Accounting payment terms

Accounting Tools

JUNE 10, 2023

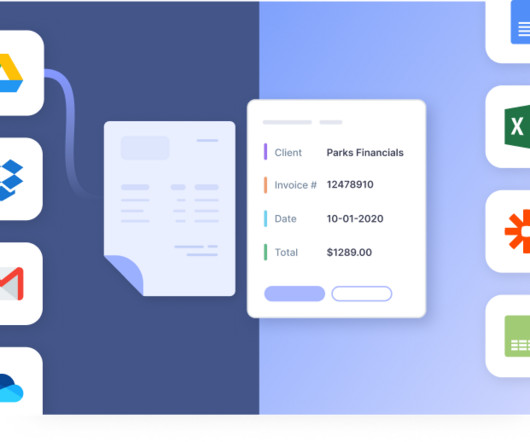

Accounting payment terms are the payment rules imposed by suppliers on their customers. Discount terms may be allowed in order to accelerate cash collections. Payment terms are imposed to ensure that payments are received by suppliers within a reasonable period of time.

Let's personalize your content