Reporting expenses by function

Accounting Tools

MAY 9, 2024

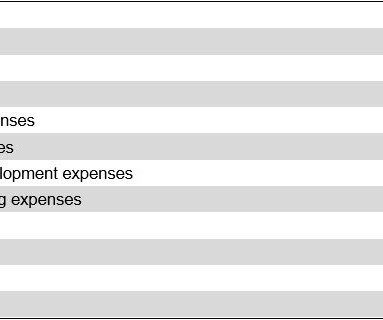

What Does it Mean to Report Expenses by Function? When expenses are reported by function, they are being reported by the type of activity being conducted. Examples of income statement line items that are presented by function are administrative expenses , financing expenses, manufacturing expenses, marketing expenses, and selling expenses. Or, a nonprofit entity that reports expenses by function could do so by aggregating its expenses into the following general functions: Programs, fund raising,

Let's personalize your content