IRS collects $1B from millionaires

Accounting Today

JULY 11, 2024

The agency is hoping to counter a widespread impression that people can get away without paying their taxes, according to Commissioner Werfel.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Collections Related Topics

Collections Related Topics

Accounting Today

JULY 11, 2024

The agency is hoping to counter a widespread impression that people can get away without paying their taxes, according to Commissioner Werfel.

Accounting Today

JANUARY 31, 2024

Tax pros and taxpayers should be aware that the IRS is restarting its 'collection notice stream.'

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

Accounting Tools

JULY 7, 2024

The collection of accounts receivable is vital, since it provides the cash needed to support company operations. Collecting accounts receivable is not just the task of the collections department. Instead, it calls for a company-wide effort, because collections can be improved before an invoice is ever issued to customers.

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

Accounting Today

SEPTEMBER 14, 2023

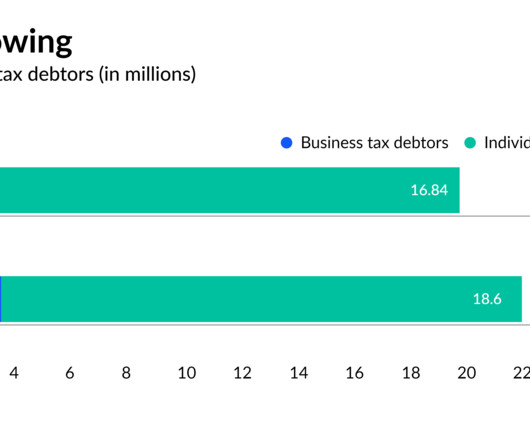

IRS data and changes to collection operations over the past four years show 10 clear effects.

Enterprise Recovery

MAY 24, 2024

Timing plays a crucial role in optimizing payment collection strategies. The basic gist is this - the sooner you can attempt to collect on past-due payments, the more successful you will be. Payment deadlines, reminders and utilizing technology can help increase the likelihood of on-time payments.

Gaviti

APRIL 8, 2024

Anyone who’s worked in accounts receivables knows how valuable a good collections email template can be. Accounts receivable collections rely on clear communication with customers, both in delivering accurate invoices on time and ensuring those invoices get paid. It also eases the burden of invoice collections somewhat).

Enterprise Recovery

APRIL 10, 2024

Many companies often turn to professional debt collection agencies for assistance when this happens. Before you hand over your delinquent accounts to a collection agency, it's important to understand their role and how they can help your business.

Enterprise Recovery

MAY 6, 2024

The tech industry is known for its rapid growth and innovation but faces unique challenges regarding debt collection and non-paying clients. Understanding the intricacies of debt collection in this sector is essential for companies to recover payments and maintain financial stability.

Accounting Today

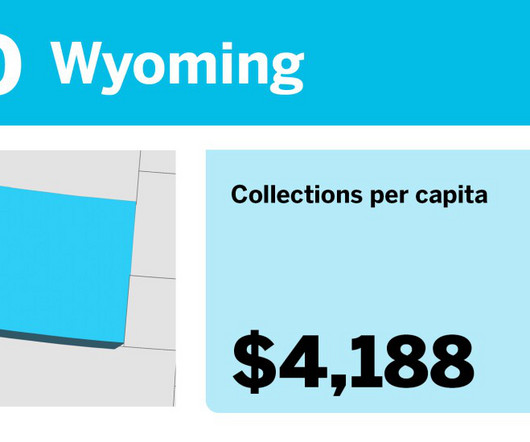

JULY 18, 2024

The top state takes in $7,200 in tax per capita.

Enterprise Recovery

APRIL 26, 2024

Discover ethical collection practices to help recover late payments while maintaining positive client relationships. In today's competitive business landscape, it's important to manage late payments while upholding positive client relationships.

Accounting Tools

JULY 24, 2023

Related Courses Credit and Collection Guidebook Effective Collections Essentials of Collection Law What is the Cash Collection Cycle? The cash collection cycle is the number of days it takes to collect accounts receivable. Clearly, this is only cost-effective for very large overdue balances.

Enterprise Recovery

NOVEMBER 10, 2023

Debt collections between businesses (B2B) is the recovery of overdue payments for goods or services provided to another company. Understanding the intricacies of B2B debt collections is essential for businesses to manage their cash flow effectively and maintain healthy financial relationships with their clients.

RevCycle

APRIL 25, 2024

While Artificial Intelligence (AI) is making waves in the debt collection industry, this paper argues that a human-centric approach focused on empathy, understanding, and flexible solutions can achieve higher netback for healthcare providers while treating patients with dignity and respect.

oAppsNet

MAY 14, 2024

Streamlining accounts receivable collections is a strategic imperative for businesses to enhance their cash flow and operational efficiency. Efficient collection processes improve a company’s financial health and strengthen customer relationships by ensuring transparency and consistency.

Gaviti

JUNE 25, 2024

Why Is Forecasting Accounts Receivable Collections Important? Forecasting Accounts Receivable Collections Using DSO The easiest and most accurate way to forecast your accounts receivable is using days sales outstanding (DSO). The post Collections Forecasting – Key Things to Watch appeared first on Gaviti.

Accounting Tools

MARCH 5, 2024

Debt collection strategies are needed to maximize the efficiency and effectiveness of the collections team. Ultimately, the result should be more collected funds in relation to the collection effort expended. A suggested set of debt collection strategies to consider are noted below. Will it accept returned goods?

Accounting Today

NOVEMBER 6, 2023

Delaying a payment or not paying an invoice and letting amounts pile up are a way for a client to give voice to a problem with your services without causing an immediate confrontation.

Bookkeeping Essentials

JUNE 17, 2024

Accounts receivable collection procedures are discussed as well as how to stop providing interest free loans to your clients and customers.

Accounting Tools

JANUARY 5, 2024

What is a Collection Period? A collection period is the average number of days required to collect receivables from customers. It is commonly tracked as a measure of the credit and collection efficiency of a business. It is measured as the interval from the issuance of an invoice to the receipt of cash from the customer.

Enterprise Recovery

OCTOBER 14, 2022

When making the decision to use commercial debt collection services, businesses should be choosy. The collections specialists will be speaking to your clients on your behalf. Here's a helpful guide to choosing the best commercial collection services.

oAppsNet

MAY 7, 2024

Among the various aspects of financial management, accounts receivable collections stand out for their direct impact on a company’s liquidity and cash flow. What Are Accounts Receivable Collections? Furthermore, efficient collections can also serve as a barometer for a business’s financial health.

Gaviti

MARCH 4, 2024

Once an invoice hits accounts receivable (A/R), it enters what’s called the average collection period. Other common names include “days sales in accounts receivable,” “average receivables collection period,” or “ days sales outstanding (DSO).” Your average collection period is an important key performance indicator (KPI).

Accounting Tools

JULY 23, 2023

Related Courses Credit and Collection Guidebook Effective Collections Essentials of Collection Law What is the Procedure for Collections? The collections staff may deal with an enormous number of overdue invoices. The detailed collection procedure is listed below. The steps are noted below.

RevCycle

DECEMBER 7, 2023

Targeted Collection Strategies Segment your customer base: Identify customers who are more likely to become delinquent and focus your communication and collection efforts on them. Personalize your approach: Avoid generic collection letters. This eliminates delays and simplifies the payment process.

Enterprise Recovery

MAY 12, 2023

Debt collections may not be the most enjoyable part of back office operations, but it's absolutely necessary. What happens when business debt goes to collections? Unfortunately, some of your business clients will miss a payment or more due to various reasons. If you've signed an agreement and fulfilled your part, they still owe you.

Enterprise Recovery

AUGUST 11, 2023

Do your business debt collections keep you up at night? Is outsourcing B2B debt collections the right choice for your business? Is outsourcing B2B debt collections the right choice for your business? More often than not, some of those invoices will remain unpaid unless you have the resources to follow up with them.

Enterprise Recovery

DECEMBER 9, 2022

The objective of an effective collections policy is to ensure that clients pay on time. When your business is struggling with cash flow or falling behind on collecting what's owed, it could be a sign that the policy needs updating. Here are signs that your B2B collections policy isn't working.

Accounting Tools

JULY 28, 2023

Related Courses Credit and Collection Guidebook Effective Collections Essentials of Collection Law What is a Collection Agency? A collection agency is a business that contacts customers on behalf of their suppliers , using various methods to enforce payment of overdue receivable and loan payments.

Enterprise Recovery

APRIL 21, 2023

If those subscribers fail to meet their obligations, their accounts can be sent to collections for recourse. Non-payer churn is one of many reasons that Saas companies need debt collection services. Businesses selling software-as-a-service (SaaS), or anything else "as-a-service," rely on monthly or annual fees from subscribers.

Enterprise Recovery

JULY 7, 2023

B2B (business-to-business) and B2C (business-to-consumer) debt collections are different. Agencies that collect from individuals will use different collection tactics and are subject to harsher regulations than those that collect from businesses.

Enterprise Recovery

JULY 17, 2023

It's crucial to provide a detailed process for escalating past-due invoices beyond accounts receivable to collections. Does your A/R team know when to escalate delinquent accounts to collections?

Enterprise Recovery

APRIL 7, 2023

When companies seek out debt collection agencies that they can trust, they also want to work with those who understand their industry. When a debt collections agency speaks your language, B2B account recovery can be more successful.

Enterprise Recovery

DECEMBER 30, 2022

Here are the Accounts Receivable and Business Collections Trends for 2023. In previous years, we've used this annual review to learn insights on how we can do better for our readers. Let us know if there's a topic that we can do better for you in the upcoming year.

Accounting Tools

SEPTEMBER 6, 2023

Related Courses Credit and Collection Guidebook Effective Collections What is Collection Dispute Cycle Time? Collection dispute cycle time is the time required to resolve the average collection dispute. Related Articles Accounts Receivable Discounted Collection Effectiveness Index Deduction Management

Gaviti

FEBRUARY 17, 2024

For some customers, however, you’ll need another strategy altogether for collecting unpaid and overdue invoices: debt collection. The Key Components of Effective A/R Management The main aspect of A/R management is the collections of receivables. Deciding between debt collections and write-offs. Dispute resolution.

Gaviti

JANUARY 8, 2023

How Prioritization Strategies Improve Collections Performance. Accounts Receivable teams can use prioritization strategies to increase the efficiency of their collections process. Organizations can improve the efficacy of their A/R processes by using task prioritization in collections management. Use Automation Tools.

Enterprise Recovery

FEBRUARY 3, 2023

Or you could escalate to a professional B2B collections agency that values your business relationships and your cash flow. Are You Taking Too Long to Collect on Receivables? Late or non-paying clients cause your business to write receivables off as bad debt, and they could cause the deterioration of your business relationships.

Accounting Tools

AUGUST 3, 2023

Related Courses Credit and Collection Guidebook Effective Collections Essentials of Collection Law Debt collection for a small business can be a difficult endeavor. A smaller organization does not have the resources to invest in an expensive debt collection infrastructure.

Accounting Today

JULY 12, 2023

The Internal Revenue Service has been sending out erroneous balance due notices demanding taxpayers in federal disaster areas pay up, even though they're supposed to get extra time.

Accounting Tools

JULY 27, 2023

Related Courses Business Ratios Guidebook The Interpretation of Financial Statements What is the Collection Ratio? The collection ratio is the average period of time that an organization’s trade accounts receivable are outstanding. The formula for the collection ratio is to divide total receivables by average daily sales.

Enterprise Recovery

JUNE 30, 2023

Business-to-business debt collections could also impact your relationships with current and potential clients. Use these tips to protect your business reputation during B2B debt collections. Nobody likes asking for money - least of all when your clients aren't paying their invoices promptly.

Gaviti

APRIL 18, 2023

This blog post will explore various strategies that finance and collections teams can adopt to better handle issues that might arise from these recent unyielding interest rate increases. Ensure that your collections team has the necessary resources and tools to collect outstanding receivables and manage cash flow effectively.

Gaviti

MAY 9, 2023

We are thrilled to announce the launch of our latest addition to the Gaviti accounts receivable collections platform: the Credit Management Module! The enhanced profiles also help streamline your communication and follow-up processes with customers, ensuring that your collections efforts are as efficient as possible.

Enterprise Recovery

NOVEMBER 11, 2022

When it's your job to collect past-due invoices, what you say matters. Here's what to say when collecting past-due invoices. And what you say will depend on your state of mind when you type the email or get on the phone. It's important that you're well-prepared.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content