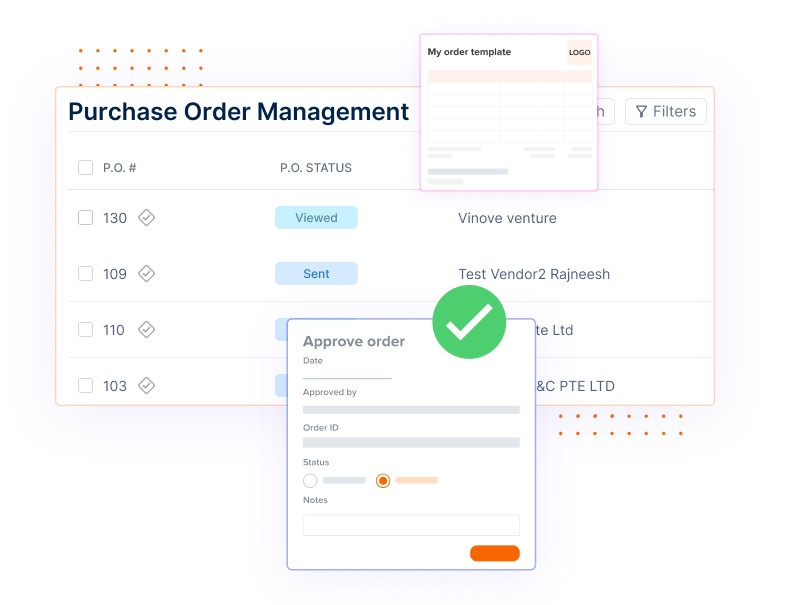

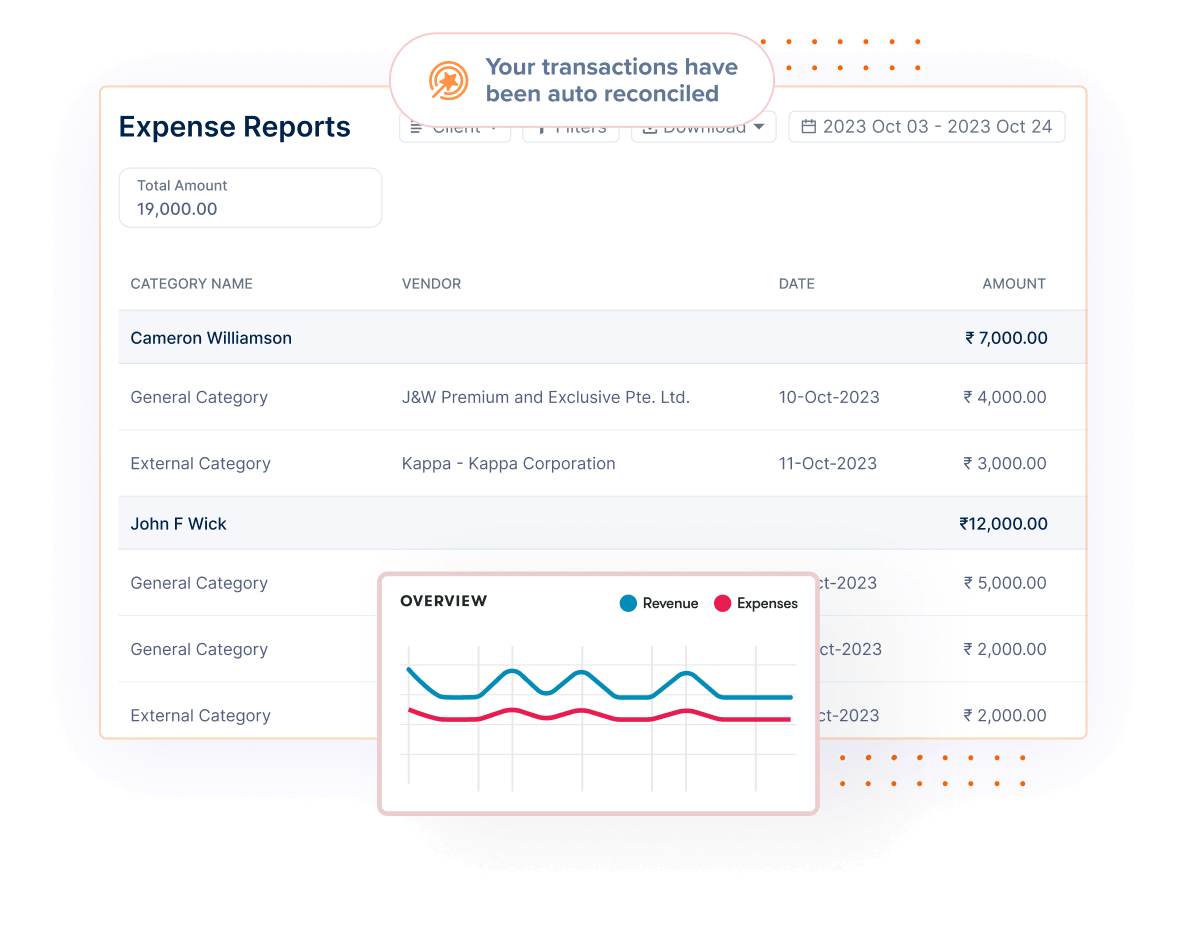

Beyond Invoicing: Additional Features in Invoicera

While Invoicera shines in invoice generation, it offers a comprehensive suite of features to manage your entire financial workflow:

- Expense Reports: Simplify the tracking of expenses by taking receipts in and creating reports for easy expense management.

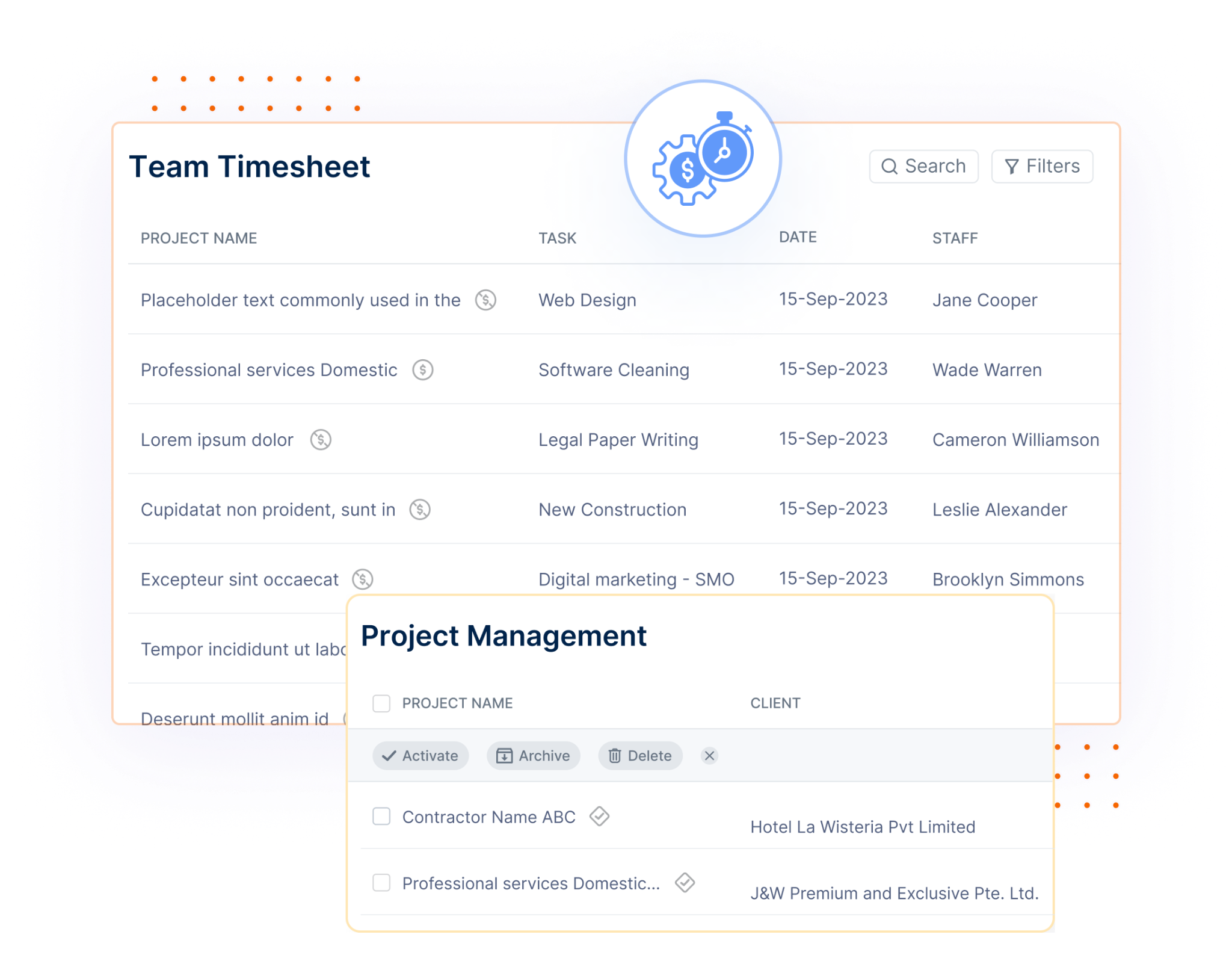

- Project Time Tracking: Track project billable hours and include them in invoices automatically because accurate billing requires it.

- Create Quotes and Purchase Orders: Produce attractive professional quotes to prospective clients and take orders from vendors.

- Vendor and Expense Management: Organize vendor details, monitor expenses, and apply some automation of the payment process for vendors.

- Client Portal: Offer a protected self-service portal to clients where they can check invoices, make payments, and track project progress should be a priority.

Pricing:

- The ‘Infinite’ plan offers everything unlimited at $149/month.

- The most popular ‘Enterprise’ plan costs $79/month.

- Small and medium-sized businesses can choose a ‘Business’ plan at $49/month.

- The ‘Starter’ plan is for startups or very small businesses at $19/month.

Invoicera also offers custom pricing for larger businesses and enterprises tailored to their specific requirements and transaction volumes.

Capterra:

4.7

| Pros | Cons |

| Easy for beginners and seasoned users | Unlimited features in only the premium plan |

| Detailed financial insights | Too many features are overwhelming |

| Mobile Accessibility |

2. Invoice Ninja

Overview

Invoice Ninja is a multipurpose open-source invoicing solution with plenty of options to ease your billing procedures. While free for low-volume invoicing under 20 clients, it offers affordable paid plans for scaling needs. One of their strong points is multi-currency support across more than 100 currencies, which makes it suitable for international invoicing.

Beyond basic invoicing, it provides project/task management, recurring/batch invoicing, estimate-to-invoice conversion, and integrations with payment gateways. Automated workflows, banking sync, vendor/expense management, and payment reminders further enhance efficiency.

Overall, Invoice Ninja is a comprehensive solution catering to small businesses seeking an intuitive invoicing experience with robust capabilities.

| Pros | Cons |

| Free plan for small businesses | Limited to 20 clients on the free plan |

| Multi-currency support for international invoicing | Advanced features require a paid upgrade |

| Project/task management and automation features | May require technical expertise for open-source customization |

3. Zoho Invoice

Overview

Zoho Invoice is a cloud-based invoicing app for small enterprises. It is very powerful but also very easy to use. As a standout feature, it’s completely free for basic invoicing needs, eliminating heavy costs. The other important features are project billing, time tracking, expense management, and online payment processing through integrated gateways.

Users can seamlessly create estimates, convert them to invoices, and send payment reminders. The user-friendly interface makes invoice creation, customer coordination, and item tracking easy.

Zoho Invoice shines with multilingual support across 17 languages and an interactive client portal for transparent collaboration. Comprehensive reporting spanning over 30 formats offers real-time financial insights.

Overall, Zoho Invoice emerges as a compelling all-in-one invoicing solution packed with premium features at no cost.

Key Features

| Pros | Cons |

| Project billing and time tracking | Limited features compared to paid alternatives |

| Online payment integration | No advanced customization options |

| Multilingual support (17 languages) | Potential limitations for scaling businesses |

4. Square Invoice

Overview

Square Invoices is another invoicing solution with advanced customization and automation capabilities. It offers unlimited invoice, estimate, and contract creation and easily converts estimates to invoices. Users can fully design invoices, add custom fields, and set up milestone-based payment schedules.

Square Invoices has plenty of payment acceptance options, including digital wallets, credit cards, bank transfers, and buy-now-pay-later services. Additional features allow refund processing, tip collection, and tax/discount application.

While a free plan is available, the paid Plus plan at $20/month unlocks the full suite of advanced functionalities.

Key Features

| Pros | Cons |

| Unlimited invoicing and estimates | Advanced features require paid Plus plan |

| Full customization of invoices and fields | May be overkill for very small businesses |

| Automation for recurring/batch invoices | Limited integration with other business tools |

5. Wave

Overview

Wave Accounting emerges as a compelling free accounting and invoicing solution tailored for small businesses seeking cost-effective money management tools. Serving over 2 million users, it offers robust double-entry accounting with unlimited expense and income tracking, user access, and reporting capabilities.

Beyond core accounting, Wave shines with its integrated invoice generation, allowing for unlimited, customizable invoices and automated payment reminders. It streamlines payment acceptance via major credit cards, bank transfers, and digital wallets like Apple Pay.

Additionally, Wave supports recurring billing, mobile receipt capture, and seamless sync across accounts and transactions. For businesses requiring comprehensive services, Wave offers payroll and tax filing in select states.

While its core accounting and invoicing services are free, transaction fees apply for payment processing.

Key Features

| Pros | Cons |

| Completely free accounting and invoicing | Transaction fees for payment processing |

| Unlimited users, transactions, and invoice customization | Limited availability of payroll/tax services in some states |

| Integrated payment processing and recurring billing | May lack advanced features for larger businesses |

| Mobile receipt capture and accounting sync | |

| Payroll and tax filing services available |

6. ZipBooks

Overview

ZipBooks emerges as a comprehensive accounting and invoicing solution tailored for small businesses, offering robust features like billing, expense management, time tracking, and business intelligence reporting. While primarily designed for US-based companies with capabilities like 1099 tracking and domestic bank connections, ZipBooks has a global presence.

Its standout strengths include affordable pricing plans, user-friendly invoicing with professional templates, and double-entry accounting support. The platform shines for service providers with its dedicated time-tracking functionality for project-based billing.

Additionally, ZipBooks provides insightful financial reports spanning income statements, balance sheets, tax summaries, and more.

Optional add-ons like payroll integrations and bookkeeping services further enhance its capabilities. While inventory management is currently lacking, ZipBooks positions itself as a well-rounded solution for small business financial management, particularly excelling in invoicing, accounting, and time-tracking requirements.

Key Features

| Pros | Cons |

| Affordable pricing for small businesses | Limited inventory management features |

| Professional invoicing and double-entry accounting | Restricted bank connections outside the US/Canada |

| Project time tracking for service providers | Customer support limited to specific business hours |

| Comprehensive financial and business intelligence reporting | Free plan allows only one bank account connection |

| Add-on services like payroll bookkeeping |

7. Freshbooks

Overview

FreshBooks stands out as the premier cloud accounting software tailored for small businesses, offering a robust suite of features that streamline invoicing, time tracking, payment processing, and payroll management. Its intuitive interface simplifies invoicing with recurring billing, online payments, and customizable layouts.

The dynamic time tracking capability enables accurate project billing, while integrated payment gateways like PayPal eliminate manual setup hassles. FreshBooks shines with its payroll synchronization, allowing employees to log hours via mobile apps for seamless expense calculation.

With over 5 million users embracing paperless billing, FreshBooks caters to businesses seeking a user-friendly accounting solution.

While pricing starts at $19 per month, the comprehensive feature set positions FreshBooks as a compelling investment for small businesses seeking efficient financial management and client billing processes.

Key Features

| Pros | Cons |

| Intuitive interface tailored for small businesses | Paid plans starting at $19/month |

| Seamless invoicing with recurring billing and online payments | Limited customization options compared to open-source alternatives |

| Robust time tracking for accurate project billing | May lack advanced features for larger enterprises |

| Integrated payment gateways like PayPal | |

| Mobile apps for employee time logging and payroll sync |

8. Zapier

Overview

Zapier emerges as a game-changing automation tool, empowering businesses of all sizes to streamline workflows and boost efficiency. Since 2011, Zapier has revolutionized the way tasks are automated, offering seamless integration across over 5,000 apps spanning marketing, CRM, e-commerce, and more.

Its core functionality revolves around “Zaps” – automated processes triggered by specific events like new emails, form submissions, or calendar events. Zapier shines with its multi-step Zap capability, allowing users to chain multiple actions in a sequence, extracting data from one app, manipulating it, and sending it to another.

Additionally, Zapier fosters team collaboration, enabling shared access and real-time brainstorming for problem-solving.

With its vast app integration, trigger/action customization, and collaborative features, Zapier positions itself as an indispensable automation powerhouse, helping businesses stay competitive in today’s demanding market.

Key Features

| Pros | Cons |

| Integrates with over 5,000 apps across domains | Potential learning curve for complex automation setups |

| Automates multi-step workflows with customizable triggers/actions | Limited free plans, and paid plans can get expensive |

| Enables team collaboration and real-time problem-solving | Reliance on third-party app stability and updates |

9. Invoice Owl

Overview

InvoiceOwl emerges as a specialized invoicing and estimating solution tailored for contractors across various trades, including construction, plumbing, HVAC, landscaping, and more. Its core strength lies in simplifying the creation of professional estimates, invoices, credit memos, and purchase orders with just a few clicks.

This user-friendly software empowers contractors to impress clients with polished estimates while generating invoices swiftly from computers or mobile devices. InvoiceOwl further streamlines operations by enabling digital contract signing and testimonial collection from completed jobs, fostering client acquisition.

Additionally, it allows for transparent itemization of labor and material costs, enhancing client trust. Overall, InvoiceOwl positions itself as an efficient invoicing and job management companion tailored to the unique needs of contractors and tradespeople, saving time and effort while maintaining a professional image.

Key Features

| Pros | Cons |

| Specialized for contractors across various trades | Focused primarily on the contracting industry, limited broader applicability |

| Efficient creation of estimates, invoices, and job documentation | May lack advanced accounting/financial management features |

| Mobile invoicing capabilities for on-the-go billing | Limited information on pricing and scalability options |

| Digital contract signing and testimonial collection | |

| Itemized breakdown of labor and material costs |

10. Refrens

Overview

Refrens stands out as a comprehensive business operating system, offering an all-encompassing suite of tools for accounting, CRM, inventory management, and more.

At its core, Refrens streamlines invoicing processes with robust features like recurring billing, customizable invoice templates, online payments, and partial payment tracking.

Its accounting capabilities extend to expense management, general ledger, accounts payable/receivable, and multi-currency support. Additionally, Refrens empowers businesses with lead management, customer databases, and eCommerce integrations for seamless sales operations. Project management, vendor management, and purchase order functionalities further enhance operational efficiency.

With role-based access control and customizable branding, Refrens caters to businesses of all sizes, providing a centralized platform for financial management, client relationships, and process optimization.

While packed with extensive features, Refrens’ user-friendly interface ensures a hassle-free experience.

Key Features

| Pros | Cons |

| Comprehensive invoicing with recurring billing, online payments | Potential learning curve with an extensive feature set |

| Robust accounting with expense tracking, multi-currency support | Limited information on pricing and scalability options |

| CRM, lead management, and eCommerce integration | May have redundant features for businesses with specific needs |

| Customizable branding and role-based access control |

Considerations When Choosing an Invoice Generator

Choosing the right invoice generator can make a world of difference for your business.

Here are some key questions to ask yourself before you pick one:

- Ease of Use: Is it simple and quick to create invoices? Complexity can waste valuable time.

- Features: Does it offer everything you need, like online payments, expense tracking, or inventory management?

- Customization: Can you personalize invoices with your branding and include important details?

- Security: How secure is your data? Look for strong encryption and data protection features.

- Pricing: Fits your budget! Free options exist, but paid plans often offer more features.

- Integrations: Does it connect with your existing accounting software or other tools you use?

- Customer Support: Will you have access to help if you run into problems?

Conclusion

This comprehensive guide explored the world of online invoice generators, highlighting their advantages and equipping you to make an informed choice for your business.

Recap:

- We saw how invoice generators automate tasks, eliminate errors, and project a professional image, ultimately saving you time and money.

- We delved into key features to consider, like user-friendliness, customization options, payment integrations, and robust security measures.

- We explored a variety of popular invoice generators, showcasing their strengths and potential drawbacks to help you find the perfect fit.

By now, you’re well-equipped to select an invoice generator that streamlines your invoicing process, improves cash flow, and empowers you to get paid faster. Don’t hesitate to revisit this guide as you navigate your options and refine your decision.

FAQs

Who can benefit from an online invoice generator?

Freelancers, small businesses, and even large enterprises can benefit from using online invoice generators.

How much does an online invoice generator cost?

There are free and paid online invoice generators. Free options typically have fewer features, while paid options offer more features and customization options. Invoicera offers a 7-day free trial to have a look at all the premium features.

How do I get started with an online invoice generator?

Most online invoice generators are easy to use and offer free trials. You can typically sign up for a free account and explore the features before committing to a paid plan.