Beryl victims in Texas get tax relief

Accounting Today

JULY 23, 2024

3 to file various federal individual and business tax returns and make tax payments. Individuals and businesses in the affected counties now have until next Feb.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Tax Related Topics

Tax Related Topics

Accounting Today

JULY 23, 2024

3 to file various federal individual and business tax returns and make tax payments. Individuals and businesses in the affected counties now have until next Feb.

Accounting Today

JUNE 7, 2024

While the Internal Revenue Service has managed to reduce its backlog of unprocessed tax returns since the pandemic, one area where it's losing ground is in processing all the documentation for tax adjustments.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

Accounting Today

MAY 9, 2024

The Internal Revenue Service and the Treasury Department plan to issue regulations on the interplay between foreign tax credits, dual consolidated losses and OECD rules.

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

Accounting Today

OCTOBER 25, 2023

In spite of the lack of new tax legislation so far this year, taxpayers and tax preparers have plenty to focus on in preparing 2023 returns.

Accounting Today

JULY 15, 2024

The IRS warned about bad advice that's being peddled on social media promoting a bogus "Self Employment Tax Credit" and prompting unsuspecting taxpayers to file false claims for the credit.

Accounting Today

JULY 1, 2024

The IRS and Treasury Department released final regulations on how companies and tax pros should report and pay the 1% excise tax on corporate stock repurchases.

Accounting Today

JANUARY 24, 2024

The House Ways and Means Committee reported the text of the Tax Relief for Workers and Families Act after voting last week to advance the bipartisan bill.

Accounting Today

FEBRUARY 12, 2024

The tax extenders legislation is still tied up in the Senate after being passed in the House as senators are still seeking changes in some of the provisions, such as the expanded Child Tax Credit.

Accounting Today

JUNE 5, 2024

The Internal Revenue Service is turning to artificial intelligence to help select tax returns to audit and narrow the tax gap, but it needs to use this new technology consistently and transparently, according to a new government report.

Accounting Today

JANUARY 3, 2024

Fifteen states are reducing either individual or corporate income taxes this year, with some states trimming both individual and corporate taxes, among 34 states starting the year with significant tax changes.

Accounting Today

APRIL 30, 2024

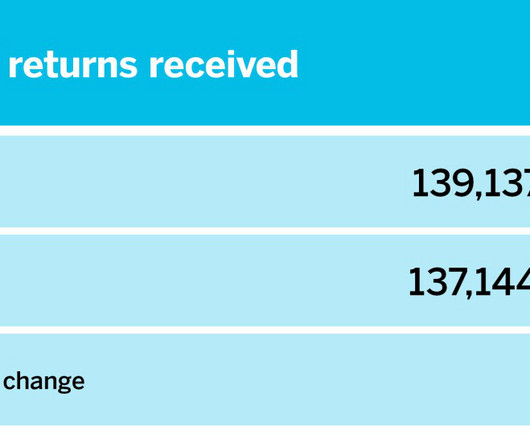

The number of individual income tax returns received rose by 16.34% in the final week of tax season.

Accounting Today

JUNE 18, 2024

The Internal Revenue Service is easing the rules for claiming a tax refund tied to a claim for the research and development tax credit.

Accounting Today

JULY 9, 2024

While the IRS and the Treasury have committed to tax administration equity, the Government Accountability Office recently found potential unintended biases in some of the systems and methods used by the IRS for audit selection — meaning some populations may be getting selected for audits at a higher rate than others.

Accounting Today

JULY 19, 2024

You need to be on your toes if you work in sales tax, as states are known to make substantial sales tax policy changes with little to no notice. Vermont, North Carolina, New Jersey and Ohio provide standout examples this summer.

Accounting Today

JUNE 6, 2024

The freedom of working remotely while traveling the world doesn't include freedom from tax compliance issues.

Accounting Today

JULY 18, 2024

Go Pats; on the hook; two down; and other highlights of recent tax cases.

Accounting Today

JULY 16, 2024

A roundup of the most important court cases, regulations and more in tax for the first six months of the year.

Accounting Today

APRIL 15, 2024

The Internal Revenue Service reported stronger performance on Monday, April 15, as it concluded this year's tax filing season, saying it had answered 1 million more phone calls from taxpayers and helped 170,000 people in person compared to last year.

Accounting Today

JUNE 6, 2024

No relief in sight; just plane crooked; no fool like a gold fool; and other highlights of recent tax cases.

Accounting Today

JANUARY 16, 2024

The chairs of Congress's two main tax committees announced a deal to extend a number of expired tax credits and tax breaks, including the expanded Child Tax Credit.

Accounting Today

JULY 2, 2024

The Internal Revenue Service issued a warning to tax professionals to be on guard against the identity thieves who are targeting them and their clients.

Accounting Today

JUNE 13, 2024

Extreme and outlandish; General nonsense; tat's all, folks; and other highlights of recent tax cases.

Accounting Today

FEBRUARY 13, 2024

While passage in the Senate is uncertain, many of the changes could impact 2023 tax returns.

Accounting Today

JULY 25, 2024

lawmaker about whether the bank it acquired, Credit Suisse Group, failed to report an American accused of evading taxes on $350 million in income. UBS Group AG was asked by a powerful U.S.

Accounting Today

JANUARY 5, 2024

The Internal Revenue Service will be hosting a Tax Professional Awareness Week starting Monday, Jan. 8, to give tax pros an opportunity to get ready for tax season.

Accounting Today

JULY 2, 2024

The end of Chevron deference, shifting IRS policies, and other major changes to the tax landscape.

Accounting Today

JULY 15, 2024

Wolters Kluwer announced CCH Tagetik Tax Provision & Reporting, a solution offering data collection and group tax provision calculations for multinationals.

Accounting Today

APRIL 16, 2024

President Joe Biden and First Lady Jill Biden paid $146,629 in federal income taxes on a combined $619,976 in adjusted gross income in 2023.

Accounting Today

APRIL 8, 2024

The Internal Revenue Service is making some changes in the way it sends tax transcripts for clients to tax professionals to beef up security.

Accounting Today

MAY 7, 2024

For CPAs who aspire to practice in Tax Court, the ability to review a case that has been litigated by a fellow CPA is a useful educational tool.

Accounting Today

DECEMBER 11, 2023

The Treasury Department and the Internal Revenue Service expect to issue proposed regulations to address the application of the foreign tax credit and related rules and the dual consolidated loss rules to certain types of taxes described in the GloBE Model Rules.

Accounting Today

JULY 11, 2024

After my last column about spreading out the tax season, several readers contacted me to share their experiences about making busy season more sane.

Accounting Today

NOVEMBER 3, 2023

The service's development of its newly introduced business tax accounts and recent improvements in its tax pro accounts could be jeopardized if funding is cut.

Accounting Today

JUNE 20, 2024

Card shark; the roof falls in; a dynamic duo; and other highlights of recent tax cases.

Accounting Today

JUNE 7, 2024

The amount of time that identity theft victims have to wait for tax refunds has increased as the Internal Revenue Service has shifted priorities, with some victims waiting nearly two years.

Accounting Today

FEBRUARY 20, 2024

In the wake of President's Day, and in the midst of tax season, take a minute to learn about Washington's and Lincoln's key contributions to the U.S. tax system.

Accounting Today

JANUARY 22, 2024

The Internal Revenue Service has revised the question it has asked in recent years about income from digital assets such as cryptocurrency on the Form 1040 for individual taxpayers this tax season and added it for the first time to tax forms for estates, trusts, partnerships and C and S corporations.

Accounting Today

APRIL 9, 2024

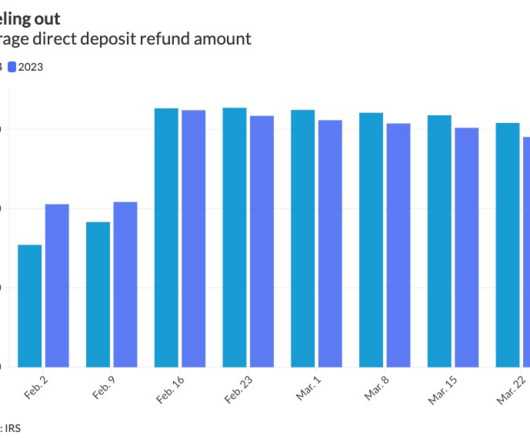

At 90,315,000, the number of individual returns received this tax season finally surpassed the same period last year, up 0.2% as of March 29, 2024.

Accounting Today

JULY 19, 2024

Accounting firms are helping clients navigate the tax incentives available under the Inflation Reduction Act.

Accounting Today

FEBRUARY 16, 2024

The Internal Revenue Service would be able to implement changes to the Child Tax Credit within weeks, IRS Commissioner Danny Werfel told Congress, and send out tax refunds promptly.

Accounting Today

APRIL 15, 2024

The Internal Revenue Service is waiving penalties to companies that fail to pay their estimated taxes for the first quarter for the corporate alternative minimum tax.

Intuit

MAY 28, 2024

As a Seasonal Tax Prep Associate for Intuit, I work remotely from my home in Kansas helping customers all over the country. If you want to transition from a bookkeeping position to a tax career like I did, keep scrolling and I’ll share the 4 ways Intuit makes it easy for you to do it. Spoiler alert: I love it! I’m Fatimah. Definitely.

Accounting Today

MAY 28, 2024

Intuit has been working to cater TurboTax to those with more complicated tax situations, betting that those customers could use online help from experts.

Accounting Today

FEBRUARY 8, 2024

The Internal Revenue Service issued a warning about a new scam email this tax season pretending to come from tax software providers asking for the preparer's Electronic Filing Identification Number.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content