The Strategic Benefits of Outsourcing Bookkeeping for Small Businesses

Less Accounting

MAY 21, 2024

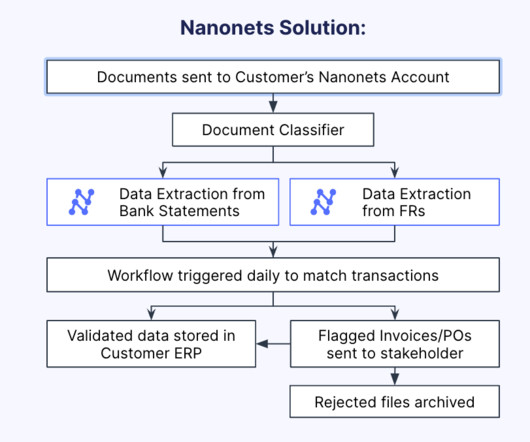

This is crucial for ensuring tax compliance and maximizing deductions. Businesses benefit from strategic financial insights and recommendations that are tailored to their specific goals. They offer customized services to meet diverse needs, from payroll processing to bank reconciliation.

Let's personalize your content