Accounts Receivable Trends for 2025: Elevate Your Financial Operations

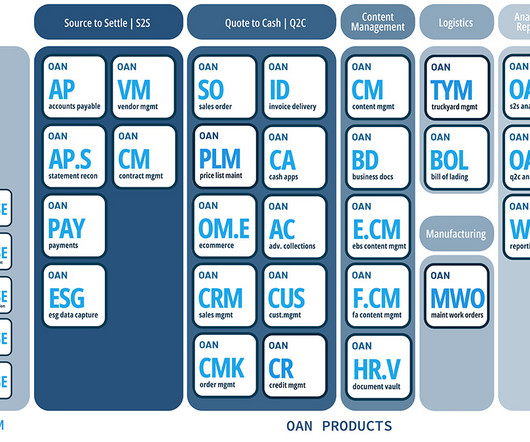

oAppsNet

FEBRUARY 20, 2025

In the dynamic landscape of 2025, businesses must stay ahead of emerging trends to maintain a competitive edge. Accounts Receivable (AR) management is a critical area where innovation can significantly impact cash flow and operational efficiency.

Let's personalize your content