Construction Company Improves Cash Flow with AvidXchange

AvidXchange

FEBRUARY 13, 2024

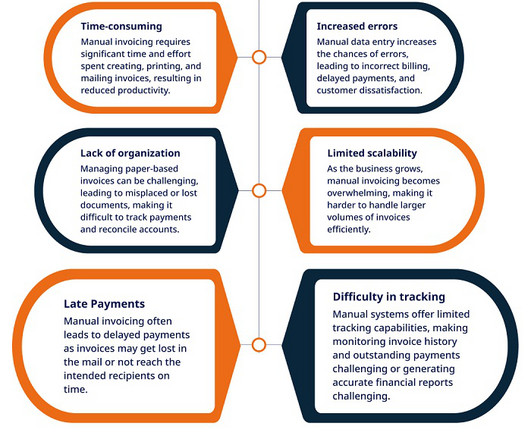

who manages all incoming and outgoing payments. However, it can be difficult to maintain high standards and deliver optimal services to clients when overdue payments, a byproduct of the construction industry’s often outdated payment practices, disrupt business continuity.

Let's personalize your content