Guide to Virtual Bookkeeping and Automation

Nanonets

APRIL 3, 2024

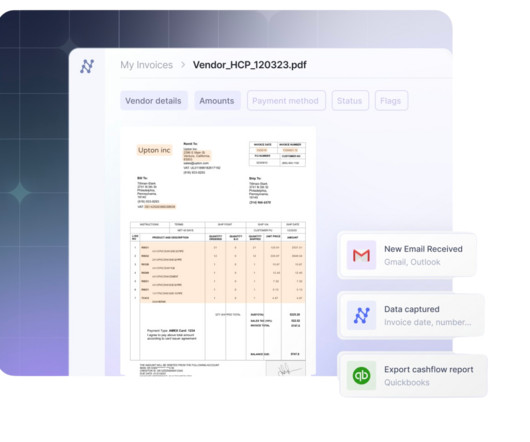

Gone are the days of tedious manual data entry and stacks of paper ledgers. Businesses are now embracing the virtual to streamline their financial management processes. Picture this: a team of expert bookkeepers diligently managing your financial records and transactions without setting foot in your office.

Let's personalize your content