State sales tax changes could mean more audits

Accounting Today

JANUARY 24, 2024

Businesses are likely to see more sales tax audits in 2024 as a result of changes happening across the states, according to a new report.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

Accounting Today

JANUARY 24, 2024

Businesses are likely to see more sales tax audits in 2024 as a result of changes happening across the states, according to a new report.

Accounting Today

SEPTEMBER 5, 2023

As an auditing professional, it's vital that you detect any discrepancies in business tax reports and either try to rectify them or report them to the IRS.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Accounting Today

OCTOBER 20, 2023

The Internal Revenue Service is making improvements to its online tax professional accounts and hiring more accountants as it ramps up enforcement.

Accounting Today

FEBRUARY 29, 2024

Tax pros say those efforts will have big implications. A new GAO study adds more fuel to the research suggesting the agency should be probing more rich households.

Accounting Today

SEPTEMBER 18, 2023

The service said Monday it plans to lower its audit rate of low-income taxpayers, even as some criticize its ability to protect taxpayer information.

Accounting Today

AUGUST 29, 2023

Accounting firms are less important than the partner leading the team in terms of the impact on the business's effective tax rate and the probability it will face an audit.

Accounting Today

AUGUST 22, 2023

You got your taxes filed by the skin of your teeth last year and before. But what if you're audited? What if you need a loan? Are you ready?

Accounting Tools

FEBRUARY 25, 2024

What is an Audit? In general, an audit is an investigation of an existing system, report, or entity. There are many types of audits that can be conducted, as noted below. This audit is most commonly used in regulated industries or educational institutions.

Accounting Today

JANUARY 30, 2024

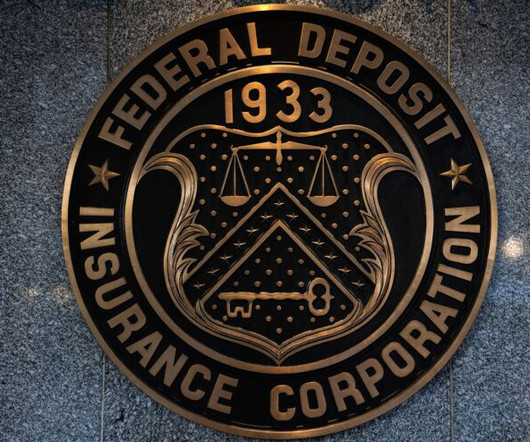

The city's department of finance audited Signature after the bank shuttered in March and found tax deficiencies for years 2015 through 2021 related to unreported income allocation and adjustments to investment and capital income.

Accounting Today

OCTOBER 12, 2023

The dispute centers on a 2012 IRS audit into transfer pricing, a method used by companies to shift profits to tax havens and avoid the U.S. corporate tax rate.

Accounting Today

SEPTEMBER 8, 2023

The Internal Revenue Service is leveraging artificial intelligence to detect tax evasion as it uses the extra funding from the Inflation Reduction Act to ramp up compliance efforts.

Accounting Today

APRIL 4, 2024

With tax authorities scrutinizing partnerships, CPAs and tax pros need to think more strategically about filing for extensions.

Accounting Today

FEBRUARY 16, 2024

The Internal Revenue Service would be able to implement changes to the Child Tax Credit within weeks, IRS Commissioner Danny Werfel told Congress, and send out tax refunds promptly.

Intuit

APRIL 8, 2024

We have recently seen quite a bit of discussion in Congress about family tax credits, and, in particular, the EITC and CTC. What we know is that tax complexity impedes individuals, the self-employed, small businesses, and especially lower-income workers from maximizing their well-earned tax benefits.

Accounting Today

DECEMBER 13, 2023

Italy's finance police had claimed that the company failed to pay taxes on about €3.7 billion of rental revenue and claimed that the company owed about €779 million after an audit of the tax years from 2017 to 2021.

Accounting Today

FEBRUARY 21, 2024

The Internal Revenue Service will be scrutinizing the use of corporate jets for personal travel more closely, focusing on big corporations and partnerships, as well as high-income taxpayers.

Accounting Today

SEPTEMBER 5, 2023

The IRS is starting to get more interested in who prepared a claim for the Employee Retention Credit.

Accounting Today

JANUARY 12, 2024

The Internal Revenue Service reported progress Friday on its efforts to increase its audits of large corporations, complex partnerships and high-income individuals, collecting over half a billion dollars from millionaires who didn't pay their taxes.

Accounting Today

SEPTEMBER 11, 2023

The Internal Revenue Service will need to tread carefully with how it uses AI amid growing questions about the reliability of the technology.

Accounting Today

JULY 27, 2023

The service is using the extra funding it received from the IRA to audit big, complex partnerships using data analytics and other technology tools, while working on hiring more experienced accountants.

Nolan Accounting Center

SEPTEMBER 15, 2023

Most of the time, small business returns are not audited. In November 2021, the IRS announced that audits would increase by 50% in 2021. If you are audited, we will have all the paperwork that you need to get through it. Most of the time, audits are fairly routine. Never ignore an audit notice.

Accounting Today

MARCH 22, 2024

With the IRS continuing to launch promoter audits, it is important that anyone subject to such an audit consider a few strategic issues.

Insightful Accountant

MARCH 6, 2024

It still has its affects tax planning, so discuss with clients. Last week our calendars all marked a unique day that only comes about once every four years. Leap Day, February 29th, this day intends to sync the calendar with the solar year.

Accounting Today

JANUARY 23, 2024

Global fee income for accounting and audit services increased 15% to $3.6 billion, while RSM's tax revenues jumped 17% to $2.6 billion.

Accounting Today

SEPTEMBER 20, 2023

The service is establishing a group within its Large Business and International division to bolster tax compliance at large partnerships and S corps.

Accounting Tools

OCTOBER 10, 2023

Related Courses How to Conduct an Audit Engagement What is a Special Audit? A special audit is a tightly-defined audit that only looks at a specific area of an organization's activities. This type of audit may be initiated by a government agency, but could be authorized by any entity, or even internally.

Accounting Tools

SEPTEMBER 29, 2023

Related Courses How to Conduct an Audit Engagement What is an Audit Test? An audit test is a sample taken from a larger population, with the intent of testing the sample for certain characteristics, which are then extrapolated to the entire population.

Intuit

NOVEMBER 20, 2023

Table of Contents Weekend Jobs in Accounting 5 Accounting and Tax Jobs to Boosts Your Weekend Income What's the Life of a Remote Accountant Like? How about doing some taxes and bookkeeping to boost your income? TurboTax Live Tax Associate Jobs $19.90 – $28.00/hr How Do I Get an Accounting Job Without Experience?

Accounting Today

MARCH 14, 2024

This new standard changes the game for auditors to make risk assessments even more effective.

Billah and Associates

SEPTEMBER 26, 2023

One of the key tools for ensuring compliance and financial integrity is auditing. In this blog post, learn more about the auditing essentials and how it plays a vital role in safeguarding a company’s financial health and reputation.

Accounting Tools

JULY 11, 2023

Related Courses How to Conduct a Compilation Engagement How to Conduct a Review Engagement How to Conduct an Audit Engagement What is a Financial Audit? A financial audit is the examination of the financial records of an entity by a certified third party examiner.

LedgerDocs

APRIL 19, 2023

Being selected for an audit by the Canada Revenue Agency (CRA), might leave you feeling overwhelmed, stressed and uncertain about what you need to do. Although the prospect of being audited may be scary and intimidating, having the right documents and information ready can help make the process smoother.

Accounting Today

MARCH 19, 2024

Next stop, more billions; misaimed mansion tax; auditing's future; and other highlights from our favorite tax bloggers.

Nanonets

JANUARY 1, 2024

In this blog, we'll delve into what invoice audits entail and why they are crucial for the financial integrity of businesses. What is an Accounts Payable Audit? An Account Payable Audit is a process by which the financial records of the accounts payable department are examined by an auditor.

Accounting Today

DECEMBER 1, 2022

(..)

CSI Accounting & Payroll

MARCH 10, 2024

What’s the difference between a tax attorney and an accountant? At CSI Accounting & Payroll, we’ve worked with small business taxes for over 50 years. We’ve spoken to tons of business owners who want to know if they need a tax attorney or an accountant for the following situations: Filing taxes Income tax audits Tax court

Accounting Today

JANUARY 16, 2024

Swag taxes; audit ROI; your best reading for 2024; and other highlights from our favorite tax bloggers.

Accounting Today

AUGUST 1, 2022

(..)

Accounting Today

DECEMBER 1, 2023

Plus, Xero now automatically calculates sales tax; and other accounting technology news and updates.

Billah and Associates

JANUARY 8, 2019

Tax audit for businesses A corporate tax audit is an efficient and effective mode of scrutiny, especially when done by a primary corporate tax accountant. The process of Corporate Tax Audit – an Overview The process of preparation for corporate tax audit begins when you prepare the T2 or other returns.

Bookkeeping Express

APRIL 6, 2023

For many business owners, the mere mention of an audit can evoke feelings of stress and anxiety. The announcement of an actual audit can be overwhelming, prompting a scramble to locate important documents, reconcile accounts, and otherwise “get things together.” Minimize your tax burden. Master cash flow forecasting.

Invoicera

APRIL 10, 2024

Knowing these rules matters if you want to ensure tax compliance, accurate financial reporting, and legal validity. Tax systems vary worldwide. Some of those contextual policies include Value Added Tax (VAT), Goods and Services Tax (GST), and sales tax.

Accounting Today

OCTOBER 23, 2023

Regulators are conducting tax audits and reviewing land use by Foxconn, the Taiwanese company that makes the vast majority of iPhones at factories in China.

Accounting Today

SEPTEMBER 20, 2023

The revised Form 6765 could help both the IRS and taxpayers avoid lengthy audits involving faulty claims.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content