Record Keeping Requirements for New Businesses in Singapore

For new businesses in Singapore, proper record-keeping is not just a good practice—it’s a legal requirement. Maintaining accurate and organised records is crucial to ensure compliance with tax obligations, manage finances effectively, and provide transparency in your company’s financial affairs.

In this guide, we’ll delve into the record-keeping requirements for newly registered companies in Singapore, covering what records must be kept, how to maintain them, the duration of record retention, and the consequences of non-compliance.

What Records Must Be Kept?

To meet regulatory requirements in Singapore, your company must maintain comprehensive records of its financial transactions. These records encompass:

- Source Documents: These include receipts, invoices, vouchers, bank statements, and any relevant documents issued to or received from customers.

- Accounting Ledgers, Schedules, and Journals: These documents detail your company’s assets and liabilities, income and expenses, as well as profits and losses.

- Any Other Written Evidence: This encompasses written evidence of transactions connected with your business operations.

It’s important to note that the specific records you must maintain can vary based on whether your company is GST-registered or non-GST registered. For instance, GST-registered businesses need to retain tax invoices issued for income purposes and records of goods disposal, while these are not required for non-GST registered companies.

Refer to this Record Keeping Checklist for a list of the different types of records required. GST-registered businesses may also refer to the types of records to keep to support their GST declarations.

How Should Company Records Be Kept in Singapore?

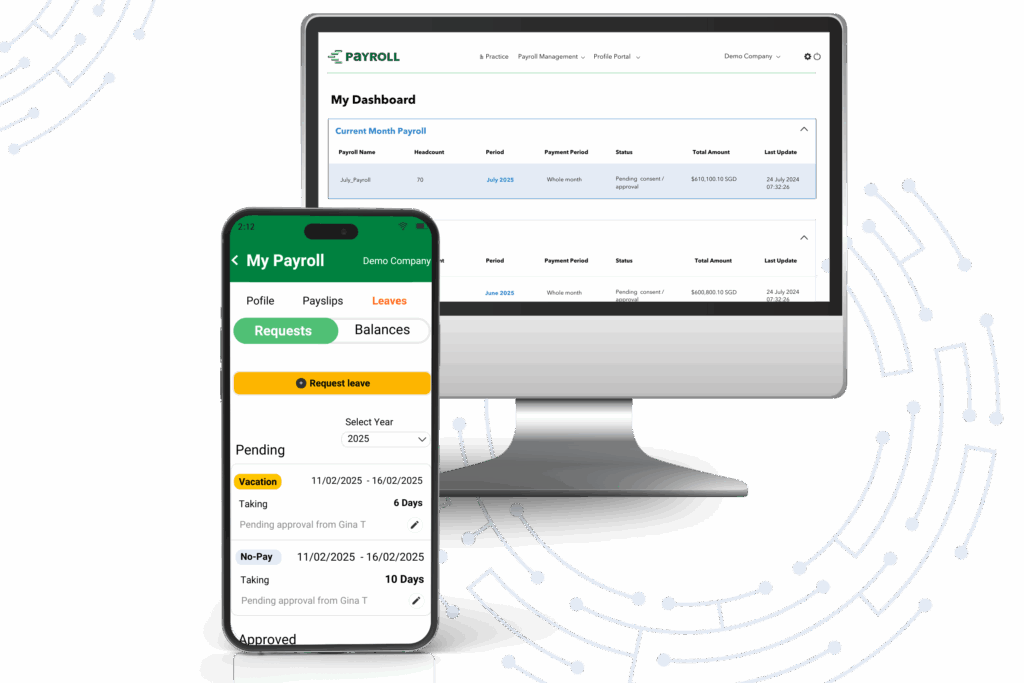

Company records in Singapore can be kept either manually or electronically, provided they are readily auditable. Here’s how you should maintain them:

- Manual Records: If your records are kept manually in a physical form, ensure they are legible and well-organized. Consider making photocopies of receipts printed on thermal paper to prevent fading over time.

- Electronic Records: When keeping electronic records, establish internal controls to ensure the integrity, completeness, and reliability of these records. This involves defining how records should be maintained, specifying filing and storage procedures within a database, and outlining guidelines for saving image captures. Security measures should also be in place to prevent unauthorised tampering.

The First Schedule of the Evidence (Computer Output) Regulations provides guidelines for storing imaged business records, which can be a useful reference.

It’s worth noting that when records are kept electronically, there’s no need to maintain physical copies of source documents for tax purposes.

How Long Should Company Records Be Kept For?

Singapore mandates that records be retained for a minimum of five years from the end of the financial year in which the relevant transactions occurred. For instance, if your business’s financial year concludes in December 2021 (covering January 1, 2021, to December 31, 2021), you should retain records until at least December 31, 2026. This applies even if your company has ceased operations.

Where Should Company Records Be Kept?

Your company’s records should be stored at its registered office or any other location deemed suitable by the company directors. These records must be accessible for inspection by the directors at all times.

Effects of Non-Compliance Failure to maintain proper records, including accounting and related documents, can have serious consequences

- Legal Consequences: Improperly kept records can result in fines of up to $5,000 or jail terms of up to 12 months for the company and relevant officers under the Companies Act.

- Tax Implications: Inadequate record-keeping can lead to income tax offences, with the Inland Revenue Authority of Singapore (IRAS) disallowing expense claims and capital allowances. Individuals found guilty of improper income tax-related record-keeping may face fines of up to $1,000 or jail terms of up to 6 months under the Income Tax Act.

Summary

Proper record-keeping is a fundamental aspect of running a business in Singapore. It not only ensures legal compliance but also facilitates better financial management. By adhering to the record-keeping requirements outlined in this guide, your newly incorporated company can maintain transparency, effectively manage finances, and avoid potential legal consequences.

Let the pro team at Counto help set up your business in Singapore quickly. Speak to us directly on our chatbot, email us at hello@counto.sg, or contact us using this form.

Here are some articles you might find helpful:

United States

United States Singapore

Singapore United Kingdom

United Kingdom