$1B in 2020 tax refunds remains unclaimed

Accounting Today

MARCH 25, 2024

Time is running out for nearly 940,000 individuals to claim refunds from 2020, with a May 17 deadline approaching for filing the necessary tax returns.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Accounting Today

MARCH 25, 2024

Time is running out for nearly 940,000 individuals to claim refunds from 2020, with a May 17 deadline approaching for filing the necessary tax returns.

Accounting Today

FEBRUARY 27, 2024

Auditors are including CAMs in more of their opinions but disclosing fewer CAMs per opinion, according to an Ideagen report.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

AI In Accounting: A Practical Roadmap For Smarter AP

Why Tech-Forward Tax and Accounting Firms Have the Inside Track to the Future

Precision in Motion: Why Process Optimization Is the Future of Manufacturing

Stop Budget Burnout: A Better Way to Grow Your Nonprofit in 2026

Accounting Today

AUGUST 21, 2024

hours on average per case in 2023, up 281% from 2020. The Treasury Inspector General for Tax Administration found that IRS Tax-Exempt Compliance Unit examiners spent 6.1

Accounting Today

FEBRUARY 5, 2025

Total undergraduate accounting enrollment for fall 2024 was 257,278 students, the highest reported since fall 2020 and just shy of the pre-pandemic fall 2019 enrollment.

Accounting Today

JUNE 12, 2025

Alvarez did not have a PTIN and admitted that in 2019 and 2020 she misrepresented taxpayers eligibility for education credits and deducted fictitious business expenses from their taxable income to reduce tax liabilities and inflate refunds. All rights reserved. In March 2019, Archer filed for Chapter 7.

Accounting Today

JUNE 26, 2025

From the second quarter of 2017 through the fourth quarter of 2020, he collected but did not pay over or report similar taxes to the IRS. All rights reserved. They instead spent the money on country club memberships and season tickets to the San Jose Sharks. Olson was also one of the owners and operators of a day spa in Saratoga, California.

Accounting Today

JUNE 19, 2025

In response, Whitman formed a trust with his girlfriend as the trustee then directed his income from the business into the trusts bank accounts and used the money to pay personal expenses. All rights reserved. In 2012, the IRS assessed nearly $800,000 in taxes against Whitman for 2002 through 2009 and began trying to collect.

Xero

APRIL 6, 2023

Our recent research found that accountants are facing a number of serious challenges, so we want to put a spotlight on their brilliant work, and their lives beyond the industry. They tell us more about the misconceptions they face, how their side projects complement their day-to-day roles, and why they love the accounting industry.

Accounting Today

MARCH 22, 2024

Dan Rotta, 77, was charged in Miami with hiding assets from the IRS in two dozen secret Swiss accounts between 1985 and 2020.

Accounting Today

JUNE 5, 2025

Trifilo worked in compliance for several large accounting and finance firms and recently was managing director at a tax firm where he specialized in transaction structuring and advisory service, tax compliance and tax due diligence. All rights reserved.

Accounting Today

OCTOBER 11, 2023

growth rate of fiscal year 2020. The median growth rate hit 9.1% in net revenue in fiscal year 2022, according to a new survey, over double the 4.2%

Accounting Today

OCTOBER 27, 2023

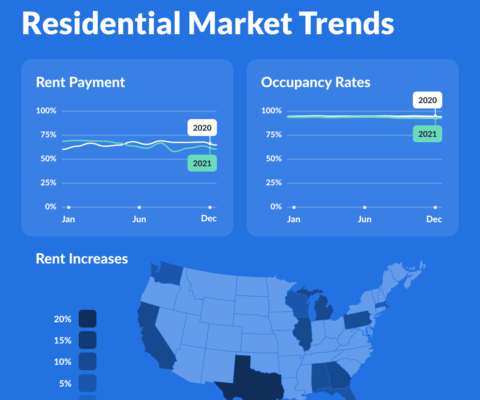

Small businesses are experiencing the weakest sales since 2020, according to a new report from Xero, despite signs of an improving economy.

Accounting Today

OCTOBER 12, 2023

The service updated its tax-gap projections for tax years 2020 and 2021, predicting a big jump from prior estimates.

Fidesic blog

JULY 25, 2023

Last year we published a post about the impact of the 2020 pandemic on accounts payable, in particular, the rise in digital B2B payment methods. As with many of the new trends we saw during the pandemic, this one didn’t go away.

Fidesic blog

DECEMBER 5, 2023

ACH remains the preferred payment method for accounts payable departments to pay their vendors. billion transactions in 2020 (a 8.2% According to data from NACHA fewer than 0.03% of ACH transactions are returned as unauthorized. ACH payments grew to 26.8 YOY increase) according to NACHA , the organization that oversees ACH activity.

Xero

DECEMBER 7, 2022

The events of 2020 and the years since have forced us all to change in some way or another. This was certainly the case for Carly Shaw from Clarative Accounting. Here, Carly tells the story of Clarative Accounting. . Many changed how we work, our long-term goals, and most importantly, how we prioritise what’s important to us. .

Xero

APRIL 16, 2023

A 2020 study from IBM found that 6 in 10 consumers are willing to change their purchasing habits to reduce their impact on the environment. At the start of 2020, global sustainable investment reached USD $35.5 Attract customers. Attract investors. Evalue8 Sustainability. CarbonInvoice. CarbonTrail. Zero Carbon.

Accounting Today

AUGUST 7, 2023

The service may revive the extra payments it provided to employees in 2020 to coax them back to the office, according to a new report.

Xero

JULY 20, 2022

I’m so thrilled to be back at Xerocon London connecting with so many of our accounting and bookkeeping partners and app partner community. The cash flow positions of most small businesses improved throughout 2020 and 2021. Have you identified areas in the accounts for improvement, and have you discussed these with your client?

Xero

MAY 30, 2022

In the UK, the Xero Small Business Index in April was 83, its lowest point since February 2021 and the most drastic monthly fall since April 2020. Similarly, they experienced the longest late payment time since September 2020, at an average of 7.7 The time it took for small businesses to be paid on average increased to 29.9

Accounting Today

OCTOBER 11, 2023

When Caroline Ellison asked the former CEO in 2020 whether the line of credit would show up in FTX's audit, he said, "don't worry, the auditors aren't going to look at that," she testified.

Accounting Today

MAY 23, 2024

billion in sales and other tourism-related tax revenue in the current fiscal year, a 16% jump from 2020. Tourists are expected to generate a record $4.9

AP Association

FEBRUARY 3, 2020

The Accounts Payable Association is delighted to announce its merger with The Payroll Centre, the UK’s largest payroll membership and learning organisation. accounts , accounts payable , payroll The support of The Payroll Centre will allow us to accelerate APA’s expansion plans with immediate effect.

Blake Oliver

MARCH 20, 2025

As we discussed in Episode 425 of The Accounting Podcast, the CPA Success Index provides fascinating insights into which accounting programs most effectively prepare students. An accounting department that makes the passing the exam the objective. What makes these programs stand out?

Xero

DECEMBER 14, 2022

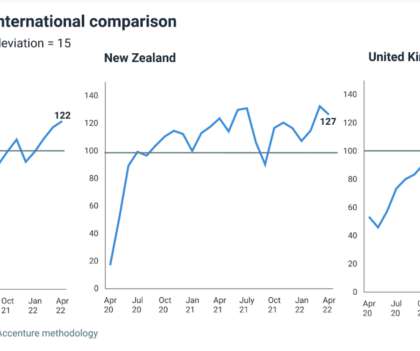

Analysis of the data across all five countries shows late payments have become more volatile since early 2020. After experiencing sharp downturns during the pandemic, all five countries made a return to positive sales growth during 2020, but some countries recovered faster than others. . Preparing for 2023. Business focus.

Xero

JUNE 30, 2022

Here are the most recent design changes in Xero: We’ve made improvements to the design and layout of bank reconciliation within the Xero Accounting app, to make your experience easier and more accessible (iOS and Android). Company accounts tax. We’ve also made substantial improvements to the formatting and presentation of accounts.

Xero

MAY 30, 2022

decline (year to December 2020). Datamolino streamlines and automates the accounts payable process. By automating the data capture process, Datamolino also saves accountants a huge amount of time and energy. With Datamolino, users can automate more than 70% of their total accounts payable volume.

Fidesic blog

DECEMBER 19, 2024

ACH remains the preferred payment method for accounts payable departments to pay their vendors. billion transactions in 2020 (a 8.2% According to data from NACHA fewer than 0.03% of ACH transactions are returned as unauthorized. ACH payments grew to 26.8 YOY increase) according to NACHA , the organization that oversees ACH activity.

Accounting Today

JULY 19, 2023

Jan Marsalek was a key figure at Wirecard before its implosion in an accounting scandal in June 2020.

Sage Intacct

JANUARY 20, 2022

Still, for accounting teams in particular, the shock of moving to a work-from-home policy meant much more than just ensuring IT provided extra monitors to employees. Before March 2020, very few accounting teams had formalized remote work policies in place. The sudden shift to remote work took us all by surprise.

Jetpack Workflow

MARCH 27, 2025

The conversation kicks off with Alyssa recounting the pivotal moment when she decided to quit her job and explore the possibility of working for herself after receiving a side accounting request. In 2017, Alyssa launched her accounting firm, quickly establishing herself as a go-to expert for businesses in need of financial guidance.

Intuit

MARCH 22, 2023

Perhaps the biggest win of Kim’s career came after her mother lost her job in 2020. After one video went viral, she capitalized on the momentum and launched an Instagram account called the.millennial.cpa. Today, as an accountant and finance influencer, Kim uses lessons from her past to help others become financially literate.

Accounting Today

NOVEMBER 22, 2024

The company failed to follow GAAP when it evaluated its less-than-truckload operations in 2019 and 2020.

Xero

FEBRUARY 5, 2023

The cash conversion cycle – the time it takes to convert investments in inventory into cash – has increased from 55 days in 2020 to more than 100 days in 2022. This information is prepared without taking into account your individual and/or business needs and objectives. Credit provided by the Commonwealth Bank of Australia.

Accounting Today

APRIL 16, 2024

Clock ticks on 2020 returns; remembrances; what's ahead for marketing tech; and other highlights from our favorite tax bloggers.

Accounting Today

JUNE 13, 2025

GEORGIA NABA president and CEO Guylaine Saint Juste (left) and Bennett Thrasher partner Durran Dunn RTW Photography Bennett Thrasher, Atlanta, announced its philanthropic arm, the Bennett Thrasher Foundation, made an investment in the National Association of Black Accountants. All rights reserved. Read the full story.)

Dext

OCTOBER 31, 2019

Last year, we took a select group of accountants and bookkeepers on an exclusive three-day retreat. And in 2020, we’ll be doing […] Receipt Bank Exchange Australia is back!

Xero

APRIL 9, 2024

One reason for this result is down to a key characteristic of the small businesses in the XSBI data set – by definition they all use at least some form of technology (like Xero) to help run their business, and they have an accountant or bookkeeper too. How did the pandemic impact productivity?

Xero

JULY 6, 2022

This blog post is written by Logan Ransley, Co-Founder of Landlord Studio – rental accounting and property management software to over 4000+ self-managing landlords (managing 38,000+ properties) to help them stay organized and prepared for the tax season. . Real estate investing is one of the best ways to build long-term wealth.

Xero

SEPTEMBER 7, 2022

Expenses were 14 percent higher in 2021 than in 2020 in Australia and New Zealand, and 18 percent higher in the United Kingdom. The good news is that there are a few steps small businesses and their accountants and bookkeepers can take to minimise cash flow risks. . And, the effects are already being felt.

Xero

SEPTEMBER 28, 2022

They integrate with Xero’s core accounting software, customising and extending Xero to enhance your business capabilities. during 2020, while those without apps saw a decline of 3.4%. . With mobile apps, you can customise your phone to do everything you want it to. . Business apps that connect to Xero do the same thing.

Blake Oliver

APRIL 11, 2025

Meanwhile, he reported less than $1 million in annual income as a mere "consultant" to these companies from 2016 to 2020. Edelman was trying to dodge a unique aspect of US taxation: America taxes global income regardless of where you live.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content