4 Financial KPIs Every Growing Business Should Monitor

Accounting Department

JULY 23, 2024

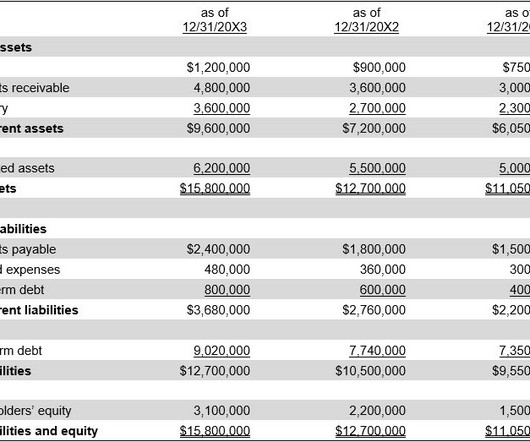

In today's competitive business landscape, staying ahead of the competition requires more than just a great product or service. Entrepreneurs, small business owners, and financial analysts must focus on tracking key financial metrics to ensure their company's growth and financial health.

Let's personalize your content