May 29, Organized Record Keeping Systems For Home Based Offices

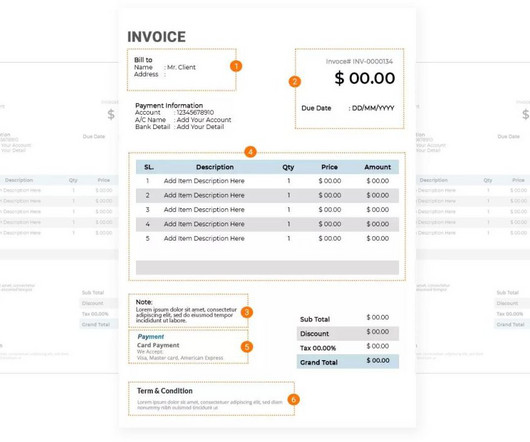

Bookkeeping Essentials

MAY 28, 2024

A series of chats about record keeping systems to get and stay organized so you can get rid of those drawers of stashed receipts? Simple choices and guidelines to eliminate stress and panic.

Let's personalize your content