How to Handle Past Due Invoices

oAppsNet

MAY 16, 2024

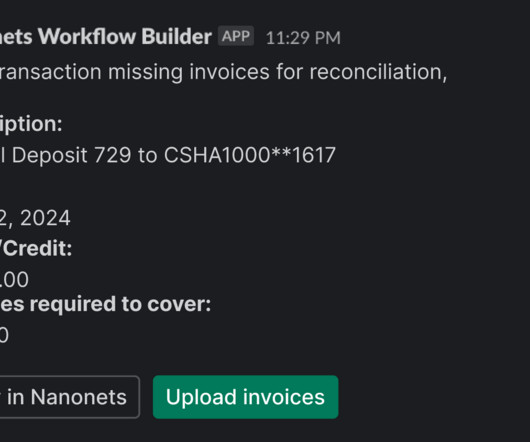

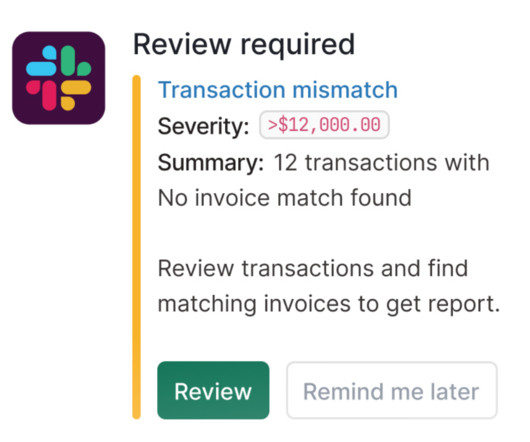

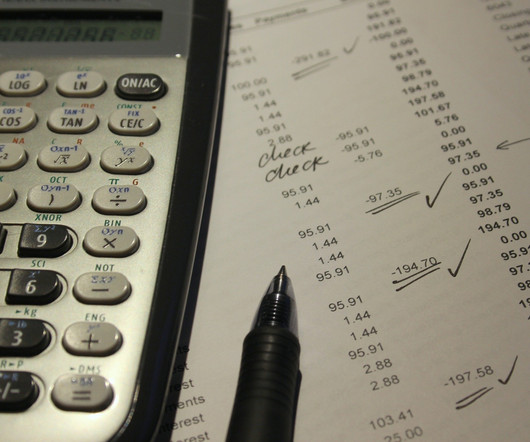

Managing past-due invoices is a delicate task that requires a careful balance between maintaining healthy cash flows and preserving strong customer relationships. When invoices become overdue, it disrupts a business’s financial planning and signals a need for effective communication and negotiation strategies.

Let's personalize your content