Bank reconciliation Vs. Book reconciliation

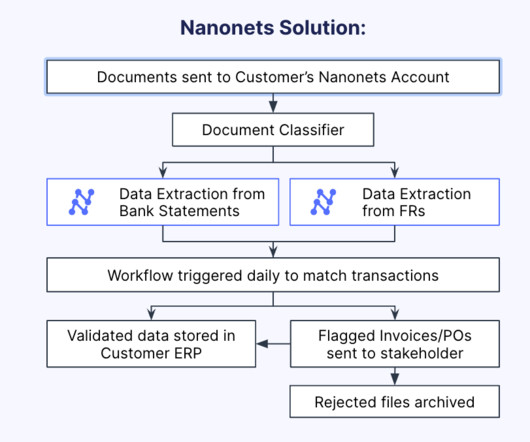

Nanonets

APRIL 12, 2024

Bank Reconciliation Vs. Book Reconciliation In accounting and financial management, we encounter the terms "Book Reconciliation" and " Bank Reconciliation " These terms are often used interchangeably, leading to ambiguity regarding their meanings. What Is Bank Reconciliation?

Let's personalize your content