The importance of General Ledger reconciliation for financial reporting

Nanonets

JULY 21, 2023

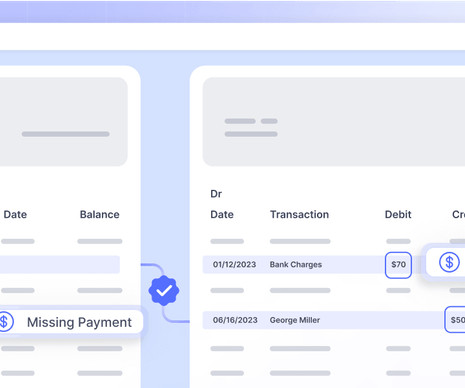

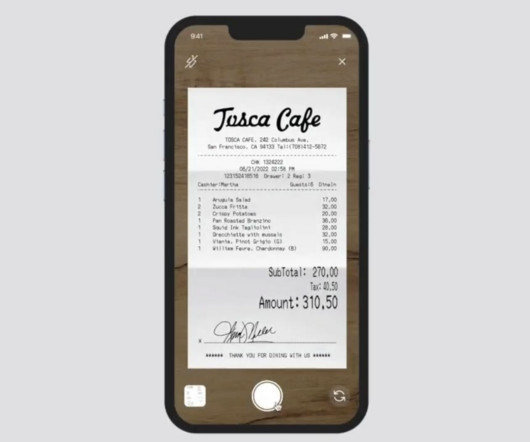

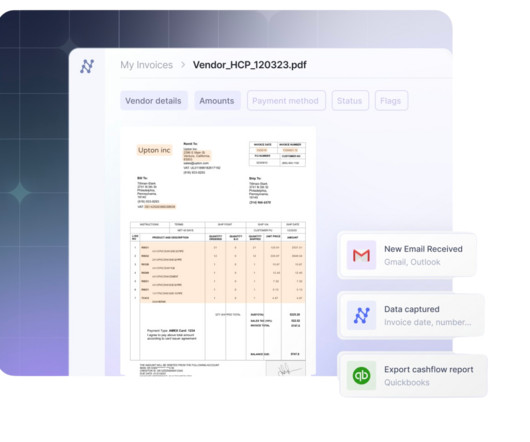

Maintaining accurate financial records is vital for any business, and the general ledger, as the central repository of financial transactions, plays a critical role in this process. Ensuring the accuracy and integrity of the general ledger requires regular reconciliation. What is general ledger reconciliation?

Let's personalize your content