Outstanding Checks and Bank Reconciliation: Simplifying Financial Processes with Automation

Nanonets

APRIL 1, 2024

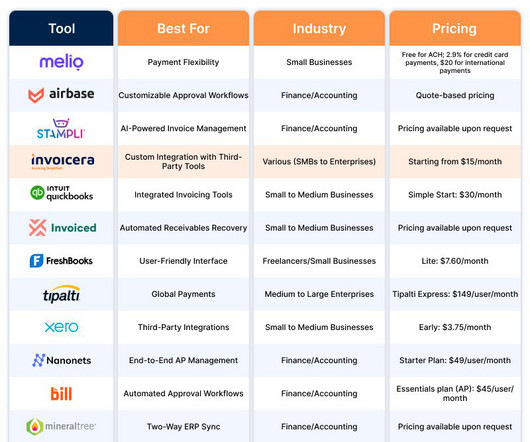

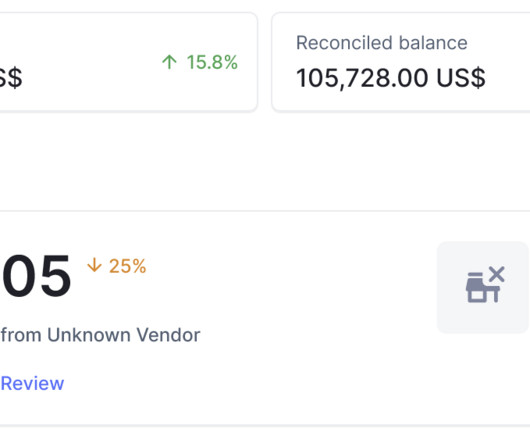

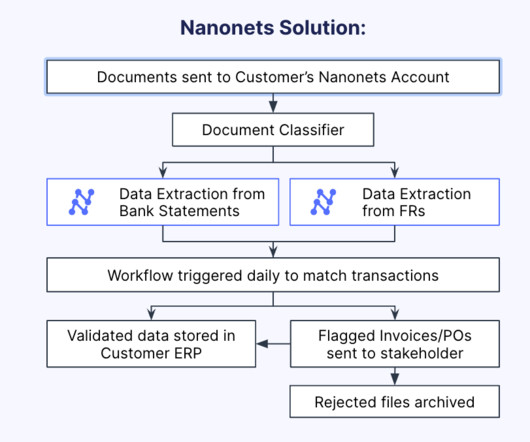

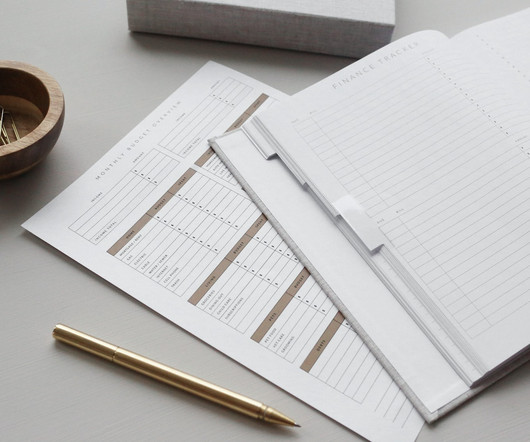

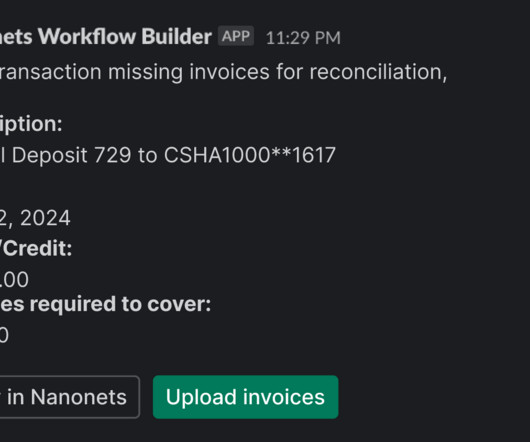

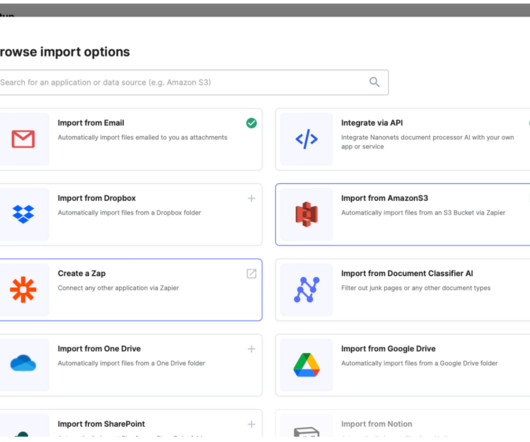

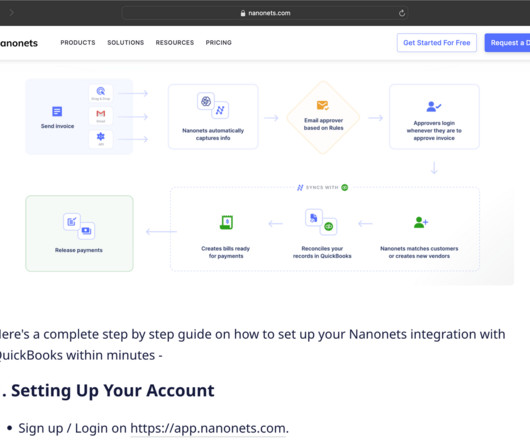

Introduction In both personal and business finance, the management of outstanding checks and thorough bank reconciliation practices are important for maintaining financial hygiene. Looking out for a Reconciliation Software? What is Bank Reconciliation?

Let's personalize your content