Understanding the Accounts Receivable Cycle - Get Paid Faster!

Nanonets

SEPTEMBER 22, 2023

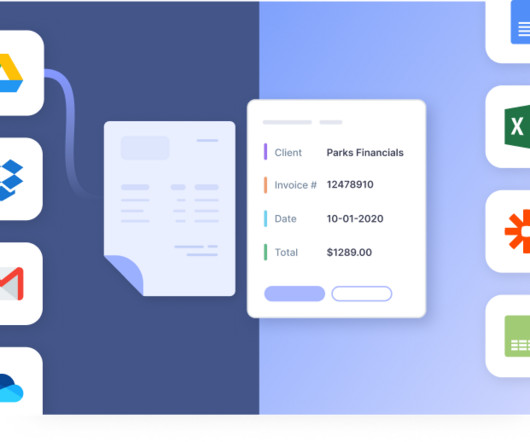

The accounts receivable cycle plays a crucial role in the financial health of businesses, enabling them to streamline operations, optimize cash flow, and ultimately get paid faster. Accounts receivable refers to the amount of money owed to a company for goods or services already provided on credit.

Let's personalize your content