Accounts Receivable Reports That Get You Paid Faster

Accounting Department

JANUARY 19, 2023

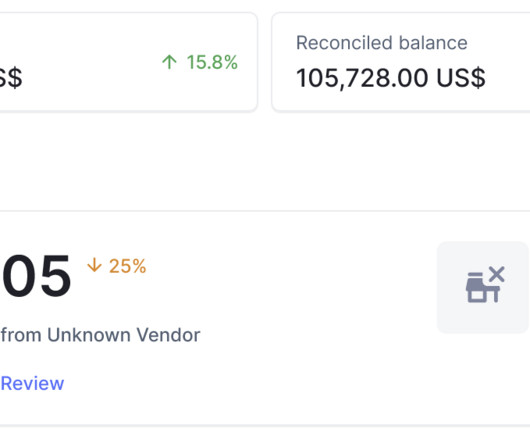

However, late payments and bad debts are a constant threat looming over an accounts receivables (AR) team. Accounts receivable reports are a key tool for businesses to manage their AR balances, forecast cash inflow, and stay on top of overdue payments.

Let's personalize your content