Accounting Basics: What Do Debit and Credit Mean?

Nolan Accounting Center

JUNE 15, 2025

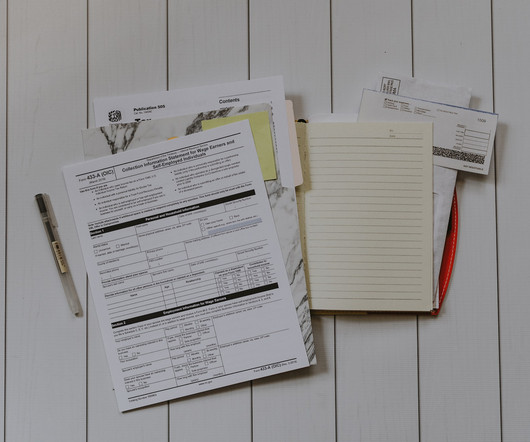

Keeping the financial records of every business in order requires tracking all the money flowing in and out of the company. For each transaction, there must be at least one debit and one credit equaling each other recorded on the company’s general ledger accounts. Tax preparation and planning.

Let's personalize your content