Engage the AR function as a strategic partner for growth

Accounting Today

APRIL 16, 2024

The impact of providing accounts receivable staff with automated AR processes goes far beyond the finance function.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Accounting Today

APRIL 16, 2024

The impact of providing accounts receivable staff with automated AR processes goes far beyond the finance function.

Cevinio

MAY 14, 2024

AR Invoice Delivery Automation is a software solution designed to transform invoicing processes, mitigate errors, and enhance cash flow […]

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

Accounting Today

JULY 25, 2024

Companies that lag in making payments more streamlined have the potential of risking customer dissatisfaction and falling behind competitors.

Secure SaaS Success: Embedded Finance as a Competitive Advantage

Breaking New Ground: Managing Innovation Fatigue With Effective Automation

How to Navigate Revenue and Expense Management: Competitive Insights for Financial Success

Top 3 Secrets to Staying Relevant with Gen Z

oAppsNet

MAY 30, 2024

The shift towards Accounts Receivable (AR) Automation marks a pivotal move for businesses aiming to streamline financial operations, enhance cash flow, and bolster customer relationships. By automating the myriad tasks associated with AR, companies can minimize manual effort, reduce errors, and accelerate payment processes.

Accounting Today

JUNE 14, 2024

Plus, Bill360 solution offers AR automation; Certa announces gen AI capacities, new ESG module; and other accounting tech news.

SSI Healthcare Rev Cycle Solutions

NOVEMBER 17, 2023

How Healthcare Billing Departments Can Maximize AR Potential Before Year-End Home / November 17, 2023 In the digital age, innovation often means mastering the fundamentals. These key insights can maximize your AR potential before year-end. SSI Pro Tip #3: Speed up claim submission and AR days by eliminating wasteful claim edits.

Insightful Accountant

FEBRUARY 29, 2024

eTreem is AR software with imbedded payment processing that integrates with QuickBooks Online.

Enterprise Recovery

MARCH 24, 2023

As accounts receivables (AR) begin to fall delinquent, your business expenses could fall delinquent as well. Use these tips to efficiently collect AR and get invoices paid faster. With every late-paying client, cash flow for payroll, rent, or other vendors falls short, threatening your company's bottom line and growth.

SSI Healthcare Rev Cycle Solutions

NOVEMBER 17, 2023

How Healthcare Billing Departments Can Maximize AR Potential Before Year-End Home / November 17, 2023 In the digital age, innovation often means mastering the fundamentals. These key insights can maximize your AR potential before year-end. SSI Pro Tip #3: Speed up claim submission and AR days by eliminating wasteful claim edits.

Insightful Accountant

FEBRUARY 9, 2024

Gary, Tim, and Kaleb discuss leveraging integrated tools to achieve "Zero AR" and address talent shortage, capacity planning, and firm growth.

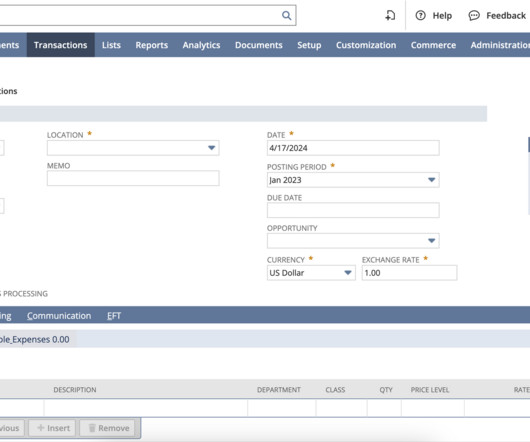

Accounting Department

MARCH 15, 2023

Your company sold a product or service to a customer on credit, and now it's time for the customer to pay their dues. In a traditional workplace, an invoice would be manually generated and issued to the customer, and then the customer would issue payment in return via cash, check, etc.

Cevinio

FEBRUARY 1, 2024

One such critical aspect is managing Accounts Receivable (AR). Recognizing the potential for improvement, many businesses are turning to AR Automation to streamline these processes. But what exactly is AR Automation, and how can your business benefit from it? These are the questions we address in this blog.

Xero

JUNE 5, 2024

ApprovalMax ApprovalMax makes it easy for you to build robust financial controls across accounts payable (AP) and accounts receivable (AR) with automated approvals and more. It also opens the door to not needing to rely on paper and email approval flows, and can help speed up AP and AR processes for finance teams.

Accounting Today

JANUARY 23, 2024

Leveraging the benefits of generative AI has the potential to improve the workplace experiences of finance professionals.

Accounting Department

JANUARY 19, 2023

However, late payments and bad debts are a constant threat looming over an accounts receivables (AR) team. Accounts receivable reports are a key tool for businesses to manage their AR balances, forecast cash inflow, and stay on top of overdue payments.

Plooto

OCTOBER 17, 2022

This is why we put together this list of the best AR automation software solutions to help you decide how to fuel your business. Businesses rely on accounts receivable to get them paid quickly and smoothly.

Nanonets

MAY 8, 2023

Start your free trial Accounts receivable (AR) is an asset on a company's balance sheet. Here's why you should consider Nanonets for AR automation. Looking to automate accounting processes? Try Nanonets accounting automation software to streamline all your accounting receivable processes.

oAppsNet

MAY 21, 2024

The rapidly evolving business landscape has spotlighted the critical function of accounts receivable (AR). AR practices are undergoing significant transformations as technologies advance and global markets expand.

Cevinio

MARCH 21, 2024

Learn how to choose the best AR automation tool to boost efficiency, accelerate payments, and optimize cash flow. […] Transform your Accounts Receivable processes with the right automation solution.

oAppsNet

MAY 28, 2024

In the contemporary business landscape, where efficiency and accuracy are paramount, automating Accounts Receivable Automation (AR) processes stands out as a transformative strategy. Embracing AR automation allows businesses to transcend traditional barriers, optimize financial health, and foster strategic growth.

oAppsNet

MAY 23, 2024

In today’s fast-paced business environment, managing accounts receivable (AR) effectively is more critical than ever. AR is a fundamental aspect of a company’s financial health, the balance of money due to a firm for goods or services delivered but still needs to be paid for by customers.

Accounting Today

NOVEMBER 4, 2022

(..)

Fidesic blog

DECEMBER 6, 2023

An internal AR audit will give deep insight into the business' incoming cash and can be a determining factor in planning the financial future of the company. Whether internal or external, financial audits can be an extremely stressful time. Accounts receivable auditing is among the most critical of financial audits.

Xero

MARCH 29, 2023

The metaverse is a form of internet that operates as a blended and immersive virtual world, powered by a mix of virtual reality (VR) and augmented reality (AR). What’s interesting is that the foundations of the metaverse are being built into technology you may already use today. This is so important,” Hayley said. “A

Billing Platform

SEPTEMBER 25, 2023

Accounts receivable (AR) provides the critical link between making the sale and receiving payment. This blog explores the accounts receivable process and its steps, AR key performance indicators (KPIs), AR challenge, and the benefits of AR automation. Think of it as an IOU to your business.

Insightful Accountant

JUNE 14, 2024

Bill360, an end-to-end accounts receivable automation solution,

Outsourced Bookeeping

MARCH 29, 2024

Nevertheless, many businesses have difficulties that impede their efforts to manage AR, including resource limitations, inconsistent invoices, and late payments. Businesses are increasingly using accounts receivable outsourcing as a strategic strategy in response to these difficulties.

Plooto

MARCH 29, 2024

Understanding accounts receivable (AR) is crucial for your company's finances. Efficiently managing your AR can help you manage your cash flow and ensure you don't lose out on cash.

Plooto

MARCH 28, 2024

The accounts receivable turnover ratio can be a helpful metric in determining the efficiency of your accounts receivable (AR) processes. The AR turnover ratio measures the number of times debts are collected from customers over a specified period.

oAppsNet

MARCH 5, 2024

One area where digital transformation can profoundly impact is accounts receivable (AR) processes. Organizations can streamline AR processes, improve cash flow management, and enhance customer satisfaction by leveraging digital technologies and automation tools.

Insightful Accountant

OCTOBER 5, 2023

The new financial operations platform for SMBs integrates category-leading solutions across accounts payable (AP), accounts receivable (AR), and spend and expense management.

Outsourced Bookeeping

FEBRUARY 28, 2023

Accounts Receivable – Need for Metrics & KPIs: The information stuck in soloed legacy systems, disorganized processes, manual operations, and inconsistent collection process makes AR vague. But what are the relevant AR KPIS and metrics? It says how quickly your AR is collecting the payments. Aging AR is the answer.

Outsourced Bookeeping

FEBRUARY 28, 2023

Accounts Receivable – Need for Metrics & KPIs: The information stuck in soloed legacy systems, disorganized processes, manual operations, and inconsistent collection process makes AR vague. But what are the relevant AR KPIS and metrics? It says how quickly your AR is collecting the payments. Aging AR is the answer.

Outsourced Bookeeping

MARCH 17, 2023

A standard set of Accounts Receivable policies will mitigate the inefficiencies and pave the way for improved AR performance. Credit incentives, versatile payment options, credit review protocols and well-structured credit policies are some standard procedures we suggest for our clients at Outsourced Bookkeeping.

Plooto

JANUARY 16, 2023

Thank you for choosing Plooto for your AP/AR automation needs. Plooto’s payment processing features have helped many businesses like yours streamline their credit card processing , cut costs, and save time.

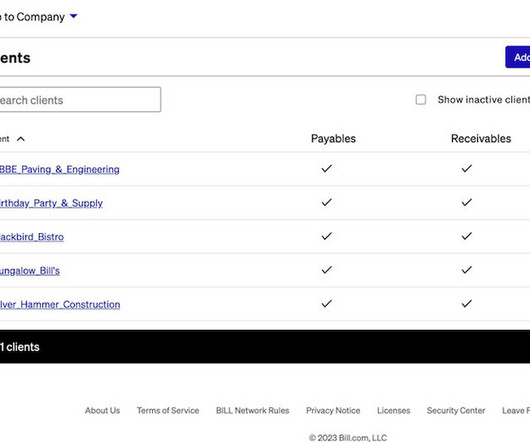

Plooto

NOVEMBER 14, 2022

Thank you for choosing Plooto for your AP/AR automation needs. Plooto’s payment processing features have helped many accounting firms like yours automate their payment processing , cut costs, and save time for themselves and their clients.

Outsourced Bookeeping

MARCH 16, 2023

A standard set of Accounts Receivable policies will mitigate the inefficiencies and pave the way for improved AR performance. Credit incentives, versatile payment options, credit review protocols and well-structured credit policies are some standard procedures we suggest for our clients at Outsourced Bookkeeping.

Jetpack Workflow

MARCH 23, 2023

This process is why an accounts receivable (AR) ledger is your best friend. An AR ledger allows you to manage outstanding payments by tracking an invoice’s due date. An AR ledger allows you to manage outstanding payments by tracking an invoice’s due date. Here are a few accounting software providers to consider.

Insightful Accountant

JULY 18, 2023

Ignition's Matt Kanas explains how firm owners can build or transition their business to have zero AR.

AvidXchange

JULY 23, 2024

Enter AI billing, a game-changer for invoicing and accounts receivable (AR). By leveraging artificial intelligence (AI) for billing, companies can streamline their accounting processes, cut costs, improve security, and enhance overall accuracy.

Outsourced Bookeeping

FEBRUARY 29, 2024

Hereby, the business owner is relieved of the time-consuming tasks of AR management. Outsourced partners are more aware of changes influencing the corporate domain. As outsourced AR experts, they will seamlessly apply whatever suitable method that applies to your business, in turn, offering additional stability to the organization.

Gaviti

APRIL 24, 2023

The AR team must identify problems and seek long-term solutions. For example, AR teams might use one system for invoicing and another for inventory management, but those two systems do not speak to each other. Then, choose AR solutions that meet your short-term needs and long-term goals. Every business is different.

Nanonets

APRIL 18, 2024

In today's fast-paced business environment, efficient management of accounts receivable (AR) and accounts payable (AP) is crucial for maintaining a healthy cash flow. Invoices are an essential part of this. Invoice creation and Invoice processing are critical steps in these processes.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content