Types of financial statements

/What are the Types of Financial Statements?

Financial statements provide a picture of the performance, financial position, and cash flows of a business. These documents are used by the investment community, lenders, creditors, and management to evaluate an entity. There are four main types of financial statements, which are noted below.

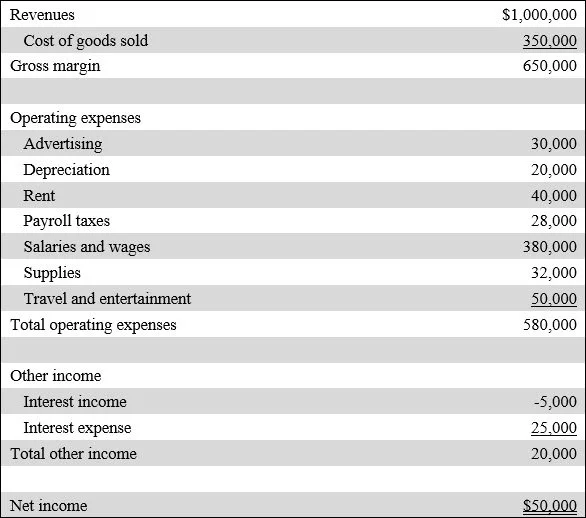

The Income Statement

The income statement reveals the financial performance of an organization for the entire reporting period. It begins with sales, and then subtracts out all expenses incurred during the period to arrive at a net profit or loss. An earnings per share figure may also be added if the financial statements are being issued by a publicly-held company. Many organizations prepare a separate version of the income statement for internal use that compares actual results to the budget, with variances noted. This is usually considered the most important financial statement, since it describes performance. A sample income statement appears below.

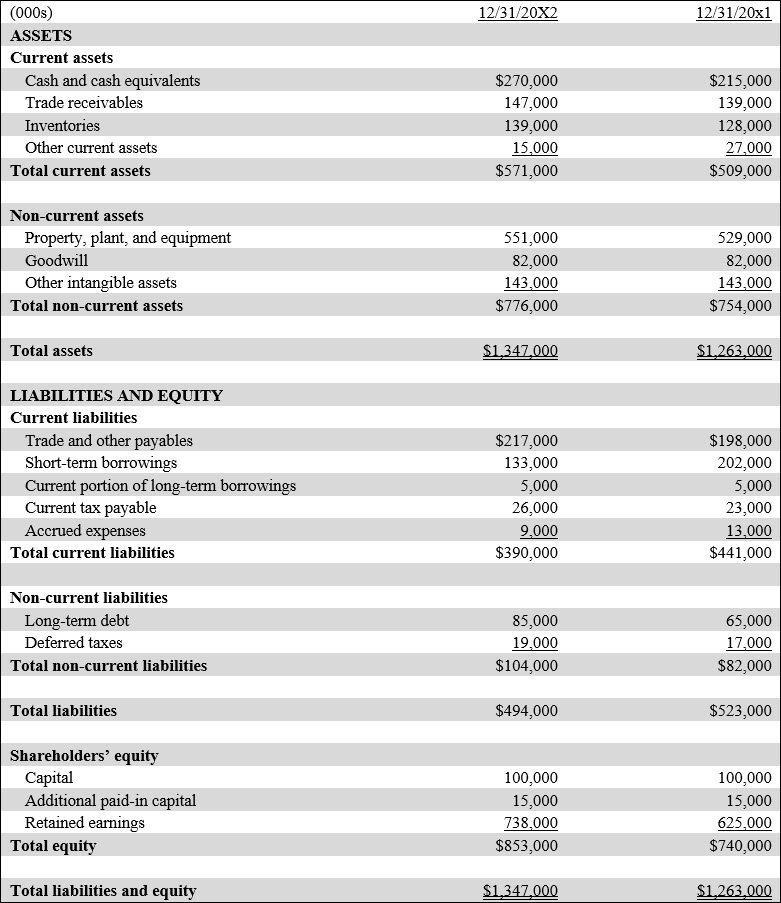

The Balance Sheet

The balance sheet shows the financial position of a business as of the report date (so it covers a specific point in time). The information is aggregated into the general classifications of assets, liabilities, and equity. Line items within the asset and liability classification are presented in their order of liquidity, so that the most liquid items are stated first. This is a key document, and so is included in most issuances of the financial statements. A sample balance sheet appears below.

The Statement of Cash Flows

The statement of cash flows reveals the cash inflows and outflows experienced by an organization during the reporting period. These cash flows are broken down into three classifications, which are operating activities, investing activities, and financing activities. This document can be difficult to assemble, and so is more commonly issued only to outside parties. A sample statement of cash flows appears below.

The Statement of Changes in Equity

The statement of changes in equity documents all changes in equity during the reporting period. These changes include the issuance or purchase of shares, dividends issued, and profits or losses. This document is not usually included when the financial statements are issued internally, as the information in it is not overly useful to the management team. A sample statement of changes in equity appears below.

Financial Statement Disclosures

When issued to users, the preceding types of financial statements may have a number of footnote disclosures attached to them. These additional notes clarify certain summary-level information presented in the financial statements, and may be quite extensive. Their exact contents are defined by the applicable accounting standards.

Related Articles

How the Balance Sheet and Income Statement are Connected

The Qualitative Characteristics of Financial Statements