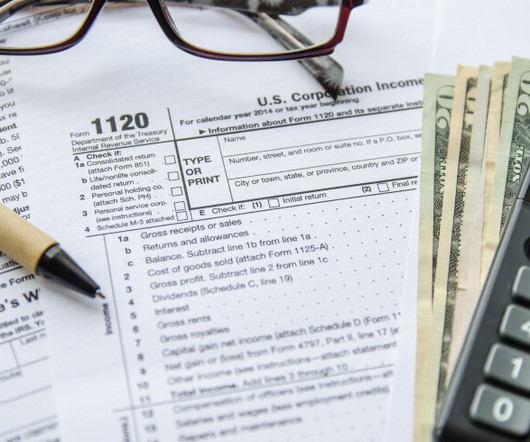

Corporate tax departments find themselves with too few resources

Accounting Today

OCTOBER 2, 2023

Nearly half the leaders of corporate tax departments believe they're severely under-resourced when it comes to technology and hiring, according to a recent survey.

Let's personalize your content