Guide to Vendor Account Reconciliation Process

Nanonets

APRIL 3, 2024

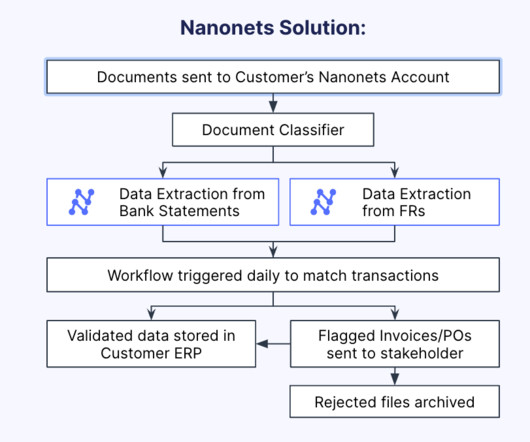

Guide to the Vendor Account Reconciliation Process Running a business involves collaboration with various vendors who provide different kinds of products and services. Vendor reconciliation , a crucial part of this process, involves scrutinizing purchase-related documents to ensure accuracy in all vendor transactions.

Let's personalize your content