What is a general ledger account?

Accounting Tools

OCTOBER 22, 2023

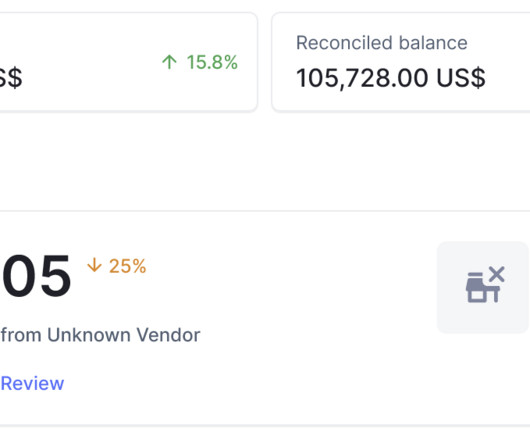

Related Courses Bookkeeper Education Bundle Bookkeeping Guidebook A general ledger account is a record in which is recorded a specific type of transaction. The ending balances in these accounts are then aggregated and reported in the balance sheet and income statement.

Let's personalize your content