7 ways to drive innovation in your firm

Accounting Today

APRIL 26, 2024

While the term "innovation" isn't necessarily associated with most CPA firms, this perception can easily be changed with the right strategic moves.

Accounting Today

APRIL 26, 2024

While the term "innovation" isn't necessarily associated with most CPA firms, this perception can easily be changed with the right strategic moves.

Ace Cloud Hosting

APRIL 26, 2024

Just like for smooth money handling, you need to create a bank account. Similarly, the right accounting platform is necessary to manage the business financial landscape. This is where QuickBooks.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

APRIL 26, 2024

Test your knowledge of the biggest accounting headlines of the week. No. 2 pencil not required!

Enterprise Recovery

APRIL 26, 2024

In today's competitive business landscape, it's important to manage late payments while upholding positive client relationships. Use the following techniques to navigate the delicate balance of recovering outstanding debts while maintaining trust and loyalty with your clients. Discover ethical collection practices to help recover late payments while maintaining positive client relationships.

Speaker: Nancy Wu, Head of Sales and Customer Success at SkyStem

Join us for an enlightening webinar as we delve into the transformative realm of modern accounting practices. In today's digital age, the convergence of outsourcing and automation has revolutionized how businesses manage their financial operations. In this webinar we will explore the synergistic potential of these two strategies to streamline processes, enhance accuracy, save cost and drive strategic decision-making.

Accounting Today

APRIL 26, 2024

Financial advisors, tax professionals and their clients get another year to think through potential tax, distribution and trust strategies, according to experts.

FundThrough

APRIL 26, 2024

For small and medium-sized businesses (SMBs), maintaining a healthy cash flow is often one of the most challenging aspects of running a company. Because many of us at FundThrough have been entrepreneurs before, we understand firsthand what it’s like to struggle with unpaid invoices. Late payments or even standard-length payment terms can have serious impacts […] The post Advancing Your Cash Flow: Should You Opt for Early Invoice Payment from Your Client?

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Tipalti

APRIL 26, 2024

What is indirect procurement and its benefits for your business? Learn how to efficiently manage the day-to-day costs of doing business, for more accurate financial forecasting.

Accounting Today

APRIL 26, 2024

The bank successfully fought off a London court claim brought by investors over tax breaks linked to financing for 'Pirates of the Caribbean 2.

Outsourced Bookeeping

APRIL 26, 2024

Real Estate is a fortune-acquiring scalable business. However, to reap its benefits you must go through the testing process, enhanced with effective finance management. This is a crucial yet challenging process, compelling you to prepare budgets, create various financial reports, perform audits, monitor cash flows, and file taxes. If you are solely handling all these accounting challenges as a business owner it might become nerve-racking.

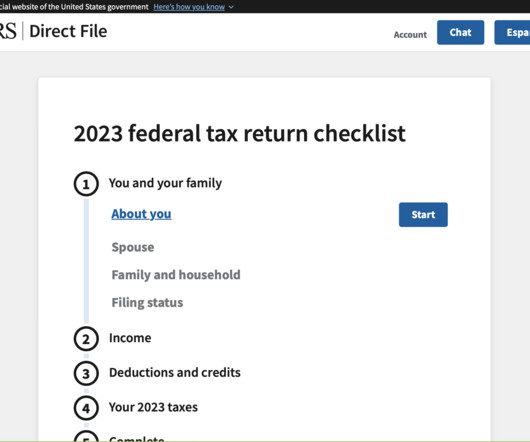

Accounting Today

APRIL 26, 2024

The Internal Revenue Service's Direct File pilot program officially closed Friday, after 140,803 taxpayers used it in 12 states.

Speaker: Robbie Bhathal, Founder & CEO, and Matthew Acalin, Head of Credit Intelligence

In today's volatile financial environment, how confident are you in your company’s financial forecasting? To get the most accurate cash predictions that will lead to long-term financial survival, real-time data is critical. Innovative cash management strategies can lead to better credit opportunities, more sustainable growth, and long-term financial prosperity.

Cloud Accounting Podcast

APRIL 26, 2024

Blake Oliver sits down with Brannon Poe of Poe Group Advisors to discuss the differences between traditional and subscription-based virtual accounting firms. Brannon shares his expertise on firm valuation, revealing that factors like cash flow to owner and owner hours play a significant role in determining a firm's value. He also emphasizes the importance of pricing strategies, noting that implementing value pricing and subscription models can dramatically improve a firm's profitability and over

Accounting Today

APRIL 26, 2024

Even if a program is predominantly funded with federal dollars, there may be other sources of funds from which local governments can draw.

Accounting Fun

APRIL 26, 2024

PwC was initially called PriceWaterhouseCoopers having been formed by the merger of Coopers and Lybrand and Price Waterhouse. Long before that merger Coopers & Lybrand was originally called Cooper Brothers and based in Gutter Lane, London. Indeed they may have been the only building with an address identified as being in Gutter Lane. Legend has it that at one stage the partners wrote to the Corporation of London suggesting that, in view of their long tenancy, it might be appropriate to renam

Accounting Today

APRIL 26, 2024

Plus, the Kansas Society of CPAs gives out scholarships; the Accounting MOVE Project announces a mini summit; and more.

Advertisement

All accounting teams know what it is like to dread the inevitable month-end scaries. If there was a way to feel less burdened and maybe even a little enthusiastic to work on your month-end close and reconciliation process, would you do it? No, don't answer that, of course you would! Automate your month-end close process by up to 40% with SkyStem's ART and see how much more alive you feel!

Ace Cloud Hosting

APRIL 26, 2024

Just like for smooth money handling, you need to create a bank account. Similarly, the right accounting platform is necessary to manage the business financial landscape. This is where QuickBooks.

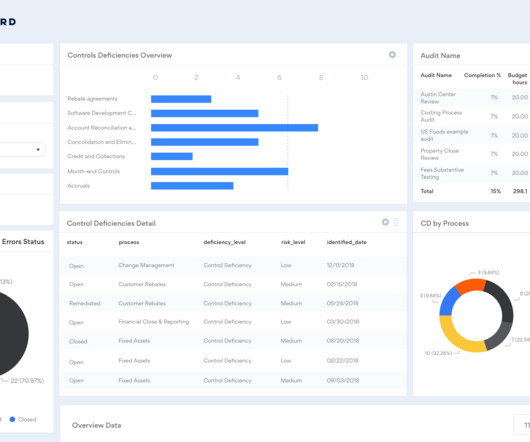

Accounting Today

APRIL 26, 2024

AuditBoard announces AuditBoard AI now generally available; Earmark launches web app; and other accounting technology news.

Tipalti

APRIL 26, 2024

Learn how procurement as a service (PaaS) revolutionizes procurement processes, offering scalability, cost-efficiency, and expert support. Explore its benefits and applications for your business.

Accounting Today

APRIL 26, 2024

The bakery chain collapsed into insolvency in 2019 after a forensic investigation revealed thousands of false entries in its accounts.

Advertisement

The status quo for AP in small and mid-market companies is broken. It consists of messy tech stacks of siloed solutions that give rise to manual work, a lack of control, wasted spend, and unnecessary risks. The benefits of shifting to spend management are tangible, measurable, and are felt across the whole organization. Spend management is a different way of thinking and an innovation whose time has come.

Intuit

APRIL 26, 2024

Mentorship isn’t about zeroing in on a single advisor for the entire scope and duration of your career. You can benefit from many different types of support over time, and often at the same time. Similarly, working with multiple mentors of diverse profiles will expand the range of perspective and guidance available to you. That’s one reason the Tech Women @ Intuit (TWI) Mentorship program is designed around six-month terms, with mentees and mentors encouraged to rotate to new pairs regularly.

Accounting Today

APRIL 26, 2024

We're witnessing the evolution of the "new firm.

Nanonets

APRIL 26, 2024

Bank feeds and automated reconciliation, easy expense claim reimbursement, and online invoicing features are just the start; Xero is a premium accounting software solution for small businesses. The tool’s out-of-box robustness lays a strong foundation to support a multitude of business processes, but it’s the Xero Marketplace – full of Xero apps and integrations – that really sets the Xero platform apart.

Spenmo

APRIL 26, 2024

As we close Q1-2024, we are thrilled to share a suite of enhancements that help finance managers improve their Accounts Payable processes. Driven by our dedication to Customer Love, we've listened closely to your feedback and tailored our solutions to meet and exceed your operational needs. Our latest updates are designed to streamline your processes, freeing up more time for high-value tasks like financial analysis and strategic planning. 1.

Speaker: Carolina Aponte - Owner and CEO, Caja Holdings LLC

In today's rapidly changing business environment, building a resilient balance sheet is crucial to the survival of any business. A resilient balance sheet allows a company to withstand financial shocks and adapt to changing market conditions. To achieve this, companies need to focus on key strategies such as maintaining adequate liquidity, managing debt levels, diversifying revenue streams, and prioritizing profitability over growth.

Let's personalize your content