Apps to help solve four common small business pain points

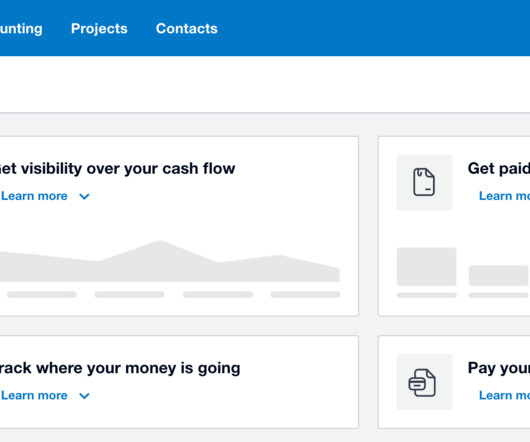

Xero

NOVEMBER 15, 2022

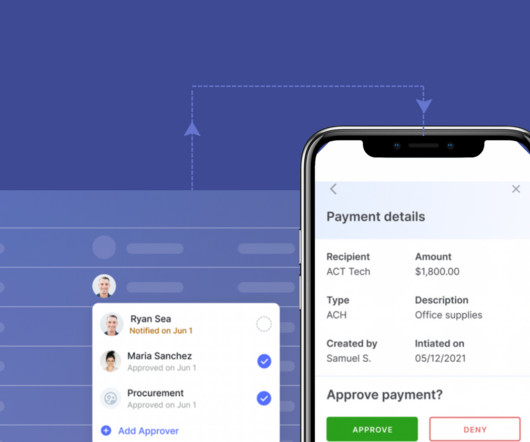

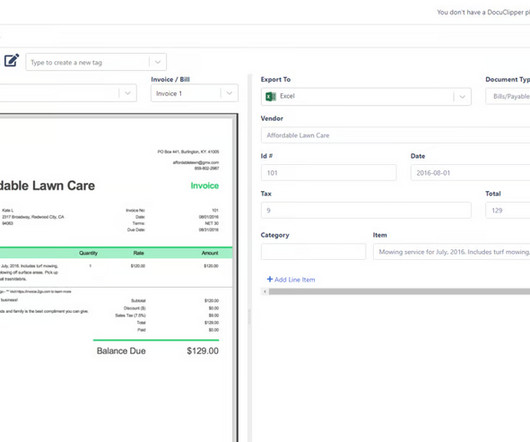

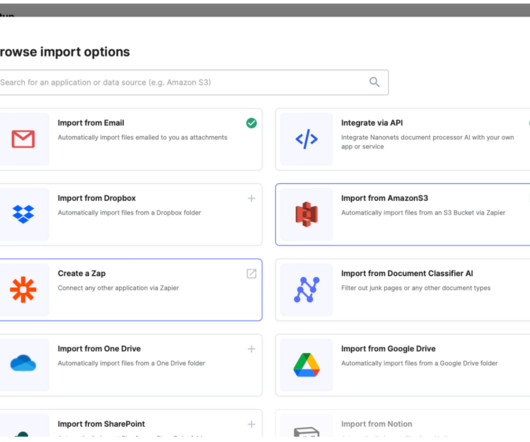

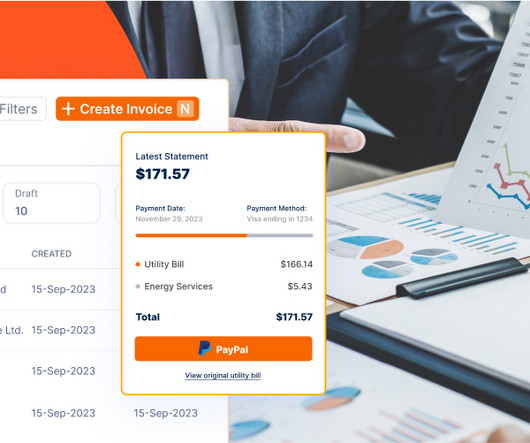

Here are some apps that can help you keep track: EzzyBills – Combine two apps in one and get invoice processing and approval management. With a mobile app for scanning receipts, it’s suitable for businesses with lots of bills or sales invoices.

Let's personalize your content