IRS crypto enforcement could get tougher

Accounting Today

JULY 15, 2024

The Internal Revenue Service could be doing a better job of cracking down on tax noncompliance by users of virtual currency or digital assets, according to a new report.

Accounting Today

JULY 15, 2024

The Internal Revenue Service could be doing a better job of cracking down on tax noncompliance by users of virtual currency or digital assets, according to a new report.

Accounting Department

JULY 16, 2024

Growing a business is a multifaceted challenge that requires careful financial management. For many business owners, juggling daily operations while keeping track of finances is daunting. Enter Client Accounting Services (CAS), a crucial element for business growth that improves financial accuracy, reduces costs, and offers expert financial guidance.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Xero

JULY 17, 2024

On 9 July, we announced that the Xero Beautiful Business Fund is back for 2024. Just as we did last year, we’re giving away more than NZ$750,000 to eligible Xero small business customers across Australia, Canada (excluding Quebec), New Zealand, Singapore, South Africa, the UK, and the US. We want to recognise the role of our accounting and bookkeeping partners in driving small business success and we’d love your help to encourage your clients to enter the Xero Beautiful Business Fund.

Fidesic blog

JULY 19, 2024

We had a blast at Summit Roadshow on Wed. If you missed our live recap yesterday we'll be sharing highlights form it here over the next couple of weeks, starting with Jim Bertler's session Dynamics GP.

Speaker: Jason Chester, Director, Product Management

In today’s manufacturing landscape, staying competitive means moving beyond reactive quality checks and toward real-time, data-driven process control. But what does true manufacturing process optimization look like—and why is it more urgent now than ever? Join Jason Chester in this new, thought-provoking session on how modern manufacturers are rethinking quality operations from the ground up.

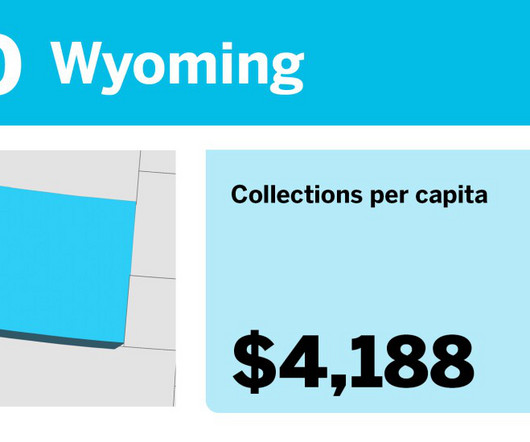

Accounting Today

JULY 18, 2024

The top state takes in $7,200 in tax per capita.

Accounting Department

JULY 18, 2024

Summer can be a challenging time for many businesses, with sales often dipping as customers take vacations and routines shift. But a slowdown doesn't have to mean a cash flow crisis.

Financial Ops World brings together the best financial operations content from the widest variety of thought leaders.

Fidesic blog

JULY 19, 2024

We had a blast at Summit Roadshow on Wed. If you missed our live recap yesterday we'll be sharing highlights form it here over the next couple of weeks, starting with Jim Bertler's session Dynamics GP.

Accounting Today

JULY 18, 2024

The Treasury Department and the Internal Revenue Service issued final regulations Thursday to update the rules for required minimum distributions.

accountingfly

JULY 18, 2024

Top Remote Accounting Candidates This Week Looking for remote accountants? Accountingfly can help! With our ‘ Always-On Recruiting ‘ program, you can access highly skilled and experienced remote accounting candidates with no upfront cost. These are just a few of our top remote accounting candidates this week. Sign up now to receive the full list of top accounting candidates available weekly!

Ace Cloud Hosting

JULY 18, 2024

One of a business’s most frequently overlooked elements is its order management. Companies must coordinate the entire process, from when customers place orders until they receive their product or service.

Speaker: Gerald Ratigan

The accounts payable (AP) function is evolving and AI is leading the charge. As finance teams face rising invoice volumes and expectations for speed and accuracy, AI-powered automation has shifted from a futuristic concept to the most practical solution. But for finance leaders, success isn’t just about selecting the right tools, it’s about implementing the right strategy.

Fidesic blog

JULY 18, 2024

Seldom used features in Dynamics GP! Keeping GP fresh with tricks you might not know.

Accounting Today

JULY 16, 2024

Accounting firms and vendors alike have stressed the importance of having a "human in the loop" to oversee AI. Just who are these humans and what do they do?

Insightful Accountant

JULY 18, 2024

If you are a ProAdvisor, Consultant, or Accountant wanting to support construction businesses as they digitally transition, you won’t want to miss this survey, which will provide valuable insights into the industry.

Ace Cloud Hosting

JULY 17, 2024

Lacerte is one of the most popular and reputable tax preparation and filing software for small—to medium-sized businesses. It offers robust features that allow tax professionals to reduce manual work.

Speaker: Sean Yoder

Nonprofits are under more pressure than ever to demonstrate financial accountability while continuing to expand their impact. Traditional budgeting models often fall short, reinforcing silos, limiting flexibility, and stalling growth. Enter collaborative budgeting: a dynamic, team-driven process that enables smarter resource allocation and builds financial resilience at scale.

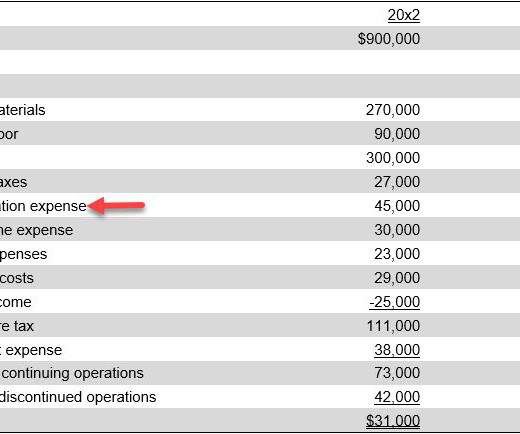

Accounting Tools

JULY 19, 2024

What are Traceable Costs? A traceable cost is a cost for which there is a direct, cause-and-effect relationship with a process, product, customer , geographical area, or other cost object. If the cost object goes away, then the traceable cost associated with it should also disappear. A traceable cost is important, because it is an expense that you can reliably assign to a cost object when constructing an income statement showing the financial results of that cost object.

Accounting Today

JULY 16, 2024

Accounting is an industry wedded to traditional techniques, so leveraging new technology will require a cultural shift within the organization.

Insightful Accountant

JULY 16, 2024

The potential expiration of key provisions of the Tax Cuts and Jobs Act (TCJA) at the end of 2025 is a critical issue that requires careful attention and proactive planning, and Section 199A is no exception.

Billing Platform

JULY 15, 2024

Also referred to as yield management, revenue management can be described in extremely simplistic terms ( selling the right product, to the right customer, at the right price, through the right channel ) or defined in a more complex manner. Brought mainstream by industries like hospitality and airlines, revenue management is a discipline that combines data mining, analytics, and operations research to understand customer behavior.

Speaker: Joe Wroblewski, Sales Engineer Manager

Automating time-consuming manual tasks can save your firm hundreds of hours–and thousands of dollars. But it can also have longer-lasting benefits, like helping you attract and retain the next generation of CPAs, and we don’t need to tell you how important that is amid the current generational staffing crisis in the tax and accounting profession. You'll want to save your seat for this new webinar with industry expert Joe Wroblewski, where we'll explore how to: Maximize ROI with Cost-Effective Te

Accounting Tools

JULY 14, 2024

What are Pro Forma Financial Statements? Pro forma financial statements are financial reports issued by an entity, using assumptions or hypothetical conditions about events that may have occurred in the past or which may occur in the future. These statements are used to present a view of corporate results to outsiders, perhaps as part of an investment or lending proposal.

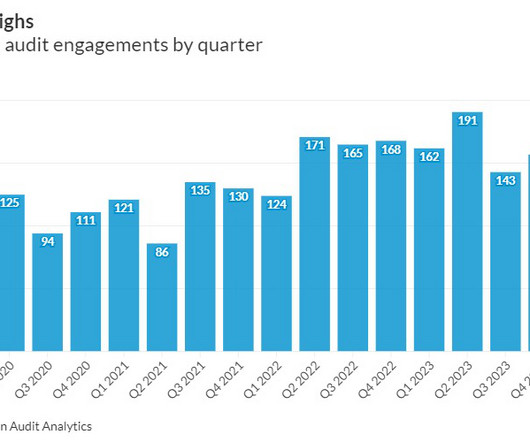

Accounting Today

JULY 16, 2024

The Big Four firm netted the most new SEC audit clients in the first quarter, followed closely by Deloitte.

Insightful Accountant

JULY 17, 2024

Ben Richmond, the Managing Director of Xero for North America, gives valuable insights into accounting firms providing 'Fractional CFO' services.

Reconciled Solutions

JULY 18, 2024

Learn more about the Augusta Rule, a legal way to increase tax deductible business expenses and personal income without paying more in taxes. The post The Augusta Rule: What is it and how can it help me improve my tax-saving strategies? appeared first on Reconciled Solutions.

Advertisement

Automation generally supercharges any process and brings its value to the forefront. See how infusing automation such as ART (our month-end close solution), into your close can get you to the next level of closing. We will share a live demo of SkyStem's solution, ART and share the key elements of month-end close automation. Through ART, we'll take a look at: What month-end close automation entails Which process steps can and should be automated Benefits of achieving process automation, and Why i

Accounting Tools

JULY 19, 2024

What is the Purpose of Depreciation? The purpose of depreciation is to match the expense recognition for an asset to the revenue generated by that asset. This is called the matching principle , where revenues and expenses both appear in the income statement in the same reporting period , thereby giving the best view of how well a company has performed in a given reporting period.

Accounting Today

JULY 18, 2024

The RSM network made five strategic acquisitions in Europe, including specialist audit and consulting firms in Austria, Denmark and France, plus a prestigious law firm in Spain.

Gaviti

JULY 18, 2024

There are two main types of cash flow forecasting: short term and long term. Short-term forecasting predicts the company’s cash flow for under 12 months, while long-term forecasting looks beyond twelve months. Financial professionals often agonize over which one to use, but most organizations need both. What is Short-Term Cash Forecasting? Short-term forecasting looks at the cash inflows and outflows over a shorter period.

Reconciled Solutions

JULY 18, 2024

Creating a budget that actually works can be tough. Use QuickBooks Online’s setup tools and these tips for more effective budgeting. The post Having Trouble Budgeting? QuickBooks Online Can Help appeared first on Reconciled Solutions.

Advertiser: Paycor

Mid-year performance reviews aren’t just boxes for HR to check. Paycor’s toolkit empowers leaders to: Identify high-potential team members. Boost engagement with meaningful feedback. Support struggling employees. Nurture top talent to drive results. Learn how to ignite employee potential through meaningful feedback. When you nurture top talent, everybody wins.

Nolan Accounting Center

JULY 15, 2024

As a small business owner, you should want to improve your business operations. Indeed, every business owner should recognize that improving operating efficiency must be an ongoing endeavor. As American editor and publisher Clarence W. Barron stated, “Everything can be improved.” More pointedly, Japanese consultant Masaaki Imai said, “Not a day should go by without some kind of improvement made somewhere in the company.

Accounting Today

JULY 15, 2024

The IRS warned about bad advice that's being peddled on social media promoting a bogus "Self Employment Tax Credit" and prompting unsuspecting taxpayers to file false claims for the credit.

Enterprise Recovery: Accounts Receivable

JULY 15, 2024

Retention marketing is the practice of implementing strategies and techniques to keep existing clients engaged and loyal to your business. While acquiring new customers is important, retaining existing ones is more valuable for the long-term success of your business. By focusing on client retention, you can build strong relationships, increase customer satisfaction, and ultimately drive revenue growth.

Reconciled Solutions

JULY 18, 2024

Are you ready to take the leap from employee to owner? Ask yourself these questions if you're considering starting your own business. The post 13 things to consider before moving from employee to owner appeared first on Reconciled Solutions.

Speaker: Victor C. Barnes, CPA, MBA

In the climb from contributor to leader, the rules quietly change. If you’re aiming for the summit, the air gets thinner—and what got you here won’t be enough to get you to the top (a concept first popularized by Marshall Goldsmith in his book What Got You Here Won’t Get You There ). What made you successful early in your finance career—technical accuracy, sharp analysis, flawless execution—won’t be what carries you to the next level.

Let's personalize your content