We made the 2022 Most Innovative Companies list

Xero

OCTOBER 16, 2022

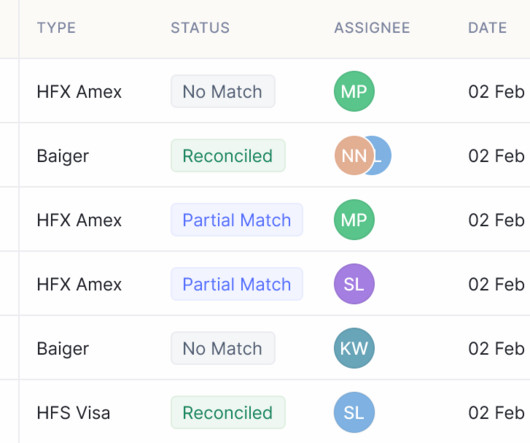

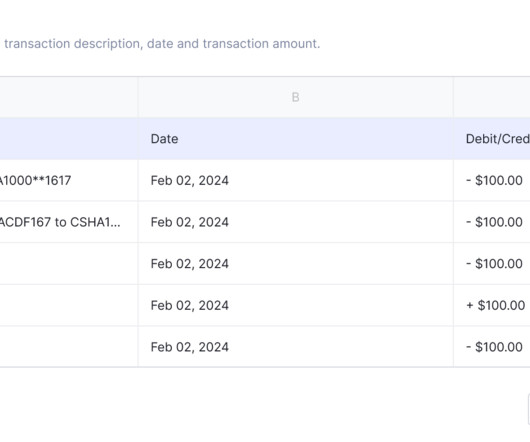

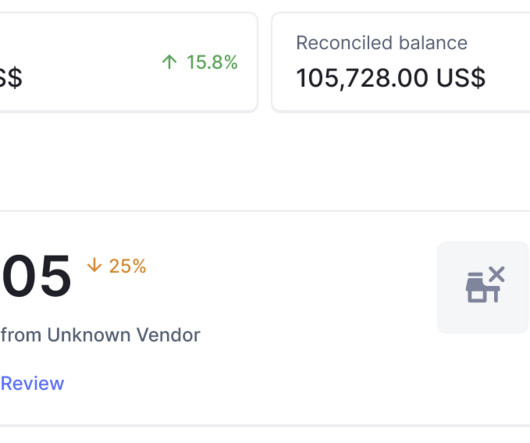

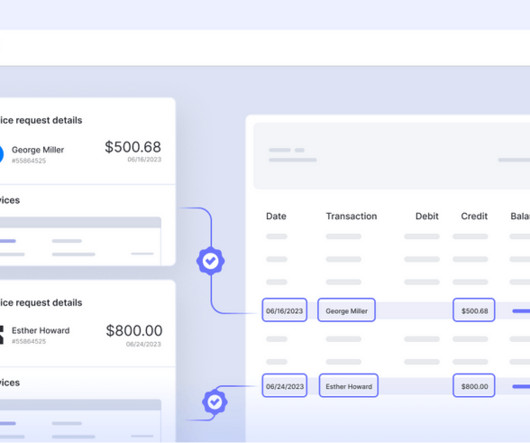

Xero placed #7 on the technology industry list out of 700+ nominations, and is a direct result of our teams’ labour of love on helping reconciling transactions to become a more beautiful experience. That is, by using the learnings of millions of past reconciled transactions. . Our ongoing commitment to reducing toil.

Let's personalize your content