IRS offers tax relief to corporations

Accounting Today

APRIL 15, 2024

The Internal Revenue Service is waiving penalties to companies that fail to pay their estimated taxes for the first quarter for the corporate alternative minimum tax.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

tax-corporation-tax

tax-corporation-tax

Accounting Today

APRIL 15, 2024

The Internal Revenue Service is waiving penalties to companies that fail to pay their estimated taxes for the first quarter for the corporate alternative minimum tax.

Accounting Today

APRIL 15, 2024

The International Ethics Standards Board for Accountants has unveiled a set of ethical standards for business tax planning in response to complaints over tax avoidance by multinational companies.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Counto

APRIL 4, 2024

Corporate Taxes: The Benefit of Tax-Deductible Donations In the realm of business, giving back to the community isn’t just about altruism—it’s also about strategic financial planning. Tax-deductible donations offer a unique opportunity for businesses to support worthy causes while also benefiting their bottom line.

Accounting Today

APRIL 9, 2024

The tax prep giant settled a proposed class-action suit that said it schemed to prevent employees from moving between corporate and franchisers.

Accounting Today

APRIL 9, 2024

The Internal Revenue Service and the Treasury Department issued proposed rules for the stock buyback tax for large corporations.

Accounting Today

APRIL 25, 2024

The Internal Revenue Service and the Treasury Department released final regulations on the transfer of clean energy manufacturing, investment and production tax credits, with specific rules for partnerships and S corporations.

Intuit

APRIL 2, 2024

The top three financial terms that students don’t understand are “stocks/bonds” (53%), “401k/retirement” (45%), and “taxes” (28%). The top three things high school students wish they knew about managing their finances are how to become wealthy (43%), how to save money (40%), and how to avoid debt (37%). But critical gaps exist.

Counto

APRIL 10, 2024

Startup Tax Exemptions: Unlocking Savings with Expert Strategies and Real Examples At Counto, we’re not just about numbers; we’re about making the complex world of taxes simpler for you. Today, we’ll have a closer look at startup tax exemptions, an essential piece of knowledge for every new business owner and entrepreneur.

CSI Accounting & Payroll

APRIL 20, 2024

How much can I pay my kids tax-free? Many of them have considered hiring their children, and they’ve asked us: Can I pay my kids from my business? How do different entities pay their kids?

Nolan Accounting Center

APRIL 15, 2024

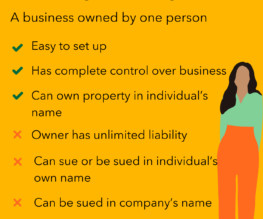

Why it is Critical to Choose the Right Business Structure When setting up your business it is critical to choose the right business structure because that influences many things including your day-to-day business operations, how much you pay in taxes, your ability to secure financing, and your personal liability. Corporation.

Counto

APRIL 21, 2024

Our Commitment to Small Businesses This improvement is just a part of our ongoing effort to fully automate accounting and tax services, making them as hassle-free as possible for small businesses like yours. Experience the Counto advantage Counto is the trusted provider of accounting, tax preparation and CFO services for startups and SMEs.

Insightful Accountant

APRIL 5, 2024

The Internal Revenue Service today advised taxpayers, including self-employed individuals, retirees, investors, businesses, and corporations about the April 15 deadline for first-quarter estimated tax payments for tax year 2024.

Counto

APRIL 7, 2024

In this guide, we’ll explore various methods and strategies for paying yourself as a sole director, ensuring both financial stability and tax efficiency. Ensuring Tax Efficiency and Legal Compliance Optimising salary payments requires careful consideration of tax implications and legal obligations.

Counto

APRIL 15, 2024

The business structure you choose has significant implications for your liability, tax obligations, and ability to attract investment. Less stringent tax compliance; no requirement to file annual returns. Lacks the tax benefits of corporate tax rates; income is taxed at personal income tax rates.

accountingfly

APRIL 11, 2024

Client-facing, experienced in client management and development Client niches: medical, dental, and legal practices, small businesses, real estate, entertainers and hospitality, estates, trusts, S Corps, partnerships, and sole proprietorships Tech Stack: Drake, LaCerte, ProSystems Tax and Engagement, QuickBooks, etc.

Accounting Tools

APRIL 6, 2024

What is a Corporation? A corporation is a legal entity whose investors purchase shares of stock as evidence of their ownership interest in it. A corporation has most of the rights and obligations of an individual, such as being able to enter into contracts, hire employees , own assets , incur obligations, and pay taxes.

Counto

APRIL 17, 2024

Experience the Counto advantage Counto is the trusted provider of accounting, tax preparation and CFO services for startups and SMEs. Get accounting plans that combine bookkeeping with corporate tax filing to help you stay compliant at an affordable price.

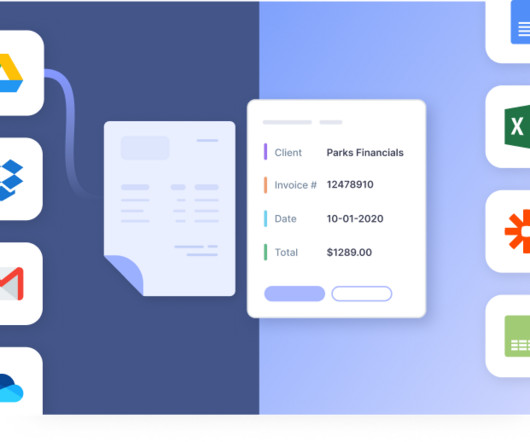

Invoicera

APRIL 10, 2024

Knowing these rules matters if you want to ensure tax compliance, accurate financial reporting, and legal validity. Tax systems vary worldwide. Some of those contextual policies include Value Added Tax (VAT), Goods and Services Tax (GST), and sales tax.

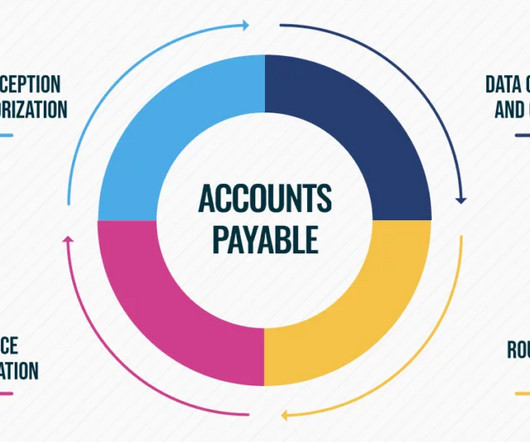

Outsourced Bookeeping

APRIL 26, 2024

This is a crucial yet challenging process, compelling you to prepare budgets, create various financial reports, perform audits, monitor cash flows, and file taxes. Moreover, you cannot stay ahead of the taxes, lose control over budgets, and lack clarity while making investment choices.

Accounting Tools

APRIL 29, 2024

A stockholder is a person or entity that owns shares in a corporation. A stockholder may own the preferred stock or common stock of a corporation (or both). A stockholder may acquire shares in the primary market when a company initially issues shares to the investment community, which means that the payee is the issuing corporation.

Counto

APRIL 6, 2024

Tax Advantages: Access exclusive tax incentives and schemes available only to private limited companies, potentially reducing tax liabilities and enhancing profitability. Cessation: Submit a Notice of Cessation to the Accounting and Corporate Regulatory Authority (ACRA) within three months of incorporating the Pte Ltd company.

Jetpack Workflow

APRIL 11, 2024

His work at Accounting Today has provided valuable insights into the latest regulations, tax laws, and industry standards, helping professionals stay informed and navigate the evolving landscape of accounting. Hood cites the example of a firm in Florida specializing in reporting and tax calculations for corporate jet ownership.

Accounting Tools

APRIL 29, 2024

Related AccountingTools Courses Bankruptcy Tax Guide Essentials of Corporate Bankruptcy It is most useful for developing an understanding of the amounts that may be available to creditors in the event of a liquidation.

Accounting Tools

APRIL 7, 2024

Thus, the costs of such items as corporate salaries, audit and legal fees, and bad debts are not included in manufacturing overhead. Related AccountingTools Courses Accounting for Inventory Activity-Based Costing Cost Accounting Fundamentals What is Not Included in Manufacturing Overhead?

Counto

APRIL 4, 2024

Additionally, it helps in meeting diverse regulatory requirements, including tax obligations and reporting standards, ensuring compliance with relevant accounting regulations. Experience the Counto advantage Counto is the trusted provider of accounting, tax preparation and CFO services for startups and SMEs.

Counto

APRIL 17, 2024

Experience the Counto advantage Counto is the trusted provider of accounting, tax preparation and CFO services for startups and SMEs. Get accounting plans that combine bookkeeping with corporate tax filing to help you stay compliant at an affordable price.

Accounting Tools

APRIL 30, 2024

Related AccountingTools Courses Bankruptcy Tax Guide Essentials of Corporate Bankruptcy Essentials of Collection Law Related Articles First Day Motions Preferential Transfer Right of Setoff Writ of Execution The clause may also be inserted into a mortgage agreement.

Accounting Tools

APRIL 17, 2024

For example, the transfer of cash to an investor in a corporation would require a dividend payment. Related AccountingTools Courses Law Firm Accounting Partnership Accounting Partnership Tax Guide Example of Withdrawals by Owner Mr. Kringle is a Christmas tree ornament store, which is run by Noel Baba.

Counto

APRIL 23, 2024

Experience the Counto advantage Counto is the trusted provider of accounting, tax preparation and CFO services for startups and SMEs. Get accounting plans that combine bookkeeping with corporate tax filing to help you stay compliant at an affordable price.

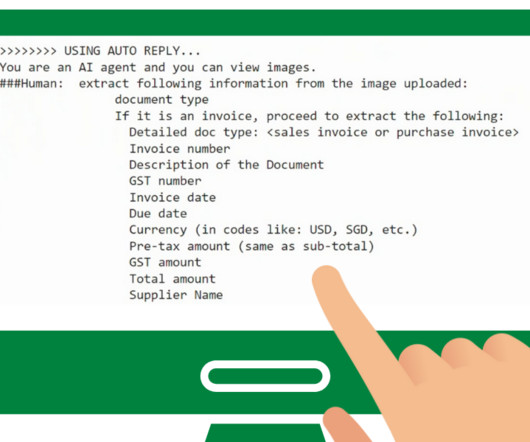

Nanonets

APRIL 14, 2024

Other Integrations Time and Expense Management Tools Expensify By offering corporate cards, next-day reimbursement features, and travel booking in one application, Expensify makes spending easy and manages that spending even easier. This ensures businesses remain compliant with tax regulations and reduces the risk of errors or audits.

Accounting Today

APRIL 25, 2024

Regulators, investors and the public are demanding ever greater tax transparency, and companies must navigate evolving, complex reporting requirements around the globe.

Accounting Today

APRIL 12, 2024

The IRS threw a late curveball at tax professionals scrambling to meet the April 15 deadline.

Accounting Today

APRIL 8, 2024

Boston Mayor Michelle Wu is seeking to raise commercial property tax rates to help protect homeowners from the brunt of the historic slump in office property values.

Accounting Today

APRIL 11, 2024

The annual rush to pay Uncle Sam tends to suck hundreds of billions of dollars from the banking system.

Accounting Today

APRIL 22, 2024

BEPS Pillar Two will affect a significant number of companies by establishing an effective global minimum tax rate of 15%.

Counto

APRIL 9, 2024

Taxation: Business profits are taxed as personal income, potentially subjecting the owner to higher tax rates. Tax Benefits: Private limited companies enjoy lower corporate tax rates and are eligible for tax incentives and exemptions. What is a Private Limited Company (Pte Ltd)?

Nanonets

APRIL 5, 2024

Airbase at a glance Tipalti offers a more comprehensive, end-to-end AP automation solution for mid-market and enterprise-level businesses with complex financial operations, global payment processing needs, and advanced tax compliance requirements. Users love its streamlined global payments, multi-method support, and simplified tax compliance.

Invoicera

APRIL 6, 2024

For example, if you receive a 1099-INT for $500 but don’t record it until a year later, you will owe taxes on $500 in interest in addition to any late fees or penalties that could apply. Whether you are a small business or a multinational corporation, your vendors deserve to be paid on time and receive accurate invoices.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content