How Bookkeeping Services Can Help CPAs Improve Their Efficiency and Productivity

Outsourced Bookeeping

MAY 29, 2023

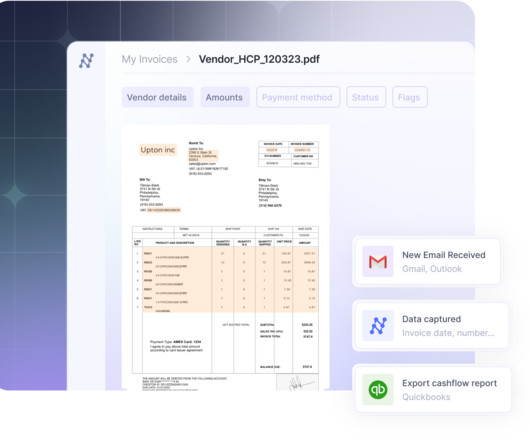

Improved Accuracy: To maintain accurate and current books, professional accounting services employ modern computer applications and procedures. Advanced software and technologies are used by bookkeeping service providers to automate manual bookkeeping procedures like data entry, account reconciliation, and financial reporting.

Let's personalize your content