How AI is transforming accounting

Accounting Today

APRIL 29, 2024

A recent survey from EY found that 90% of respondents already use at least some AI in their work, and other recent developments around the technology.

Accounting Today

APRIL 29, 2024

A recent survey from EY found that 90% of respondents already use at least some AI in their work, and other recent developments around the technology.

Xero

APRIL 30, 2024

We want to make sure the needs of small businesses and their advisors are met well into the future — and that means providing you with easier access to tools that help you run your business efficiently. That’s why we’re refreshing our subscription plans for small businesses and partners, which will be available from 1 July 2024. We’ve put a lot of consideration into creating streamlined plans with bundled tools and features, to help solve your most important accounting and people managemen

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Department

MAY 3, 2024

We are thrilled to announce that Episode 18 of our podcast, Beyond the Books , is now live and ready for your listening pleasure.

Fidesic blog

MAY 2, 2024

What is VendorVault? VendorVault by Fidesic is a secure vendor portal that makes it easier for your vendors to submit, manage and status check their own invoices.

Advertisement

As scams grow more sophisticated, it's crucial to stay proactive in defending against these threats. This guide equips CFOs, accountants, and business leaders with five essential steps—from fundamental safeguards to advanced security measures to strengthen your financial defenses. From enhancing data security to implementing fraud detection tools and safeguarding financial transactions, this guide provides expert advice that could save your company millions.

Accounting Today

MAY 3, 2024

The landscape of Corporate Transparency Act beneficial ownership information reporting continues to evolve, and accountants and others who advise their small business clients need to stay ahead of the curve.

Xero

MAY 2, 2024

We are thrilled to announce our UK Xero Award winners for 2024 , recognising the legends of the UK accounting, bookkeeping and app partner community. This year’s celebrations took place for the first time in Manchester at the iconic New Century Hall – a place built for legends. The venue has played host to music legends from Jimi Hendrix and Jerry Lee Lewis, to The Who and The Bee Gees.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Insightful Accountant

APRIL 29, 2024

Insightful Accountant proudly announces this year's Top 100 ProAdvisors along with our Emeritus ProAdvisors of the Year. Congratulations to all being recognized for this year's awards.

Accounting Today

MAY 2, 2024

The Internal Revenue Service released an update of its Strategic Operating Plan, with improvements planned in services and technology for both taxpayers and tax professionals.

Xero

APRIL 28, 2024

Bank feeds are a great way to import transactions from your financial institution directly into Xero, so you can easily complete the reconciliation process. But the US is a pretty challenging market when it comes to providing high-quality bank feeds. There are more than 4,000 financial institutions, each with their own capabilities and nuances. To address this and help you get transactions into Xero more easily, we’ve been focused on improving the coverage and quality of our bank feeds.

Accounting Department

MAY 2, 2024

Last week, AccountingDepartment.com Business Development Representative, Shawn Marcum hit the road and attended the CEO Coaching Make BIG Happen Summit in Miami, FL.

Speaker: Hilary Akhaabi, PhD - Founder, Chief Financial & Operations Officer at Go Africa Global

In the fast-paced world of corporate finance, staying ahead of the curve is crucial for sustainable growth and profitability. This exclusive webinar with leading expert Hilary Akhaabi, PhD, will teach you practical ways to navigate complex financial landscapes and enhance your company's revenue management capabilities. Whether you're aiming to refine your financial strategies or seeking innovative solutions to drive performance, this new session is for you!

Cevinio

APRIL 29, 2024

Discover the essential role of a comprehensive training program in our latest blog, which highlights why it's the first critical step in any successful AP automation plan for automated invoice processing.

Accounting Today

MAY 3, 2024

The Securities and Exchange Commission charged the fast-rising auditing firm with deliberate, systemic failures to comply with PCAOB standards for audits and reviews.

Xero

APRIL 28, 2024

We know how important time, attendance and scheduling (TAS) needs are for any small business. And for Australian employers, we know it is even more important because Australia has some of the most complex payroll compliance requirements in the world. Following a careful review of our current TAS solution, we have made the difficult decision to retire our Planday product on 30 September 2024.

Insightful Accountant

MAY 3, 2024

May is Military Appreciation month in the US and we at Insightful Accountant want to say "Thank You" to those who are serving or have served, and to their families for their service.

Speaker: Claire Grosjean

In today’s fast-paced business environment, finance professionals are under increasing pressure to optimize operations and drive strategic value. As a result, automation has become a core part of business strategy, offering unprecedented opportunities to streamline operations and drive efficiency. Join esteemed global finance and operations executive, Claire Grosjean, for a comprehensive guide on how to harness automation’s power through strategic collaboration with functional leaders.

Plooto

MAY 3, 2024

What led you to join Plooto, and what has your journey been like since then? As someone who majored in Economics, I was always interested in working in fintech. When I was looking for startups to apply to, the name Plooto kept coming up. Plooto is well known in the Toronto startup space, and I thought the company would be a good fit.

Accounting Today

MAY 2, 2024

A set of polls has found that leaders expect that generative AI will lead organizations to actually increase, not decrease, their headcount, at least in the short term.

Counto

MAY 3, 2024

Revolutionising Tax Workflow with AI: Highlights from Our “Let’s Talk Tax Technology” Webinar with SCTP In the fast-evolving world of tax technology, staying ahead means embracing innovation. At Counto, we not only adopt advancements; we innovate, building our own AI-powered systems. Our recent collaboration with the Singapore Chartered Tax Professionals (SCTP) for the “Let’s Talk Tax Technology” webinar is a testament to our commitment to reducing compliance

Insightful Accountant

APRIL 30, 2024

It's time to recertify for most QuickBooks Online ProAdvisors ('Core' or 'Advanced'). The recertification window opens May 1 with a June 30, 2024 deadline for exam completion.

Speaker: Brian Muse-McKenney, Chief Revenue Officer & Matt Simester, Cards and Payments Expert

In today’s world of social media, dating apps, and remote work, businesses risk becoming irrelevant or getting "ghosted" if they fail to meet the evolving needs of Gen Z consumers. In this new webinar, Brian Muse-McKenney of Episode Six and Matt Simester of Payments Consultancy Limited will reveal key considerations banks should factor into their efforts to develop target products for the next generation of bank customers.

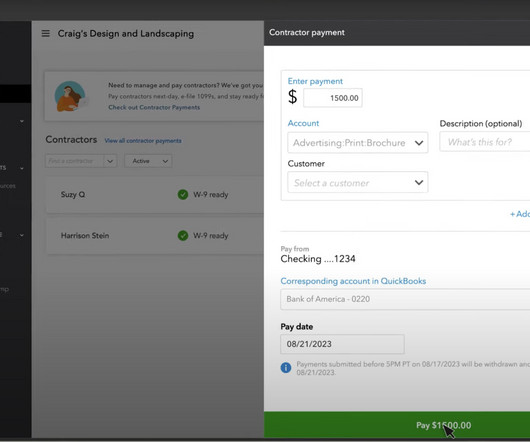

Nanonets

APRIL 30, 2024

Businesses increasingly lean on outside contractor support for many operational functions as payroll costs balloon and global talent pools become increasingly accessible. For companies using QuickBooks, a range of self-service contractor payment options are available that, additionally, can be optimized using third-party integrations. We’ll take a quick look at paying contractors through QuickBooks, but, in reality, the process couldn’t be more straightforward for even the least te

Accounting Today

MAY 3, 2024

Sen. Ron Wyden, in a letter, demanded that TurboTax refund customers who, due to a software glitch, were inappropriately encouraged to take non-optimal choices, resulting in higher taxes.

Accounting Tools

MAY 2, 2024

What is a Self-Liquidating Loan? A self-liquidating loan is a debt that is paid off from the cash flow generated by the assets originally acquired with the funds from the debt. The scheduled loan payments are typically structured to coincide with the cash flows generated by the underlying asset. These loans are structured to have a short duration, and are used to fund temporary increases in current assets.

Insightful Accountant

MAY 1, 2024

MassCPA's report highlights DE&I disparities in accounting. 80% of leaders are white, 60% male. Perception gap: 68% of leaders vs. 36% of employees feel empowered. 1 in 10 left due to lack of inclusion measures. Read more about it!

Speaker: Gary Dmitriev

Our upcoming webinar aims to demystify the process of selecting and implementing automation tools for financial institutes. This session will provide your roadmap for vetting potential solutions, focusing on due diligence, vendor assessments, and aligning technology with strategic goals. We’ll also address the critical issue of innovation fatigue, offering tips on maintaining enthusiasm and momentum for new initiatives.

Ace Cloud Hosting

MAY 2, 2024

Thinking about getting QuickBooks to streamline your inventory and simplify accounting? Awesome! But hold on a sec… Before you proceed further, let’s make sure if it’s the right move for.

Accounting Today

MAY 2, 2024

The pace of small business job growth slackened in April, but hourly earnings ticked up to 3.34% for the month, ending a nearly two-year slowdown, according to payroll processor Paychex.

Accounting Tools

MAY 2, 2024

What is a Separate Entity? The separate entity concept states that we should always separately record the transactions of a business and its owners. The concept is most critical in regard to a sole proprietorship , since this is the situation in which the affairs of the owner and the business are most likely to be intermingled. Here are several examples of the rules to be followed when using a separate entity: An owner cannot remove funds from a business without recording it as either a loan , c

Insightful Accountant

APRIL 28, 2024

Microsoft says that the solution to the problem of having been unable to send emails from QuickBooks after updating Outlook Desktop to Version 2402 has now been resolved.

Speaker: Ian Hillis, SVP of Growth at Payrix and Worldpay for Platforms

Join us for an exclusive webinar hosted by Ian Hillis, SVP of Growth at Payrix and Worldpay for Platforms, where he’ll explore the significant impact of embedded finance on the software industry! This session is designed to provide you with the strategic insights needed to navigate the future of SaaS successfully, all while gaining a deeper understanding of how these trends can enhance your competitive edge, boost revenue, and deepen customer loyalty.

Ace Cloud Hosting

MAY 3, 2024

As accounting businesses and firms prepare for the future, many of them are realizing that empowering women is of great importance for helping their firm forge the way of doing.

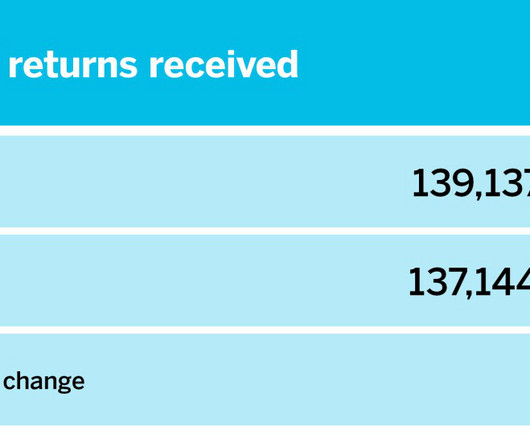

Accounting Today

APRIL 30, 2024

The number of individual income tax returns received rose by 16.34% in the final week of tax season.

Accounting Tools

APRIL 29, 2024

What is Short-Term Debt? Short-term debt is the amount of a loan that is payable to the lender within one year. Other types of short-term debt include accounts payable, commercial paper , lines of credit , and lease obligations. The balance in the short-term debt account is a major consideration when evaluating the liquidity of a business. Evaluating Short-Term Debt To evaluate short-term debt, compare the current assets figure on the balance sheet to the current liabilities figure.

Insightful Accountant

MAY 1, 2024

In 2024, tax tech is evolving rapidly with AI, data analytics, and blockchain. Tax pros need to adapt to these innovations for effective use.

Speaker: Aaron Jacob, VP of Accounting Solutions & Reagan Cook, GTM Lead

Are you struggling to navigate the complexities and challenges that come with crypto accounting? 🤔 This new webinar will cover everything businesses need to know to get started with crypto accounting after incorporating crypto into their business models! Industry experts Aaron Jacob and Reagan Cook of TaxBit will thoroughly explore the prevalent operational hurdles encountered by accounting teams when interacting with crypto on the books, and detail how software solutions can effectively

Let's personalize your content